- Tesla stock is showing signs of strength after losing a third of its value this year

- Tesla is confident that it will meet its target to increase vehicle deliveries by 50% this year

- Tesla's production lead, combined with strong demand, offers a good reason to remain positive on the stock

After losing more than a third of its value this year, shares of Tesla (NASDAQ:TSLA) have begun to show new signs of strength. The world's largest electric carmaker has gained more than 11% during the past two trading days on the back of a better-than-expected Q2 earnings report.

The numbers presented to investors on Jul. 20 indicate that Elon Musk's company has been weathering global supply chain disruptions, higher material costs, and COVID-related disruptions in China much better than its peers.

Tesla posted adjusted earnings of $2.27 a share, against analysts' estimates of $1.86 a share average. Tesla's total revenue rose 42% from a year ago to $16.9 billion, meeting analysts' average estimate.

Ahead of the earnings report, the Austin, Texas-based company reported delivering 254,695 vehicles worldwide in the quarter, up 27% from a year ago but down from its first-quarter record of 310,048. The main reason for the quarter-on-quarter drop is lingering COVID restrictions in China--which led to the temporary shutdown of the company's factory in Shangai.

However, for the second half of the year, Tesla is confident it will meet its target of increasing vehicle deliveries by 50%, taking the total production to 1.5 million vehicles. Tesla had made about 564,000 through the first half.

There is no doubt that a 50% growth target is aggressive in the current uncertain economic environment, and it creates a downside risk for the stock if the company fails to deliver on this front. Nonetheless, Tesla has consistently shown during the pandemic that it can maintain robust deliveries despite facing a hostile macroeconomic environment.

Priced For Perfection

Tesla's production expectations, along with solid global demand for its vehicles, offer a good reason to remain positive on Tesla stock. In a note today, Argus reiterates Tesla as a buy, saying it sees robust revenue growth for the rest of 2022.

"We expect Tesla to report strong revenue and higher automotive gross margins over the remainder of the year, setting the stage for further earnings growth."

Baird analyst Ben Kallo said in a note that he is confident that the EV maker will meet its target of record deliveries during the year's second half. He argues that Berlin and Austin factories should keep running strong, with production from Fremont and Shanghai returning to full steam.

