by Tanzeel Akhtar

As governments across the world, including in China, South Korea, Singapore, Hong Kong and the US, crack down on initial coin offerings (ICOs), should we expect to see a drop in the number of companies looking to raise capital via this route? So far in 2017, ICOs have raised over $3 billion.

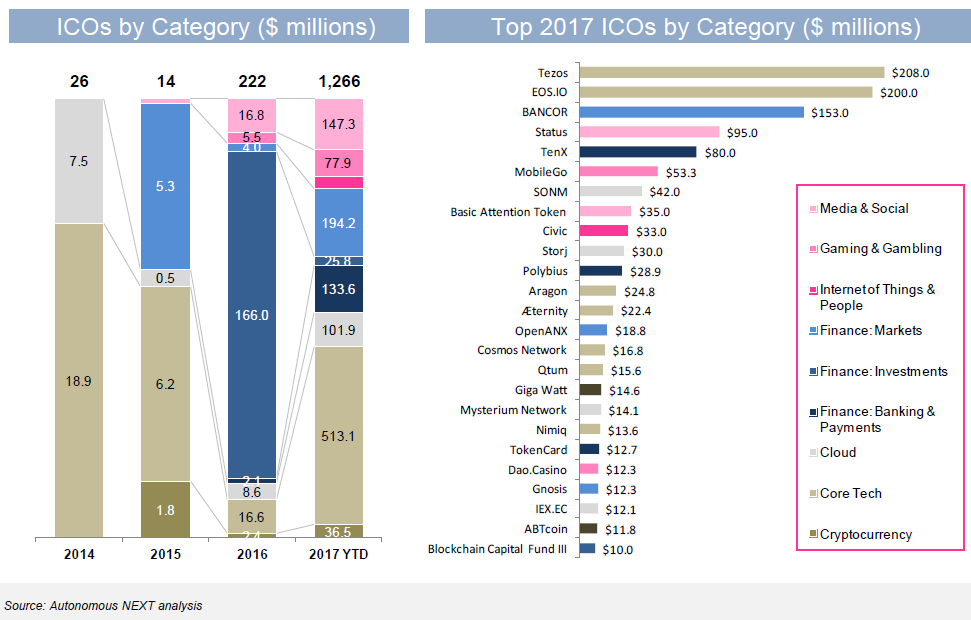

According to Autonomous Next, in the first half of 2017 alone, over $1.2 billion was raised through initial coin offerings, "far outstripping venture capital investment into Blockchain and Bitcoin firms."

For those unfamiliar with the term ICO, it's a digital stock certificate, similar to an initial public offering (IPO) but the crypto version. Essentially, an ICO is a way for a cryptocurrency businesses to raise funds without being hampered by the numerous and cumbersome steps surrounding a stock offering, which involve lawyers, venture capitalists and investment banks. As such, ICOs are an unregulated means by which funds can be quickly raised for a new cryptocurrency venture.

Recently, too, high profile celebrities such as boxing champion Floyd Mayweather, rapper Ghostface Killah and socialite and media personality Paris Hilton have all endorsed ICOs. The Securities and Exchange Commission (SEC) has warned celebrities to disclose paid endorsements of ICOs they've promoted.

At the beginning of November, the SEC warned:

“Celebrities who endorse an investment often do not have sufficient expertise to ensure that the investment is appropriate and in compliance with federal securities laws. Conduct research before making investments, including in ICOs. If you are relying on a particular endorsement or recommendation, learn more regarding the relationship between the promoter and the company and consider whether the recommendation is truly independent or a paid promotion. For more information, see an Investor Alert that the SEC’s Office of Investor Education and Advocacy issued today regarding celebrity endorsements.”

Trace Schmeltz, a partner in the Chicago and Washington, D.C. offices of Barnes & Thornburg LLP, believes the SEC scrutiny into the ICO market is good for investors, although it will certainly slow the pace of tokenized fundraising.

According to Schmeltz, ICOs have became increasingly popular because they appeared to hold the promise of easy access to capital, in exchange for a virtual token with some desirable function. He highlights for example, Playkey, an online gaming company. The company is presently raising money by selling tokens that will allow holders to access high powered computer systems for gaming.

