Markets Turn Risk Off:

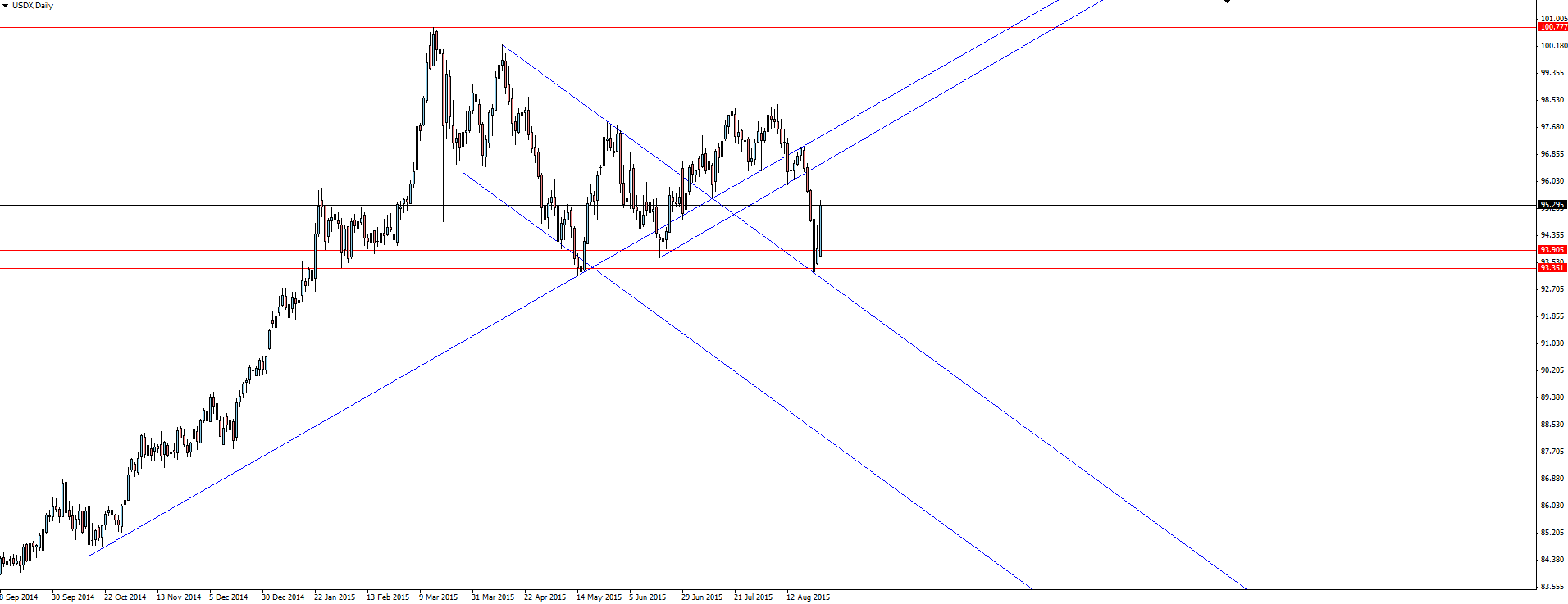

Risk-Off sentiment returned to the US Dollar Index overnight, causing the USDX to snap sharply higher.

USDX Daily:

Following the giant squeeze up in EUR/USD that we’ve seen this week, it would seem that enough weak hands have been shaken out for the currency to prepare its descent lower again. So often volatile moves one way are met with equally violent moves the other and if you throw in a Fed speaker or two then this is what you get!

This move is all about sentiment rather than data and as the irrational nature of some of the panic moves we’ve seen to start the week unwind, we are starting to see a more rational risk oriented rally in the US Dollar.

