US liquefied natural gas (LNG) exports have maxed out and are ramping up further as the Biden administration pledges to supply Europe—providing what could be important market support as weather in the United States transitions from winter into milder spring.

US LNG exports should continue to climb, averaging 13.3 billion cubic feet (bcf) daily for the entire year, an increase of 16% from 2021, according to the latest forecast from the US Energy Information Administration. That would be up from 11.2 bcf daily in January, and 10.4 bcf per day from the fourth quarter of last year.

Natural gas prices often slide in the spring because heating demand fades and temperatures remain too mild to spark widespread cooling demand—creating a market dynamic commonly known as “shoulder season.”

Last year, gas futures on New York’s Henry Hub hovered at around $2.40 per million metric British thermal unit in March as spring got underway. It was even lower in March 2020, reaching a trough of $1.52 per mmBtu.

This year though, after spring broke on Mar. 20, Henry Hub’s front-month went from a low of $4.75 to as high as $5.62 at Wednesday’s settlement. For all of last week, prices rose almost 15% before retreating about 1% week-to-date.

The price blowout was underpinned by expectations of European demand for US LNG amid the bloc’s determination to wean itself off Russian supply in the aftermath of Moscow’s expansion into Ukraine.

But fundamentals aren’t the only thing favoring gas pricing now—even technicals appear biased to the upside, says Sunil Kumar Dixit, chief technical strategist at skcharting.com.

“Prices are trading above short-term moving averages and momentum is bullish,” Dixit said in a forecast shared with Investing.com.

The crossover of the 50-day Exponential Moving Average and the 200-day Simple Moving Average on Henry Hub’s front-month further strengthens the upside, he said.

“A sustained move above the $5 handle favors bulls, who could be eyeing $6 and $6.70 over the next week, though weakness below $5 can also initiate corrections to $4.50 and $4.30,” added Dixit.

Gas at $5-$6 or above at this time of the year would be seasonally high.

Yet, the 2022 spring is shaping to be very different. On Mar. 25, President Joseph Biden and European Commission head Ursula von der Leyen announced in Brussels a watershed pact where the United States would become the biggest single exporter of gas to the EU. The EU used to get 40% of its home-heating fuel from Russia.

The nuts and bolts of the deal, as broken down in a Fortune column, entails the US replacing 50 billion cubic meters (bcm) of Russian gas this year and fulfilling the REPowerEU schedule to dump all Russian imports by 2030. The 2022 goal represents a reduction of around one-third of Europe's annual Russian imports.

Source: Gelber & Associates

The US-EU pact tags US LNG as the principal source for filling the gap created by the epic axing of Russian gas. The blueprint calls for the US to fill one-third of the gap by upping its LNG shipments by 15 bcm in 2022.

The EU would achieve the additional reduction through a combination of accelerating the transition to renewables and encouraging home energy saving practices such as deploying smart thermostats and heat pumps. Still, the big surprise was the jaw-dropping, longer-term target for US shipments.

In fact, US producers are already sending record LNG shipments to Europe. Last year, America took first place for the first time by capturing a 26% market share, edging past Russia (19%) and Qatar (22%).

In the first three months of 2022, the US has been capturing almost 60% of all LNG shipments, raising its annualized total from around 25 billion cubic meters (bcm) last year to almost 50 billion. The joint announcement calls for an increase in non-Russian imports of 15 bcm in 2022 and sets a target for the US to supply an additional 50 bcm annually (bcm/y) in the years ahead.

It's unclear if the EU is using last year's exports of 25 bcm or the current number closer to double that figure as the baseline. But at the least, US producers would be supplying three times 2021 volumes, and by Fortune's estimates, possibly quadrupling shipments to 100 bcm/y.

The blueprint doesn't say how fast US imports would ramp to the full extra 50 bcm/y. But it strongly implies the shift would happen fast.

A note from research firm Rystad Energy commenting on the announcement predicts that all that new, virtually guaranteed, long-term business will "encourage" the "final investment decisions" for expanding LNG output in the US.

One evidence of that was “the very quick and efficient ramp-up of Calcasieu Pass,” said Dan Myers, analyst at Gelber & Associates, a gas market-focused consultancy in Houston.

The Calcasieu Pass is the seventh US gas processing facility using what is described as a highly efficient, modular, mid-scale LNG liquefaction technology to lower cost and maximize output.

