DXY found some footing Friday night:

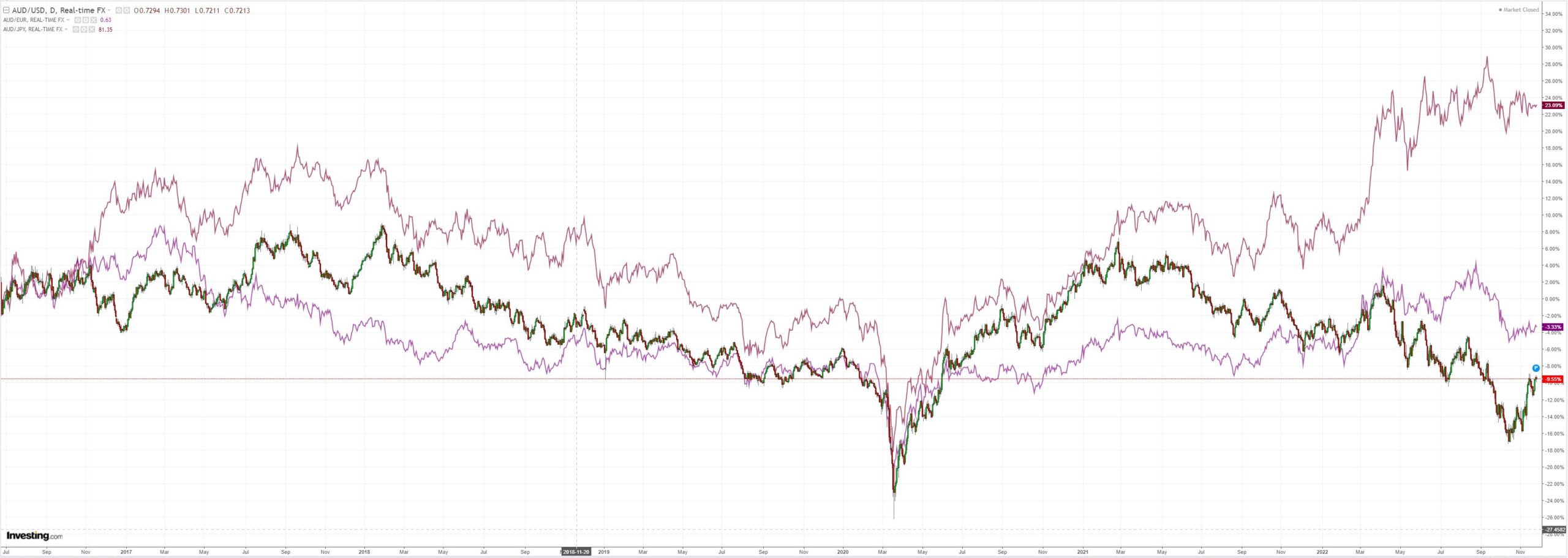

AUD eased:

Interesting that the bear market rally has not dislodged speculative shorts:

Oil looks ready to break:

Base metals are stuck:

