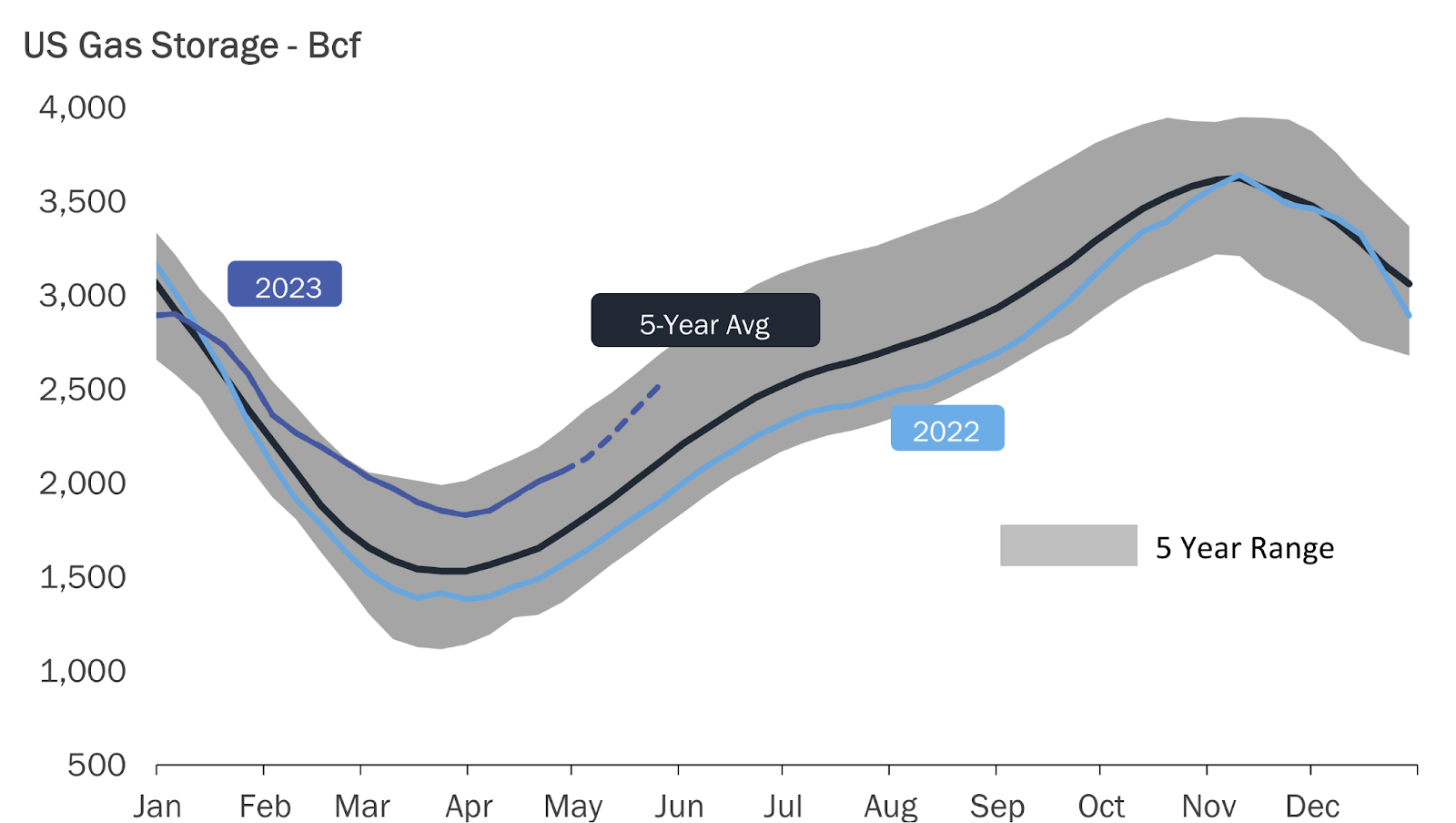

- US gas storage 33% above year-ago, 20% higher than the five-year average

- Stay neutral or short any gas rally, says Citigroup, which sees Q2 price of $2.20

- Technical charts, however, suggest dip buying if market gets below $1.94

It could hardly be described as a positive call for the bullish investors in America’s favorite fuel for indoor temperature control.

Stay neutral on your natural gas positions; If you must trade, then short, or sell, into any rally, said Citigroup in a note issued Thursday.

With gas inventories standing 33% above year-ago levels and 20% higher than the five-year average, it's not surprising to get such a call from one of Wall Street’s leading forecasters for energy — even if it’s a firm known to be typically more bearish than its peers on oil and gas calls.

Inventory data from the US Energy Information Administration on Thursday showed total gas stored in underground caverns in the United States at 2.063 trillion cubic feet, or tcf, after the latest weekly build of 54 billion cubic feet, or bcf.

The same week a year ago, storage was at 1.556 tcf. The average between 2018-2022 was, meanwhile, at 1.722 tcf.

