Powell’s recent Jackson Hole Summit speech was mainly as expected. Well, except for the part where Powell obfuscated the truth behind the surge in inflation. More telling was the misunderstanding of the impact of fiscal and monetary policies on long-term outcomes.

Let’s begin with Powell’s assessment of the cause of inflation.

“The ongoing episode of high inflation initially emerged from a collision between very strong demand and pandemic-constrained supply. By the time the Federal Open Market Committee raised the policy rate in March 2022, it was clear that bringing down inflation would depend on both the unwinding of the unprecedented pandemic-related demand and supply distortions and on our tightening of monetary policy, which would slow the growth of aggregate demand, allowing supply time to catch up. While these two forces are now working together to bring down inflation, the process still has a long way to go, even with the more favorable recent readings.”

It’s crucial to note the complete dismissal of the causes behind the “collision between very strong demand and pandemic-constrained supply.” I suspect this was intentional to avoid placing blame at the feet of the current or previous administrations or themselves. However, it muddies the impact of their actions that created the problem.

While the Fed, the Government, and the media repeatedly blame everyone but themselves for inflation, from greedy corporations to individuals, the issue is, and always has been, basic economics.

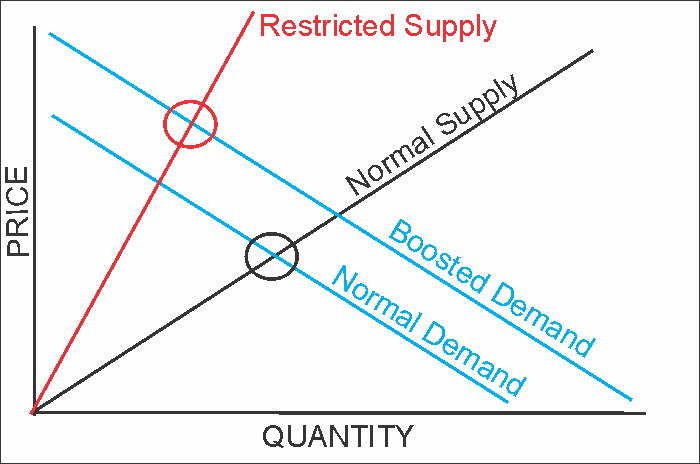

Basic Economics

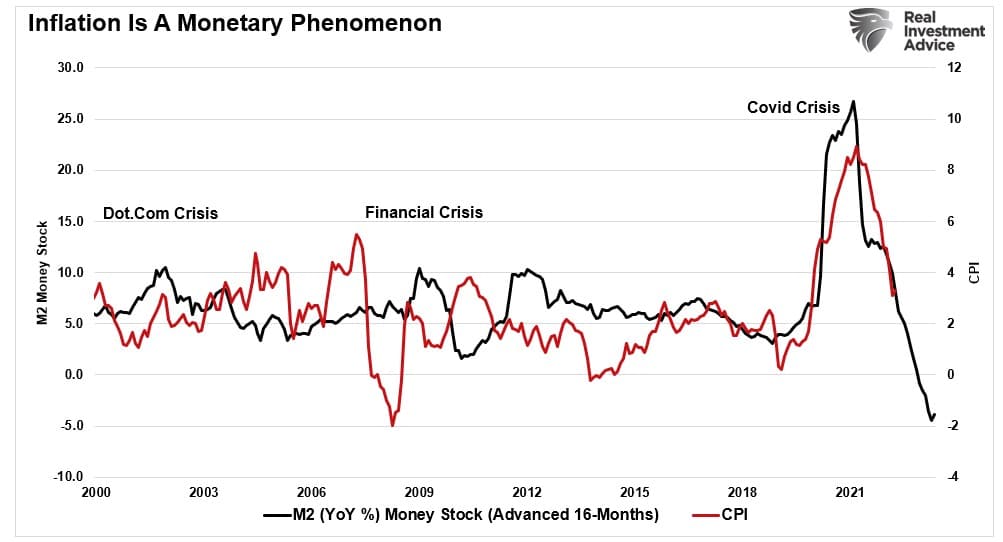

As Milton Friedman once stated, corporations don’t cause inflation; governments create inflation by printing money. There was no better example of this than the massive Government interventions in 2020 and 2021. Those policy decisions sent subsequent rounds of checks to households. Those funds created demand concurrently with an economic shutdown constraining the supply of goods.

The following economic illustration is taught in every “Econ 101” class. Unsurprisingly, inflation is the consequence if supply is restricted and demand increases by providing “stimulus” checks.

