As crude oil and other commodity prices have rallied over the past few weeks, some analysts have pointed to a new, resurgent age in commodity demand out of China. However, the recent rally hides the current supply-side rebalancing that is occurring within the Asian powerhouse.

October has been a watershed month for commodity markets as the weaker US economic data, along with supply cuts to metals, have provided some buoyancy to depressed prices. In particular, crude oil (WTI) has fought its way out from a tight range to rally to nearly $50.00 a barrel. The metals markets were also relatively upbeat with both gold and silver experiencing rallies. However, the negative fundamentals which led us to where we are today are still present within the global markets.

Despite the short term bullish trends, an oversupply is still the key fundamental aspect in the long term. Production capacity across a range of commodity markets has been increasing for well over a decade due to growing demand from emerging markets (EM). Rising commodity prices meant a growing incentive for increased production capacity and innovation within many of the operations. This phase of capacity build-up has effectively led us to where we are today, a fundamental over-supply, and significantly depressed prices.

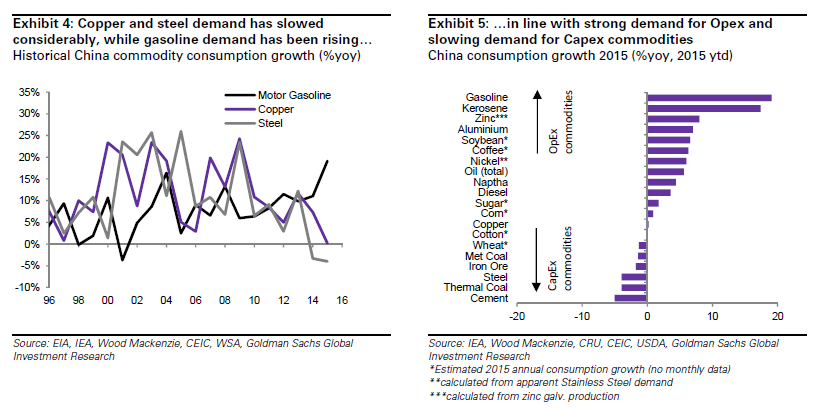

There is a view that the decline in commodity prices that has occurred since 2014 was primarily caused by macroeconomic factors, including deflation in input costs and the US dollar. However, this argument seems to avoid any mention of China and the ongoing rebalancing that is occurring between CAPEX and OPEX.

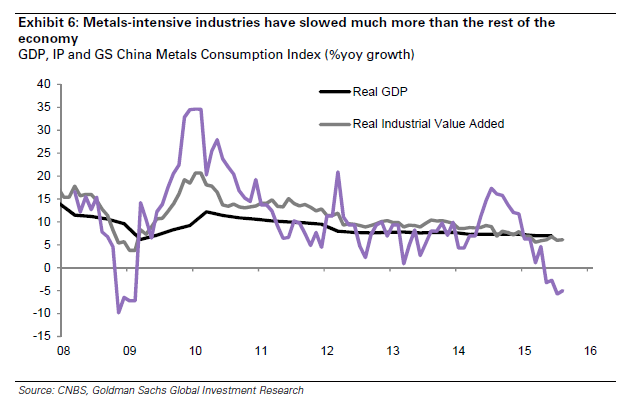

As China’s markets mature, there are some key indicators that investment is moving away from CAPEX industries (Steel, Cement, Iron et.al) towards OPEX-based industries (Energy, Aluminium, and consumption based commodities). Historically, China has reached a point where their level of income and growth supports a structural move away from industries requiring significant capital expenditure. This structural change is not at all unexpected, and has been bandied about by analysts for some years, but the reality of the change is yet to become fully apparent to market participants.

The rebalancing of commodity demand within China is likely to pose some challenges for those within the metals industry as it becomes clear that “peak metals demand” might actually now be behind us. China has also recently come some way in developing a level of independence within their domestic metals industry, especially towards nickel pig iron. This level of independence is starting to subsequently impact demand for commodity imports.

The question remains as to which country will fill the Asian powerhouse’s void and step up to become the next “China” within the EM. India certainly has the underlying growth and population to support the strong demand for capex and the requisite building of productive capacity. As likely a candidate as India is, it will have to remain to be seen which country is to fill the exceedingly large shoes that China will leave behind.