- Discover the top stocks and sectors favored by legendary investors through InvestingPro.

- Effortlessly add Warren Buffett's or Ray Dalio's portfolio to your watchlist with a single click.

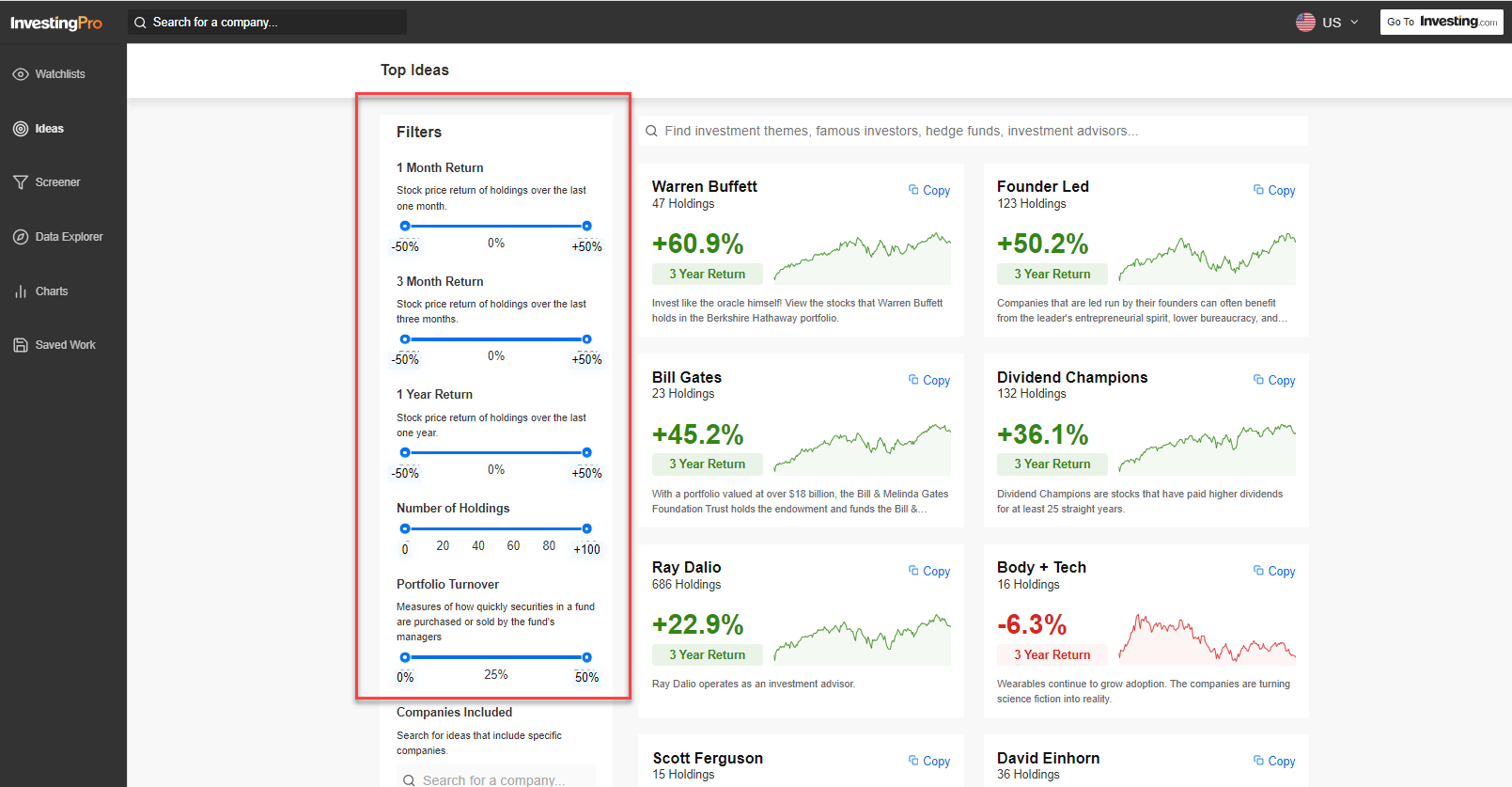

- Leverage InvestingPro's robust filter in the Ideas section to make informed decisions on mirroring your portfolio based on your chosen investor.

