- Coinbase is in a solid position to weather a bear market on the back of its balance-sheet strength

- The exchange is trying to diversify its business and reduce its reliance on trading revenue

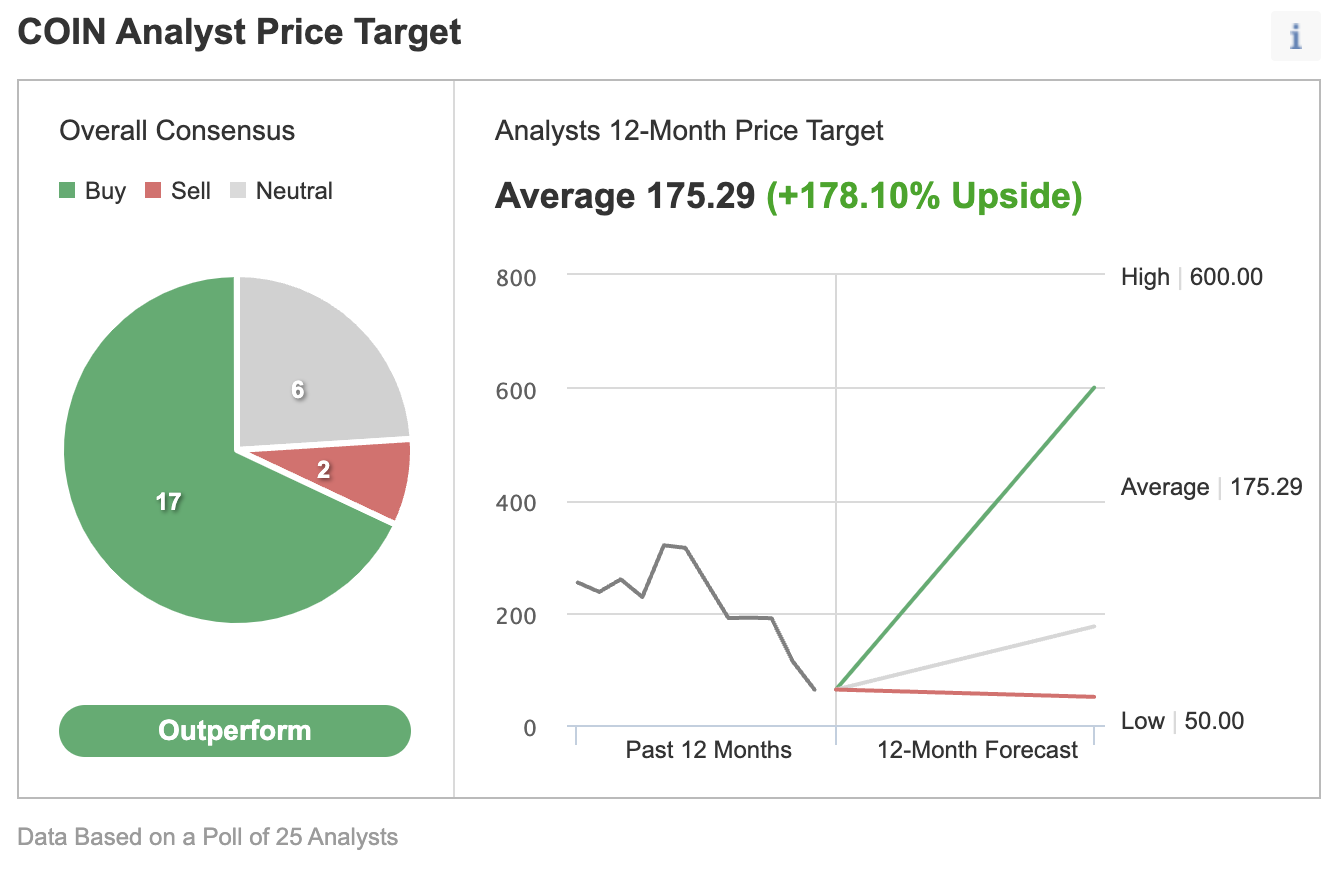

- The majority of analysts rate COIN as a buy

-

If you’re interested in upgrading your search for new investing ideas, check out InvestingPro+

Coinbase Global (NASDAQ:COIN) has been on a slippery slope this year. Shares of the largest cryptocurrency exchange in the US have lost more than 80% of their value since hitting a record high in November amid a widespread sell-off in crypto coins and other speculative assets. COIN closed Wednesday at $63.03.