- Who had the power to shut down the entire economy and force everyone into their homes using a fear-driven campaign? Was it the war, corporations, or the Government?

- Who then supplied trillions in stimulus checks directly to households to spend when no supply could be produced? Was that corporations? Russia? Or was it the Government?

- Who supported the issuance of trillions in debt issuance to fund those stimulus checks and keep interest rates suppressed? Was that the Federal Reserve, Russia, or corporations?

- Was it corporations who put a moratorium on student loan, rent, and mortgage payments giving individuals a source of additional funds to spend? Or was it the Government?

The inflation surge had much less to do with the war or giant corporations taking advantage of consumers and more about the Federal Reserve’s and the Government’s actions. The cause of inflation was the economic consequence of “too much money chasing too few goods.”

Unfortunately, Powell is blaming the wrong culprit.

War With Ukraine Is Not The Issue

“The effects of Russia’s war against Ukraine have been a primary driver of the changes in headline inflation around the world since early 2022. Headline inflation is what households and businesses experience most directly, so this decline is very good news. But food and energy prices are influenced by global factors that remain volatile, and can provide a misleading signal of where inflation is headed.”

While the war between Russia and Ukraine certainly did not help matters, it wasn’t as much of a factor of inflationary pressures as Mr. Powell makes it.

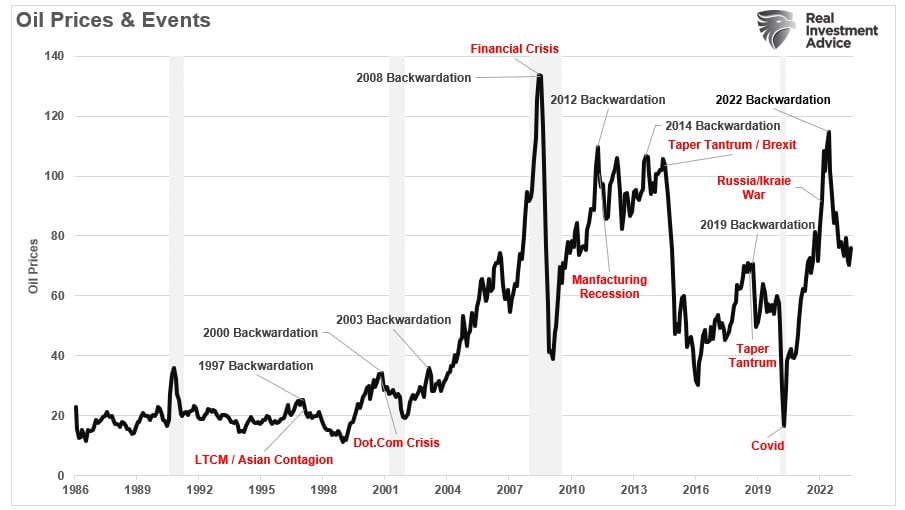

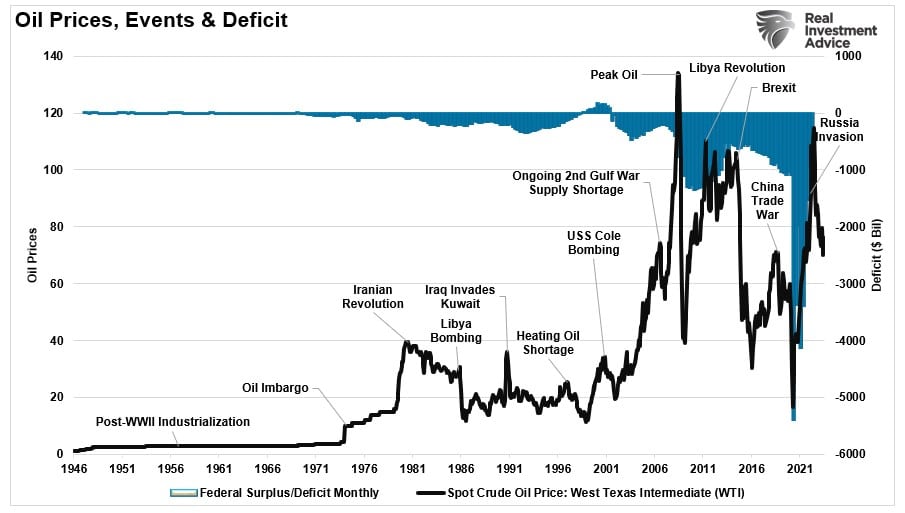

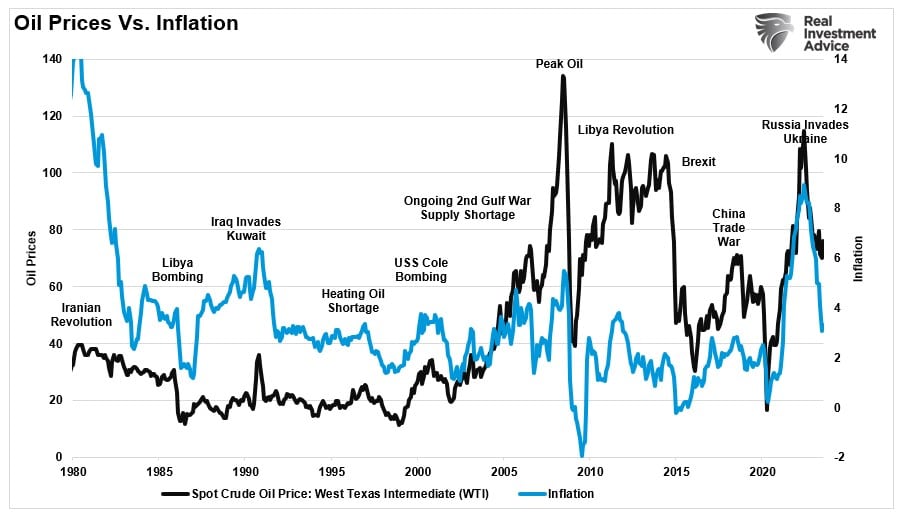

First, as Mr. Powell states, “I will focus on core PCE inflation, which omits the food and energy components.” Secondly, while the surge in energy prices was partially due to the war and restricted supply of Russian oil, prices were already well on the rise from the Covid collapse as the world began to open back up.

In fact, since the peak of backwardation in 2022, oil prices have steadily declined, lowering the inflationary impact on U.S. households. Such is also a function of the extraction of the $5 Trillion in deficit spending used to send checks to families, creating an outsized demand for oil during a production shutdown.