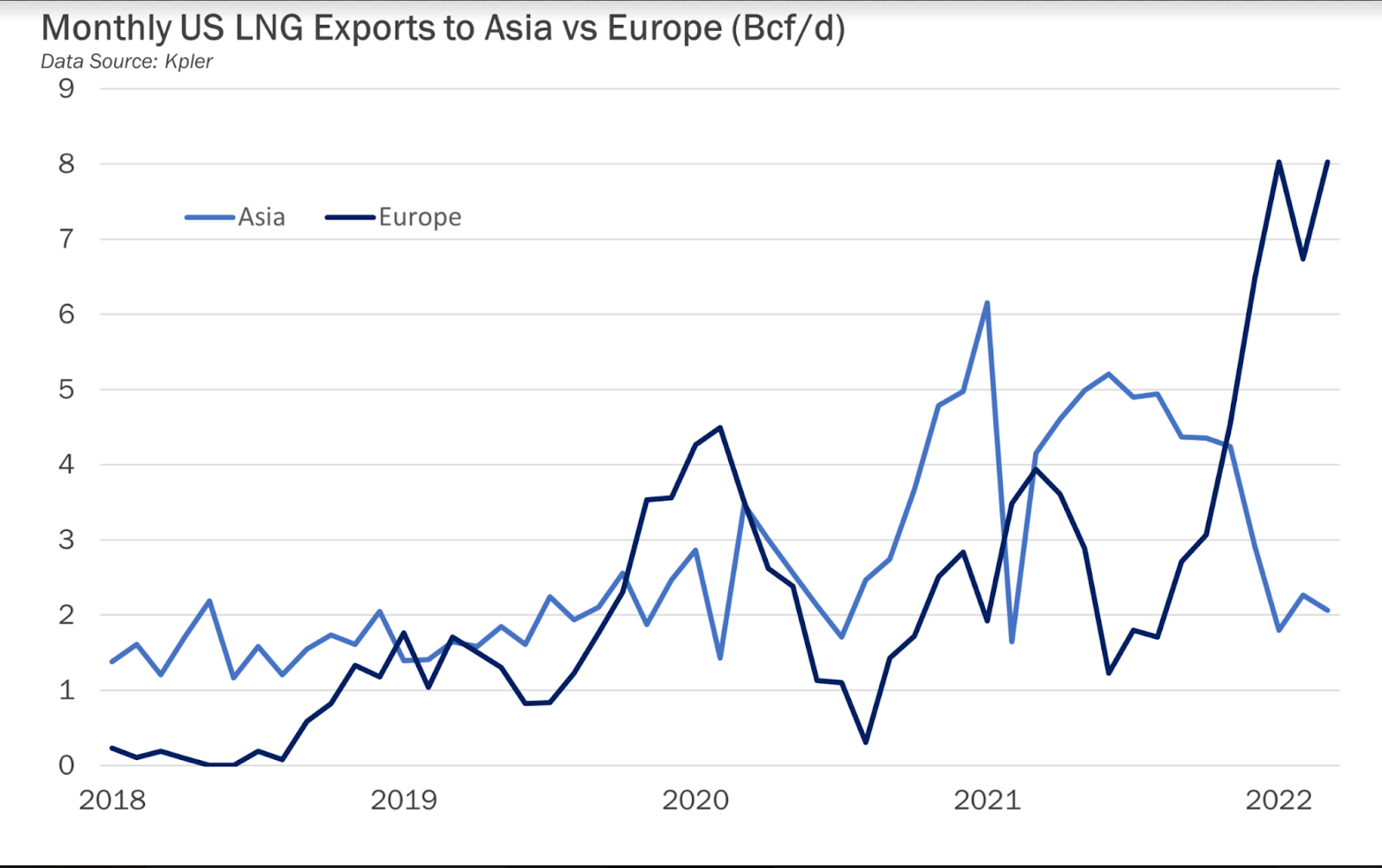

Gelber & Associates’ data shows US LNG exports to Europe having surpassed 8.0 bcf per day—accounting for 60% of the recent record high.

“High European prices have incentivized Europe as a final destination for international LNG, and given US proximity to Europe, US cargoes are clearly prioritizing Europe over Asia,” Myers said. “The difference between received LNG exports from the US between Asia and Europe has widened significantly since December.”

On the gas inventory front, as the market braces for the latest weekly storage update from the Energy Information Administration at 10:30 AM today (14:30 GMT), the consensus among analysts tracked by Investing.com is for an addition of 21 bcf last week—the first injection of the 2022 season due to relatively mild weather.

The draw will compare with the build of 7 bcf during the same week a year ago and a five-year (2017-2021) average withdrawal of 23 bcf.

In the prior week to Mar. 18, utilities withdrew 51 bcf of gas from storage.

If analysts' consensus forecast is on target, the withdrawal during the week ended Mar. 25 would take stockpiles up to 1.410 trillion cubic feet (tcf), about 15% lower than the five-year average and 20% below the same week a year ago.

