- Tech giants like Amazon and Alphabet are hitting new highs, potentially driving a broader rally.

- QQQ, an ETF tracking the Nasdaq 100, is nearing overbought territory but the bullish trend remains intact.

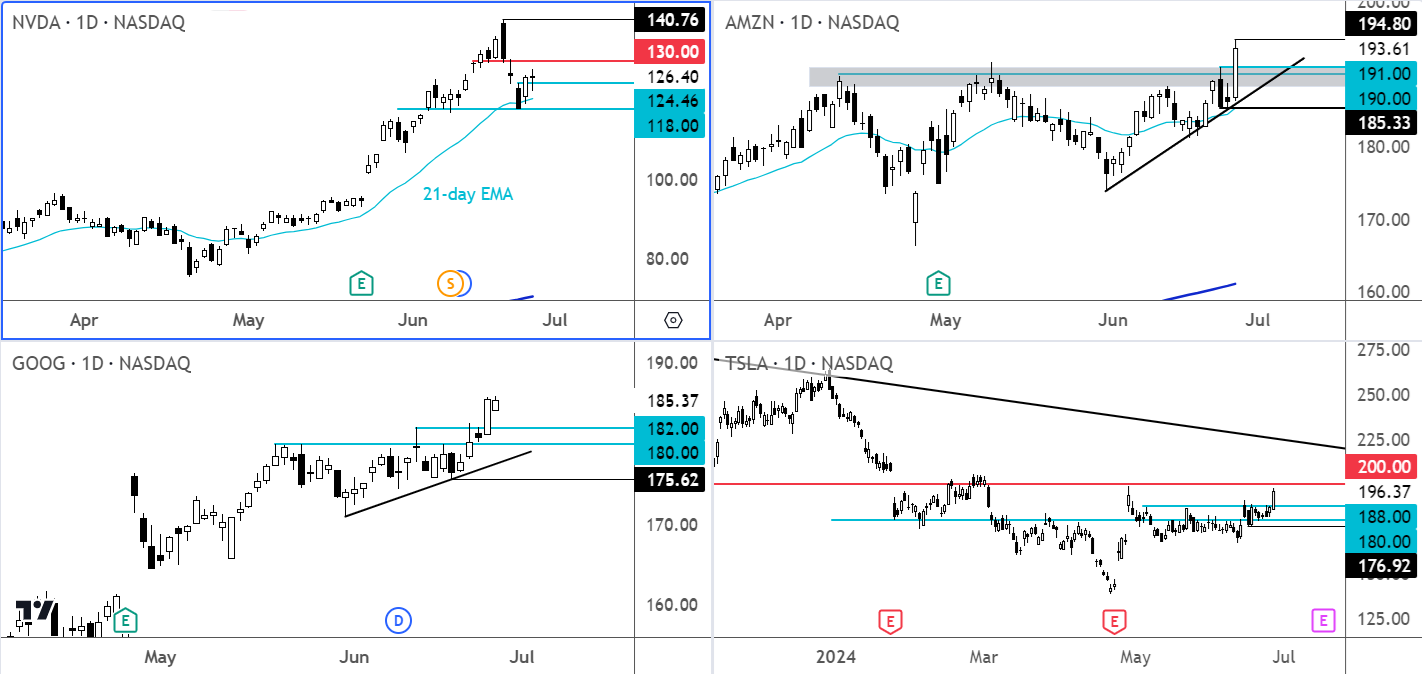

- Key support and resistance levels are highlighted for Amazon, Alphabet, Tesla, Nvidia, and QQQ.

- Unlock AI-powered Stock Picks for Under $7/Month: Summer Sale Starts Now!

US index futures have been relatively flat following a mixed close yesterday, with a few tech giants reaching new all-time highs. Investors are largely on hold ahead of Friday’s core PCE data release, so the recent consolidation in major indexes and certain market sectors isn't surprising.

However, this trend could shift as Wall Street opens, with the tech sector potentially leading the charge again. Given the bullish price movements in stocks like Amazon (NASDAQ:AMZN), Alphabet (NASDAQ:GOOGL), and Tesla (NASDAQ:TSLA), a tech-driven rally seems likely. The key to watch is Nvidia (NASDAQ:NVDA), whose performance heavily influences major US indexes. Let's examine the charts of these four stocks and discuss QQQ, an ETF tracking the Nasdaq 100 index.

Can AI Help Maximize Your Gains This Summer?

The answer is yes. Our cutting-edge AI analyzes mountains of data to pinpoint high-potential stocks before the market reacts.

Stop missing out and subscribe to ProPicks today!

Amazon, Alphabet, Tesla, and Nvidia: The Tech Rally's Potential Drivers

Amazon, Alphabet, Tesla, and Nvidia are pivotal tech stocks to monitor. At least three of these have shown bullish trends this week, potentially sustaining the tech rally and supporting the Nasdaq 100, and by extension, QQQ.

