- Fed officials gather for their annual symposium in Jackson Hole, Wyoming, this week.

- All eyes will be on Fed Chair Powell’s keynote speech in which he will give his latest views on interest rates, the economy, and inflation.

- I expect Powell to use the occasion to reiterate his hawkish stance and push back against rising expectations of a dovish pivot in policy.

The Federal Reserve may send financial markets a hawkish message when global central bankers meet at the Jackson Hole Economic Symposium this week.

The highlight is expected to take place when Fed Chair Jerome Powell delivers a highly anticipated speech on Friday morning in which he will talk on the outlook for monetary policy, the economy, and consumer prices.

In my view, Powell will strike a hawkish stance and hint that additional rate hikes will be needed to prevent a flare-up in inflation. I also believe the Fed chief will use his keynote speech to signal that rates will stay higher for longer and push back against the idea of rate cuts.

Indeed, the bond market appears to be preparing for a more hawkish monetary policy road ahead, as the U.S. benchmark 10-year Treasury yield climbed to a more than 15-year high of 4.366% on Tuesday last week.

Meanwhile, the year-to-date rally in the stock market has lost momentum, with the S&P 500 down 4.4% so far in August.

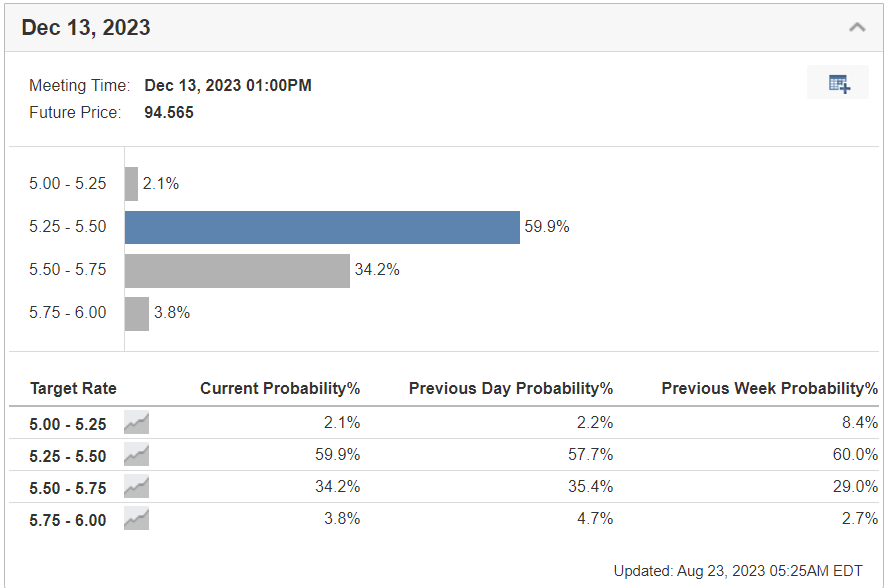

Traders of contracts tied to the Fed's policy rate now see a roughly 40% chance of another rate hike by the end of this year, up from about a 30% chance in the previous week.

