The US payment behemoth Visa (NYSE:V) has been on a slippery slope since this summer. Its stock, after hitting a record high in the mid-July, has fallen more than 21%, missing out in a powerful rally tied to the economic reopening.

This bearish spell, however, is not exclusive to Visa. Other payment companies are also under pressure. The Bloomberg Digital Payments Index touched its lowest level since December yesterday.

The biggest drag on the outlooks for these companies is surging coronavirus cases, mostly in Europe. It’s a development that could further delay overseas spending. German Chancellor Angela Merkel said the latest surge in COVID-19 infections is worse than anything Germany has experienced so far and called for tighter restrictions to help check the spread.

New infections are at record levels, and some countries, including the Czech Republic and Greece, are clamping down on the unvaccinated as health services are pushed to the limit. Austria imposed a nationwide lockdown last Monday.

While overseas spending on Visa cards jumped 38% in the most recent earnings report, the company warned that widespread border closures are still a threat to recovery in business.

Cross-border travel likely won’t reach pre-pandemic levels until the summer of 2023, Chief Financial Officer Vasant Prabhu told analysts last month. Customers outside the US account for more than 50% of Visa’s revenue.

According to Prabhu:

“COVID variants are still with us and vaccination rates remain low in large parts of the globe. With these factors as the backdrop, forecasting the trajectory of the return to normalcy remains difficult.”

A Dispute With Amazon

Another drag on Visa’s growth outlook is the company’s dispute with Amazon (NASDAQ:AMZN). The e-commerce giant said last week it would no longer accept purchases made with Visa credit cards in the UK starting next year as the e-commerce giant pressures the company to cut its fees. In Singapore and Australia, Amazon has already imposed a surcharge for those using Visa credit cards.

In addition, Visa is also under the regulator’s review over its possible monopolistic practices. Earlier this year, reports indicated the US Department of Justice (DoJ) was investigating Visa over allegations that it limited the ability of merchants to route debit card transactions in order to limit so-called “network fees.”

The Wall Street Journal reported last month that the DoJ expanded its anti-trust probe by looking into Visa's relationship with fintech companies, specifically the kinds of incentive payments it had offered Square (NYSE:SQ) and PayPal (NASDAQ:PYPL).

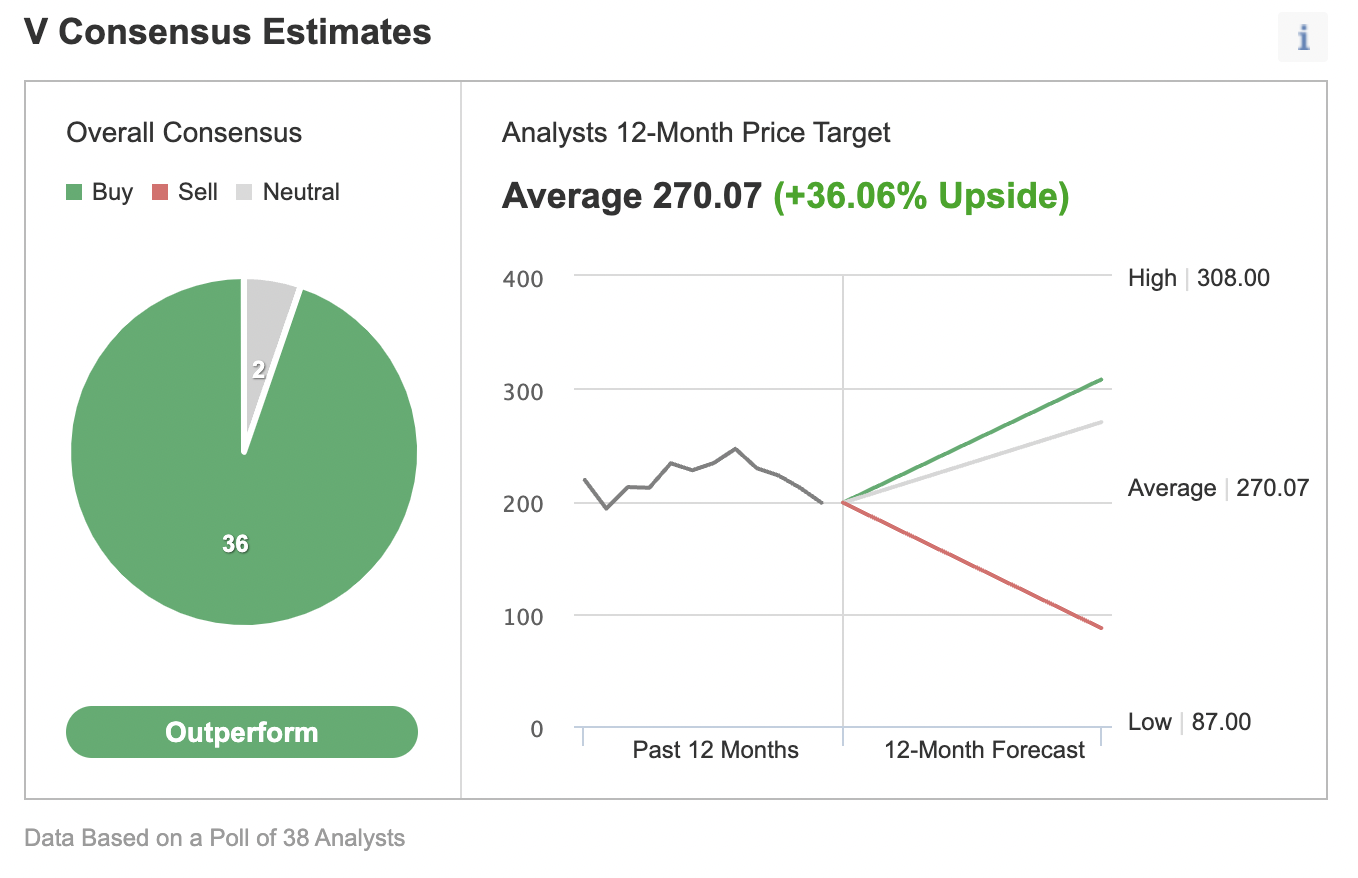

These headwinds certainly show that Visa stock will continue to remain under pressure for some time. But that weakness, according to some analysts, is a buying opportunity. Of 38 analysts polled by Investing.com, 36 have an “outperform” rating on the stock with their consensus price target showing a 37% upside from the current price.

Visa has faced similar, but bigger, threats before. In the US, for example, both Walmart (NYSE:WMT) stores and Kroger (NYSE:KR), two powerful retailers, had settled their stand-offs over fees with the payment giant in recent years.

Another attraction to owning Visa stock is that as the pandemic becomes contained and people resume normal spending, the company is likely to resume its double-digit dividend growth.

While its dividend has a lower-than-average yield, Visa has raised its annual payout for 12 straight years and has a lot of cash to comfortably continue making hikes. Just in the past three years, Visa's dividend has grown almost 80%. Over the past five years, the stock returned 146% in total returns.

Bottom Line

Visa stock has been under pressure recently for a variety of reasons. But these headwinds are temporary in our view and offer a buying opportunity in a stock that has an impressive track-record for both growth and income.