My most recent analysis on natural gas futures, garnered mixed reactions due to my writing on the probabilities of a bounce despite the bearish trend in March 2023. However, the last trading day of March saw a 2.95% gain, bringing natural gas futures to $2.074 from a fresh low.

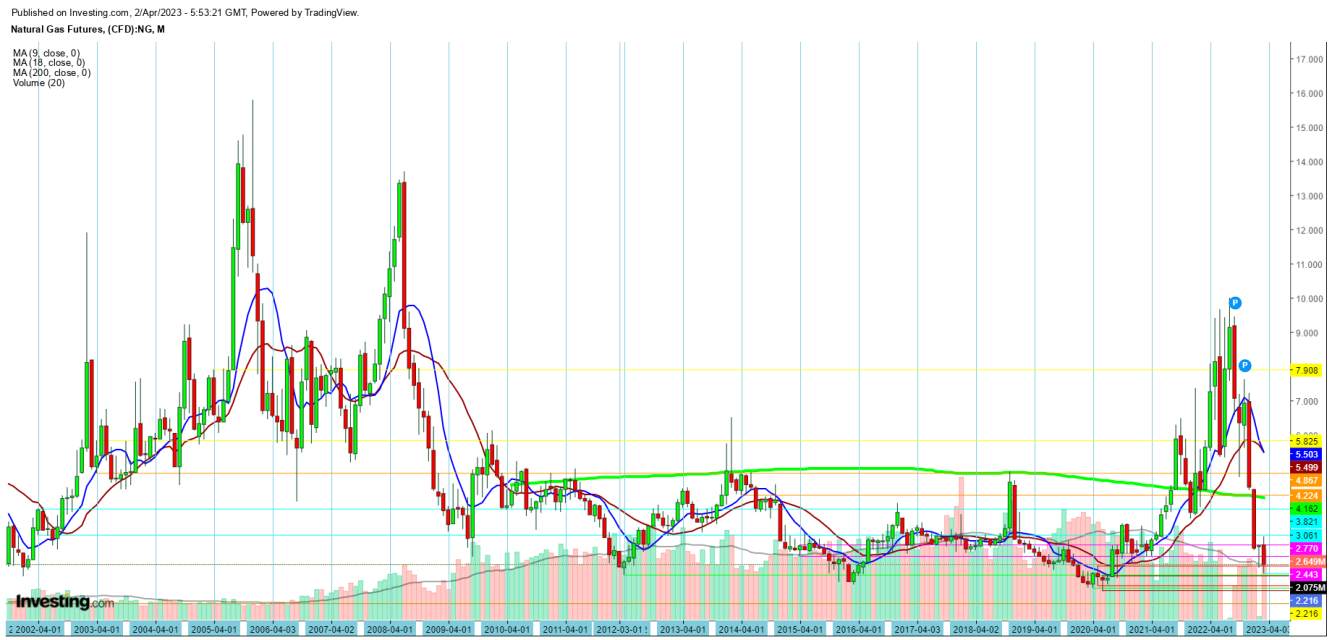

Bearish sentiments have been prevalent in natural gas prices since Dec. 19, 2022, when futures faced stiff resistance at $6.116. The prices have continued to slide until hitting a low of $1.972 on Feb. 22, 2023, and then rebounded to $3.026 on Mar. 3, 2023.

While a sudden bounce on the last day of March may raise some suspicion among bulls and bears alike, it is worth noting that the weather continues to favor the bears, as overproduction and reduced supply since the Freeport LNG terminal explosion in June last year remains a challenge.

However, there are indications of a shift from bearish to bullish sentiment. For instance, LNG net flows to U.S. LNG export terminals rose to a record 14.2 bcf/day on Wednesday, with natural gas exports continuing to increase from the Freeport LNG terminal. Lower-48 state dry gas production also rose to 101.4 bcf (+6.0% y/y) on Thursday, indicating that U.S. electricity output is bullish for natural gas demand from utility providers.

According to the Edison Electric Institute, the total U.S. electricity output for the week ending Mar. 25 also rose +5.9% y/y to 74,307 GWh (gigawatt/hours).