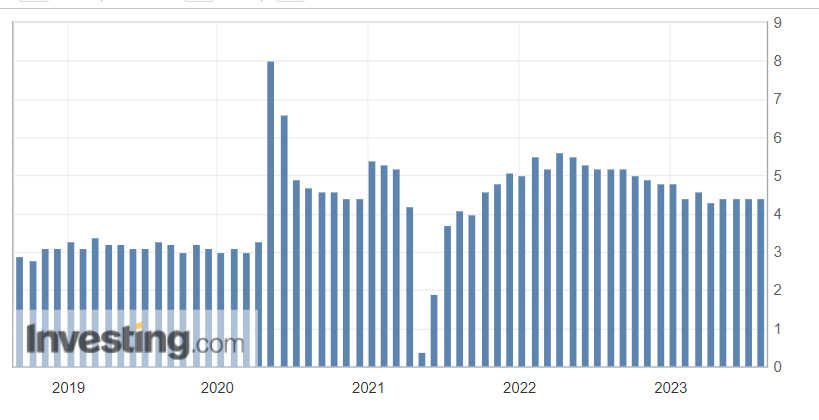

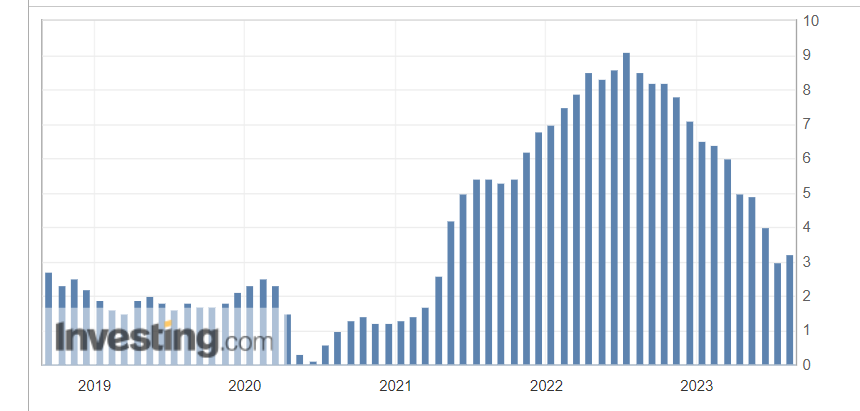

Source: Investing.com

At the same time, hopes of seeing rate cuts by early next year have faded, with investors realizing that rates are not going to go back down as quickly as they thought.

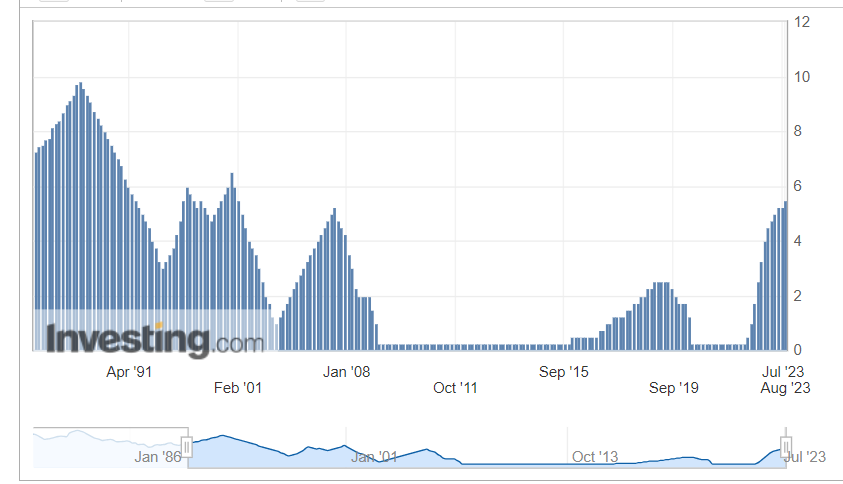

The Fed has raised its benchmark interest rate at 11 of its last 12 policy meetings, lifting it by 525 basis points since March 2022 to the current 5.25%-5.50% range.

Here are the three primary reasons why the Fed will not stop tightening monetary policy anytime soon.

1. Strong Economy

Powell's Jackson Hole speech will come after another strong batch of economic data showed consumer spending remained resilient in July, with retail sales recording their biggest monthly gain since February.

A year ago, many in the market were convinced the U.S. economy was headed towards a deep and severe recession as the Fed embarked on its historic tightening cycle to tackle inflation.

Fast forward to today, and the economy has held up much better than expected, prompting several FOMC members to scrap their forecasts for a looming downturn.

"The staff no longer judged that the economy would enter a mild recession toward the end of the year," the minutes from the Fed’s July 25-26 meeting revealed last week.

Not only is the economy not slowing, but it is actually showing signs of picking up.