- Looking for more actionable trade ideas to navigate the current market volatility? Members of Investing Pro get exclusive ideas and guidance to navigate any climate. Learn More »

- Which stocks should I invest in?

- How do I assemble my initial watchlist?

- What criteria should guide my choices?

- Should I rely on technical or fundamental analysis?

- Can I trust my brother-in-law's investment tips?

- And, perhaps most importantly, where can I find dependable data and recommendations?

- Engage in exhaustive manual searches, sifting through search engines and the web pages of various investment firms associated with these prominent individuals. Be prepared for a considerable investment of time.

- Turn to artificial intelligence to access data on these investors' portfolios, although the accuracy and timeliness of this information may be in question.

- Explore InvestingPro's Ideas section - a straightforward, user-friendly, and efficient solution.

When embarking on your journey into the world of investing and trading, you're bound to encounter a common set of questions:

Exploring the stock market world, especially as a newcomer, often leads to the desire to examine the portfolios of renowned investors and successful gurus who have thrived in the market over the past decades.

The challenge, however, lies in locating comprehensive information about figures like Warren Buffett, Ray Dalio, Bill Gates, not to mention Hedge Funds, Hedge Funds, and Private Equity.

Where do they place their investments? What sectors do they favor?

At this juncture, you have a few options:

If you've opted for the third choice, congratulations! Here, you can uncover the investment choices of the most renowned and prosperous investors.

