- Meta is back to 2016 levels after yet another dismal earnings report

- The Metaverse continues to account for the greater part of the company's losses

- However, InvestingPro shows that there are still positive aspects in Meta's balance sheet

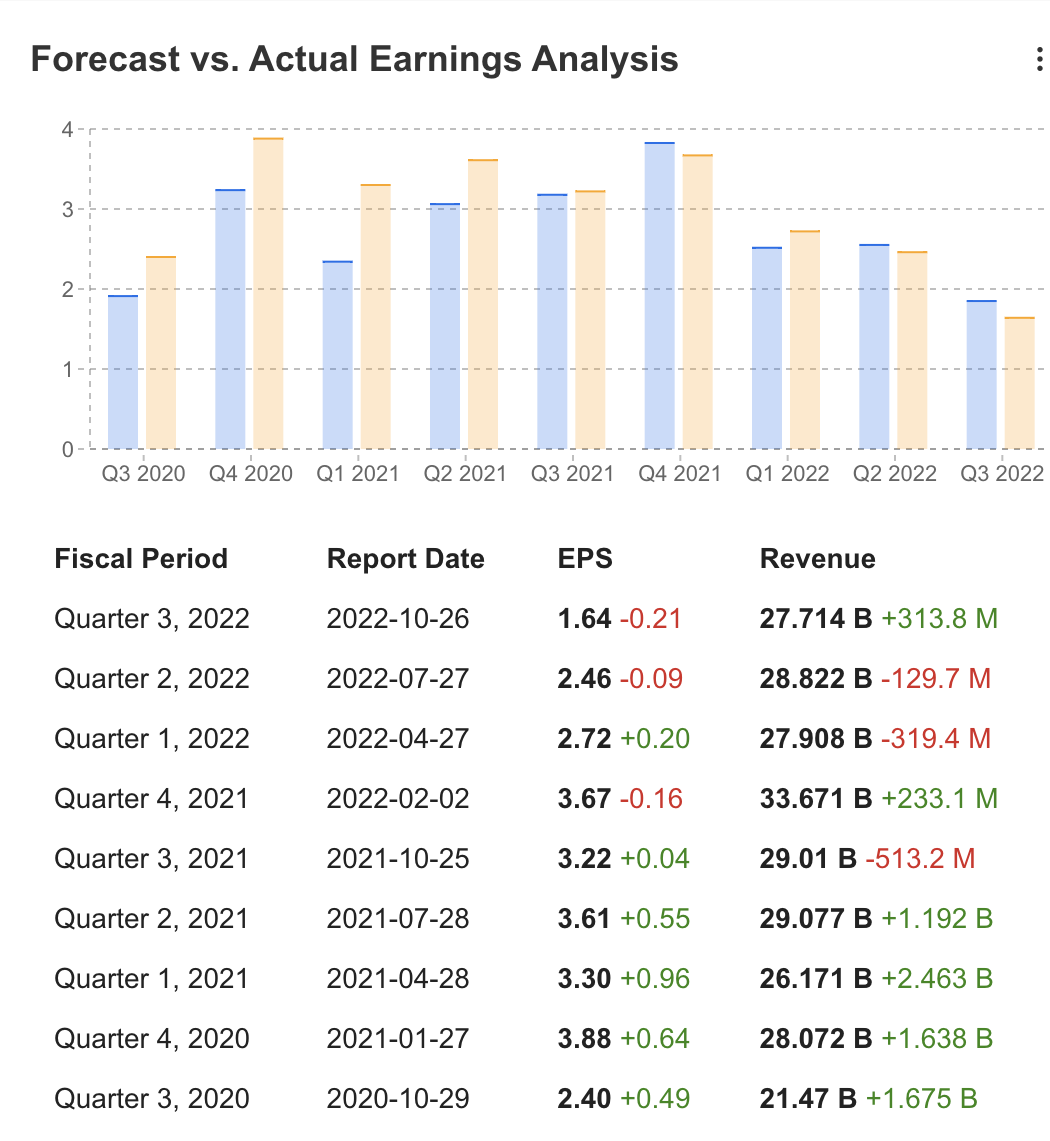

Despite rebounding in today's session, Meta Platforms (NASDAQ:META) is down roughly 23% since reporting earnings on Wednesday. Amid sinking EPS, the report had some positive surprises, i.e., year-on-year user growth and higher-than-expected revenue ($27.71 billion vs. $27.57 billion expected).

Source: InvestingPro

Here are the key metrics from Wednesday's report:

- DAU (Daily Active Users): +4%.

- MAP (Monthly Active Users): +4%.