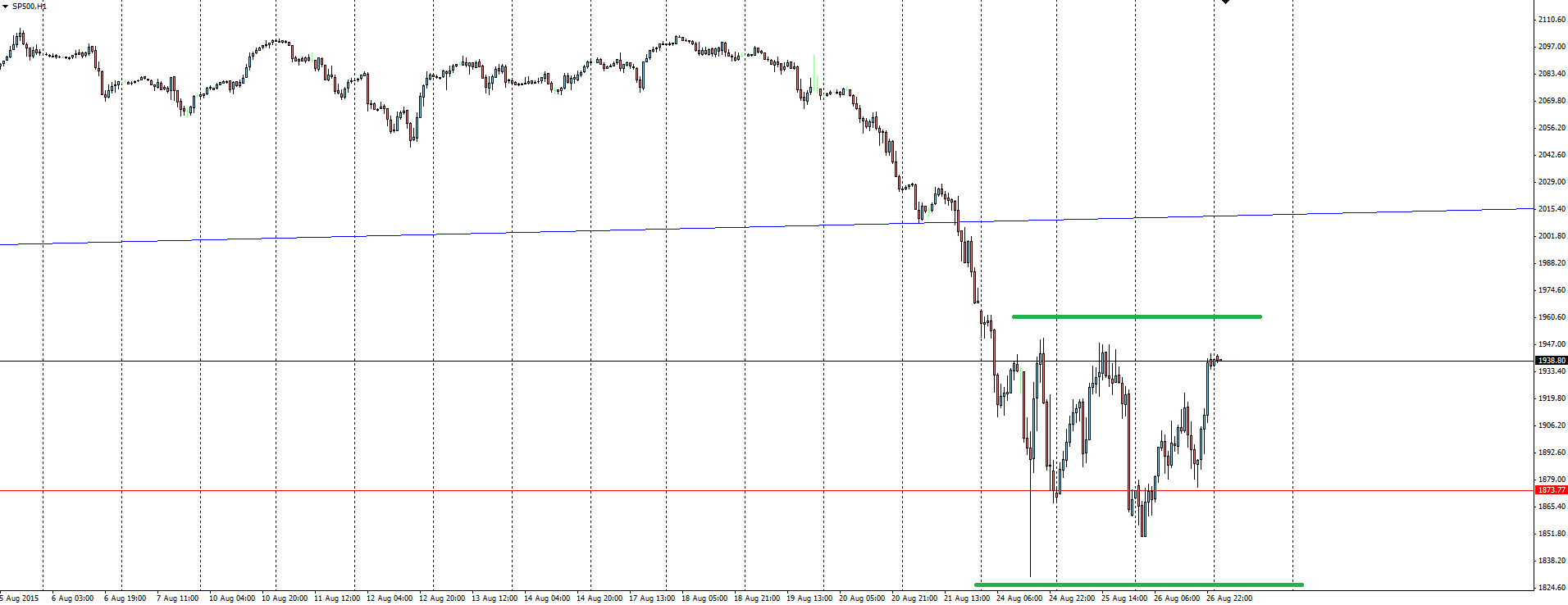

“The Dow Jones industrial average finished 3.95 per cent higher at 16,285.51.”

“The S&P 500 gained 3.9 per cent to 1,940.51.”

As you can see, the S&P 500 posted its largest single day rally since 2011, while the Dow was also up more than 600 points!

To be fair, these daily swings are just ridiculous. The new normal seems to be that ‘Rule 48′ is invoked for the open on US exchanges. The idea of Rule 48 is to ensure orderly trading amid financial market turbulence. This is done by speeding up the open by suspending the requirement that stock prices be announced first. CNBC has a nice little overview here.

Crazy times.

Dovish Dudley:

In a few short statements to interviewers, New York Fed President Bill Dudley was quoted as saying that the case for the Fed making their move in September was now “less compelling” than this time last week.

While providing a nice sound grab on which markets can move around, Dudley actually was quite upbeat about the economic data coming out of the US over the past few months and maybe wasn’t as dovish as that soundbite portrays.

“From my perspective, at this moment, the decision to begin the normalization process at the September FOMC meeting seems less compelling to me than it was a few weeks ago.”

