It has been an interesting two years since the S&P500 struck its all-time high at $4818 on January 4, 2022. Although the Bears feel pretty beat up by now and the Bulls invincible (the latest weekly AAII reading stands at only 24% Bears and a whopping 45% Bulls) remember the Bulls have so far been the losers. So, if you are a Bear and have lost money, please examine your entry and exit strategies. Namely, this has been a tough market for everyone, as many probably sold longs and/or covered shorts too late. Market participants have been so conditioned to trending markets since at least 2009 and possibly as early as 1974 (!) that many have forgotten, or may never have experienced, that sideways is an option, too. The main winners since the ATH are those who stayed nimble, took (partial) profits, and raised stops prudently.

Moreover, regular readers may recall that already in early August, see here, we warned that per the Elliott Wave Principle (EWP), a significant top could be forming. We followed up on our forecast regularly, with the market throwing the obligatory and occasional curve ball. But by the end of October, the index had lost 11%. We then found, see here, that a reversal was likely and that the market could rally to $4800+. In our last update, we showed the potential was in place for a rally to be as high as ~$ 4550. And here we are; today, the index reached as high as $4587.

However, the index reached the target zone more directly than anticipated as the more pronounced pullback we expected didn't materialize but was contained to one down day (November 9). It happens; we cannot foresee everything, and since the market doesn't owe us anything, we must acknowledge that no system, pundit, or analyst can be 100% accurate. If anyone is under the impression that one must always be right to succeed in the markets, let me disabuse them of that notion. Market analysis is not an exact science. If one approaches the markets as if it is, one's portfolio will be in big trouble.

That said, the index is now again at an inflection point. See Figure 1 below.

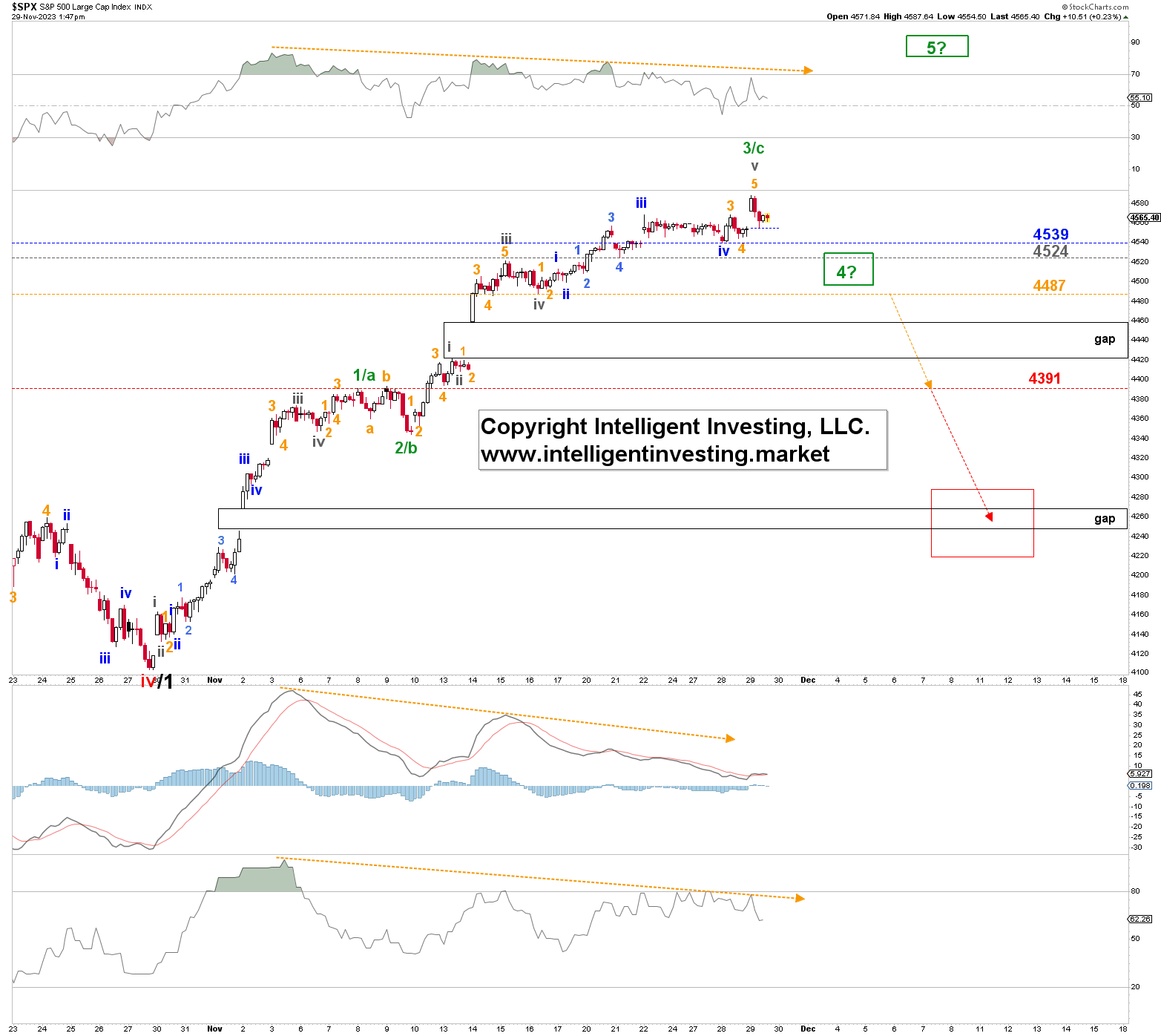

Figure 1. S&P500 hourly resolution chart with technical indicators and detailed EWP count Namely, the index has now completed what counts best as five, subdividing, waves up from the grey W-iv, November 15 low. These are part of the green W-3/c. Thus, the first order for the Bears is to present us with a daily close below $4539 to target $4524 in the green, potential, W-4 zone. Below that, $4487 can be achieved. The latter level is still acceptable for a possible 4th wave.

Namely, the index has now completed what counts best as five, subdividing, waves up from the grey W-iv, November 15 low. These are part of the green W-3/c. Thus, the first order for the Bears is to present us with a daily close below $4539 to target $4524 in the green, potential, W-4 zone. Below that, $4487 can be achieved. The latter level is still acceptable for a possible 4th wave.

However, note there are a lot of negative divergences (orange arrows), suggesting the uptrend is losing momentum and strength, supporting the case for a pullback, but those are conditions, not triggers. Price is the final arbiter and trade-trigger. Thus, the Bulls would want to hold $4487 or risk facing closure of the November 14 gap open at $4421. Moreover, a drop from current levels below the November 9 high at $4319 will tell us a much more significant pullback to ideally $4220-90 is most likely underway before we can see another substantial rally. Conversely, a move above today's high means that $4640+/-10 can be reached.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.