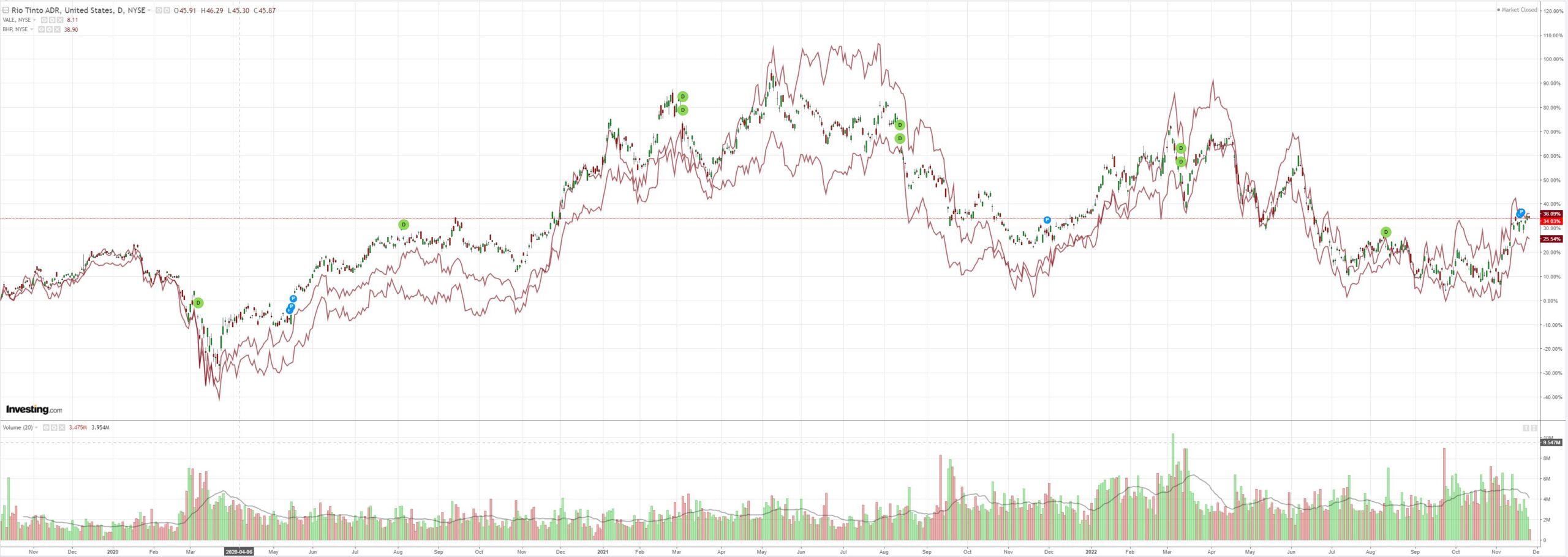

Miners (NYSE:RIO) don’t care:

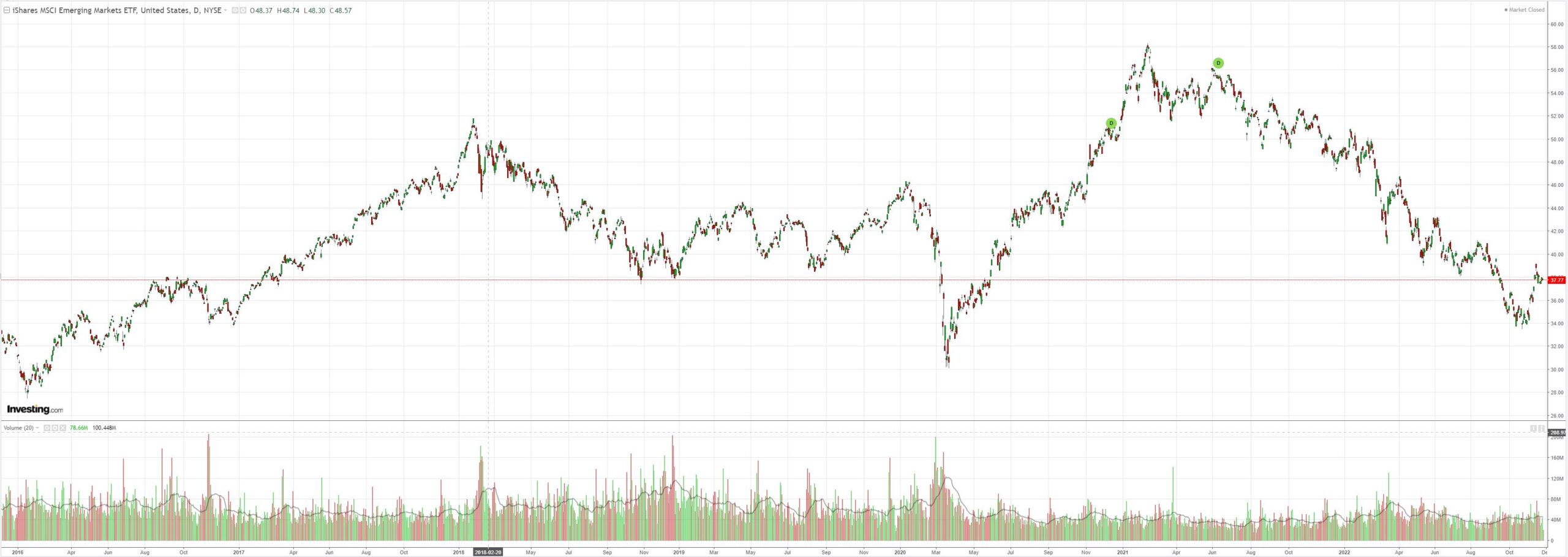

EM stocks (NYSE:EEM) are unconvincing:

