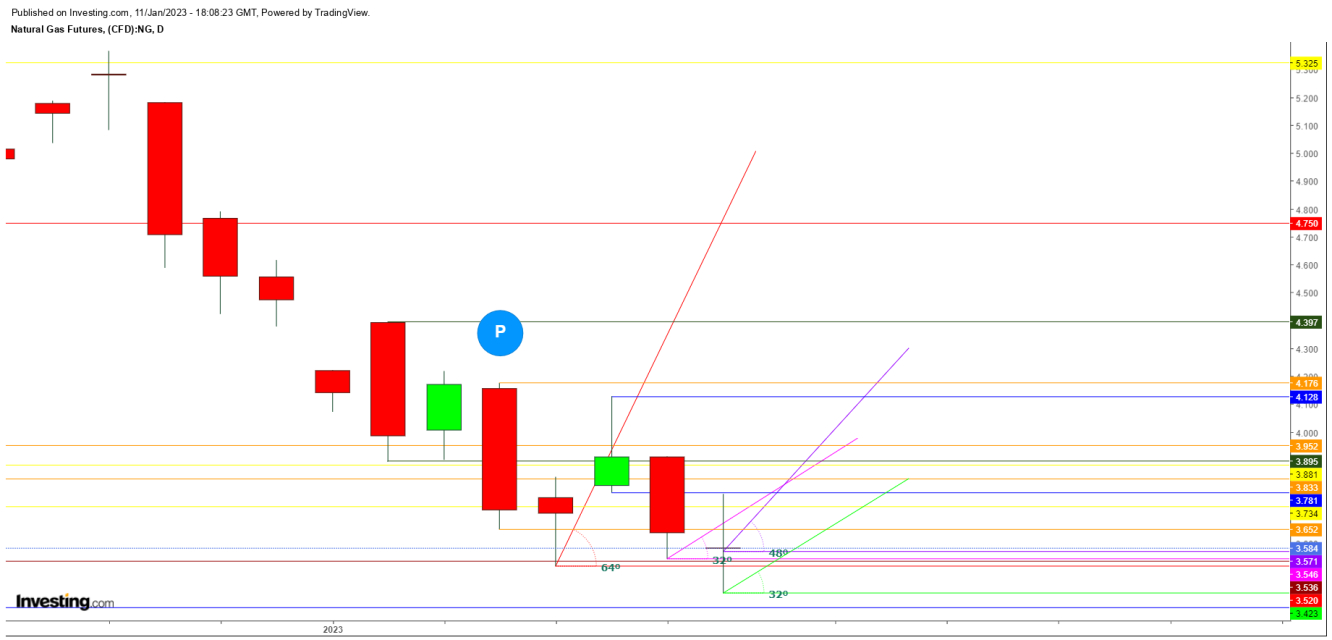

Movements of the natural gas futures on a wobbly Wednesday indicate the extreme downside limits have been tested at $3.423 by the commodity's bears -- approximately 100 points below the previously cited turning point.

After testing this new low of this winter season, bears look ready to run towards heights before they get trapped at such a low level as any sudden shift in the weather outlook could result in the sudden entry of big bulls at current levels.

At the time of writing, natural gas futures are trading at $3.753 after an extremely volatile move on Wednesday from $3.776 - $3.423.

Technically, on the daily chart, movements indicate equal thrust applied by both bulls and bears, as the upcoming weekly inventory and US inflation data on Thursday could define the further direction for the energy sector.

On the 15-minute chart, natural gas is currently holding above the immediate support at $3.549. The reversal could continue if natural gas futures sustain above the significant resistance at 200 DMA, which is at $3.732.

It is impossible to predict the next directional move at this crucial point as price movements would be highly tied to fundamentals. Still, if the commodity closes this week above $4.511, then bulls will have a great opportunity ahead of them.

Disclaimer: The author of this analysis does not have any position in Natural Gas futures. Readers are advised to take any position at their own risk; as Natural Gas is one of the most liquid commodities of the world.