So here are the four trading opportunities on offer if tech leads the charge higher today:

1. Amazon Breaks Out After Bullish Consolidation

Amazon surged past resistance in the $190 - $191 range on Wednesday, closing up 3.9% at a record high and becoming the fifth member of the "Magnificent 7" to reach a $2 trillion market cap. This breakout is a strong bullish indicator, which could sustain the tech rally even if Nvidia pauses.

The $190-$191 area now serves as key support; it must hold to maintain bullish sentiment, with $185.33 (Monday’s low) as a critical level. A drop below this could invalidate the breakout, potentially leading to a sell-off. If support holds, Amazon could target $195 initially and $200 subsequently.

2. Alphabet Hits Another All-Time High

Alphabet has consistently reached new all-time highs, breaking out of a bullish consolidation pattern this week and surpassing the $180 resistance level. It has since exceeded the recent high around $182, making this a critical support level. Ideally, the stock should stay above this breakout area, but falling below it isn't disastrous unless it drops past the recent low around $175.62, which would undermine the bullish breakout.

3. Tesla Continues Its Recovery

Tesla’s long-term chart shows a bearish trend since November 2021, with several lower highs. However, short-term action since late April has been bullish. The stock broke past the $180 resistance and has hovered around this psychological level for weeks.

This week, Tesla moved higher, surpassing short-term resistance at $188, now the crucial support level. On the upside, $200 is the next hurdle, with minimal resistance until the bearish trend line around $220, depending on the price movement. The recent low at $176.92 is critical; a break below it would negate this week's bullish trend and potentially deter investors.

4. Nvidia Shows Signs of Stabilization

Nvidia, a key stock for the tech sector, has been volatile recently, falling from its record high of $140.76 last Thursday. Currently, it seems to have found support around $118, holding above the 21-day exponential moving average. The break above Monday’s high of $124.46 must hold on a daily closing basis to sustain bullish momentum. The critical support level is $118. In terms of resistance, $130 is the key level to watch, having served as support before last week's breakdown.

QQQ Chart Remains Constructive

The chart of QQQ, an ETF which tracks the performance of the Nasdaq 100, remains constructive for now. But the RSI is still near the overbought levels of 70, which may need to be addressed before we potentially see the next big upward move.

Since the end of May, QQQ has rallied almost 10% from its lowest point of 443.06 to its most recent high so far of 486.86. It has made more than 17% when you use its lowest point made in April at 413.07. As a result of this sharp rally, the index has reached extreme overbought technically levels.

For example, the relative strength index (RSI) has now climbed well above the 70.0 threshold to reach north of 80.0. With the market being this overbought, it is becoming increasingly uncomfortable for traders to justify continued buying into mini, intraday, dips.

The RSI needs to work off its overbought conditions, at least through time (i.e., consolidation) if not price action (i.e., at least a mini sell-off). For this bullish trend to remain intact, you obviously don't want to see too much technical damage. But a bit of a pullback should be a welcome sign, even from a bullish point of view, as this will remove some froth from the market.

Last week saw QQQ reach 485.61, the 200% extension level of the last downswing that took place between March and April. With the RSI being above 70 at that point, the subsequent drop is understandable. The RSI is now a little less overbought, but it remains near 70.

If the bullish trend continues, then that 485.61 level would remain the first objective. Meanwhile, the 261.8% Fibonacci extension of the same swing comes in at 508. In between those extension levels, you have the psychologically-important 500 level, which also needs to be watched closely, should we get there.

In terms of support levels to watch, the first line of defence for the bulls is at 473/474 area, which was tested and held earlier this week. Below that, 468.14 is the next level down, where we have seen a breakaway gap. The latter also comes in close proximity to the 21-day exponential moving average. A more significant support zone is seen at around 449, which corresponds with the high from May.

The bulls would be happy they have now seen a bit of a pullback and consolidation. However, if we instead see a full-on sell off that potentially takes out the most recent low at 443.06, then that would be a bearish development, for then we will have created our first lower low. In that case, we could then see some follow up technical selling towards the 200 moving average and long-term support at around 412, which was also the high from last year.

However, we will cross that bridge if and when we get there. For now, the bullish trend remains intact.

***

This summer, get exclusive discounts on our subscriptions, including annual plans for less than $7 a month!

Tired of watching the big players rake in profits while you're left on the sidelines?

InvestingPro's revolutionary AI tool, ProPicks, puts the power of Wall Street's secret weapon - AI-powered stock selection - at YOUR fingertips!

Don't miss this limited-time offer.

Subscribe to InvestingPro today and take your investing game to the next level!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.