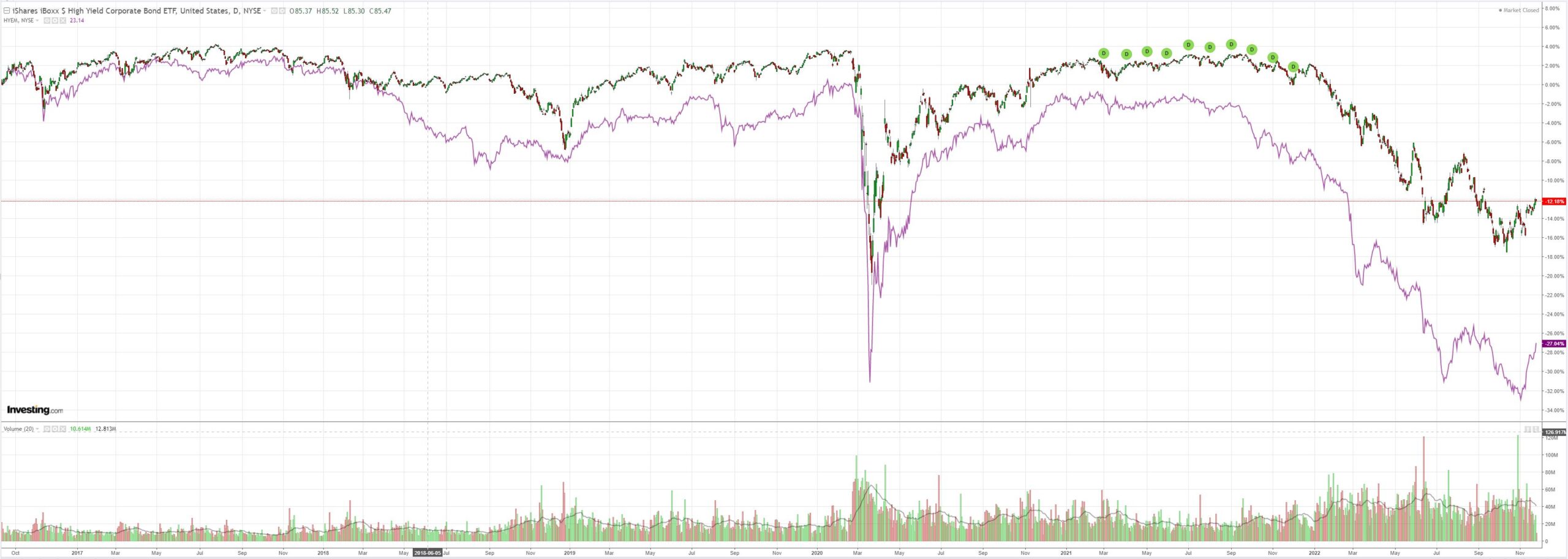

Though EM (NYSE:HYG) is closing in on crucial levels:

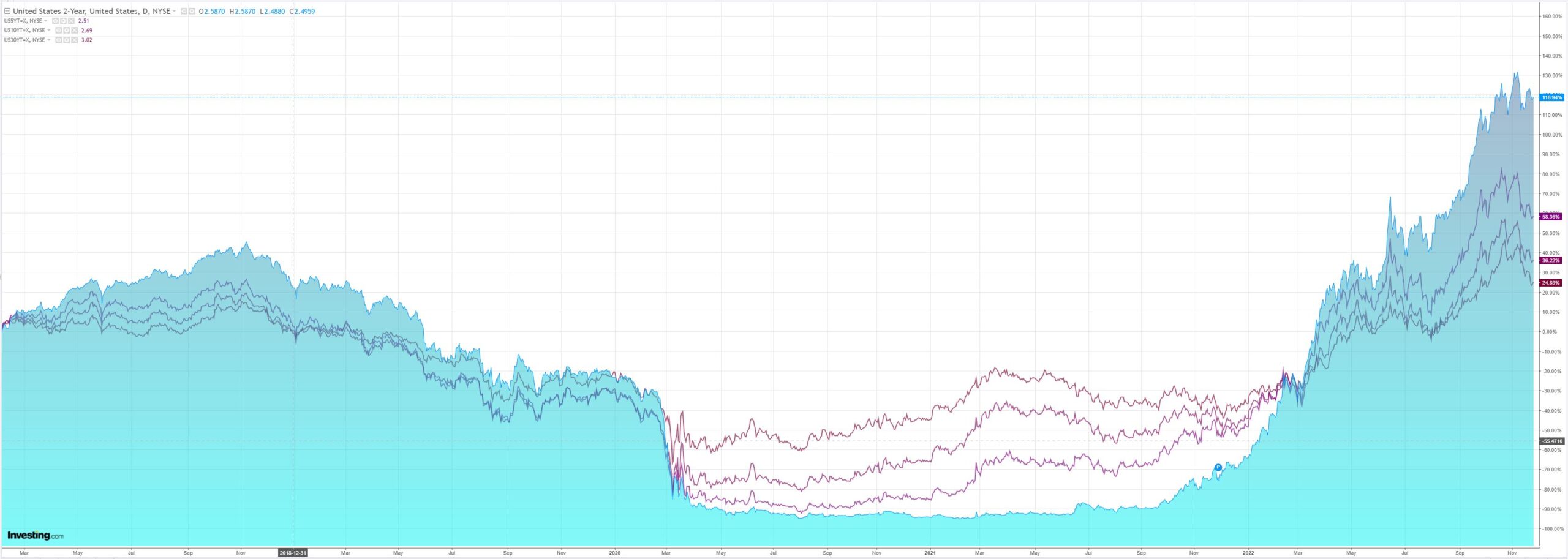

The Treasury curve remains mired in a deep red inversion:

Stocks faded:

The AFR says the AUD is done falling:

Before the Fed’s hint of a slowdown, the US dollar index, which measures the greenback against major currencies, had risen by as much as 18 per cent this year which fed through to prices, especially energy and commodities that are traded in US dollars.

…Analysts predict further gains for the currency. “While a hawkish RBNZ has stoked fresh recession fears, FX markets are sensitive to interest rates and carry, and higher rates here will be a tailwind for the NZD,” ANZ New Zealand chief economist Sharon Zollner says.

“Getting on top of inflation also lessens the need for the nominal exchange rate to trade at a discount to the real exchange rate.”

The local currency’s outlook is not as rosy as the NZ dollar, as China’s COVID-19 outbreaks worsen. The Australian dollar is sensitive to news out of China, Australia’s key export market.

“The recent spike in infections is a real test for Chinese leaders, who have recently signalled a higher degree of tolerance to minimise the economic impact from lockdowns,” says Rodrigo Catril senior FX strategist at NAB. “But its speed may force them to change their mind.”

Maybe. But more likely not. China is locking down harder.

The private sector appears horribly spooked by the virus even as it evades said public lockdowns. In some ways, for good reason. China is not prepared if it rips:

Other jurisdictions are in uproar over lockdowns:

Protests against Covid restrictions spread across China on Sunday as citizens took to the streets and university campuses, venting their anger and frustrations on local officials and the Communist Party.

There was heavy police presence in some areas where huge crowds gathered in Shanghai, after protesters at one of the locations on Saturday called for President Xi Jinping to step down, a level of national dissent unheard of since he took power a decade ago.

Chaos sounds like the worst-case scenario for economic activity going into winter. See oil.

Moreover, the Fed is not done and every tick-up in the bear market rally only increases its terminal rate. On the Bloomberg financial conditions index, the rally has wiped out the equivalent of more than 200bps of Fed hikes. GDPnow is rampaging at 4%!

Yet CorePCE is still glued at 5% annualised:

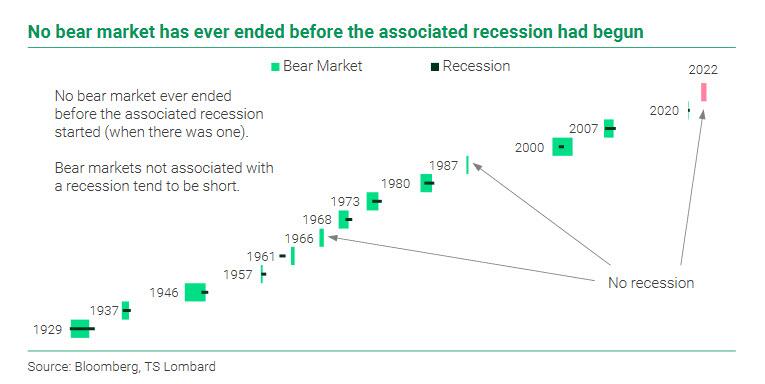

No bear market has ever ended before the recession has begun (unless there isn’t one):

On top of this, the RBA may be slowing, but it has already baked-in an immense mortgage rate hock across 2023. And when I say immense, I mean huge:

The broad second derivative Fed rates rally is built on sand. So, therefore, is the recovery in the AUD.

I don’t know if the Battler has bottomed but the odds favour us going materially lower from here before the market regime shifts.