- Ad Impressions: +17%

- Price per Ad: +18%

- Revenue: -4% YoY

- EPS: -49% YoY

Let's, as always, check in with InvestingPro to analyze the stock in more detail.

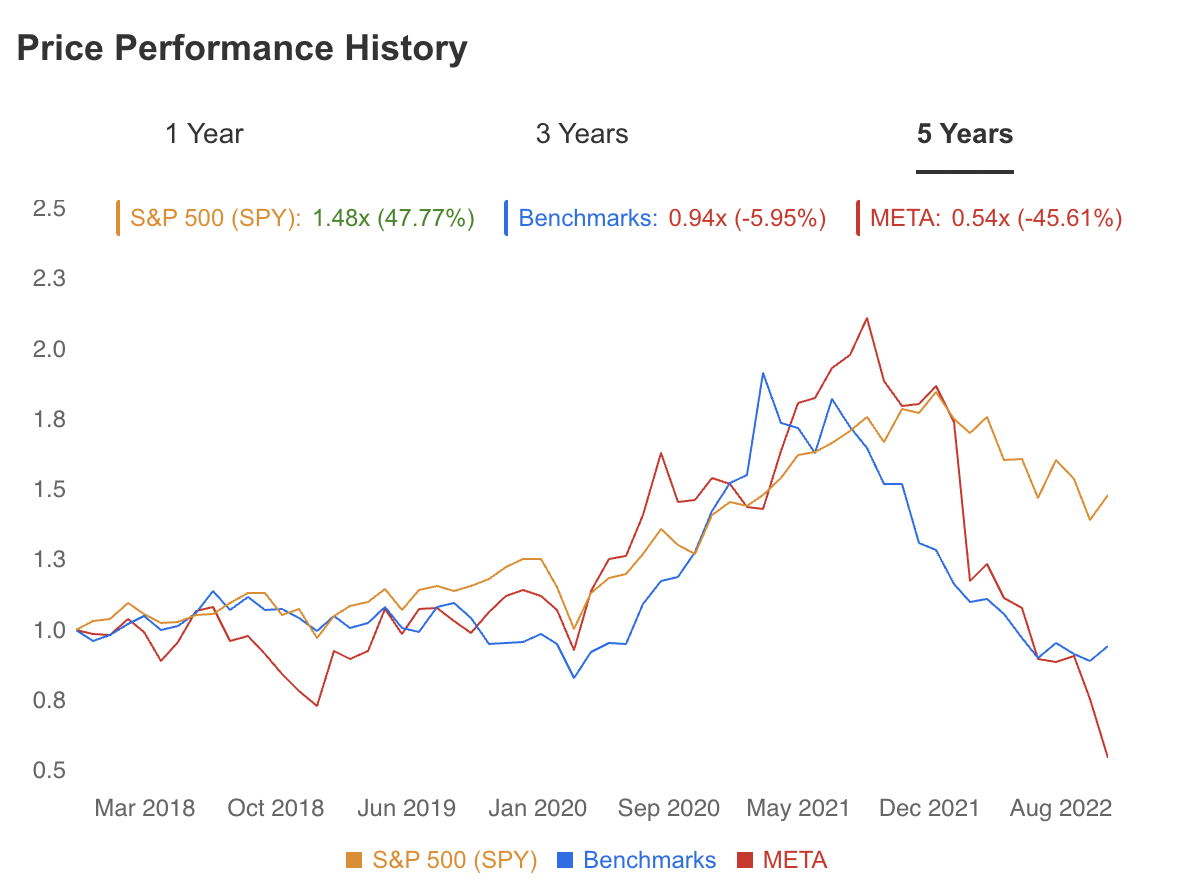

Meta has effectively returned to 2016 levels (down 73% from highs). Now, that seems excessive to me if we consider the phenomenal profit made during the last six years.

