The Kiwi dollar is coming under continuing selling pressure as speculation runs rife that the Reserve Bank of New Zealand (RBNZ) is set to savagely cut interest rates. The RBNZ is set to meet on Wednesday to decide upon the Official Cash Rate and a cut of between 25 and 50bps is likely.

A range of factors are likely to lead to the RBNZ cutting rates, including a deteriorating dairy trade market and lacklustre inflation within the economy. Global dairy trade prices have declined significantly over the past 12 months with last week adding a -10.7% result to the rout.

The New Zealand dairy industry represents over 30% of the country’s net exports which means the flow on effects of the decline have been marked. In fact Fonterra has just announced a round of staff cuts totalling over 500 positions which is likely to add further political and financial pressure.

Subsequently, the RBNZ faces an economic situation that has deteriorated significantly since June’s monetary policy meeting. The overarching opinion in the market is that there will be a 50bps cut to the Official Cash Rate in a decisive response to the slowdown. However, RBNZ Governor Wheeler is a canny individual who is conservative in his view of business cycles. I suspect this means he will likely opt for a 25bps cut initially which will allow him to review the data before undertaking a larger cut in September. Regardless of the rate cut size, the looser monetary policy will impact the New Zealand dollar strongly.

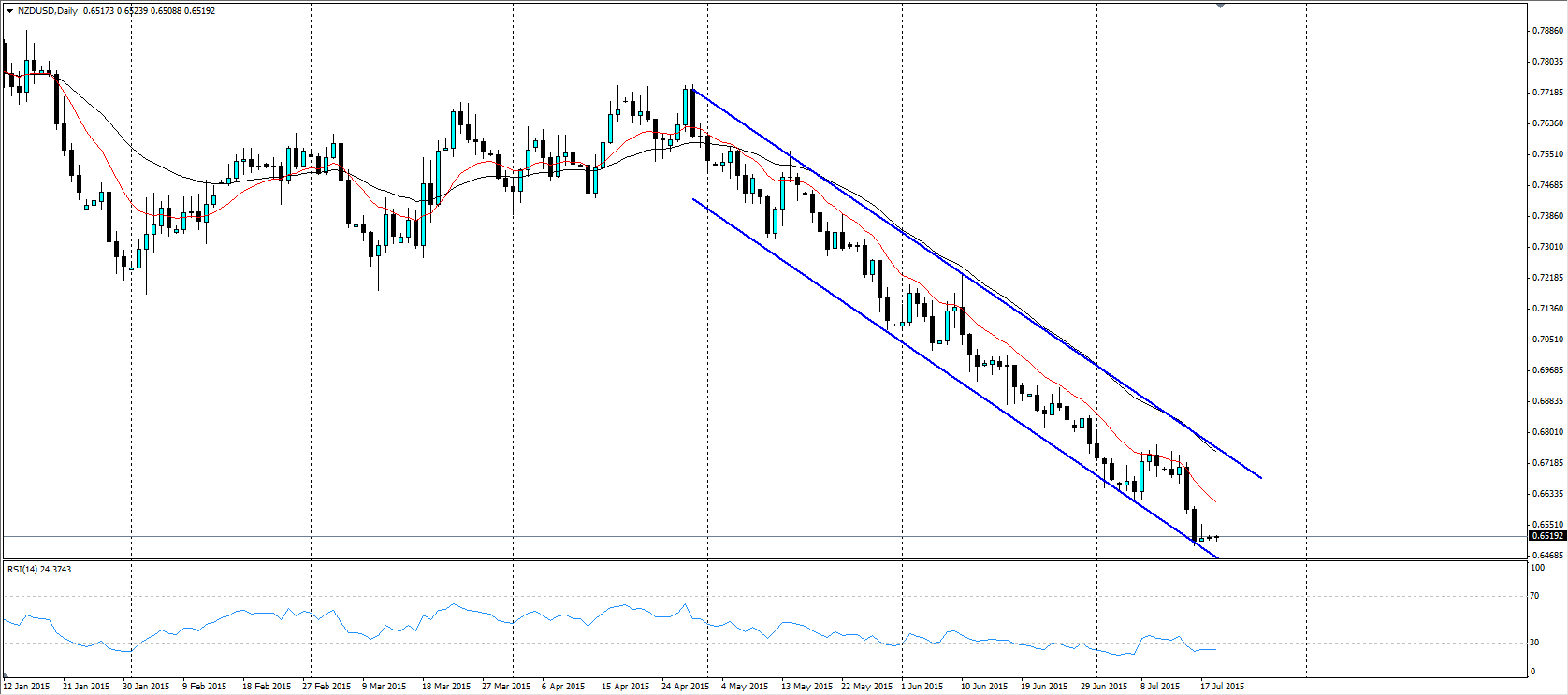

At the time of writing, the Kiwi dollar currently clings for life just above the key 65 cent handle but any moves to cut rates will see it tumbling and putting strong support at 0.6200 under pressure. Our analysis suggests that at least two rate cuts are in store for the beleaguered currency in the coming months and that this leaves us with a mid-term downside target of 0.60 by Q1, 2015.

However, the real downside risk rests with any decision by the US Federal Reserve to increase interest rates. When the Fed commences their monetary tightening cycle, the resultant fall of the Kiwi dollar will be significant and will potentially bring about a valuation in the 0.55 – 0.59 range. Yet with the amount of jawboning coming from the Fed, it is any ones guess when they will eventually commence tightening.

Overall, the Kiwi dollar faces a strongly developing bear market trend that will likely make it tough to call short term retracements. The combination of potentially easing NZ monetary policy and a hawkish US Fed makes for plenty of downside risk that will play out over the ensuing months.