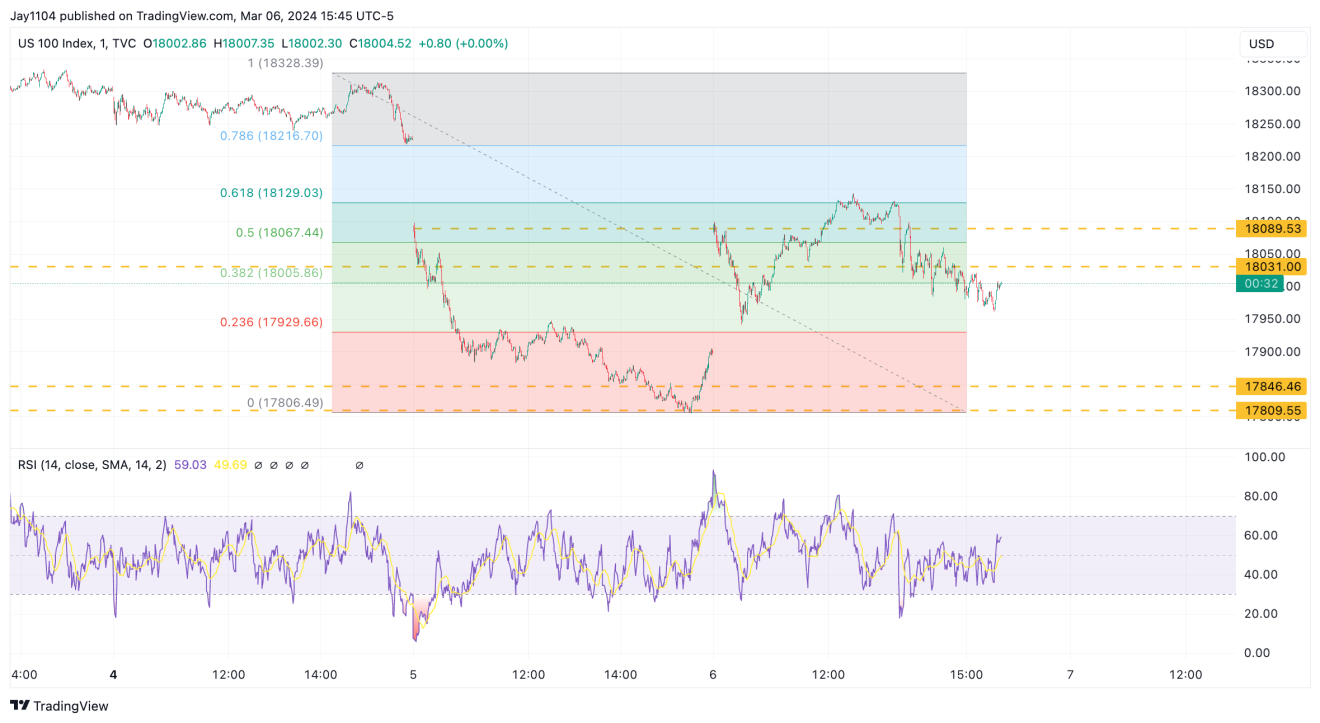

Stocks finished the day mostly higher, with the NASDAQ retracing 61.8% of the day before yesterday’s declines at its peak yesterday.

Typically, when we have seen 61.8% retracements in the past and a failure to follow through, we tend to see the previous day’s trends resume.

So, if we have started a correction in the market, we should follow through lower today and take out the low of 17,810.

Powell didn’t have much to say yesterday about the path of monetary policy. There were a lot of questions about the banks and Basel III, as well as capital requirements.

Perhaps today, Powell will be more open about the path of monetary policy. The only clue Powell gave us yesterday was that he would like to see more of the same type of m/m of inflation reports we got at the end of 2023 because he knows that y/y will come over time.

However, January certainly wasn’t in line, and February CPI is currently expected to be at 0.4%, which would be up from January. So, hopefully, today will shed more light on the subject matter.

