Two weeks ago, see here; we found, based on our interpretation of the price action for the Nasdaq 100 using the Elliott Wave Principle (EWP)

"the index has so far, only completed three (green) waves lower from the July high. Three waves lower is corrective. The NDX must remain below $15365 (green W-a/1) because otherwise, the potential W-4 will overlap with W-a/1, and that is not allowed in an impulse. We will then shift focus to the red W-v? to ideally $16775+/-25."

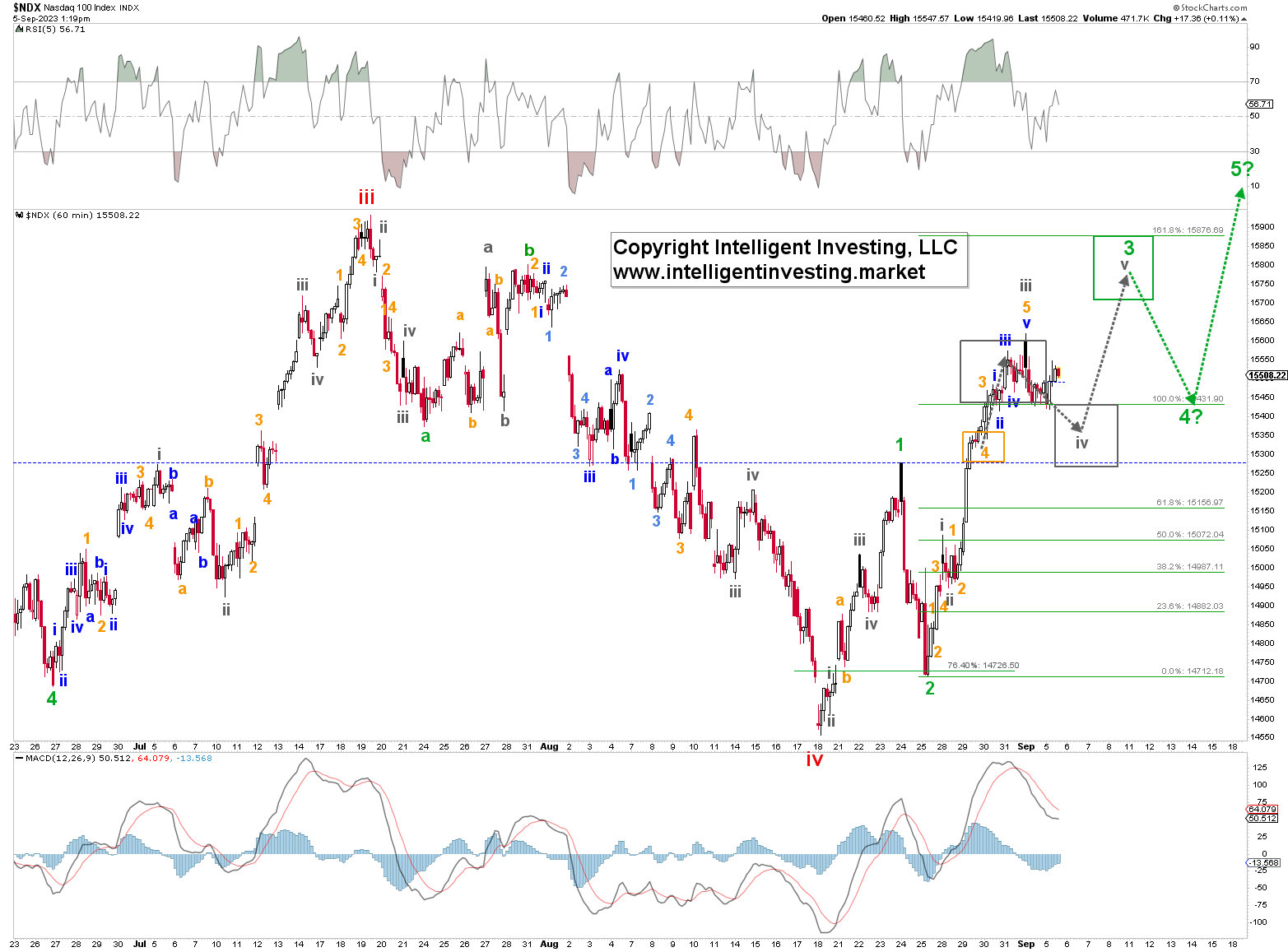

Fast forward, and the index moved above the critical $15365 level last Tuesday, August 29. Thus, the potential W-4 overlapped with W-a/1. See the purple box in Figure 1 below. As such, we must label the recent decline as (green) W-a, -b, and -c of what most likely was all of the red W-iv.

Figure 1. NASDAQ 100 daily resolution chart with technical indicators and detailed EWP count.

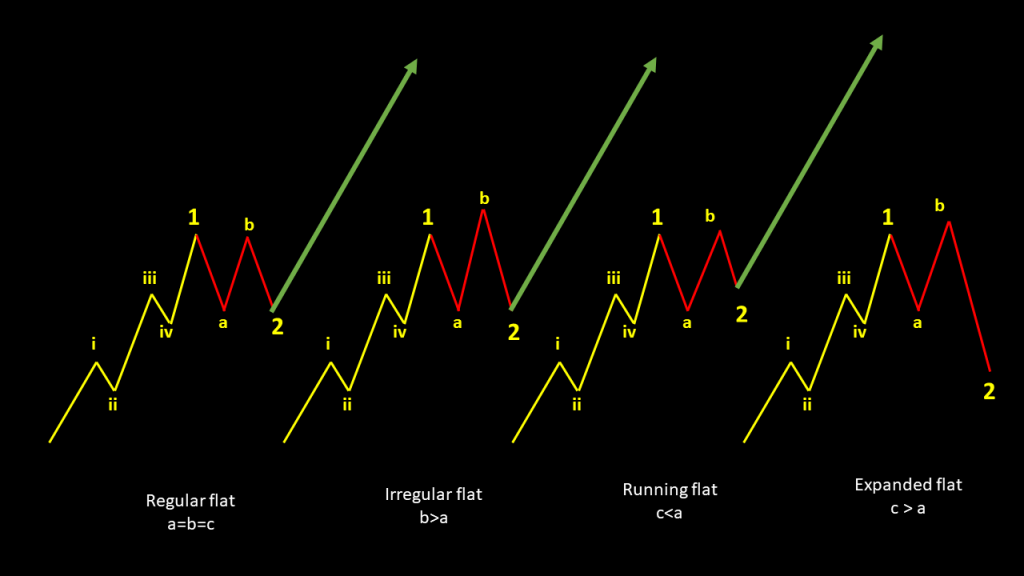

However, from our last update, we know the only caveat is that "after three waves down, expect at least three waves back up." Namely, the market can present us with a flat correction consisting of three waves down, three back-ups, and five waves down (3-3-5). See below:

These three waves back up, which could now be underway, can challenge or exceed the July high, whereas the five waves down can target or exceed the recent lows. That pattern is the green W-/a, -/b, /c in Figure 1 above.

It means the index should top out at ideally ~$15750+/-100, then drop back to the low $14Ks again before staging the red W-v rally. It will require a break below the green W-1 high at $15277, the blue dotted line in Figure 2 below, to start to suggest that path, which is our alternate EWP count. If the index stays above that level and continues to follow the grey/green boxes/path outlined to our premium members already mid-last week, then the Bulls will remain in complete control.

Figure 2. NASDAQ 100 hourly resolution chart with technical indicators and detailed EWP count. Thus, thanks to the EWP, we have precise price levels to watch that give easy-to-execute "if/then" scenarios. These price levels are warning signs that the potential upside pattern we are tracking is starting to fall apart, increasing the odds for renewed downside.

Thus, thanks to the EWP, we have precise price levels to watch that give easy-to-execute "if/then" scenarios. These price levels are warning signs that the potential upside pattern we are tracking is starting to fall apart, increasing the odds for renewed downside.