Mr. Powell is correct that declining inflation is a benefit to households. However, the excuse of using the war between Russia and Ukraine as a basis for inflationary pressures is disingenuous. Given that oil prices significantly correlate to the overall rise and fall of inflation, despite being a relatively small component of the overall calculation, it suggests it is far more of a reflection of the actions of both the Federal Reserve and the Government since 2020.

The most significant contributor to the decline of inflation is the reversal of the massive amount of monetary stimulus and support forced into the economy. As Powell noted:

“Turning to the outlook, although further unwinding of pandemic-related distortions should continue to put some downward pressure on inflation, restrictive monetary policy will likely play an increasingly important role. Getting inflation sustainably back down to 2 percent is expected to require a period of below-trend economic growth and some softening in labor market conditions.”

The problem with that statement is that if Powell does not acknowledge the actual cause of inflation, the Federal Reserve will likely be behind the curve when something eventually breaks.

A Day Late And A Dollar Short

As Powell noted in his speech:

“Beyond these traditional sources of policy uncertainty, the supply and demand dislocations unique to this cycle raise further complications through their effects on inflation and labor market dynamics.

These uncertainties, both old and new, complicate our task of balancing the risk of tightening monetary policy too much against the risk of tightening too little. Doing too little could allow above-target inflation to become entrenched and ultimately require monetary policy to wring more persistent inflation from the economy at a high cost to employment. Doing too much could also do unnecessary harm to the economy.

Without correctly identifying the true culprits of the current bout of inflation, the risk of doing too much or too little becomes elevated. In simpler terms, if you aim at the wrong target, the odds of success fall dramatically.