Source: InvestingPro

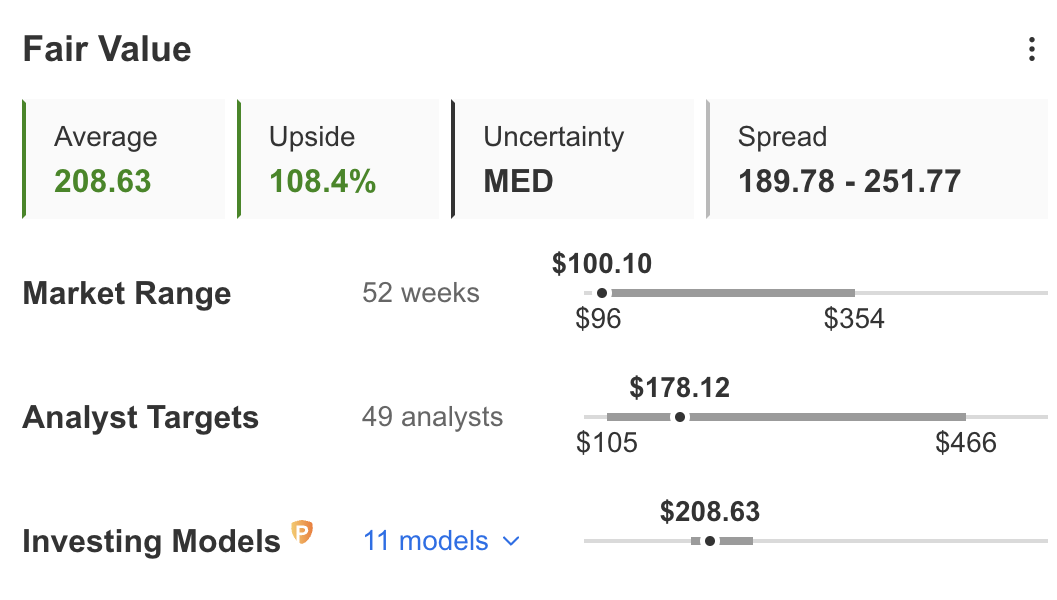

At the valuation level, the stock has a Fair Value of $208, implying a 108.4% upside potential from current levels.

Source: InvestingPro

The main problems of the last three quarters, which coincided with a decline in earnings, are:

- The strength of the U.S. dollar, which has impacted the returns of virtually every U.S. company with a global business scope

- The context of general weakness in ad revenue, which was also a key problem in Alphabet's (NASDAQ:GOOG) and Snap's (NYSE:SNAP) reports

- Competition from TikTok; although Instagram Reels has performed remarkably well

But the main bet from Zuckerberg is the Metaverse, which has, to date, produced no profits, and represents a living cost that impacts the entire company's business.

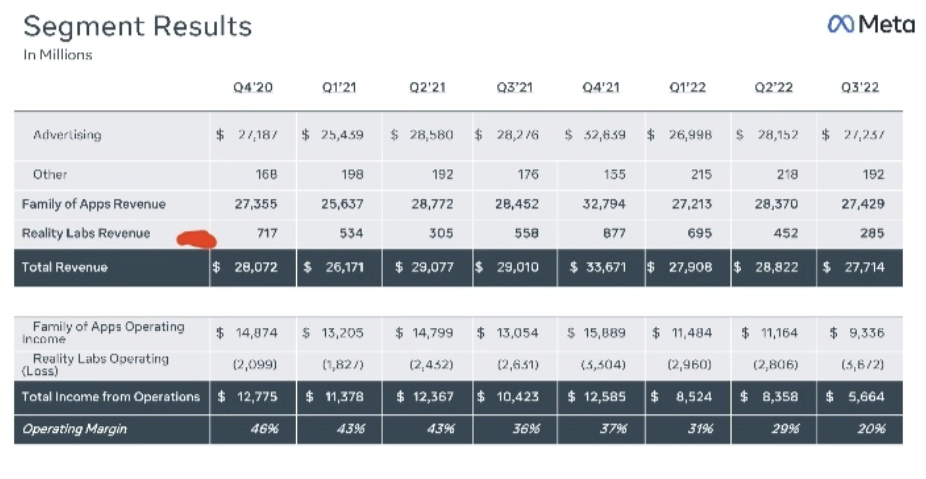

Source: Quartr

As we can see from the line in red, the Reality Labs segment produces just $285 million in revenues compared to almost $28 billion overall (nothing) but impacts at the loss level with around $3.67 billion.

Even at the CapEx level, which impacts investments, we see a major increase in the last three quarters precisely because of the heavy investment in this segment.

Now, there are two stories:

- The Metaverse starts to turn around and brings Meta Platforms to unseen businesses and horizons (with significant impacts on the stock).

- Eventually, Zuckerberg realizes the Metaverse is a losing bet and returns to doing what he has been doing all along.

Either way, Meta's accounts would improve.

At the balance sheet level, if we consider that Meta has about $42 billion between cash and short-term investments, this equates to about $16 per share or 15% of the value of the stock.

I believe, in the short term, Meta has been excessively penalized, as happened to Netflix (NASDAQ:NFLX), PayPal Holdings (NASDAQ:PYPL), Alibaba (NYSE:BABA), and many others like them.

So while there are elements of short-term weakness, I personally believe that Meta makes little sense at current levels. Thus, for long-term investors, this could represent a great buying opportunity.

Disclosure: I closed my positions in Alibaba and will continue to buy Meta Platforms at current levels with multiple entries.