A week and a half ago, see here; our primary expectation based on our interpretation of the price action for the Nasdaq 100 using the Elliott Wave Principle (EWP) was:

"… a drop below $15725 will mean grey W-iv is underway to ideally $15525+/-25 from where grey W-v to ideally $16110+/-25 kicks in. The index will have to drop below the grey W-i high, $15275, to tell us the more significant red W-iv? is underway."

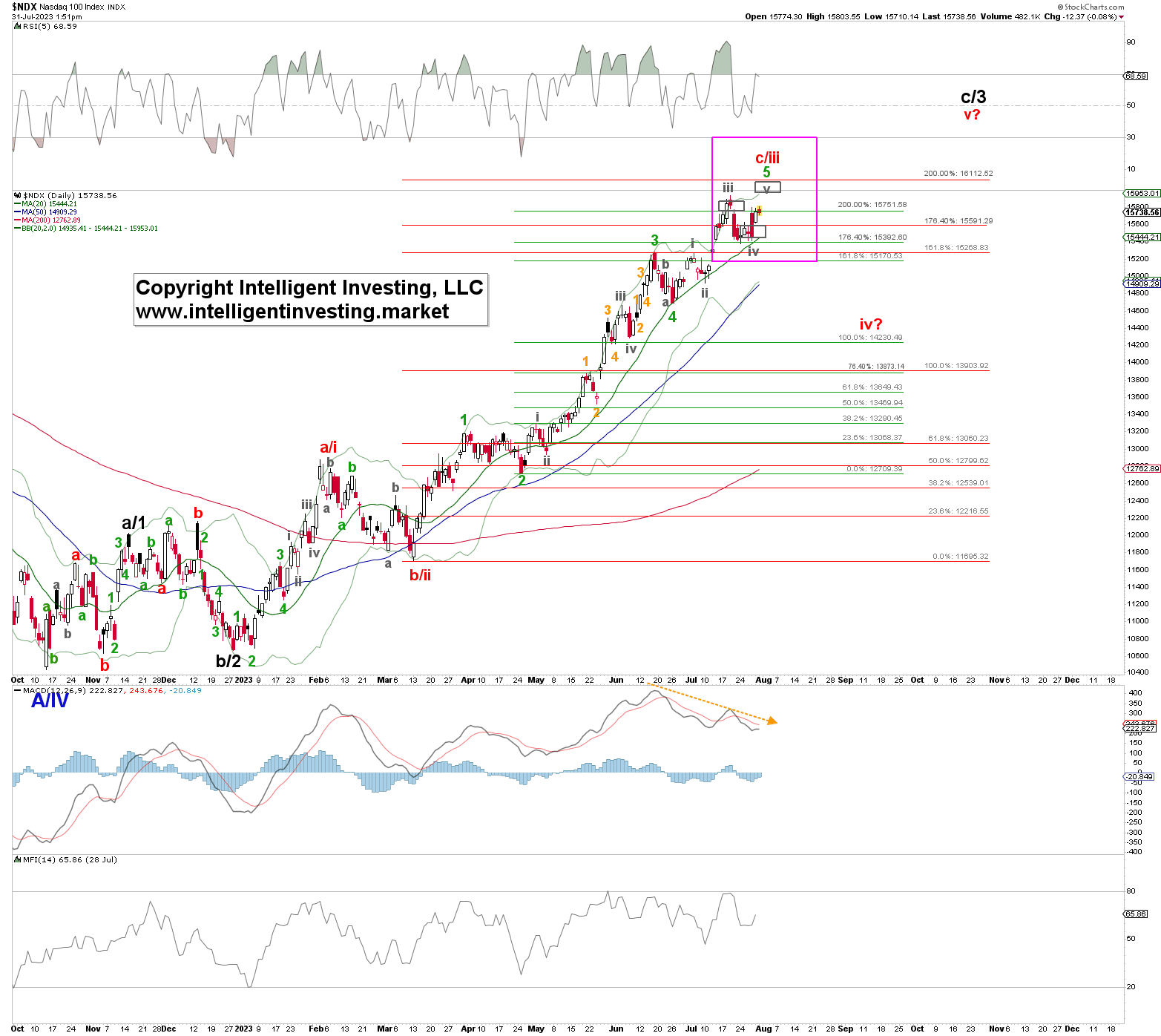

Fast forward, and the index opened below $15725 the day after our article was posted, reaching as low as $15429. Last week, the NDX bottomed out for three days at $15375, $15411, and $15416, respectively. Currently, it trades at $15750. Thus, the index dropped and bottomed out per our forecast. See the purple box in Figure 1 below.

Figure 1

Now that the index came within 0.80% of the ideal grey W-iv target zone and has since rallied back to the scene of the crime ($15750s), it appears the grey W-iii and W-iv completed July 19 and 27, respectively, and the grey W-v to ideally $16110+/-25 is underway. The index must break above the July 19 high at $15932 to confirm our anticipated W-v while always holding last week's lows.

Namely, a drop below $15375 will be our first signal the red W-c/iii has topped, and the index is ready to embark on at the least the red W-iv? correction to ideally $14400+/-200. That is not our preferred scenario, but in trading, one must always have a contingency plan to prevent havoc on one's portfolio.

From a trend perspective, the index is still well above its rising and bullishly stacked 20-day Simple Moving Average > 50d SMA >200d SMA, while the MACD is negatively diverging (orange arrow). Thus, the trend is still 100% Bullish, but the upside momentum is weakening. This setup matches our preferred EWP account as described above.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.