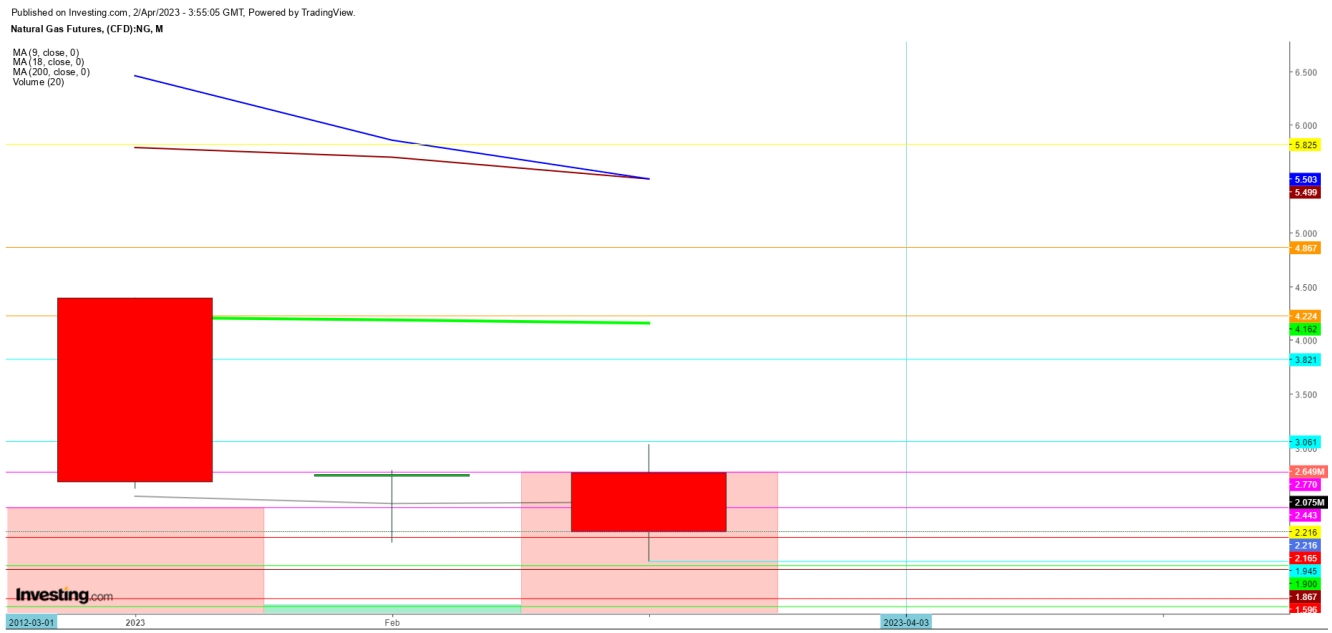

Technically speaking, in the monthly chart, the monthly candle of March 2023 has shown some recovery after hitting a low at $2.074. This bearish candle seems to be a repetition of March 2012.

