- Kinder Morgan provides substantial income, albeit with little expected appreciation

- Shares are 21% below their pre-COVID 2020 high

- Wall Street analyst outlook is neutral

- The market-implied outlook is neutral

- KMI is worth considering for a covered call strategy

Kinder Morgan (NYSE:KMI) operates a significant network of pipelines, storage facilities and terminals for natural gas, refined products and CO2 across North America. It adds stability to revenue with multi-year and take-or-pay and fee-based contracts that don’t depend on commodity prices.

The Houston-based energy infrastructure operator sees substantial strategic benefit from its natural gas storage facilities to support a responsive electrical grid. In addition, the growth in solar energy, as well as flexible and responsive natural gas generators have an increasingly important role in supporting the grid. As the energy economy moves to lower carbon emissions, natural gas demand will remain robust. KMI appears well-positioned for this transition.

Source: Investing.com

KMI’s share price has fallen over the past five years and remains 21% below the pre-COVID 2020 high of $22.24 reached Feb. 20, 2020. The shares are 8.2% below the TTM high close of $19.14 on June 11, 2021.

While KMI’s price appreciation is reduced by the firm’s high distribution, currently 6.2%, the trailing total returns suggest some caution. The trailing 3-, 5- and 10-year annualized total returns for KMI are 4.26%, -0.62% and -1.12%, respectively.

I last wrote about KMI on Oct. 21, when I assigned a neutral/hold rating. Even with the 6.1% distribution at that time, the risk-return proposition did not look like a good bet. At that time, the Wall Street consensus outlook for KMI was mixed (neutral or bullish, depending on the source of the consensus estimate), with a consensus 12-month price target that was about 5% above the share price. Given the trailing and implied volatility for KMI, 29%, the total expected 12-month return of 11% was too low to justify a buy rating.

In addition to the fundamentals and the Wall Street consensus outlook, I rely on the options market for guidance in rating a stock. The price of an option reflects the market’s consensus estimate of the probability that the stock price will rise above (call option) or fall below (put option) a specific level (the option strike price) between now and when the option expires.

By analyzing prices of call and put options at a range of strike prices, all with the same expiration date, it is possible to calculate a probable price forecast. This is called the market-implied outlook and represents the consensus view among buyers and sellers of options. As of Oct. 12, the market-implied outlook to the middle of March of 2022 was predominantly neutral and expected volatility was 29%.

With two quarterly earnings reports since my last analysis, Q3 on Oct. 20 and Q4 on Jan. 19, I have updated the market-implied outlooks to provide a view through 2022 and compared these to the current Wall Street consensus outlook.

Wall Street Consensus Outlook For KMI

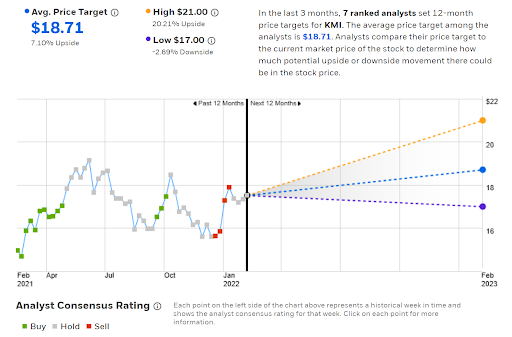

E-Trade calculates the Wall Street consensus outlook by combining the views of seven ranked analysts who have published ratings and price targets within the past 90 days. The consensus rating is neutral, although it was bearish/sell as recently as Jan. 7. The consensus 12-month price target for KMI is $18.71, 7.1% above the current share price.

Source: E-Trade

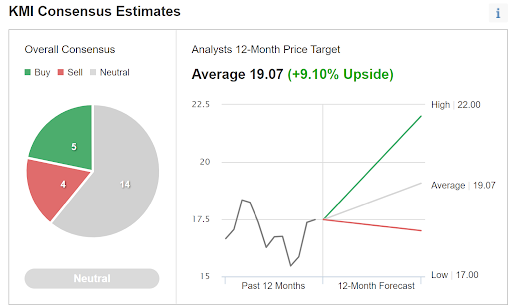

Investing.com’s calculation of the Wall Street consensus combines the views of 23 analysts, and the results are similar to E-Trade’s results. The consensus rating is neutral and the consensus 12-month price target is 9.1% above the current share price.

