- With Alberta blazes under control, U.S. gas supply seen steadying, bears say

- Bulls think wildfire disruptions to Canada gas flows will have lasting U.S. impact

- Weekly storage build at 108 bcf; gas futures steady at North of mid-$2

If natural gas bulls’ base case for Canada is to be believed, the wildfires up North may have already changed the calculus of the U.S. summer build season for the fuel.

As the heroic efforts of firefighters leave just a handful of blazes still raging in Alberta, what’s being suggested is that the problems caused by the dip in Canadian gas flow to the United States won’t go away even with the full resumption of exports, which could take until July.

The bull argument is that disruption from the North and other counter-seasonal activity has likely skewed injection plans across a large swath of the country for U.S. gas flowing from the south-central to the Midwest, Northeast, and elsewhere.

The premise is that this season’s aggressive and systemic LNG facility maintenance prevents storage builds from being much higher than they should be.

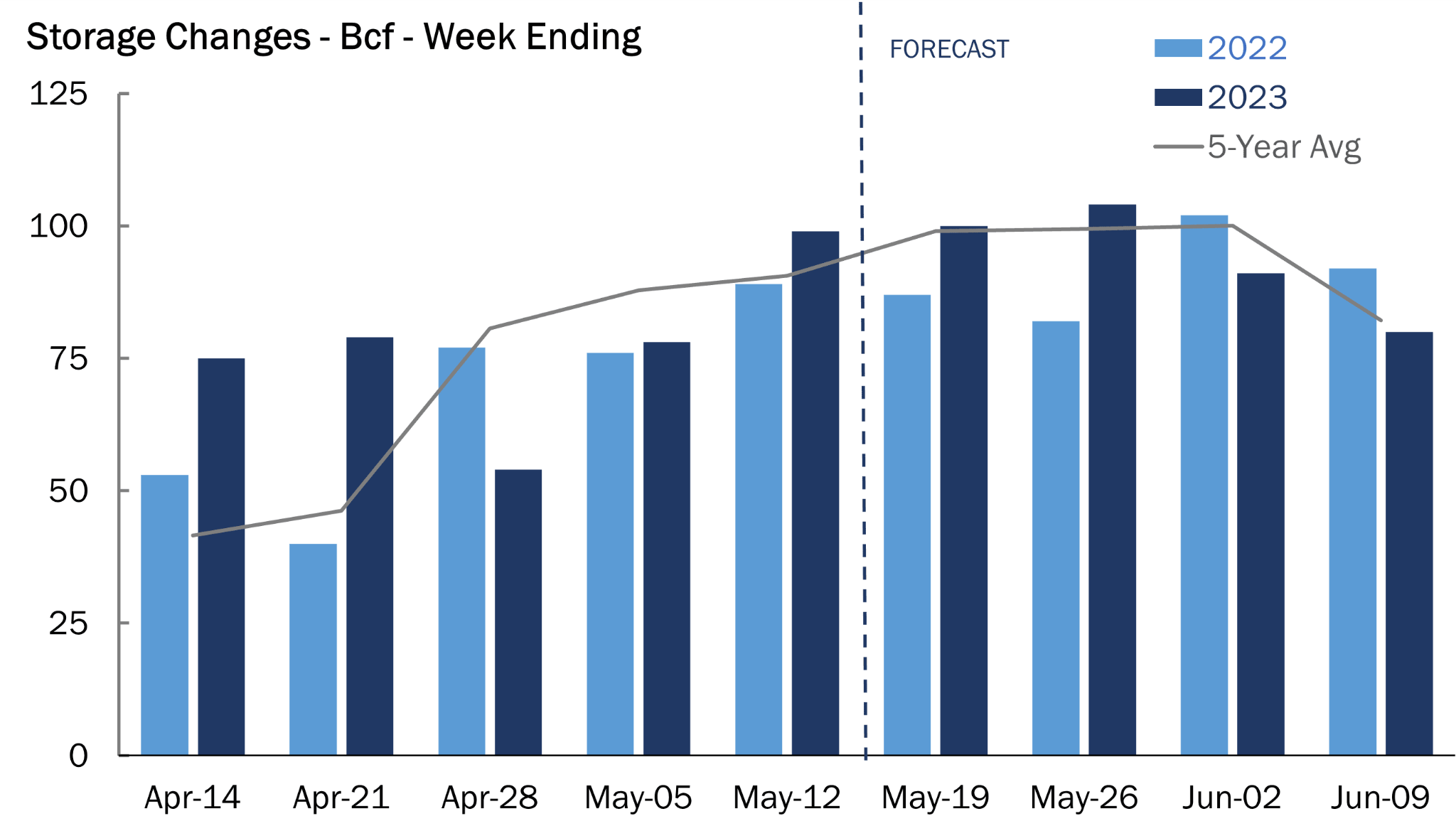

The underwhelming build of 99 billion cubic feet, or bcf, reported by the U.S. Energy Information Administration, or EIA, for the week ended May 12 could be a case in point for this, is what we hear. The forecast of industry analysts for that week had been for an increase of 108 bcf.