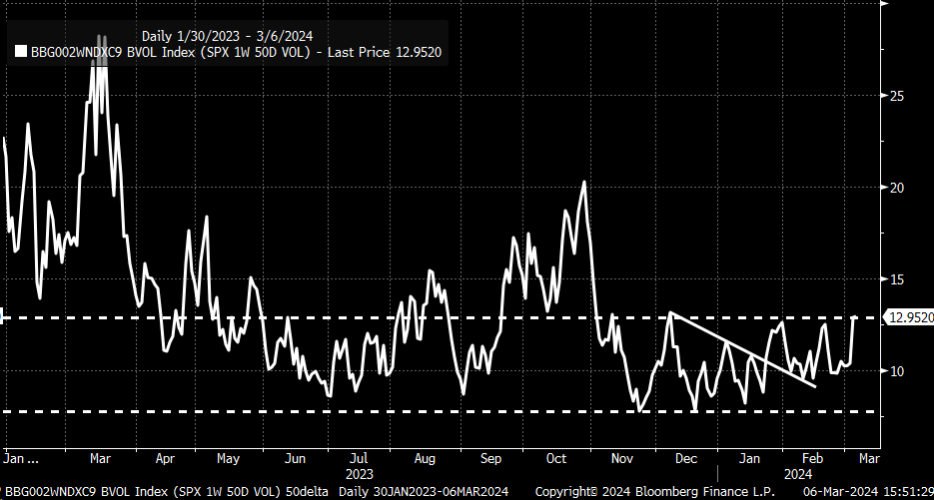

Meanwhile, the S&P 500 1-week 50 delta option saw its implied volatility level increase to just about 13 yesterday, which in the past has been a resistance level for it.

So we will want to see if this continues to push higher today, which is a sign that the market is getting more interested in looking for hedges over the short term.

In the meantime, Tesla (NASDAQ:TSLA) continues to deteriorate and may continue to weaken if it cannot maintain support around $177.

The chart below shows that a break of support could set up a further decline of an additional 14%, at least to the next significant support level.

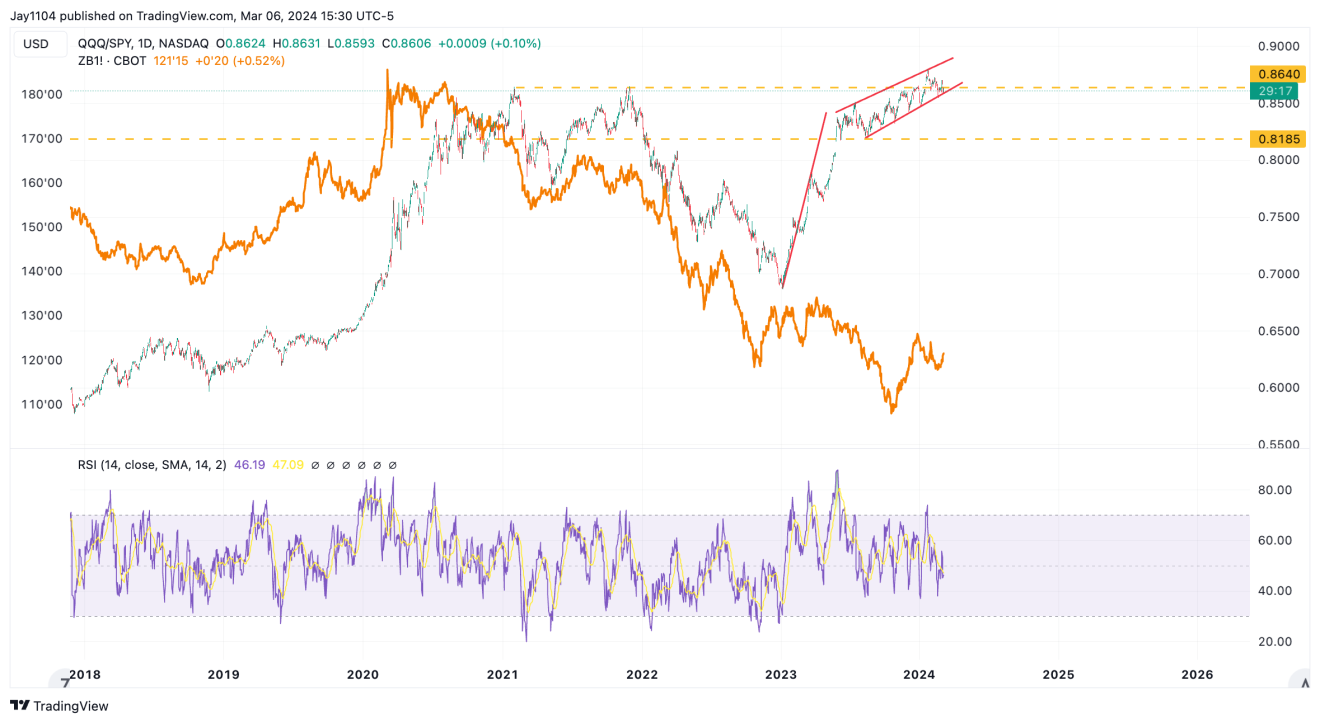

Finally, we can look at the QQQ to SPY ratio; interesting that we are seeing the relationship where it is at the moment. It has a nice rising flag pattern.

What is also interesting is that we are back to levels seen in February 2021 and November 2021, two critical periods in the market.

February 2021 was when we saw the peak in the Biotech sector and the ARKK ETF, long-duration growth assets.

November 2021, of course, was the peak in the top in the NASDAQ, and of course, the devastation of 2022 that followed. We also started to see the ratio trade with bond prices until they separated in January 2023.

The ratio was only higher in the dot com bubble when comparing the NDX to SPX ratio.