After several challenging quarters, the setup for cloud stocks is significantly more favorable in 2H23. While flight-to-safety is providing support for the mega-cap stocks, the valuation gap is becoming difficult to ignore.

Contents

- Takeaways from earnings reports: AWS, Azure, GCP

- Positioning for 2H - easy comps and AI tailwinds

- Mid-caps lagging mega caps creating outsized opportunities

Cloud data points from earnings - not getting worse

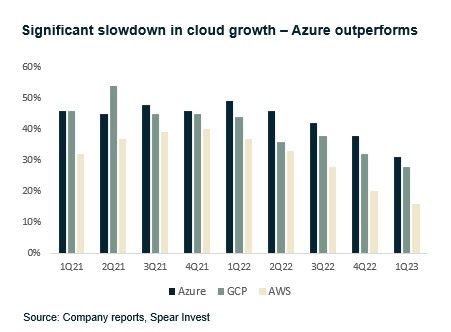

While earnings from the hyper scalers did not meaningfully surprise the upside, any incremental positive commentary resulted in outsized reactions. Microsoft (NASDAQ:MSFT) reported the strongest results, while GCP and AWS were in-line to disappointing. The most important takeaway echoed by all companies was that cloud optimization trends are not getting better but also are not getting worse. This is important as we believe that in order to find the bottom during downturns, it is all about focusing on the second derivative. This comment signaled a bottom.

Microsoft's Azure grew 31% on a ~$60bn base. The company guided to 26-27% growth, with 1% coming directly from AI. While this may not seem like a lot, it is roughly >$400mm run-rate for AI services, a strong starting point. The interesting commentary that came out of the earnings call is that while companies are still optimizing spend, Microsoft is starting to see new workloads pick up in areas that they have not seen before (life sciences, etc.). Moreover, management made a comment that while optimization is expected to continue, "at some point workloads can not be optimized any further".