This stance is important as Dudley is seen as one of the more dovish Fed presidents while also a member of Yellen’s inner circle and in wrapping up, made sure to once again reiterate the fact that the Fed is concerned about the outlook.

On the Calendar Thursday:

AUD Private Capital Expenditure q/q

USD Prelim GDP q/q

USD Unemployment Claims

Chart of the Day:

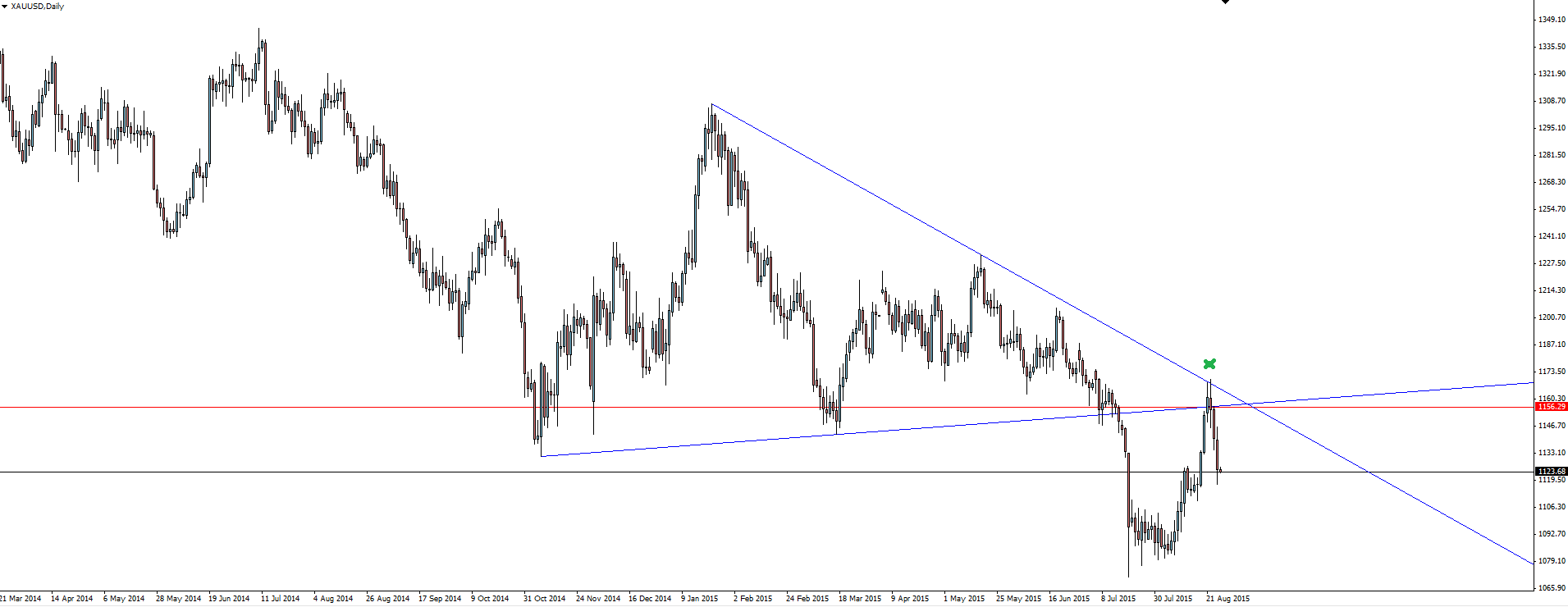

While the US Dollar managed to rip, demand for Gold has once again all but dried up. As we spoke about on Twitter (NYSE:TWTR) yesterday, the ‘world ended’ yet Gold STILL failed to catch a bid.

Gold Daily:

A clean technical setup that continued to play out overnight with falls accelerating.

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by Vantage FX Pty Ltd, does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. The research contained in this report should not be construed as a solicitation to trade. All opinions, news, research, analyses, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently any person acting on it does so entirely at their own risk. The experts writers express their personal opinions and will not assume any responsibility whatsoever for the actions of the reader. We always aim for maximum accuracy and timeliness and Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on the service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.