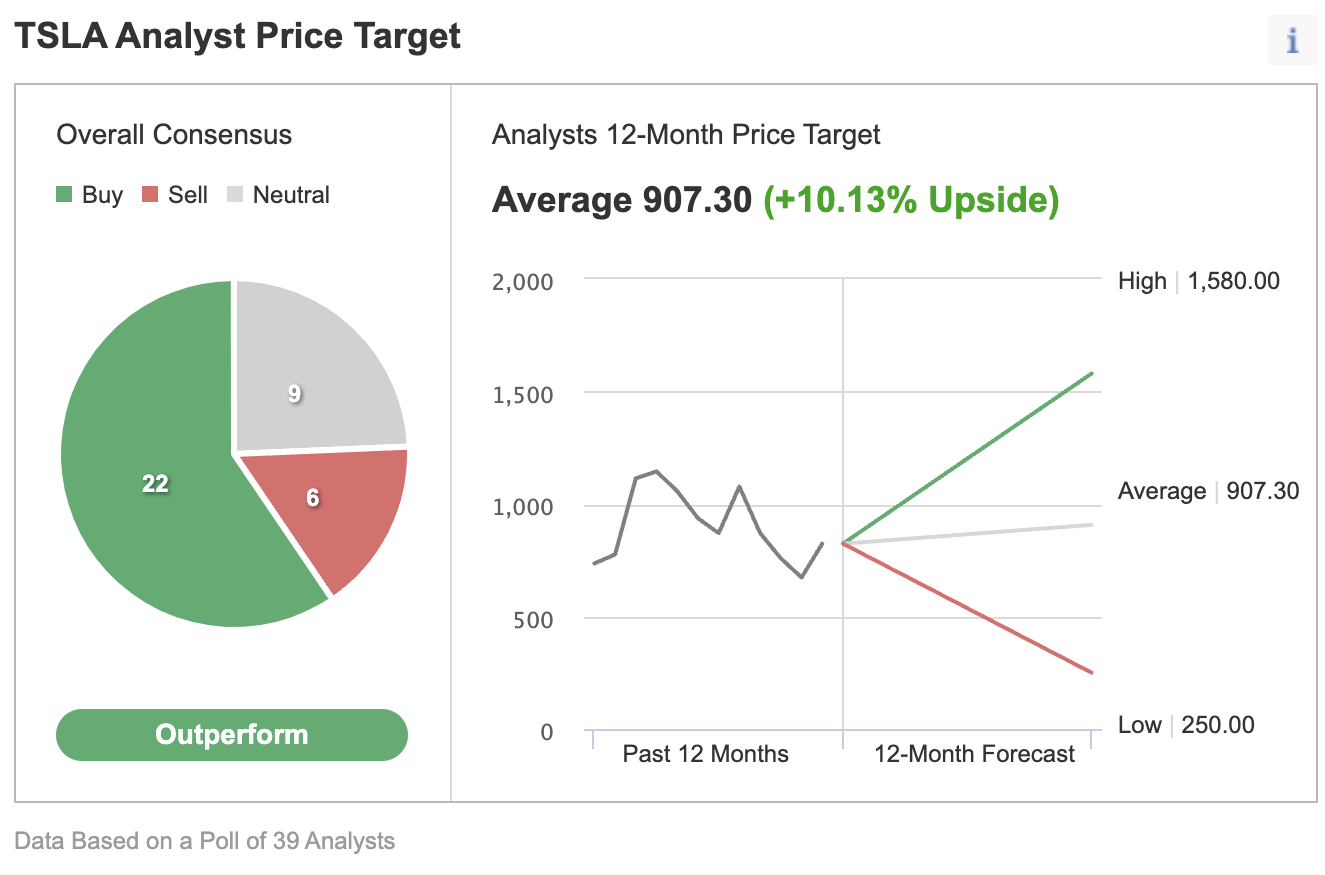

Most analysts maintain an outperform rating on Tesla stock in an Investing.com poll. Their average price target, however, does not show a significant upside potential in the near term.

Source: Investing.com

In my view, Tesla's already rich valuation and the looming recession are the two main factors holding back the share price.

Even after a major correction this year, Tesla stock still trades at a price-to-earnings multiple of about 100, while the S&P 500 trades at more than 18 times earnings. The world's largest carmaker in terms of sales, Toyota Motor (NYSE:TM), trades at a P/E multiple of 10.8.

Bank of America's analyst John Murphy sees Tesla stock remaining in a holding pattern near term with a $950 a share price target. His note says:

"Despite the relatively good 2Q:22 performance, we have trepidation that TSLA stock may already be priced for perfection (or at least priced for hyperbolic growth), such that near-term earnings beats may be insufficient to get bulls incrementally positive."

Beyond production challenges, Tesla is vulnerable to the risk of demand compression if the global economy spirals into a recession in the next 12 months. Furthermore, the company's CEO, Elon Musk, faces an upcoming legal battle with shareholders of Twitter (NYSE:TWTR).

On the bright side, the EV maker has reportedly sold 75% of its Bitcoin holdings, improving its overall liquidity amid an uncertain market.

Bottom Line

Tesla's latest earnings report provides a solid reason to remain optimistic about the company's outlook. That said, its stock may not have much upside from here, given its rich valuation and the possible recession, which could hurt demand for big-ticket items.

Disclosure: The writer doesn't own shares of Tesla.

***

Looking to get up to speed on your next idea? With InvestingPro+ you can find

- Any company’s financials for the last 10 years

- Financial health scores for profitability, growth, and more

- A fair value calculated from dozens of financial models

- Quick comparison to the company’s peers

- Fundamental and performance charts

And a lot more. Get all the key data fast so you can make an informed decision, with InvestingPro+. Learn More »