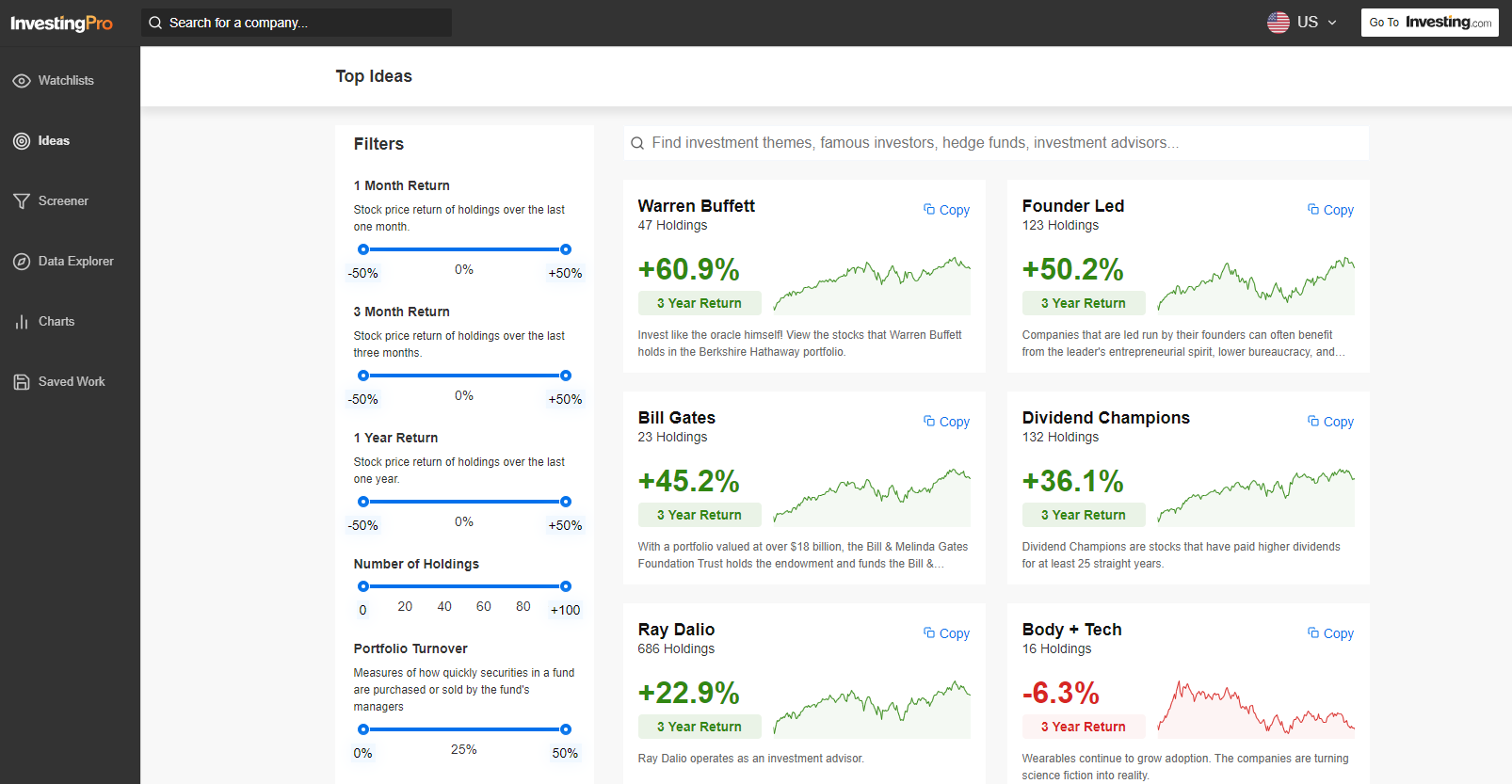

InvestingPro - Top Ideas Section

To begin, let's navigate to InvestingPro and access the Ideas section. Source: InvestingPro

Source: InvestingPro

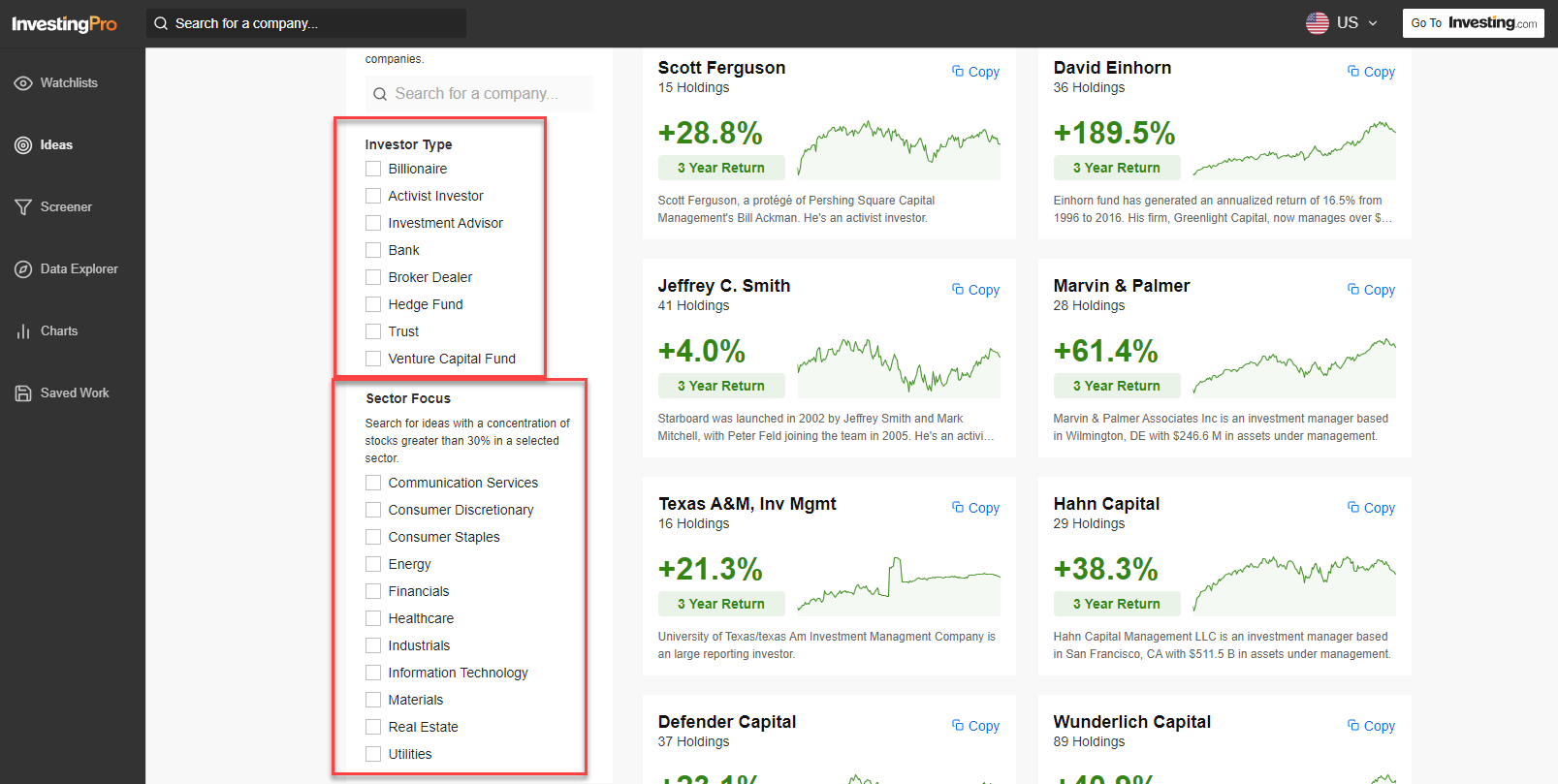

From here we can filter by investor type (billionaire, activist investor, investment advisor, bank, stockbroker, hedge fund, or private equity fund) or by sector.

Source: InvestingPro

In addition, you can choose those portfolios that have monthly, quarterly, or annual returns above a specific percentage.

Other filtering options are the number of participants, the allocation changes they make in their portfolios, or that they contain a specific company in their portfolio. Source: InvestingPro

Source: InvestingPro

This opens up a whole new world of investment and stock market possibilities.

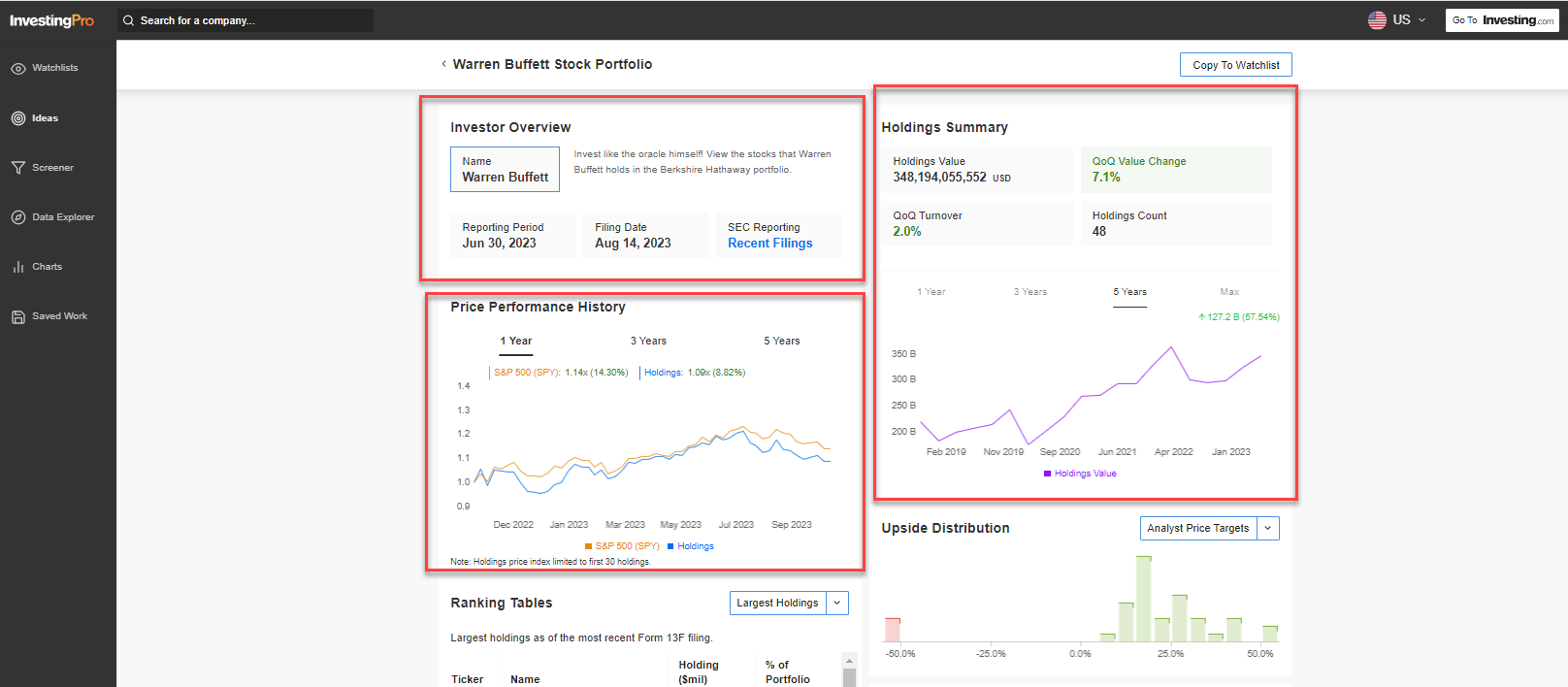

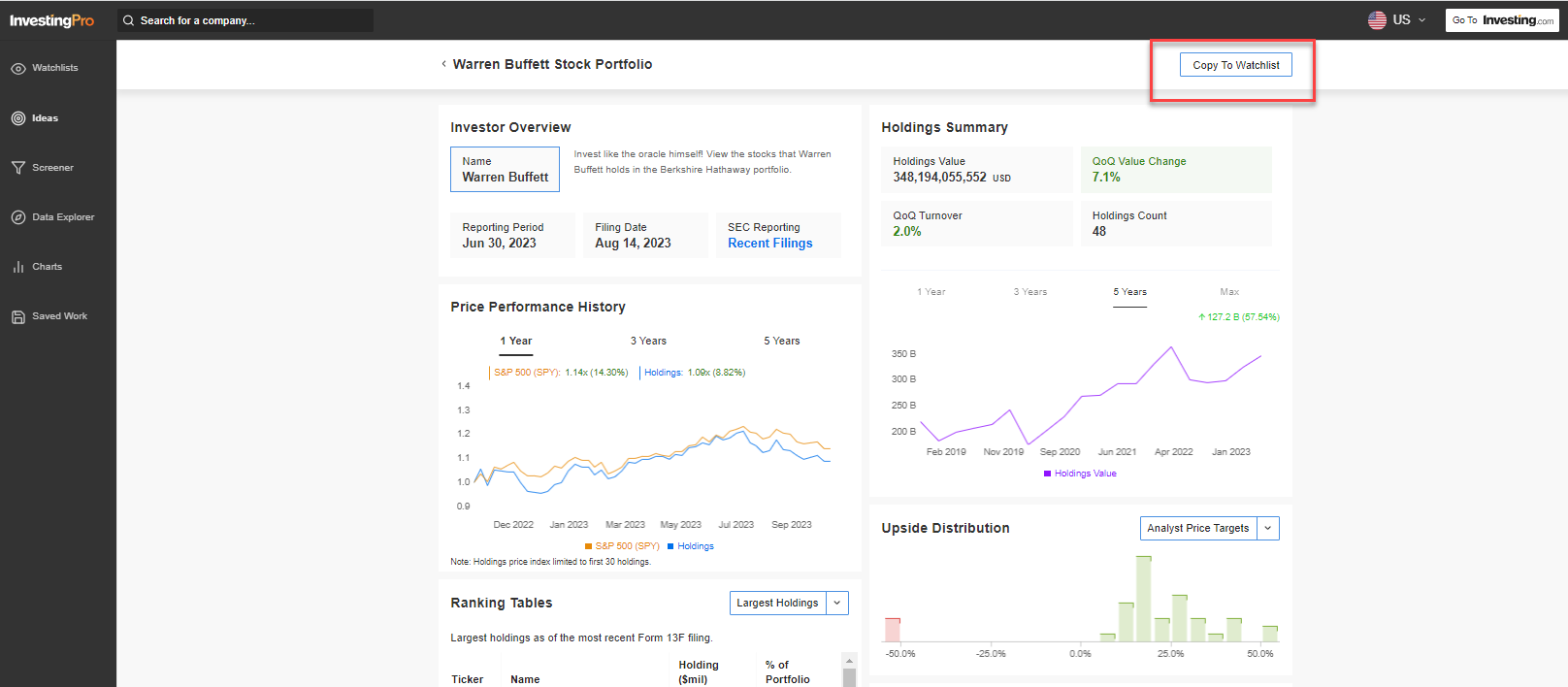

So, let's take Warren Buffett's portfolio (who else) and his investment vehicle Berkshire Hathaway (NYSE:BRKa) as an example.

Here you can see the historical price performance, the value of your assets, the % change over the last quarter, the total assets, or the sector concentration.

Source: InvestingPro

Thus far, the information is undeniably valuable, but it hardly surprises, given Warren Buffett's consistent track record of strong returns. Over the past five years, his investments have, after all, enjoyed a remarkable appreciation of 78%.

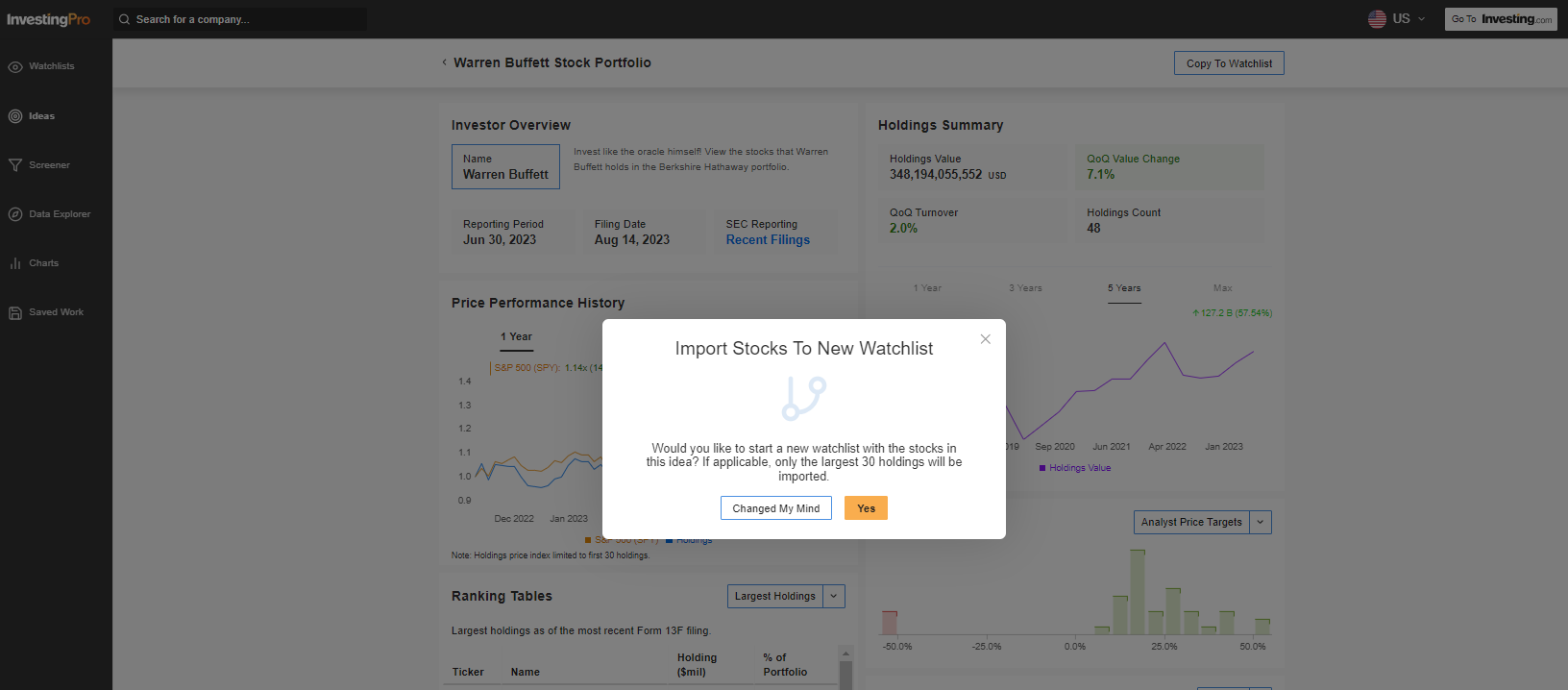

How to Copy Warren Buffet's Portfolio to Your Watchlist on InvestingPro?

Just click on "Copy to watchlist" and copy all the stocks in Warren Buffett's portfolio directly to your personal watchlist. Source: InvestingPro

Source: InvestingPro Source: InvestingPro

Source: InvestingPro

From here onward, utilizing the enhanced watchlist options within InvestingPro, you can delve into Warren Buffett's portfolio to discover an investment that aligns with your risk tolerance and investment horizon.

It's worth noting that your selection will be backed by Warren Buffett's endorsement, which, while not guaranteeing 100% success, significantly bolsters your odds compared to relying on the advice of your brother-in-law or a friend.

***

With InvestingPro, you can conveniently access a single-page view of complete and comprehensive information about different companies all in one place, eliminating the need to gather data from multiple sources and saving you time and effort.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice or recommendation to invest as such and is in no way intended to encourage the purchase of assets. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and associated risk remains with the investor.