- Investors should brace for more volatility next week as the stock market faces a pair of significant market-moving risk events.

- U.S. CPI inflation data and the Federal Reserve’s final policy meeting of the year will be in focus.

- Taking that into account, next week will be key in determining the Fed’s policy moves through 2024.

- Missed out on Black Friday? Secure your up to 60% discount on InvestingPro subscriptions with our extended Cyber Monday sale.

Next week is expected to be another volatile one, as investors brace for two of the biggest economic events that remain for 2023.

On the economic calendar, the most important will be Tuesday’s U.S. consumer price inflation report for November, which is forecast to show annual CPI continues to cool.

Meanwhile, the Federal Reserve will announce its rate decision at its last meeting of the year on Wednesday. No action by the central bank is seen as the most likely outcome, as investors believe the Fed is all done tightening.

Taking that into account, the week ahead promises significant movements, and its impact will likely ripple through the stock market for months to come.

Here’s what to watch out for:

Tuesday, December 12: U.S. CPI Report

With investors now firmly expecting a Fed rate cut in March, next week’s U.S. CPI inflation data takes on added significance.

As per Investing.com, the consumer price index is forecast to inch up 0.1% on the month after a flat reading in October. The headline annual inflation rate is seen rising 3.1%, slowing from a 3.2% annual pace in the previous month.

A cooler-than-expected print, which sees the headline figure fall to 3% or below, would add to the rate-cut fervor, while a surprisingly strong reading would likely keep pressure on the Fed to maintain its fight against inflation.

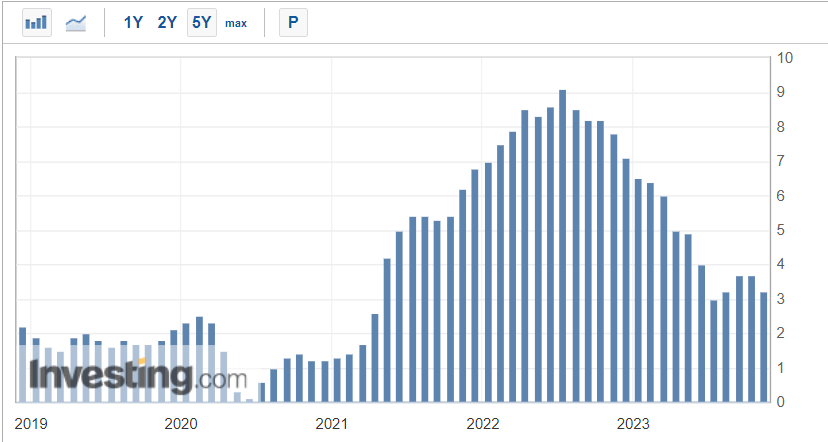

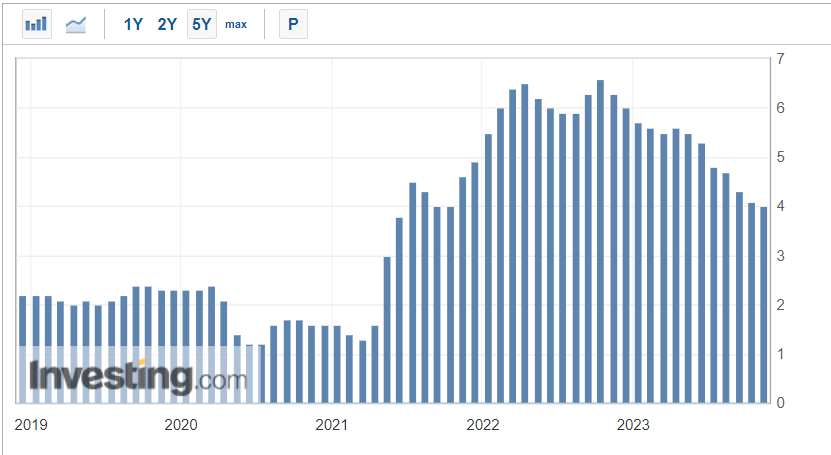

As seen in the chart below, U.S. inflation has come down considerably since the summer of 2022, when it peaked at a 40-year high of 9.1%, amid the Fed’s aggressive rate-hiking cycle.

Meanwhile, the November core CPI index - which does not include food and energy prices - is expected to rise 0.2% in the month, matching the same increase in October. Estimates for the year-on-year figure call for a 4.0% gain, the same as in the previous month.

The core figure is closely watched by Fed officials who believe that it provides a more accurate assessment of the future direction of inflation.

- Prediction:

I believe the data will add to further signs that inflation is cooling and bolster the view that interest rates may have peaked.

In comments made last week, Fed Chairman Jerome Powell vowed to move "carefully" on rates, describing the risks of going too far with tightening as "more balanced" with risks of not hiking enough to control inflation.

Taking that into consideration, the U.S. central bank is likely done raising rates and could begin to cut them as soon as the first quarter of 2024 as inflation continues to fall back towards the 2% target the Fed considers healthy.

Wednesday, December 13: Fed Decision, Powell News Conference

Adding to the intrigue next week is the highly anticipated Federal Reserve meeting, where the future direction of interest rates and monetary policy adjustments could hang in the balance.

