Morgan Stanley (NYSE:MS) with an argument that I agree with. Add China going ex-growth and US AI leadership and this argument carries weight well into the next cycle.

We continue to recommend long USD positions against EUR and AUD. Our bullish USD view reflects our belief that markets appear to have priced optimistic outcomes in the US (inflation declines,Fed cuts) and abroad (growth remains supported), and that USD will gain as tail risks become increasingly priced.

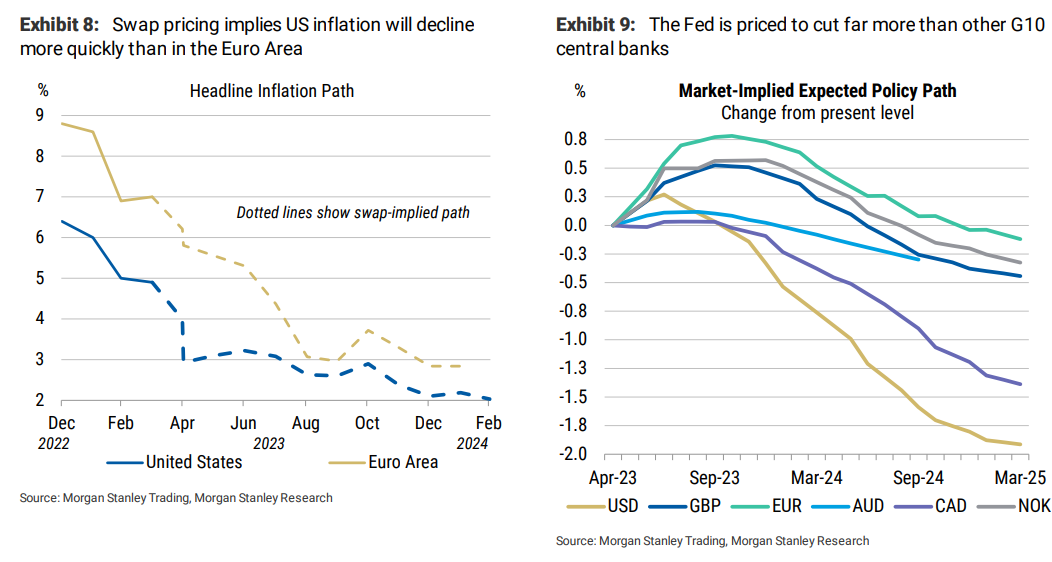

Inflation swaps imply US inflation falls quickly (Exhibit 8). As inflation is expected to fall swiftly, market pricing implies the Fed will cut rates more and more quickly than other G10 central banks (Exhibit 9).

These market-implied paths for inflation and policy rates strike us as assigning too low a probability to tail risks. In our view, markets should assign a higher probability to the tail risk that US inflation remains high and sticky.

As our US rates strategy colleagues note here, 3m, 6m, and 12m core CPI are all close to 5%, which we think suggests recent inflation has been sticky near 5%. We also think markets should assign a higher probability to the tail risk of a sharp global growth slowdown.

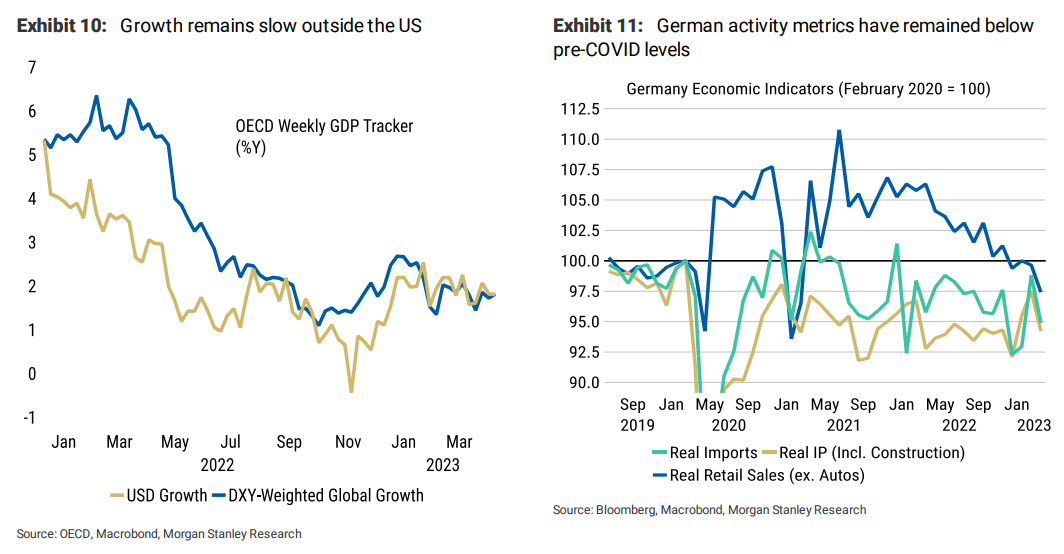

Coincident data from the OECD suggest that growth outside the US has slowed to around the low levels seen in Q4 of 2022. Chinese growth data have been surprisingly weak, raising questions about whether further policy support will be needed.

Meanwhile, the European economic recovery from the COVID-19 pandemic has been lackluster. Demand and production data from Germany indicates that activity remains below pre-COVID levels in real terms (Exhibit 11).

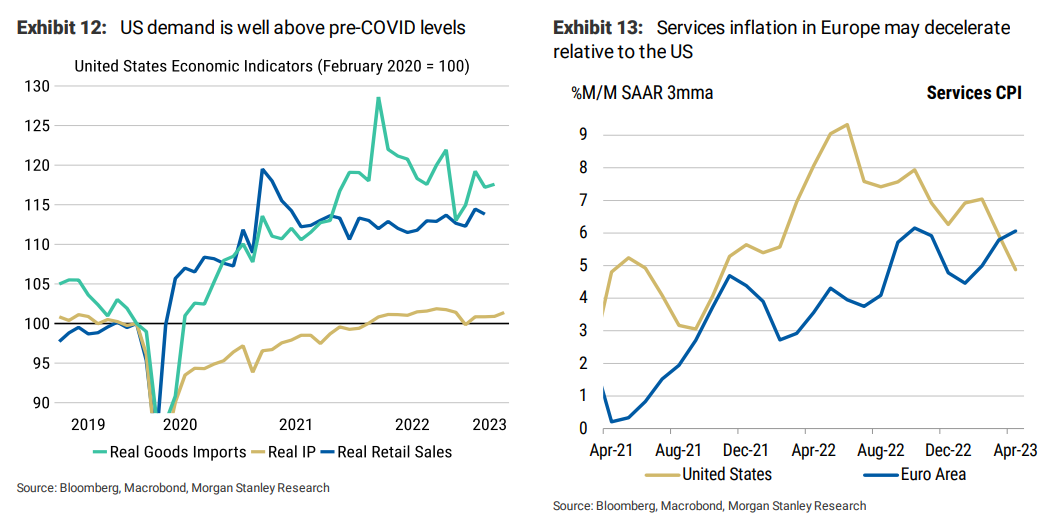

That sluggish economic momentum contrasts with similar metrics in the US. Demand data suggest that price pressures remain well above pre-COVID levels (Exhibit 12).

Relatively muted demand in the euro area raises risks that services inflation decelerates in Europe as it has in the US (Exhibit 13). A higher market-implied probability of these risks (stickier-than-expected inflation in the US, a sharp global growth slowdown, or a deceleration in euro area services inflation) would likely support the USD.