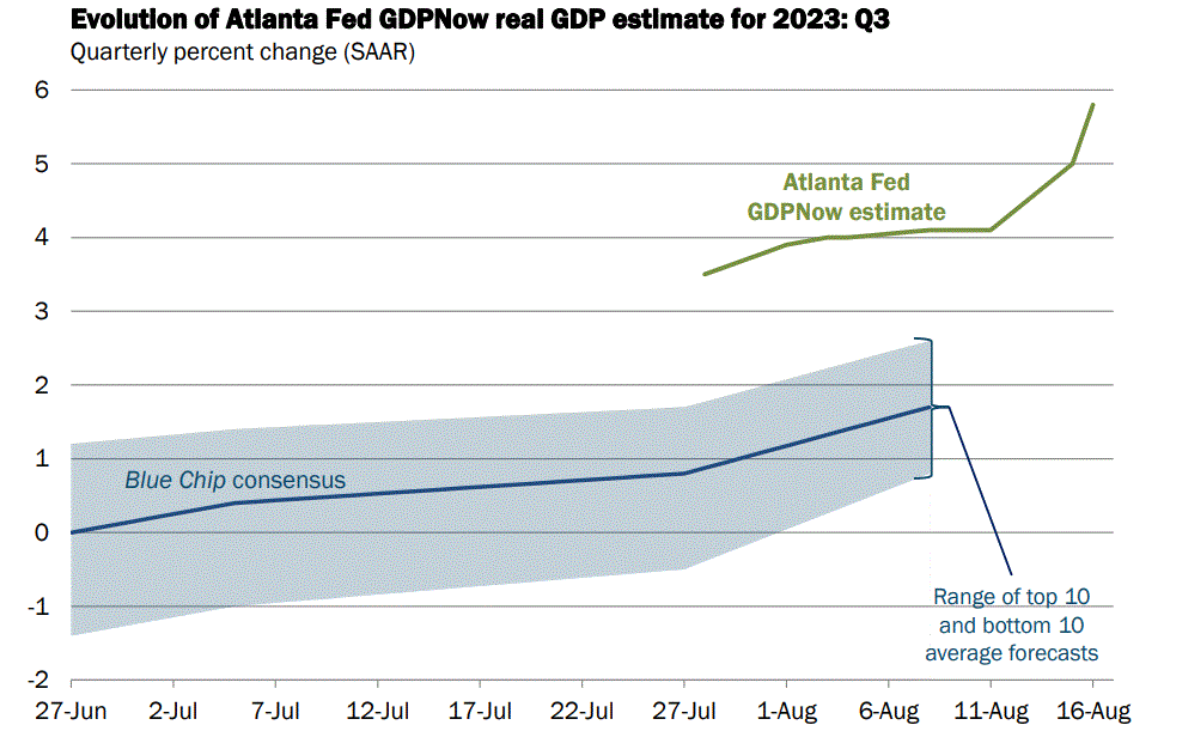

An Atlanta Fed GDP Now tracker puts GDP growth for the current July-September period at a whopping 5.8%, highlighting continued strong momentum from consumption and a surprising bounce in industrial production and home starts.

Source: Atlanta Fed

All things considered, a strong economy and robust consumer spending indicate there is little justification for Powell to turn more dovish at Jackson Hole.

2. Hot Labor Market

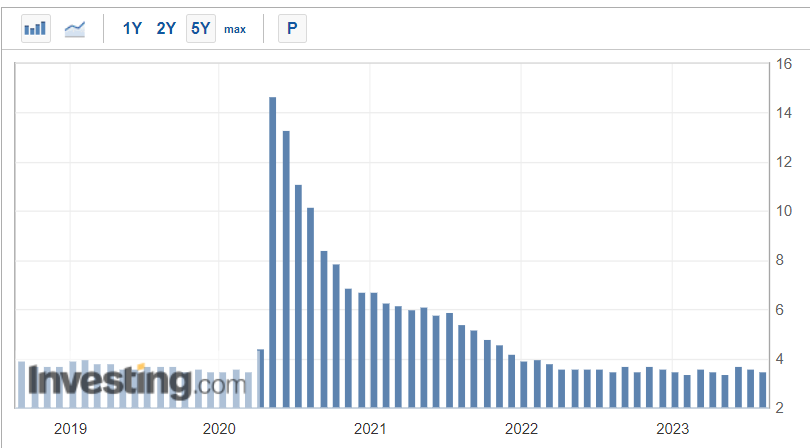

Contrary to expectations, the U.S. labor market continues to run hot as recent data showed solid wage gains and a decline in the unemployment rate back to 3.5% in July.