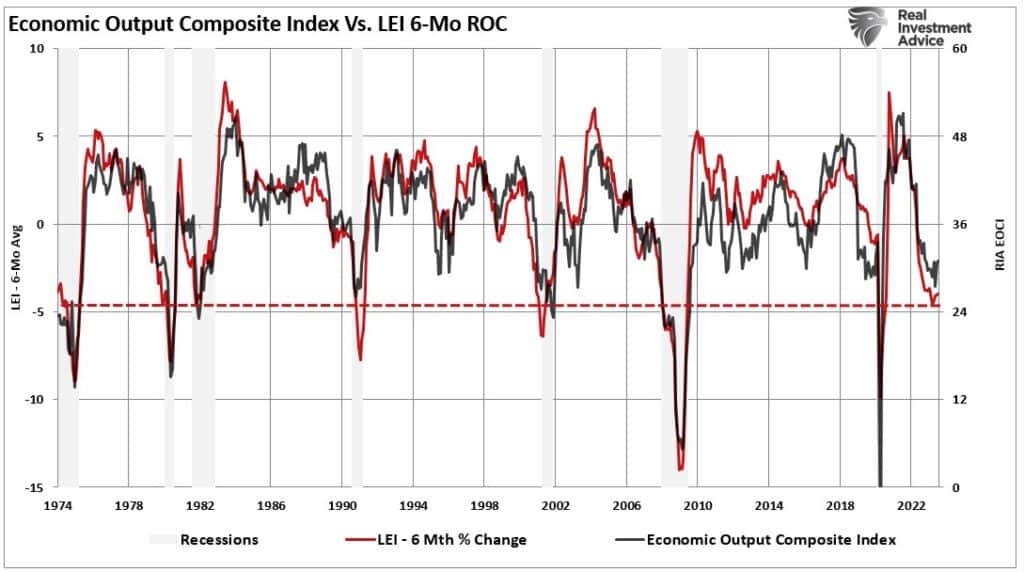

The problem is that monetary policy is already very restrictive. From inflation, surging short and long-term interest rates, and the “bullwhip effect,” economic growth will slow as the “lag effect” catches up. Such is already showing up in many of the economic reports. Our real-time composite economic index and the 6-month rate of change in the Leading Economic Index confirm the same.

While Powell most likely understands the true causes of inflation, he can’t undermine the current Administration. As Ian Shepherdson previously noted, this is more about controlling sentiment.

“Policymakers know very well the path of inflation, especially the core rate, over the remainder of this year is impervious to interest rate decisions. Monetary policy works with long lags. But the Fed has constituencies other than monetary economists; they have to calm the inflation fears of the public, the markets, and politicians. That means they have no choice but to sound as tough as possible because part of their job is to rein in inflation expectations.”

As we discussed in “Stability/Instability Paradox:”

“The ‘stability/instability paradox‘ assumes that all players are rational, and such rationality implies an avoidance of complete destruction. In other words, all players will act rationally, and no one will push ‘the big red button.’”

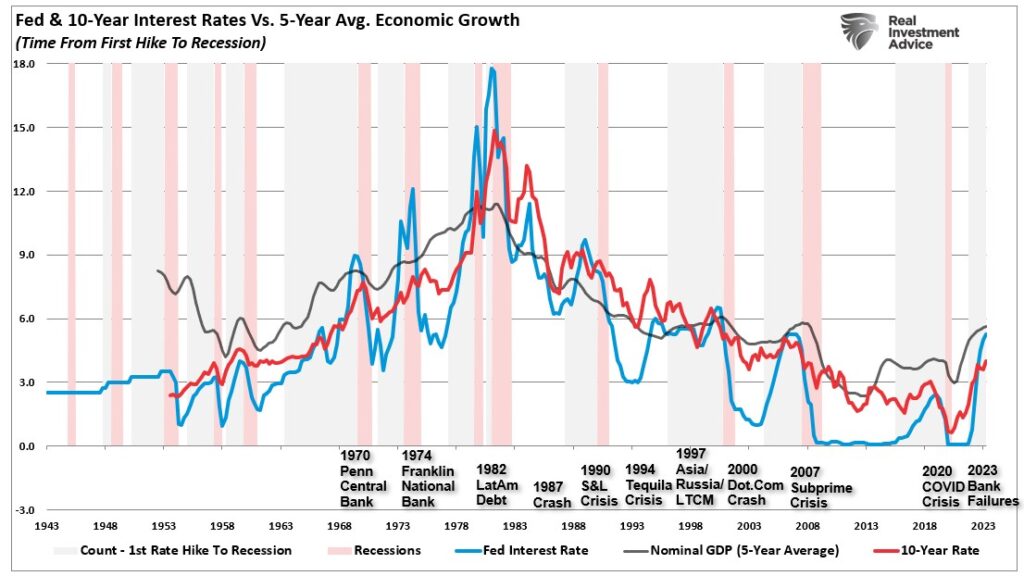

With consumers under pressure from higher interest rates, tighter lending standards, and slowing economic growth rates, the risk of doing too much is rising. Since 1980, the financial landscape has been littered with the carcasses of monetary policy miscalculations.

Could the Fed engineer a “soft landing” in the economy? Such is always possible. However, even Jerome Powell admits that sticking such a landing may be more challenging than many expect.

“As is often the case, we are navigating by the stars under cloudy skies.”

The problem for “Powell & Co.” is that intentionally obfuscating the truth about the cause of inflation is one thing. However, if he genuinely believes that inflation is the function of organic economic activities, he will most likely be the architect of the next recession.