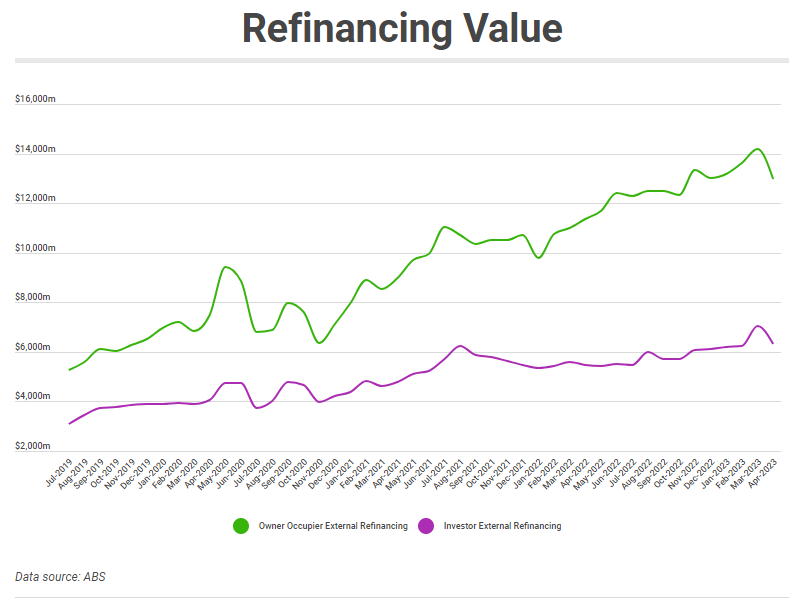

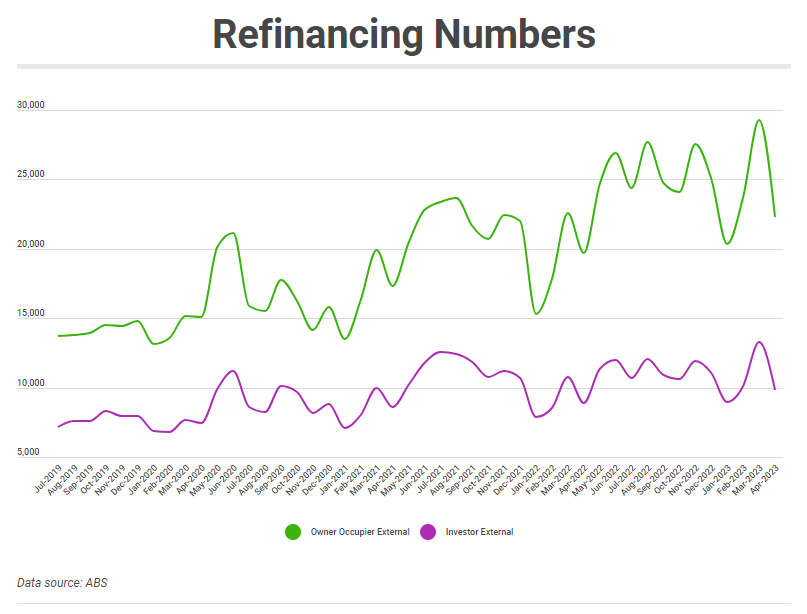

This comes as ABS lending indicator data released on Friday revealed both owner occupiers and investors saw significant dips in refinancing levels throughout April, with total refinancing across the housing sector falling 9.2% to $19.3 billion.

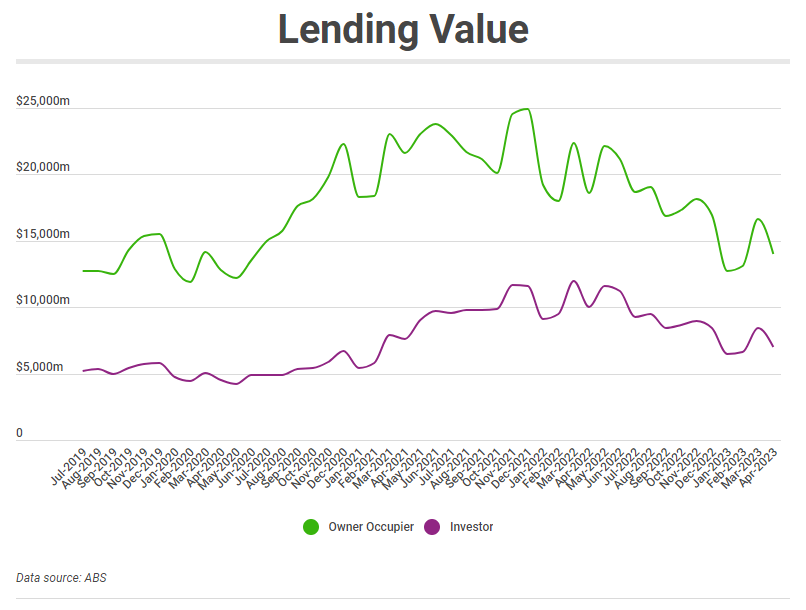

- ABS Lending Indicators revealed the value of home loans declined 2.9% in April.

- Refinancing declined significantly in April, falling 8.6% for owner occupiers and 10.4% for investors.

- First home buyer loan commitments fell 0.9% in April.

Alongside owner occupiers, investors were less inclined to refinance in April, with the value of external refinances falling 10.4% to $6.3 billion.

Over the past couple of months, many lenders have announced their cashback offers will come to an end, including three of the four major banks.

Overall the appetite for new home loans declined in April, with ABS figures detailing a 2.9% decline to $23.3 billion, after a 5.3% rise in March.

ABS Head of Finance Statistics Mish Tan noted the value of new owner-occupier loan commitments fell 3.8% to $15.4 billion in April, while the value of new investor loan commitments fell 0.9% to $7.9 billion.

NAB Head of Market Economics Tapas Strickland said the decline in lending is consistent with NAB's view that the reduction in borrowing capacity from higher rates will hamper the sustainability of the recent rebound in dwelling prices.

"[NAB] forecast a further fall in dwelling prices of around 3.5% for a peak to trough decline of around 12%," Mr Strickland said.

Further, the ABS revealed the number of new owner-occupier first home buyer loan commitments fell 0.9%, despite a rise of 16.5% in March.

Major bank economists were well and truly off the mark, with Westpac anticipating a 3.0% increase in housing finance in April, while ANZ had forecast a 2.0% increase.

CommBank economists were the only to expect a retraction in housing finance, forecasting a 1.0% decline in April.

CommBank Head of Australian Economics Gareth Aird said home prices rose solidly in May, however this lift in home prices is not due to an increase in the demand for credit.

"New lending for homes, excluding refinancing, fell by 2.9% in April compared to the consensus forecast for a lift of 2.0%," Mr Aird said.

"Stronger than anticipated population growth has caused vacancy rates to drop and rents to surge around the country.

"This dynamic lies at the heart of the turning point in Australian property prices."

"Is the refinancing rush over for mortgage holders?" was originally published on Savings.com.au and was republished with permission.