After this sharp decline, investors wonder if this is the right time to start building exposure in the first major cryptocurrency-focused company to go public. Coinbase’s latest earnings report offers some clues.

Last week, the San Francisco-based company reported earnings that missed analysts’ forecast as trading volume declined. First-quarter revenue dropped 27% to $1.17 billion, while the company also reported a net loss of $430 million.

Coinbase’s results reflect the general sentiment in the crypto market. Since its all-time high in November, Bitcoin is down more than 50%, pushing many retail traders to stay on the sidelines. Coinbase earns the bulk of its revenue from trading fees.

The sell-off in crypto assets accelerated this month after the collapse of TerraUSD and its sister token LUNA, which sent a ripple effect across the industry.

Nonetheless, in a letter to investors, Coinbase said it is in a solid position to weather a bear market on the back of its balance-sheet strength. During a prolonged bear market, the company will continue to aim to manage its full-year potential adjusted EBITDA losses to about $500 million.

The letter added:

“We believe these market conditions are not permanent, and we remain focused on the long-term.”

Furthermore, the company also told investors it focuses on the next generation of crypto opportunities beyond trading.

Trading At A Distress Level

However, this positive outlook by the management doesn’t hide the fact that there may be more pain ahead. COIN announced yesterday that it would slow hiring and reevaluate its headcount, reversing earlier plans to triple its workforce in 2022.

For some analysts, COIN’s 80% plunge shows that the market is already pricing in a prolonged weak trading environment, and the stock is offering a buying opportunity.

These sentiments are also reflected in an Investing.com poll of analysts in which the majority of forecasters recommend buying the stock. Their consensus price target implies about 178% upside potential for the next 12 months.

Source: Investing.com

In a recent note, Oppenheimer’s Owen Lau said that the market has gone too bearish on Coinbase, which appears to be trading at a distress level.

He added that the company’s fundamentals remain substantial and long-term crypto adoption remains intact, providing an attractive entry point for long-term investors.

Lau rates COIN shares an Outperform, with a 12-month price target of $197.

Bank of America, in a note this week, also reiterated Coinbase as a buy, saying it’s sticking with the stock after its latest earnings report. Its note said:

“We continue to think COIN remains well-positioned to roll out new products that will generate top-line growth and diversify revenues.”

Coinbase is trying to diversify its business and reduce its reliance on trading revenue which are likely to remain volatile. According to a report in Bloomberg, its staking product that allows users to put their coins into special yield-earning accounts is gaining traction.

Coinbase has also been working on launching crypto derivatives. This month, it opened its new marketplace for nonfungible tokens (NFTS)—essentially, digital art connected to blockchain—to all users.

Bottom Line

COIN’s dramatic plunge this year has opened a window for investors to take a position in the largest crypto exchange in the US. That said, COIN isn’t a stock that suits investors with a short-term horizon due to the market’s highly volatile nature.

As crypto-assets take a plunge in the current market rout, COIN will continue to face the impact on its trading volumes, shedding its earnings by extension.

Looking to get up to speed on your next idea? With InvestingPro+ you can find

- Any company’s financials for the last 10 years

- Financial health scores for profitability, growth, and more

- A fair value calculated from dozens of financial models

- Quick comparison to the company’s peers

- Fundamental and performance charts

And a lot more. Get all the key data fast so you can make an informed decision, with InvestingPro+. Learn More »