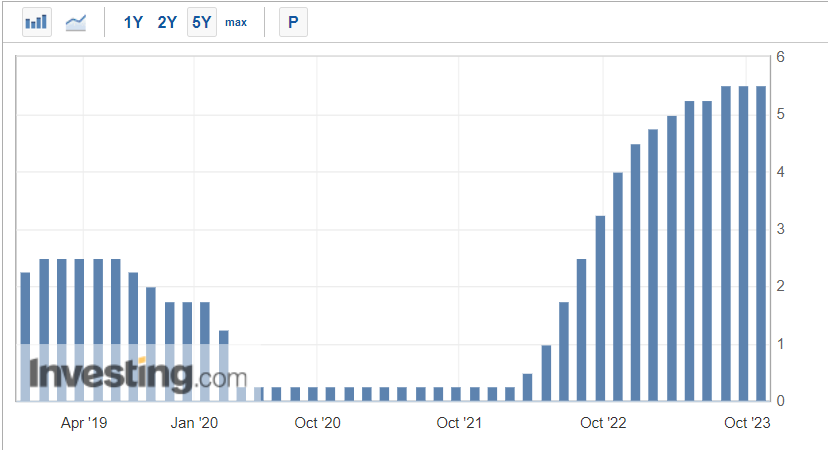

After raising borrowing costs by 525 basis points since March 2022, the Fed is widely expected to keep interest rates unchanged for the third meeting in a row as policymakers assess signs of economic softening.

As of Friday morning, there is a 99% chance of the U.S. central bank holding rates at current levels, according to the Investing.com Fed Rate Monitor Tool. That would leave the benchmark Fed funds target range in between 5.25% and 5.50%.

As always, most of the focus will be on Fed Chair Powell, who will hold what will be a closely watched press conference shortly after the release of the FOMC statement.

Speculation about the Fed's approach to inflation, interest rates, and potential policy shifts has been rife in recent weeks, intensifying as economic data continues to present a mixed picture.

Beyond the expected policy decision and Powell press conference, Fed officials will also release new forecasts for interest rates and economic growth, known as the ‘dot-plot’, as investors grow increasingly certain that the Fed is done hiking.

Powell said last week it was clear that U.S. monetary policy was slowing the economy as expected, with a benchmark overnight interest rate "well into restrictive territory."

The Fed chief noted, however, that policymakers are prepared to tighten policy further if deemed appropriate.

- Prediction:

While the Fed is all but certain to hold off on hiking rates next week, the upcoming meeting holds the potential for signaling changes in the central bank's strategies regarding the course of future monetary policy actions.

Many in the market have highlighted the delicate balance the Fed must strike - a challenge of taming inflationary pressures without tipping the economy into a recession.

As such, I believe that Powell will reiterate his commitment to moving forward carefully with additional policy firming while acknowledging that the Fed has made significant progress in bringing down inflation as the economy hits a soft patch.

Investors largely believe the Fed is unlikely to raise rates any further and have started to price in a series of rate cuts beginning next spring.

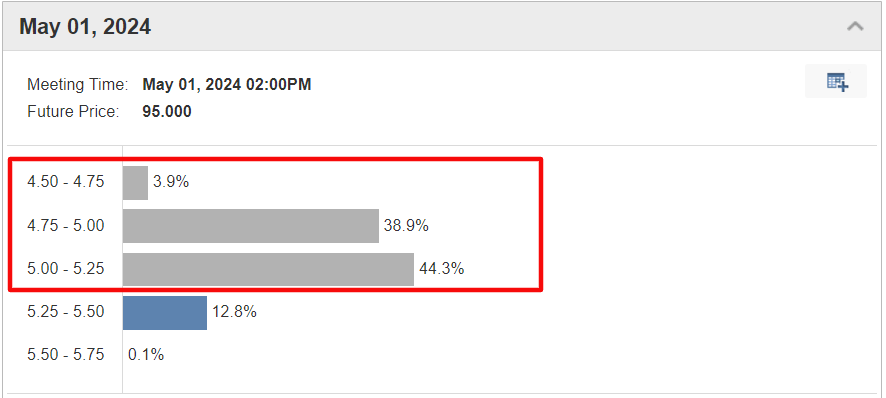

As seen below, there is a roughly 90% chance of a rate cut at the Fed's May 2024 meeting, while odds for March stand at almost 65%.

Any indications or shifts in the Fed's tone during next week's FOMC meeting could trigger significant market movements and investor sentiments.

Taking that into consideration, market participants are advised to remain vigilant, exercise caution, and diversify portfolios to hedge against potential market fluctuations.

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading.

With InvestingPro's stock screener, investors can filter through a vast universe of stocks based on specific criteria and parameters to identify cheap stocks with strong potential upside.

You can easily determine whether a company suits your risk profile by conducting a detailed fundamental analysis on InvestingPro according to your own criteria. This way, you will get highly professional help in shaping your portfolio.

In addition, you can sign up for InvestingPro, one of the most comprehensive platforms in the market for portfolio management and fundamental analysis, much cheaper with the biggest discount of the year (up to 60%), by taking advantage of our extended Cyber Monday deal.

Disclosure: At the time of writing, I am long on the S&P 500, and the Nasdaq 100 via the SPDR S&P 500 ETF (SPY (NYSE:SPY)), and the Invesco QQQ Trust ETF (NASDAQ:QQQ). I am also long on the Technology Select Sector SPDR ETF (NYSE:XLK). I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies' financials. The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.