Source: Gelber & Associates

The EIA is to provide an updated natural gas storage number for the week ended May 19 at 10:30 ET (14:30 GMT) today, with analysts again calling for a 108 bcf increase.

The previous reading already put total gas in underground caverns in the United States at 2.24 trillion cubic feet, or up 30.3% from the year-ago level of 1.9 tcf and 17.9% higher than the five-year average of 1.9 tcf.

Yet bulls say all that can be used up in a matter of weeks if a super hot summer arrives.

The Desk, an industry journal for gas, said in a commentary:

“History tells us anything is possible in this sector. All it takes is a couple back-to-back unforeseen blistering weeks to suck that overhang dry – plus, expectations for lower production in Q3 simply adds to a far more bullish vibe. This season is hardly written.”

Eli Rubin of EBW Analytics says that despite a near-term bearish fundamental outlook, the next four EIA builds could average more than 3 Bcf/d looser versus the five-year average. He adds:

“Last week’s price spike serves as a stark reminder of lurking upside risks. Although the July contract may initially struggle to maintain a 25-cent premium to Henry Hub cash prices, the market could rapidly price in upside over the next 30-45 days if the summer forecast begins to heat up.”

Mobius Risk Group concurs, saying,

"thus far, mild weather has not generated the magnitude of injections market bears were calling for.”

But Rhett Milne of NatgasWeather.com says going forward, weather patterns remain quite comfortable through the first week of June, and thus several additional builds near or over 100 Bcf could be expected in the coming week. He added:

“We look to the second and second weeks of June for more impressive heat to show up across the southern US, and it will need to, along with a decrease in production, or surpluses will remain healthy.”

Milne’s thoughts are more reflective of what those with a less sanguine outlook on gas have to say.

Houston-based energy markets advisory Gelber & Associates noted that production was expected to rise over the May 29 U.S. Memorial Day holiday weekend due to the lack of weekday maintenance.

Gelber also pointed out that Canadian natural gas imports have returned to somewhat “normal” levels similar to those seen before the wildfires in Alberta and other provinces shuttered oil and gas wells. It added:

“Canadian imports to the U.S. were hovering around 4 bcf daily, but the past 2 days have seen import flows equaling 5.3 bcf per day. Wildfire counts in Alberta have continuously been on the decline over the week with the active number of wildfires reaching 67 and only about 20 of those are still ‘out of control’. Should these counts continue to decrease, further volatility in Canadian imports is sure to dissipate.”

It also expected more volatile-than-usual gas price action upon the release of the latest EIA inventory.

That brings us to the money shot for this week. After the cumulative 20% surge over the past two weeks, the front-month gas contract on the New York Mercantile Exchange’s Henry Hub was headed for a drop of 0.5% in the current week.

At the time of writing, the absolute price for the front month itself hovered at $2.58 per mmBtu or million metric British thermal units.

The gas benchmark hit an 11-week high of $2.707 on Monday, breaking out from the tight confines of mid-$2 pricing on the notion that the market may finally be turning the corner on fundamentals despite being oversupplied.

On the technical front, charts also looked favorable for Henry Hub’s front-month contract to target $3.75, said Sunil Kumar Dixit of SKCharting.com.

Source: SKCharting.com

“Sustainability above the 100-day SMA, or Simple Moving Average, of $2.56 indicates continuation of a bullish momentum for the contract,” said Dixit. “This targets the 5-month EMA, or Exponential Moving Average, that’s dynamically positioned at $2.98 and the 100-month SMA statically aligned to $3.25.”

**

Disclaimer: The content of this article is purely to educate and inform and does not in any way represent an inducement or recommendation to buy or sell any commodity or its related securities. The author Barani Krishnan does not hold a position in the commodities and securities he writes about. He typically uses a range of views outside his own to bring diversity to his analysis of any market. For neutrality, he sometimes presents contrarian views and market variables.