Source: Investing.com

With a consensus rating of neutral from E-Trade and Investing.com, and expected price appreciation in the range of 7.1% to 9.1%, the overall outlook has slightly improved since my last analysis.

Market-Implied Outlook For KMI

I have calculated the market-implied outlook for KMI for the 4.2-month period from now until June 17 and for the 11.3-month period from now until Jan. 20, 2022, using options that expire on these dates. The options trading on KMI is not very active, so I am somewhat circumspect about drawing strong conclusions from the market-implied outlook.

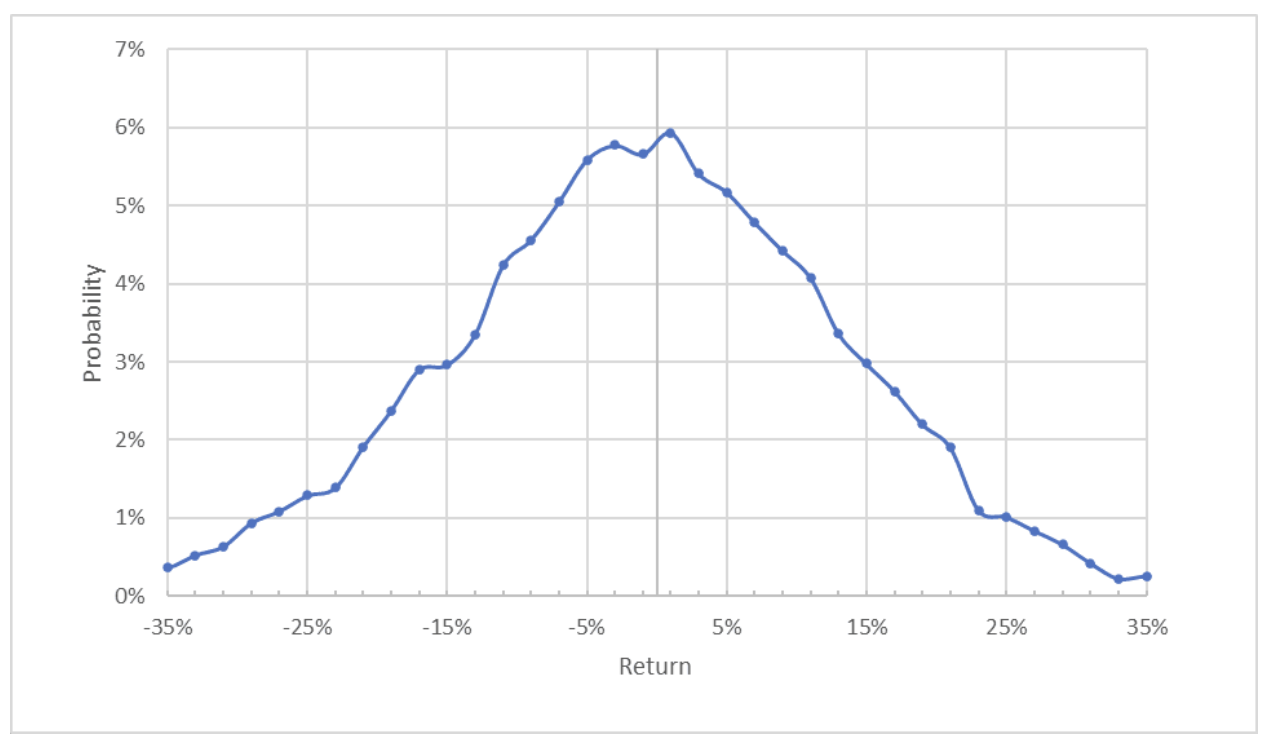

The standard presentation of the market-implied outlook is a probability distribution of price return, with probability on the vertical axis and price return on the horizontal.

Source: Author’s calculations using options quotes from E-Trade

The market-implied outlook to the middle of 2022 is extremely symmetric, with very similar probabilities of positive and negative returns of the same magnitude and the peak probabilities are indistinguishable from a zero price return. The annualized volatility calculated from this distribution is 25%.

