What a difference a week makes in natural gas. With the US market for heating entering its fourth day of spring weather, gas futures have turned ballistic again.

Just a couple of weeks ago, calmer weather appeared headed our way, promising temperatures that would be neither too cold to crank the heat all the way up, nor warm enough to require the air conditioner to be turned on.

The so-called “shoulder season" transition between early and mid-spring is typically a demand killer for gas. For this week, the initial expectation for pricing of gas futures on New York’s Henry Hub is at mid-to-$4 levels per thermal unit or even lower.

But that’s not what happened. Since the Mar. 15 close, Henry Hub’s front month has jumped a whopping 66 cents over the six trading sessions to Wednesday, closing five of them higher for a net gain of almost 15% and a one-month high at $5.33.

Henry Hub’s strip pricing for other 2022 contracts was at an average of $5.40.

As Thursday’s Asian trading window opened, the market added almost another percent by 2:00 AM in New York (2:00 PM in Singapore) on revised expectations that the cold will not subside yet with the advent of spring that began on Mar. 20 or Sunday.

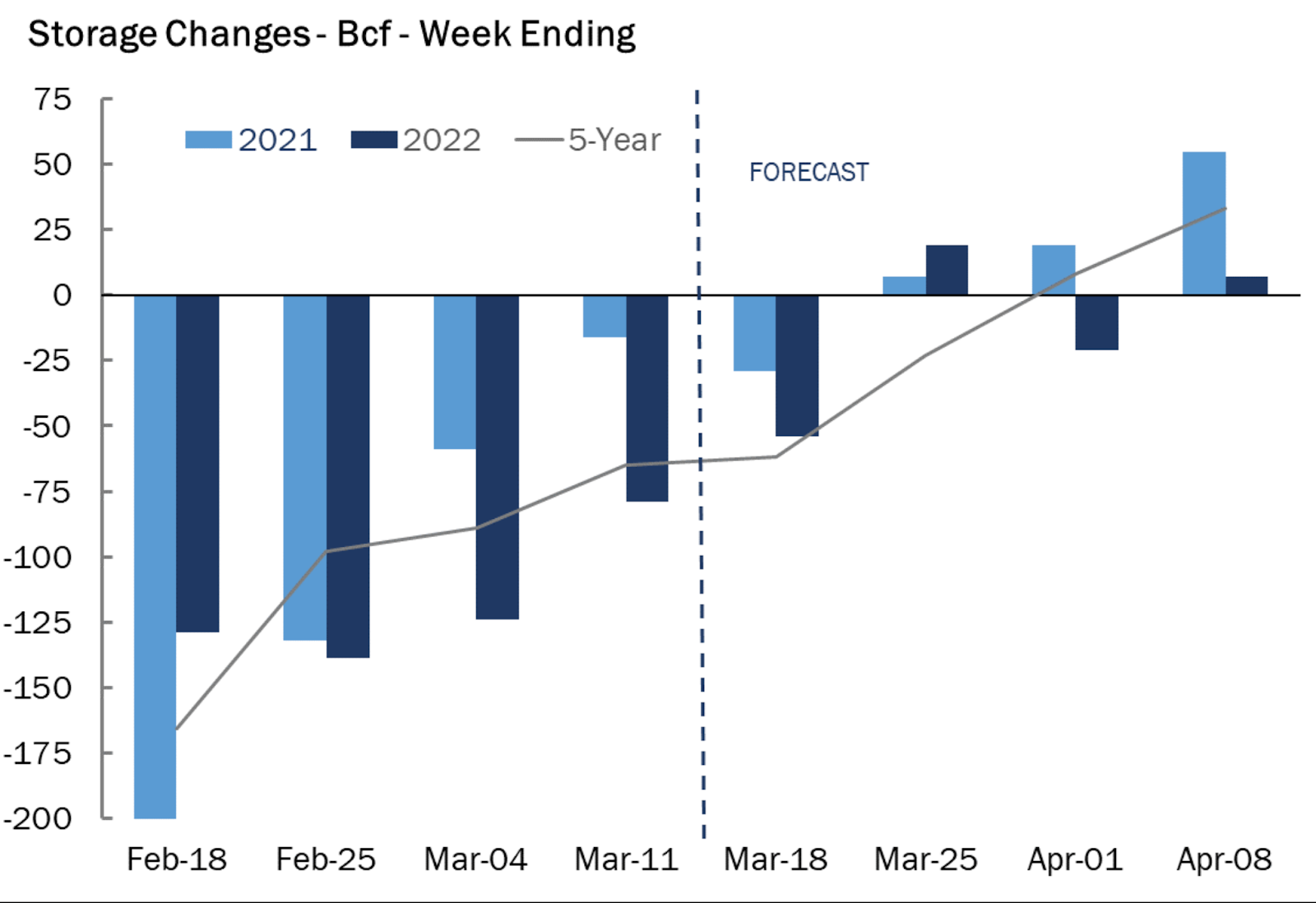

"Overall, revisions since Monday of this week have added nearly 50 bcf to weather-driven demand expectations for storage weeks ending on April 1st and 8th,” Dan Myers, analyst at Houston-based gas market consultancy Gelber & Associates, said in an email to the firm’s clients on Wednesday.

The 50 bcf, or billion cubic feet, addition to demand will be integral to determining how gas balances in US storage—as well as prices—fare over the next two weeks.

As the market braces for the latest weekly storage update on gas that the Energy Information Administration will provide today at 10:30 AM Eastern US, the consensus among analysts tracked by Investing.com is for a withdrawal of 56 bcf for the week ended Mar. 18.

The draw will compare with the decline of 29 bcf during the same week a year ago and a five-year (2017-2021) average withdrawal of 62 bcf.

In the week prior to Mar. 11, utilities withdrew 79 bcf of gas from storage.

Source: Gelber & Associates

If analysts' consensus forecast is on target, the withdrawal during the week ended Mar. 18 would cut inventories to 1.384 trillion cubic feet, about 17.7% lower than the five-year average and 21% below the same week a year ago.

Despite last week’s colder-than-anticipated weather, in terms of actual Heating Degree Days, or HDDs, there were just 110 for the week ended Mar. 18 compared with a 30-year normal of 128 HDDs for the period, weather data provider Refinitiv said.

HDDs, used to estimate demand to heat homes and businesses, measure the number of degrees a day's average temperature is below 65 degrees Fahrenheit (18 degrees Celsius).

Another market phenomenon that could occur in gas by next week—despite the recent pivot towards more chill—is the shift towards gas injections into storage if less of the commodity is burned to provide heating and to generate power.

Myers, however, urged Gelber & Associates’ clients in his e-mail to be wary of more temperature surprises ahead.

"Given the indecisive, flip-flopping nature of the coming weather pattern, storage changes are expected to be marginally more bullish than their typical 5-year counterpart in the next four storage reports on net.

"This is a significant turnaround from the relatively bearish, weak demand period that seemed to be approaching just a few days ago."

Disclaimer: Barani Krishnan uses a range of views outside his own to bring diversity to his analysis of any market. For neutrality, he sometimes presents contrarian views and market variables. He does not hold positions in the commodities and securities he writes about.