Source: Gelber & Associates

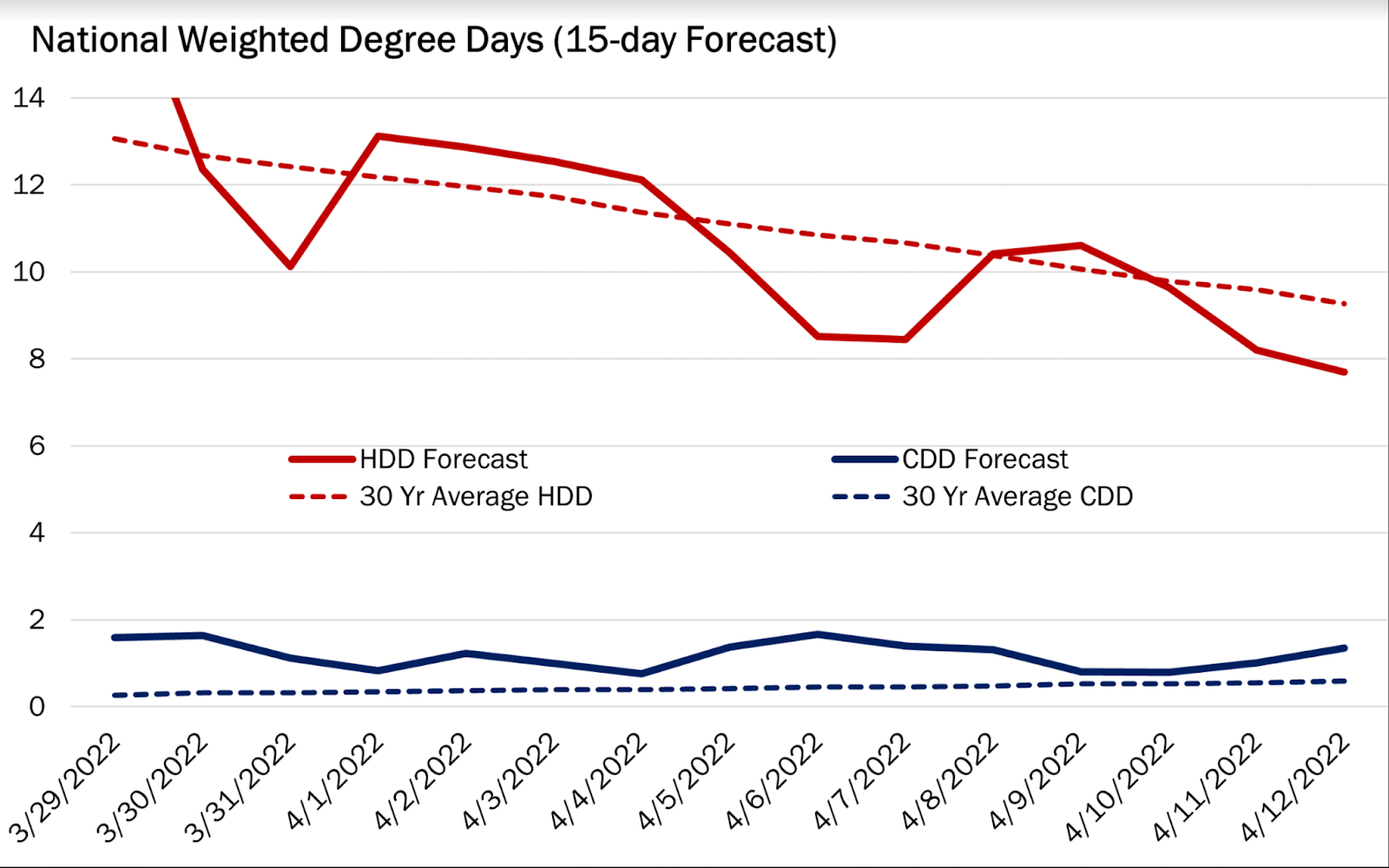

The weather last week was milder than normal with just 90 heating degree days (HDDs) compared with a 30-year normal of 114 HDDs for the period, data from Refinitiv showed.

HDDs, used to estimate demand to heat homes and businesses, measure the number of degrees a day's average temperature is below 65 Fahrenheit (18 Celsius).

Bespoke Weather Services said the early spring outlook for natural gas was neutral heading into Wednesday’s session. The American and European weather models were “mostly stable” day/day, with projected gas-weighted degree days for the 15-day period remaining “a little on the below-normal side,” the forecaster said in comments carried by naturalgasintel.com.

Bespoke said sharp weather swings are “often needed to move the needle much at this time of year.”

Weakening in the negative North Atlantic Oscillation pattern starting this weekend should lead to “warmer variability…if not ultimately a skew warmer than normal” toward the third week of April, according to the firm, leaving mostly comfortable temperatures across the Lower 48 US States.

Disclaimer: Barani Krishnan uses a range of views outside his own to bring diversity to his analysis of any market. For neutrality, he sometimes presents contrarian views and market variables. He does not hold positions in the commodities and securities he writes about.