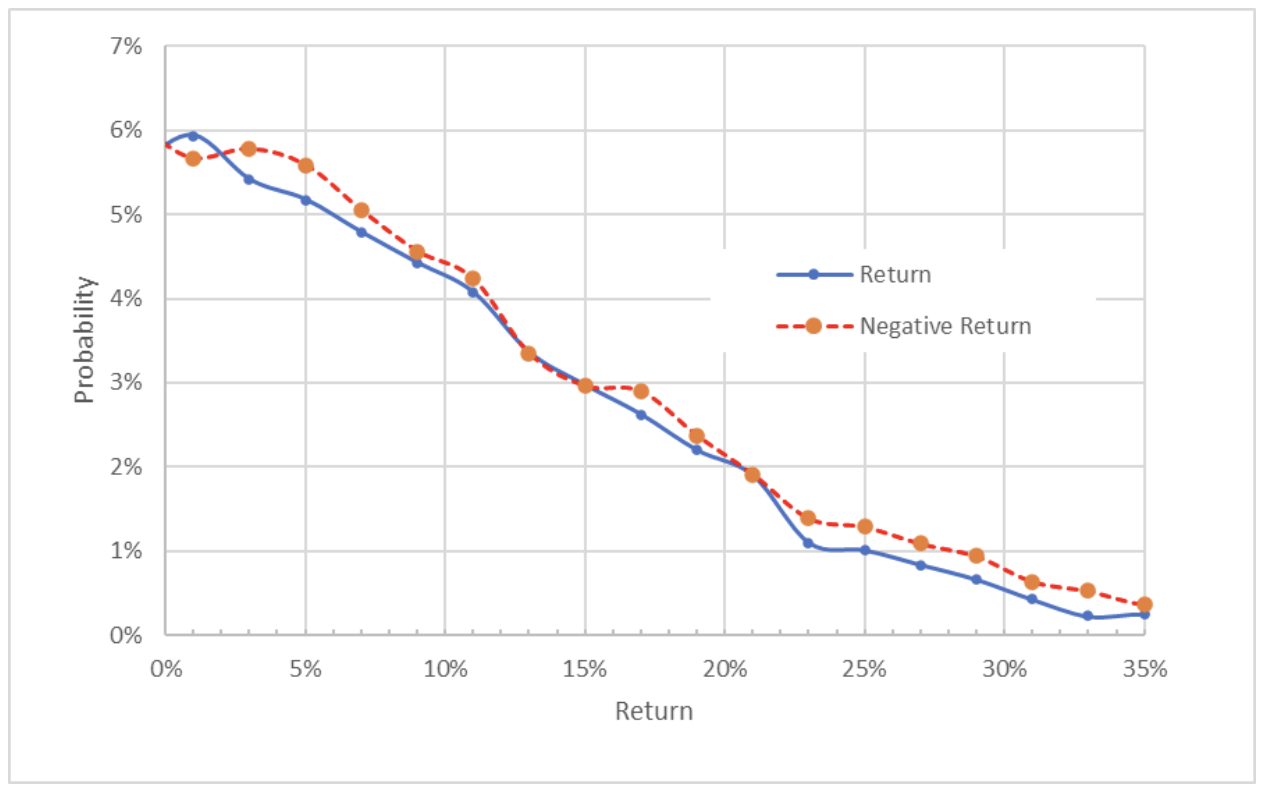

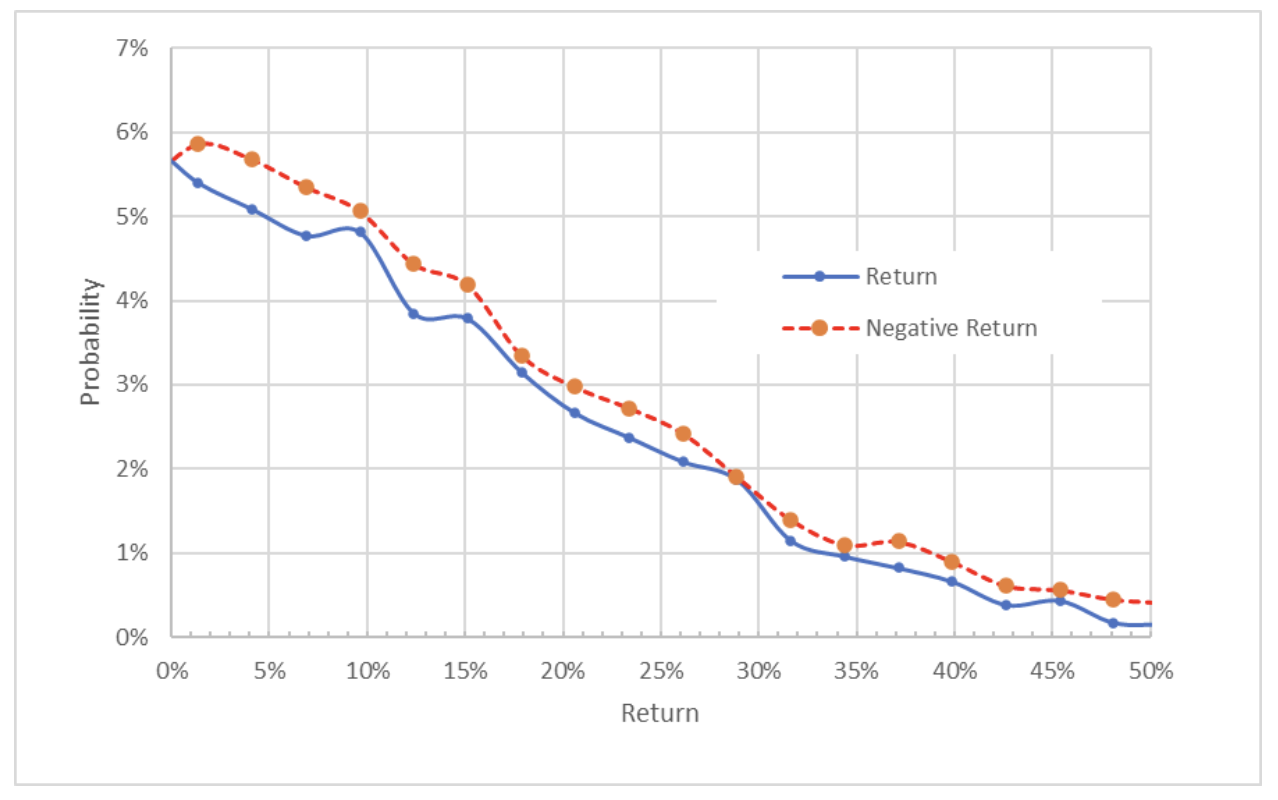

To make it easier to compare the probabilities of positive and negative returns, I rotate the negative return side of the distribution about the vertical axis (see chart below).

Source: Author’s calculations using options quotes from E-Trade

This view shows that the probabilities of positive and negative returns are almost identical, although the probabilities of negative returns are very slightly elevated. (The red dashed line is a short distance above the solid blue line.)

If the market-implied outlook was unbiased, this market-implied outlook would be interpreted as neutral with a slight bearish tilt. The market-implied outlook is believed to have negative bias, however, because risk-averse investors tend to be willing to pay more than fair value for downside protection. While there is no way to robustly estimate the negative bias, or even if this bias is present, the potential for this tilt makes the market-implied outlook for KMI to June 17 look neutral.

The market-implied outlook for the 11.3-month period from now until Jan. 20, 2023, is very similar to the outlook to the middle of 2022, albeit with a slightly larger negative tilt. Given the potential for a negative bias, this outlook is best interpreted to be neutral. The annualized volatility calculated from this distribution is 27%.

Source: Author’s calculations using options quotes from E-Trade

The market-implied outlooks for KMI look similar to those from my previous analysis, albeit slightly more favorable today with less of a negative tilt.

Summary

KMI should provide a reliable income stream, but the valuation is challenging. The volatility and overall decline in the share price over the past several years suggest caution even with the robust distributions.

The Wall Street consensus outlook is neutral, with expected 12-month return of about 8% for an estimated total return of 14% over the next year. Even taking this outlook at face value, KMI does not look especially attractive. As a rule of thumb for a buy, I look for an expected 12-month return that is at least half the expected annualized volatility.

Using the expected volatility from the market-implied outlook, 27%, the expected return is very close to half the volatility. The market-implied outlook for KMI is neutral to the middle of 2022 and neutral for the full year. While the outlook for KMI has improved since my last examination, I am maintaining my overall neutral view. I see no obvious red flags, but neither do I see KMI as a compelling buy at this time.

While I am neutral on KMI on a standalone basis, a covered call strategy may be worth considering. On Feb. 8, I bought shares of KMI at $17.37 and sold Jan. 20, 2023, call options with a strike price of $17 for $1.54. These options are slightly in the money, so the actual expected income from the call options is $1.17 ($1.54-$0.37), for an effective income of 6.7% ($1.17/$17.34). With the current distribution of 6.2%, the total expected income from this covered call position for the next year is 12.9%.