Source: Gelber & Associates

Fundamentals for gas aren’t looking great either: The weather is warming slightly, daily production in the fuel is still relatively high and exports of LNG, or liquefied natural gas, are lower than usual, say analysts at Houston-based energy markets service Gelber & Associates. They add:

“If a hot summer emerges and power demand competes with storage as is expected, storage being in such a healthy position now will ensure that a scenario like last year’s race to fill storage will not happen this year.”

Given those circumstances, it was probably understandable for Citi to have taken the stand it did in calling on investors to be cautious about building long positions at current prices, which it said would likely be challenged by continuously high production.

“The constructive narrative for prices over the rest of the year, based mainly on stronger YTD (year-to-date) gas demand for electricity generation, could very well be offset by other supply-demand drivers,” the Citi note said.

“In general, we suggest staying neutral or selling into major rallies until the market gets a better sense of summer weather and other fundamental developments. A price bounce during summer could quickly be overwhelmed by robust production, thereby taking prices right back down.”

Output continues to head higher as both natural gas and oil rig counts remain resilient, Citi said:

“Looking ahead, production could very well stay more resilient than expected, as many producers are maintaining their gas rig count amid the emerging constructive narrative that dissuades many producers from being more prudent.”

Production continues to hold around 100 bcf per day — well above year-earlier levels and within roughly 2 bcf/d of record activity, trade portal naturalgasintel.com said in a report.

“We’re moving farther into this shoulder season with strong supply, and so the market is myopically hanging just above the $2 level until something happens – until we see a demand stimulus,” Thomas Saal, senior vice president of energy at StoneX Financial, told the portal.

For now though, domestic gas consumption remained the driver of prices, “and we need some heat before we see much of a change”, added Saal.

The most-active June gas contract on the New York Mercantile Exchange’s Henry Hub settled Thursday’s trade down 6.9 cents, or 3.2%, at $2.101 per mmBtu, or million metric British thermal units.

Charts by SKCharting.com, with data powered by Investing.com

A year ago, the benchmark gas contract on the Henry Hub was trading at between $7 and $8 per mmBtu, with a high of above $9 on fears of a supply squeeze heightened triggered by the Russia-Ukraine conflict.

In Citi’s base case, benchmark Henry Hub prices were likely to average $2.20 in the second quarter of this year, down from the $2.80/ averaged in the first quarter.

Storage, meanwhile, could top out at 4.0 tcf or by end-October, ahead of the seasonal demand for winter heating, particularly if the coming summer was mild due to the El Niño weather phenomenon, added Citi.

The debate on when the bearish tide would irrevocably turn for ‘natty’ — as the all-season fuel for heating and cooling is known — has raged since gas prices began their headlong fall from 14-year highs of $10 per mmBtu in August.

At brief intervals this year, the market had appeared to be on a cusp of a serious rebound — like in late February when it got above $3 after breaking below $2 earlier that month for the first time since September 2020.

Since the start of 2023, however, gas has not made a forceful break amid the mid-$2 level, which technical chartists say is critical if the fuel is to make a new upward trajectory.

Despite Citi’s bearish call, technical charts suggest that building longs beneath $2 might be opportune for investors in gas, said Sunil Kumar Dixit, chief technical strategist at SKCharting.com. Dixit added:

“A break below the $1.94 horizontal support zone will be seen as potential weakness, though there is limited room for downside and the risk versus reward ratio will eventually favor buying the dips.”

“On the flip side, consolidation above the $2.04-$1.94 range will lead to a recovery towards $2.20. But bulls will need to establish a daily close above the 50-day Exponential Moving Average, or EMA, of $2.42 to resume the uptrend. At that point, targets would be the weekly Middle Bollinger Band of $2.78, followed by the 100-day Simple Moving Average, or SMA, of $2.90.”

Dixit, however, acknowledged that the current momentum in gas was bearish with the 5-day EMA of $2.15 making a negative overlap below the daily Middle Bollinger Band of $2.21.

“If the $2.04 support is broken, expect a drop to $1.94, below which the correction can extend to $1.80 and $1.64.”

Despite Citi’s narrative that daily output is sticking stubbornly to 100 bcf and above, there could be production slashes by companies responding to the market malaise, said analysts at Mobius Risk Group.

They noted that several natural gas producing companies had reported mulling lower output during their first-quarter earnings calls, after weak gas prices had weighed on the bottom line.

However, “the market is clearly impatient when it comes to pricing in the potential for lower output and tighter late-year balances, and instead remains focused on mild near-term weather and a year-over-year inventory surplus,” the Mobius team said.

***

Disclaimer: The content of this article is purely to educate and inform and does not in any way represent an inducement or recommendation to buy or sell any commodity or its related securities. The author Barani Krishnan does not hold a position in the commodities and securities he writes about. He typically uses a range of views outside his own to bring diversity to his analysis of any market. For neutrality, he sometimes presents contrarian views and market variables.