The April update on US consumer inflation was widely reported as delivering another round of encouraging news. But a closer look at a broader set of inflation metrics suggests that further progress on disinflation could take longer than expected.

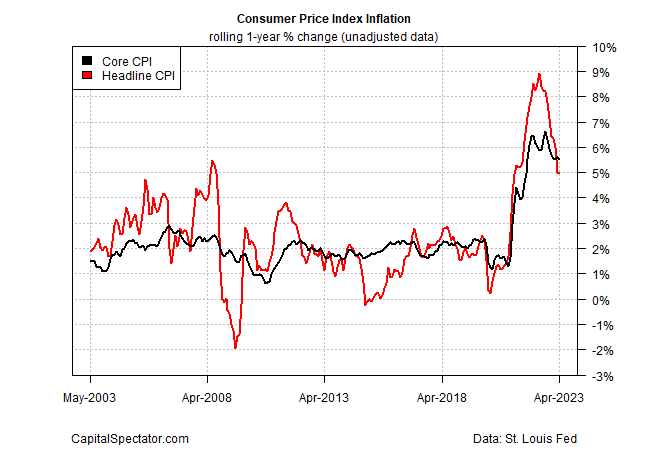

Let’s start with the good news. Consumer prices at the headline level slipped below 5% on a year-over-year basis for the first time in almost two years. CPI’s annual pace eased to 4.9% in April, down slightly from 5.0% in March and far below the recent peak of nearly 9%.

The April data “suggests that the Fed’s campaign to quell inflation is working, albeit more slowly than they would like,” says Quincy Krosby, chief global strategist at LPL Financial.

But some analysts remain cautious about the outlook.

“Inflation is still sticky; I don’t think that the Fed is going to look at this and cut rates, or heave an especially big sigh of relief,”

Opines Priya Misra, head of global rates research at TD Securities. “We can’t draw the conclusion that the inflation problem is over.”

The case for reserving judgment on how fast and how far inflation eases in the months ahead is supported by looking at a wider range of price indexes. One way to track a more robust measure of pricing pressure is by monitoring several alternative inflation metrics published by regional Fed banks. On that basis, the disinflation trend of late has stalled.

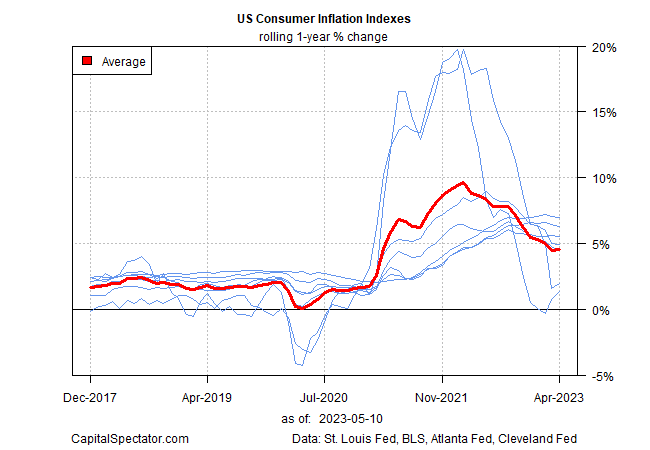

The chart below tracks the year-over-year change in seven inflation benchmarks. In addition to the standard headline and core CPI estimates of inflation, I’ve added:

- Sticky price core CPI

- Sticky price core CPI ex-shelter

- Median CPI

- Flexible CPI

- Flexible core CPI

The five alternative metrics are designed and published by the Atlanta and Cleveland Fed banks. Each offers a different set of pros and cons vs. the standard CPI data. Monitoring all seven indexes by way of the average offers a clearer measure of the inflation trend. On that score, there’s reason for concern because the average was flat in April for the first time since August.

The next chart shows how the one-year trend evolves month to month – the bias. As you can see, the downside bias has faded as the overall change for the seven indexes was flat last month.

It’s unclear if the zero bias in April is a temporary pause in an ongoing run of disinflation or a warning that inflation will prove to be more persistent going forward. The next several months will likely provide the answer. Meanwhile, it’s premature to conclude that the inflation battle has been won and that the Fed can declare victory.

Nonetheless, the Fed funds futures market is pricing in high odds that the Federal Reserve will pause its rate hikes at the next FOMC meeting on June 14.

But Federal Reserve Governor Michelle Bowman cautions that the path ahead for monetary policy is still uncertain.

“I will look for signs of consistent evidence that inflation is on a downward path when considering future rate increases and at what point we will have achieved a sufficiently restrictive stance for the policy rate,” she advised in a speech earlier today.

“Inflation remains much too high, and measures of core inflation have remained persistently elevated, with declining unemployment and ongoing wage growth,” Bowman noted. “I expect that our policy rate will need to remain sufficiently restrictive for some time to bring inflation down and create conditions that will support a sustainably strong labor market.”