This article was written exclusively for Investing.com

- A wild and volatile year

- Lumber made economists eat their words

- Lumber is highly illiquid, but it is a benchmark

- Three reasons why lumber is rallying

- Lumber is saying other raw materials prices will move higher

I have traded commodities for over four decades and have held risk positions in almost all raw materials that trade on the US and worldwide exchanges. However, I have never traded one contract of lumber futures. Lumber is what professional traders call a roach motel. Getting into long or short positions is possible but exiting can be more than a challenge when the price moves contrary to expectations.

While I do not trade in the wood futures arena, I watch the price action like a hawk. Lumber is a benchmark and bellwether market that can provide clues about the path of least resistance of other industrial commodities. We have seen incredible price swings in the lumber market that have moved from a turbocharged bull that took the price to an all-time high in May 2021 to below one-third the price by August 2021. Since the low, lumber futures have made a substantial comeback and were trading at over $1000 per 1,000 board feet at the end of last week. Lumber is sending the markets a message; ignore it at your peril.

A wild and volatile year

As the global pandemic gripped markets across all asset classes in early 2020, lumber futures declined to $251.50 per 1,000 board feet.

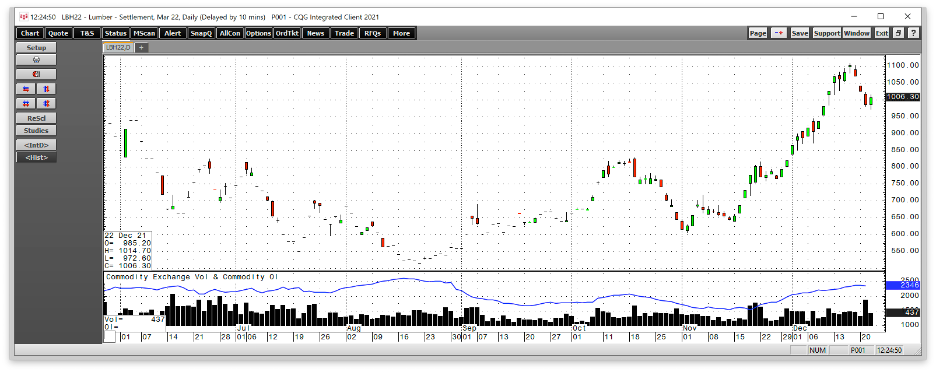

Source: CQG

The chart shows the head-spinning moves higher and lower since the March/April 2020 low. The price rose by over 6.8 times when it reached a record $1711.20 per 1,000 board feet high in May 2021. The price ran out of upside steam and plunged to $448 in August, less than one-third the price at the May peak.

Meanwhile, buying returned to the lumber market, pushing the price back over the $1,100 level in mid-December. As the end of 2021 approaches, lumber was sitting at over the $1,000 level on Dec. 22.

Lumber made economists eat their words

The Fed, financial news pundits, and economists began using the term “transitory” to characterize |inflation when consumer price data began to reflect rising prices earlier this year. Many pointed to the lumber price as proof that inflation was a temporary phenomenon caused by supply chain bottlenecks and other pandemic-related factors. While they cited the price action in the lumber futures arena, they never qualified their perspective with even a mention of lumber’s illiquid nature.

Illiquid markets experience price gaps on the up and downside as bids and offers evaporate as the price begins to move. Therefore, they often rise and fall to prices that defy logic, reason, and rational analysis. The lumber example was flawed from the start, but it was a convenient excuse to validate a hypothesis. One economist, Mohamed El-Erian, recently said that “Calling inflation transitory is probably the worst call in the Fed’s history.” Using the illiquid lumber market to validate the claim was likely the worst unqualified example.

The lumber price took off on the upside while economists, Fed officials, and the US Treasury continued to use the term “transitory.” They only abandoned the term after the November CPI data made them eat their word.

Lumber is highly illiquid, but it is a benchmark

Liquidity is a critical consideration for trading, investing, and analysis. I would never trade one lot of lumber because it is a roach motel.

Source: CQG

The chart highlights the total number of open long and short positions in the lumber futures market stood at 2,346 contracts as of Dec. 21, with an average daily volume at around 500 contracts. Liquid markets have far more critical mass as of Dec. 21:

- Crude oil - open interest at over 1.89 million contracts, average daily volume over 800,000 contracts level

- Gold - open interest at over 500,000 contracts, average daily volume over 150,000 contracts level

- Copper - open interest at over 170,000 contracts, average daily volume over 50,000 contracts level

- Natural gas - open interest at over 1.14 million contracts, average daily volume over 300,000 contracts level

- Corn - open interest at over 1.485 million contracts, average daily volume over 200,000 contracts level

Many other examples show that lumber is not only illiquid, but it is also untradeable. However, the price action is a benchmark as illiquid markets often move dramatically higher or lower before other markets. However, they should never be concrete examples for macroeconomic trends, as we witnessed when economists attempted to use the action in the wood market to buy time and extend the dovish policies that led to the inflationary surge.

Three reasons why lumber is rallying

Three factors point to the latest surge in the lumber futures market:

- The prospects for rising interest rates could cause a rush of new home buying this spring before mortgage rates move appreciably higher.

- The US infrastructure rebuilding program will likely require substantial construction materials, and lumber is no exception.

- Illiquidity pushed lumber too high in May and too low in August. At just over the $1000 per 1,000 board feet level on Dec. 22, the price is near the year’s midpoint, reflecting inflationary pressures that continue to impact all prices. Production input costs, wages, and other prices put upside pressure on all raw material prices.

Lumber is sitting at a logical level, but that does not mean that logic will prevail. In an illiquid market, the potential for irrational price movement is always a clear and present danger.

Lumber is saying other raw materials prices will move higher

Ironically, the Fed and Treasury’s lumber excuse came back to bite them in their analytic hindquarters. The recovery in lumber is a sign that raw material prices are not falling anytime soon.

Bull markets rarely move in straight lines. Commodities are highly volatile assets. Even the most liquid commodity futures market can experience violent corrective downdrafts, as we recently witnessed again in crude oil. Nearby NYMEX crude oil futures fell from the highest price since 2014 at $85.41 in late October to a low of $62.43 in early December, a 26.9% decline in six short weeks. Be careful if economists begin to point to the energy commodity as proof that inflation is receding because the energy commodity is currently at the seasonally weakest time of the year.

Always look deeper into unqualified statements, particularly when they cite raw material prices. Lumber’s move to its midpoint of the 2021 range is a sign that 2022 could see a continuation of the bullish relay race in raw material markets as fiat currencies continue to lose value.

Inflation is a challenging beast. The Fed’s current forecast for 0.90% short-term rates in 2022 and 1.60% in 2023 is validation that the current inflation levels will keep real rates in negative territory over the coming years. Inflation is the commodities asset class’s best friend, and lumber tells us that the economic beast continues to roam without the requisite aggressive monetary policy response.