To put things in context, the jobless rate stood at 3.7% exactly one year ago in August 2022, suggesting that the Fed still has room to lift rates.

Fed officials have signaled in the past that the unemployment rate needs to be at least 4.0% to slow inflation.

Another sign of a tight labor market is the fact that employers continued to raise wages at a strong pace last month. Average hourly earnings gained 0.4% in July after rising by the same amount in June, which is still too hot for the Fed.

That saw the year-on-year rate increase by 4.4%, adding more fuel to a worrying inflation outlook that gives the Fed enough cushion to stay on its tightening path.

“Labor market conditions broadly are going to be an important part of getting inflation back down and that's why we think we need some further softening in labor market conditions," Powell said at the Fed's post-meeting press conference last month.

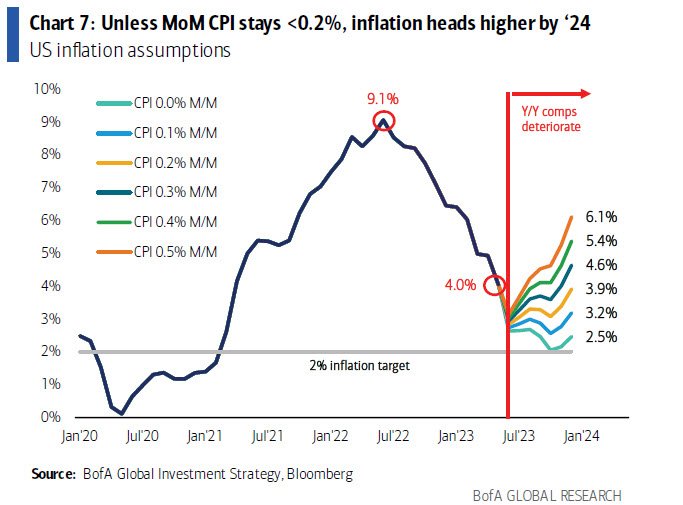

3. Reaccelerating Inflation

Overall, while the trend in CPI has been lower, the latest data raise the risk of a fresh increase in inflation, which is already running far more quickly than what the Fed would consider consistent with its 2% target range.

Consumer prices advanced 3.2% in July, marking the first time in 13 months the annual CPI rate picked up from the previous month. That followed a 3.0% increase in June.

In light of the recent notable increases in both energy and food prices, my expectation is that inflationary pressures will reaccelerate in the upcoming months.

This trend is likely to persist into early 2024, with CPI potentially rising back towards a 4.6%-to-5.4% range.

As such, it is my belief that inflation levels could remain elevated for a more extended duration than what is presently anticipated by financial markets.

During last month’s post-FOMC meeting press conference, Powell warned that while inflation has moderated somewhat since the middle of last year, hitting the Fed’s 2% target still “has a long way to go.” Furthermore, he added that he did not see inflation falling to the 2% goal until 2025.

All things considered, the current environment is not indicative of a Fed that will need to pivot on policy, and I believe there is still some way to go before policymakers are ready to declare mission accomplished on the inflation front.

***

Disclosure: At the time of writing, I am long on the Dow Jones Industrial Average via the SPDR Dow ETF (DIA). I also have a long position on the Energy Select Sector SPDR ETF (NYSE:XLE) and the Health Care Select Sector SPDR ETF (NYSE:XLV). Additionally, I am short on the S&P 500, Nasdaq 100, and Russell 2000 via the ProShares Short S&P 500 ETF (SH), ProShares Short QQQ ETF (PSQ), and ProShares Short Russell 2000 ETF (RWM).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies' financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.