But much like stocks, getting in at the initial coin offering isn't always a guarantee of asset appreciation. Schmeltz warned:

“The tokens from these offerings can appreciate in value either because they are limited in number or because they are tied to the growth of the issuer’s enterprise. The Securities and Exchange Commission has deemed the latter kind of token to be a security. Accordingly, any entity seeking to offer tokens reflecting the value of the enterprise needs to follow the listing requirements under the Securities Exchange Act of 1934.”

The expense and effort involved in this fundraising process has slowed within the ICO market, says Schmeltz. “In our firm, entities seeking to conduct initial coin offerings often drop the idea once confronted with the time, expense and effort it will take to meet the Exchange Act’s requirements. The retrenchment in the ICO market is likely a good thing, however.”

Case Study: Tezos ICO

One now notorious case involves the cryptocurrency Tezos, the technology project that raised $232 million via an ICO in July. It was considered a mammoth and successful offering at the time, but the company has since been discredited, and a class-action lawsuit has been filed against its organizers, alleging that it violated US securities laws while also misleading investors about the company. Reuters, citing a lawsuit filed on October 25 in California Superior Court, San Francisco, argued that the people behind Tezos violated U.S. securities laws and defrauded investors because no digital coins have yet been issued and "participants were told they were making a donation and may never receive any."

Schmeltz explains:

“Tezos’ recent initial coin offering, for example, was not registered under the Exchange Act and raised approximately $230 million in US dollars. The offerers reportedly consider each investor to have made a “non-refundable donation,” rather than an investment. Now, there are rumors that the Tezos project is stalled by infighting and that reports of the adoption of its blockchain technology are greatly exaggerated. If the project fails, the investors may have a difficult time pursuing recovery from the offerers.”

Additional major concerns regarding ICOs?

There are a number of key red flags Schmeltz points to:

“To begin with, startup companies may lack the type of controls and corporate governance needed to ensure that money is used for business purposes. Some have nothing more than a good initial idea, without the needed follow through to execute on that idea. As a result, fundraising by such companies without the disclosures required under, or the protections provided by, the Exchange Act can leave investors open to significant losses.”

“The strictures of the Exchange Act are intended to protect investors. The disclosures required by the Act provide critical business information needed to make an intelligent investment decision. Furthermore, the Act requires that offerers avoid materially false statements while raising money—including exaggerations of product adoption or technological success.”

Not everyone believes increased regulation and governmental crackdowns are hampering the ICO marketplace. Sol Lederer, Blockchain Director of LOOMIA, a technology company currently focused right on textile innovation, says that according to icoalert.com there are now more ICOs than ever. He makes the point though that there 5-10 per day but that funding expectations have changed:

“However, the combined amount being raised is less than it ever was. The quantity of ICOs may be negatively impacting investor enthusiasm since they now have a harder time picking winners. The main reason, however, for the lack of enthusiasm is that the price of ether has leveled out, so there are no profits to redistribute into ICOs. When ether sees another run-up, there will once again be large investments into ICOs."

Cancerous Growth?

One critic compares the uncontrolled growth of ICOs to the spread of cancer. Shidan Gouran, president of Global Blockchain Technologies, an investment firm providing clients with access to a basket of holdings within the blockchain space, says that's the name for an uncontrolled growth without checks and balances. He's negative on the current situation but believes things will improve as the regulatory environment strengthens:

“My optimism is for the long term, and we need some control in this space to prevent fraud and maintain the community's confidence, which is why I welcome regulatory oversight. It will slow down the pace of growth but is necessary if the technology is to maintain its usefulness and potential of turning strong social networks — and by that I mean any strong network of users — into efficient and autonomous markets. Those digital assets will be survivors. So far, most Western and Eastern regulators have been very reasonable on their stances, and I'm as optimistic as ever. Good regulatory initiatives will survive and bad ones that don't benefit their respective constituents will not.”

As global lawmakers move in on the Digital Wild West and introduce more carefully thought out checks and balances, the number of ICOs may drop, at least at first, but if future offerings are successful and investors satisfied, the growth horizon will no doubt expand accordingly.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI