- The latest 13F filing reveals that Michael Burry is refocusing his investments on China, with significant holdings in JD.com and Alibaba.

- Scion Asset Management, led by Michael Burry, focuses on identifying undervalued investment opportunities worldwide.

- Benjamin Graham's margin of safety, Burry has notched an approximate 25%+ gain over the past year.

- For less than $9 a month, access our AI-powered ProPicks stock selection tool. Learn more here>>

The latest 13F filing has revealed that legendary 'Big Short' investor Michael Burry is once again focusing his bets on China.

For those unfamiliar, the 13F is a crucial document that institutional investment managers in the U.S. must file with the Securities and Exchange Commission (SEC). Many use Form 13F to identify potential market trends.

For instance, if a particular stock is heavily bought or sold by institutional managers, it might indicate an emerging trend.On this topic, it is important to mention that Michael Burry's firm, Scion Asset Management, specializes in identifying undervalued investment opportunities worldwide.

So, after long years of underperformance, does this mean investors be looking more favorably toward Chinese equities again?

In the following article, we'll use the power of InvestingPro to better understand Burry's angle

Big-Picture View

Over the past year, Burry's strategy has paid off, with the legendary investor closely matching the performance of the S&P 500 by achieving a 25%+ gain.

Source: InvestingPro

Burry's investment strategy focuses on rigorously applying Benjamin Graham's concept of margin of safety. By studying corporate fundamentals, he selects undervalued stocks and does not shy away from shorting stocks of overvalued companies.

InvestingPro provides access to the full 13F statements, making it easier to view major purchases, sales, and changes in holdings across different companies.

Source: InvestingPro

Michael Burry's portfolio concentrates on a few key stocks, with the largest holdings being two Chinese retail giants: JD.com (NASDAQ:JD), followed closely by Alibaba Group Holdings (NYSE:BABA). This implies that the legendary bull believes that the long sell off in these stocks has most likely reached a bottom.

See the full list of stocks in Michael Burry's Portfolio here.

You can copy the entire portfolio into your watchlist with one click, allowing you to view the fair value of individual stocks and access all the information you need!

Source: InvestingPro

Performance View

Although the 13F report does not disclose the exact date of purchase, we can estimate that Burry's stock choices have yielded a positive return of around 10% in Q1. During this period, he has rotated the portfolio with a quarterly turnover rate of 54%.

Specifically, Alibaba has performed exceptionally well, recording an 18 percent gain in the last three months.

Source: InvestingPro

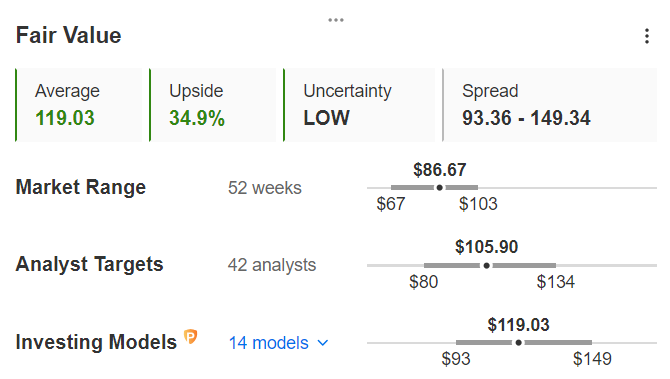

Despite the recent gains, InvestingPro's Fair Value, based on14 investment models, estimates Alibaba's value at $119.03, which is 34.9% higher than its current price.

Source: InvestingPro

InvestingPro subscribers have been able to track the development of analysts' forecasts, which remain bullish on the stock with a target price of $105.90. Both analysts and the Fair Value estimate agree on the stock's potential for growth.

Additionally, Alibaba's risk profile is favorable, boasting a good level of financial health with a score of 3 out of 5.

All that remains is to wait for the next few months to see if Burry has been right again compared to the major fund managers in this early part of the year.

***

If you want to analyze more stocks, follow us in upcoming hands-on lessons, and subscribe now with an additional discount by clicking on the banner image below.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.