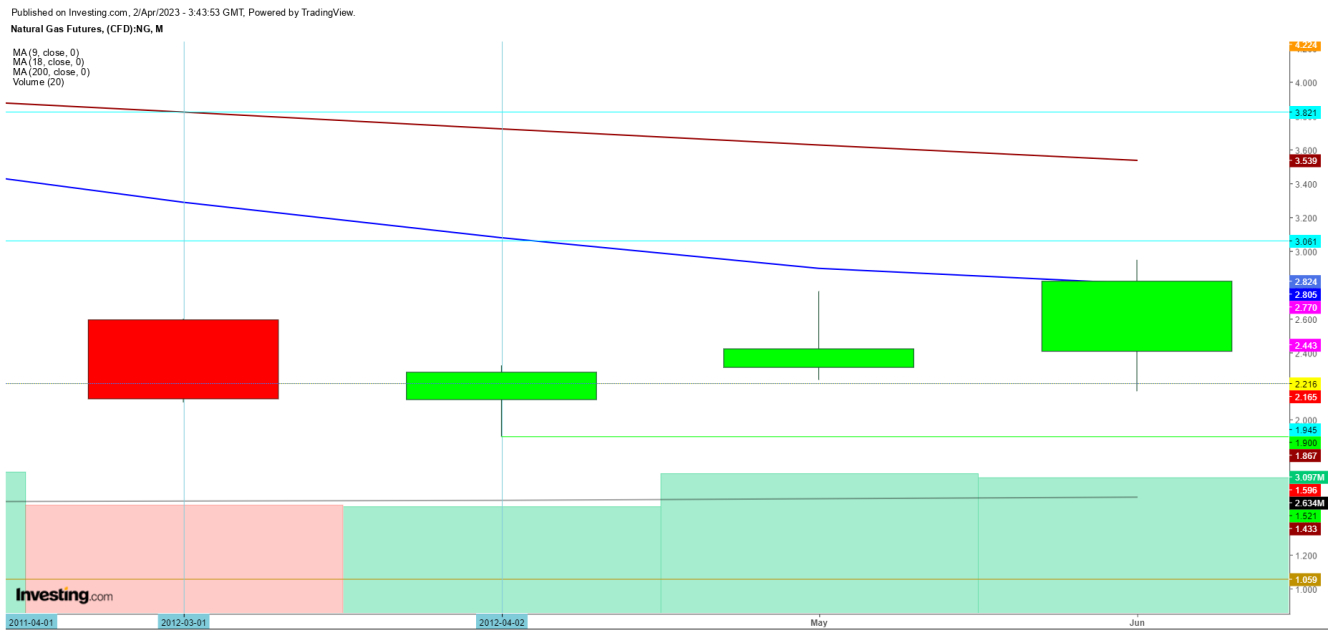

Let’s compare the monthly candles, formed in March 2012 and March 2023, to check the probabilities of further moves from April to May this year

In March 2012, natural gas futures tested a low of $2.121, followed by a green candle for April 2012 that hit a fresh low at $1.900 before closing the month at $2.295. The monthly candles for May, June, and July were also green.

In contrast, the monthly candle formed in March 2023 indicates suspicion despite the changing production, demand, and supply still being a significant challenge.

To check the probability of upcoming movements, the opening level on the first trading session will play a crucial role in deciding the next direction of natural gas prices in the upcoming months.