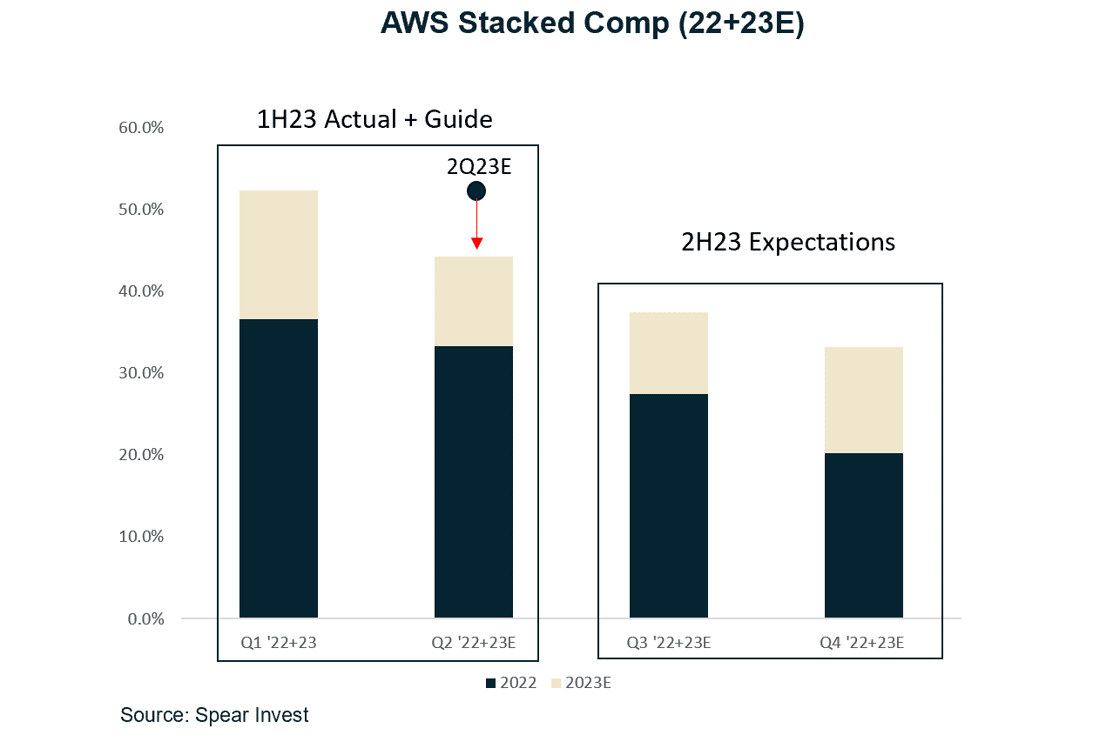

Amazon's (NASDAQ:AMZN) AWS revenue grew 16% on a ~$85bn base (vs. the guide for mid-teens). While this was interpreted as significantly positive at first, management noted that April is tracking toward 11% growth. Investors were already expecting slower growth in 2Q23 vs.1Q23, but the magnitude of the delta was not well received.

Google's (NASDAQ:GOOGL) GCP grew 28% on a ~$30bn base and generated an operating profit in the quarter. Google is the smallest and least profitable of the three.

Overall, Microsoft's results stood out as the company is now guiding to higher growth in 2Q23 vs. Amazon if April trends were to persist through the quarter. The biggest takeaway was that while companies are expecting slower growth in 2Q23, the underlying trends (client optimizations) are not getting worse.

Easy comps short term; AI long term

While the down-trend in cloud spending growth over the past four quarters is easy to spot, what is not as obvious is the difference in set-up in 1H23 vs. 2H23. As we get into the second half of 2023, the comparables get significantly easier, especially in the fourth quarter, as this is when we observed the first sign of the slowdown.

While we expect easy comps to set a floor for the cloud stocks, we believe we are on the cusp of a major cloud spending wave. Three key points:

- While cloud bills are high, the cloud is still more cost-effective than on-premise for most use cases. In fact, one of the reasons why we are going through a down-cycle is because customers have the ability to scale down their usage based on demand, rather than having to commit capital.

- We expect AI to be a catalyst for the next cloud spending cycle. Large AI-Language Models are expensive to train. Access and flexibility will be paramount. Outside of a select group of mega-caps that are likely to train their own models, most companies will be leveraging hyper scalers. In fact, Nvidia (NASDAQ:NVDA) is in the process of partnering with several cloud vendors to make their hardware available as a service.

- Significant runway ahead: 90%+ of global IT spend is still on-premise, per Amazon's CEO Andy Jassy (1Q23 earnings call), providing the company with confidence for the next cycle.

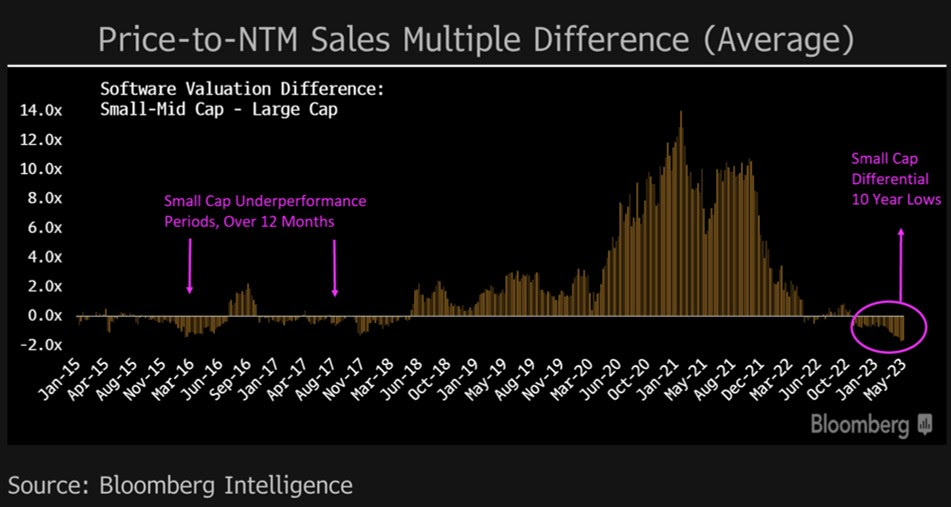

Mid-caps lagging mega-caps creating outsized opportunities

While "flight to safety" favors the mega-caps, the valuation gap is becoming too large to ignore. The multiple differentials between small caps and large caps in the software space is now at a 10-year low.