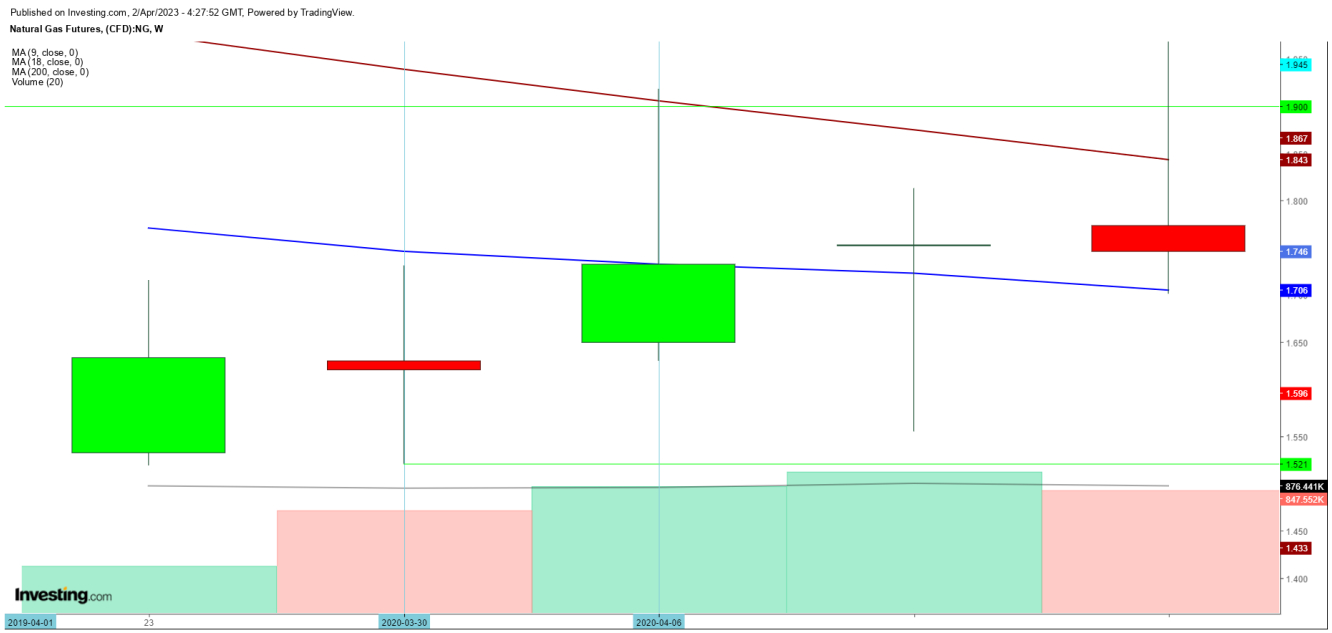

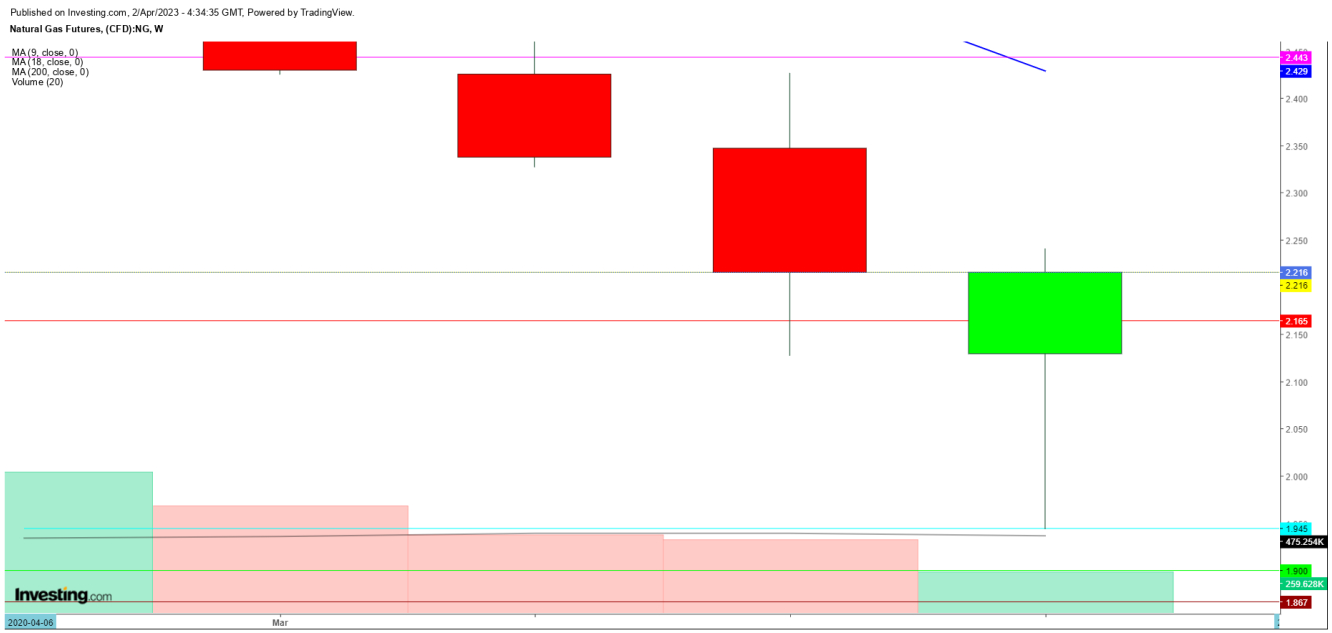

Looking at the movements of natural gas futures in the first week of April 2020 on a weekly chart, we see indecisive movements with a sell-off despite an attempt to hit $1.919 after a gap-up start, followed by sharp volatility during the next three weeks.

However, the weekly candles formed in March 2023 suggest changing sentiments from bearish to bullish. The last weekly candle of March 2023 is a bullish hammer formed after hitting a low of $1.945, which is much higher than the weekly highs in April 2012.

Undoubtedly, the opening levels of natural gas futures on the first trading session of April 2023 and follow-up moves on the first two trading sessions will provide a clear view of the further intention of the bulls and bears.

The wild price swings could follow the movements, which could be on either side of the closing of March 2023, long-term support and a decisive level for natural gas prices.

Disclaimer: The author of this analysis does not have any position in natural gas futures. Readers should take a trading position at their own risk as natural gas is one of the most liquid commodities in the world.