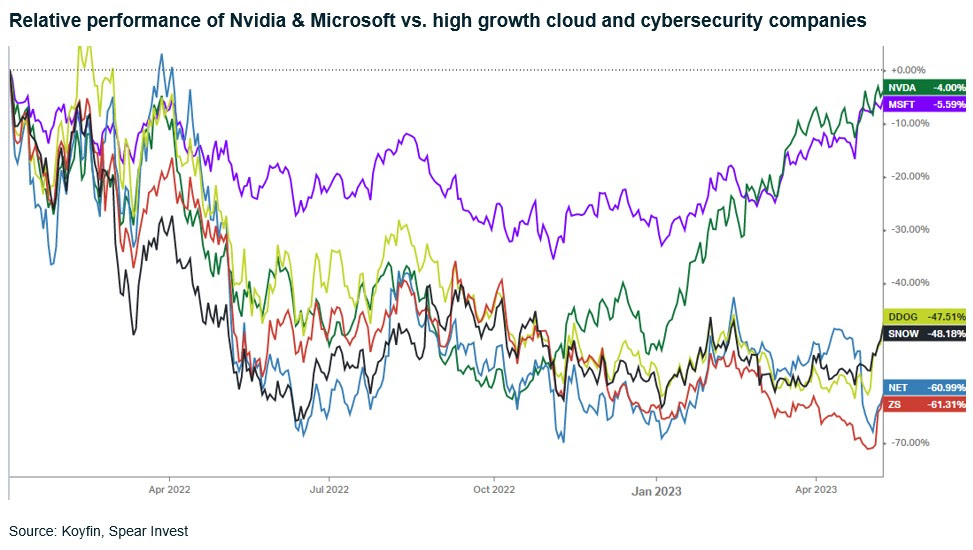

Mid-cap companies such as Snowflake (NYSE:SNOW), Datadog (NASDAQ:DDOG), Cloudflare (NYSE:NET), and Zscaler (NASDAQ:ZS) generally grow revenues at a multiple of the hyper scalers growth.

What stood out to us during this quarter is that while these mid-cap stocks have been getting hard hit (down ~50-60% since Jan/22), diverging in performance from the hyper scalers/semis, the gap in fundamentals is not widening. Generally, a company like Datadog historically has grown 2x the AWS growth rate. In the most recent quarter, the company guided to 2Q23 growth of 23% at the mid-point vs. AWS at 11%, implying that the gap is, at the minimum, staying constant.

What is especially appealing for fundamental investors is that these mid-cap companies have proven business models (already generating $1 billion in revenues) and maintain positive free cash flow. Their growth and volatility profiles resemble a company like Nvidia, with the primary distinction being that Nvidia is "early-cycle." Consequently, while we still expect a strong performance from Nvidia, the gap could significantly narrow over time.

Disclosure:

Views expressed here are for informational purposes only and are not investment recommendations. SPEAR may, but does not necessarily have investments in the companies mentioned. For a list of holdings click here. All content is original and has been researched and produced by SPEAR unless otherwise stated. No part of SPEAR’s original content may be reproduced in any form, without the permission and attribution to SPEAR. The content is for informational and educational purposes only and should not be construed as investment advice or an offer or solicitation in respect to any products or services for any persons who are prohibited from receiving such information under the laws applicable to their place of citizenship, domicile or residence. Certain of the statements contained on this website may be statements of future expectations and other forward-looking statements that are based on SPEAR's current views and assumptions, and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. All content is subject to change without notice.

All statements made regarding companies or securities or other financial information on this site or any sites relating to SPEAR are strictly beliefs and points of view held by SPEAR or the third party making such statement and are not endorsements by SPEAR of any company or security or recommendations by SPEAR to buy, sell or hold any security. The content presented does not constitute investment advice, should not be used as the basis for any investment decision, and does not purport to provide any legal, tax or accounting advice. Please remember that there are inherent risks involved with investing in the markets, and your investments may be worth more or less than your initial investment upon redemption. There is no guarantee that SPEAR's objectives will be achieved.

Further, there is no assurance that any strategies, methods, sectors, or any investment programs herein were or will prove to be profitable, or that any investment recommendations or decisions we make in the future will be profitable for any investor or client. Professional money management is not suitable for all investors. Click here for our Privacy Policy.