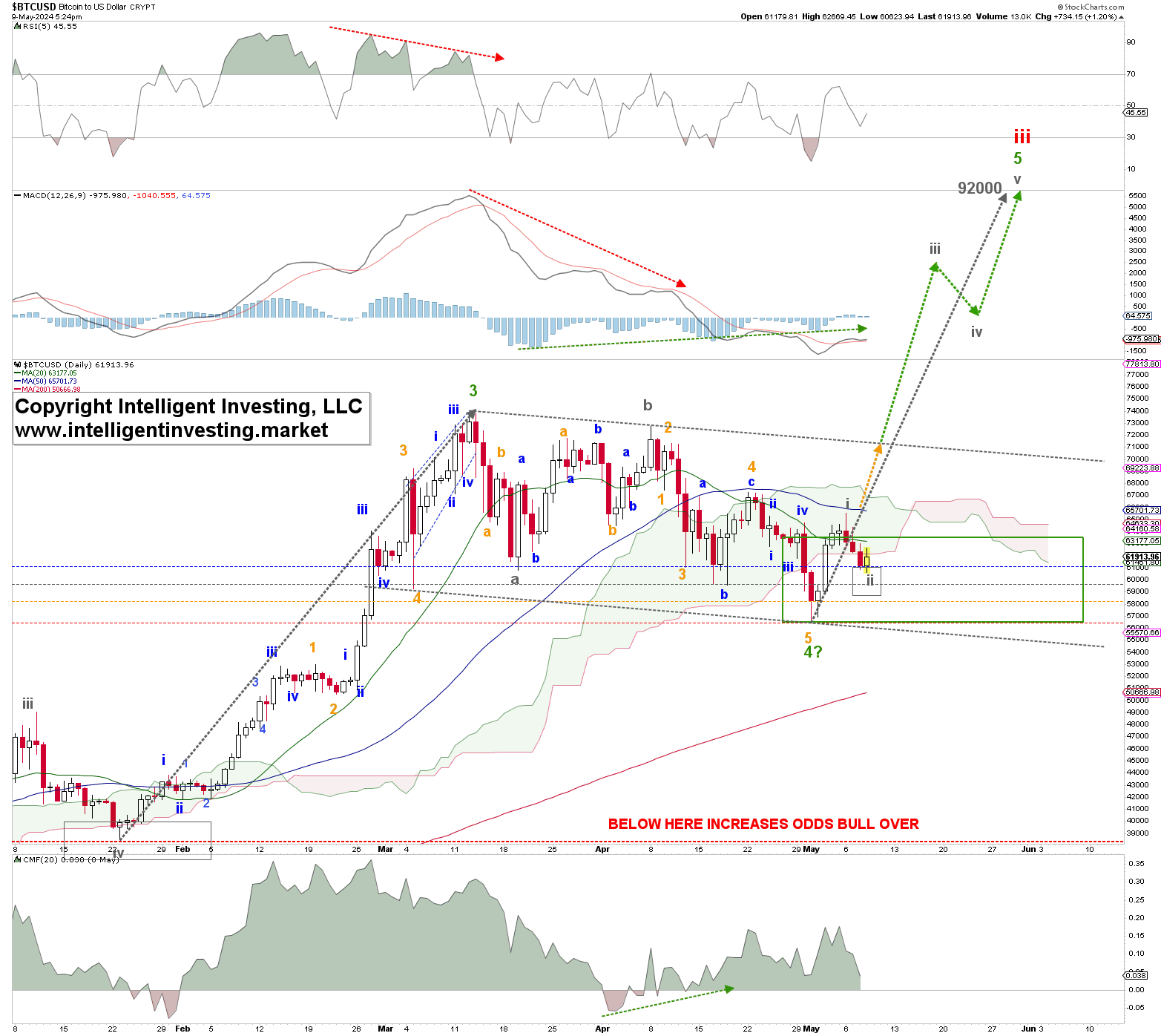

Three weeks ago, we showed Bitcoin (BTCUSD) was forming a Bull flag, and based on our Elliott Wave Principle (EWP) analyses, we found that,

“…BTCUSD should now be wrapping up the final (orange) 5th wave to ideally $60-62K, possibly as low as $56-59K. See the orange and grey target zone boxes in Figure 1 above.”

Fast-forward and BTCUSD bottomed out on May 1 at $56516 after forming a complex smaller degree (orange) W-4, which we, unfortunately, didn’t foresee. See Figure 1 below. However, Bitcoin bottomed right inside the lower range and right at the lower edge of the green W-4 target zone, a classic 38.20% retracement of the entire green W-3.

Since that low, BTCUSD has staged what counts best as a five-wave rally (grey W-i), and today, it bottomed right inside the ideal grey W-ii target zone of $60+/1.5K. Thus, contingent on holding above the colored warning levels shown in Figure 1, with each lower level increasing the odds the green W-4 low is not in, we can start to look for the grey W-iii. However, it will require at least a break back above the 20-day Simple Moving Average (20d SMA) followed by a daily close above the blue 50d SMA to be more certain the low is in place.

In that case, Bitcoin can then attack the upper descending grey trend line of the potential Bull-flag pattern that is still in play. A break above that trendline will seal the deal in favor of the Bulls, and we should then ideally look for ~$92K (the Bull flag pattern’s target).

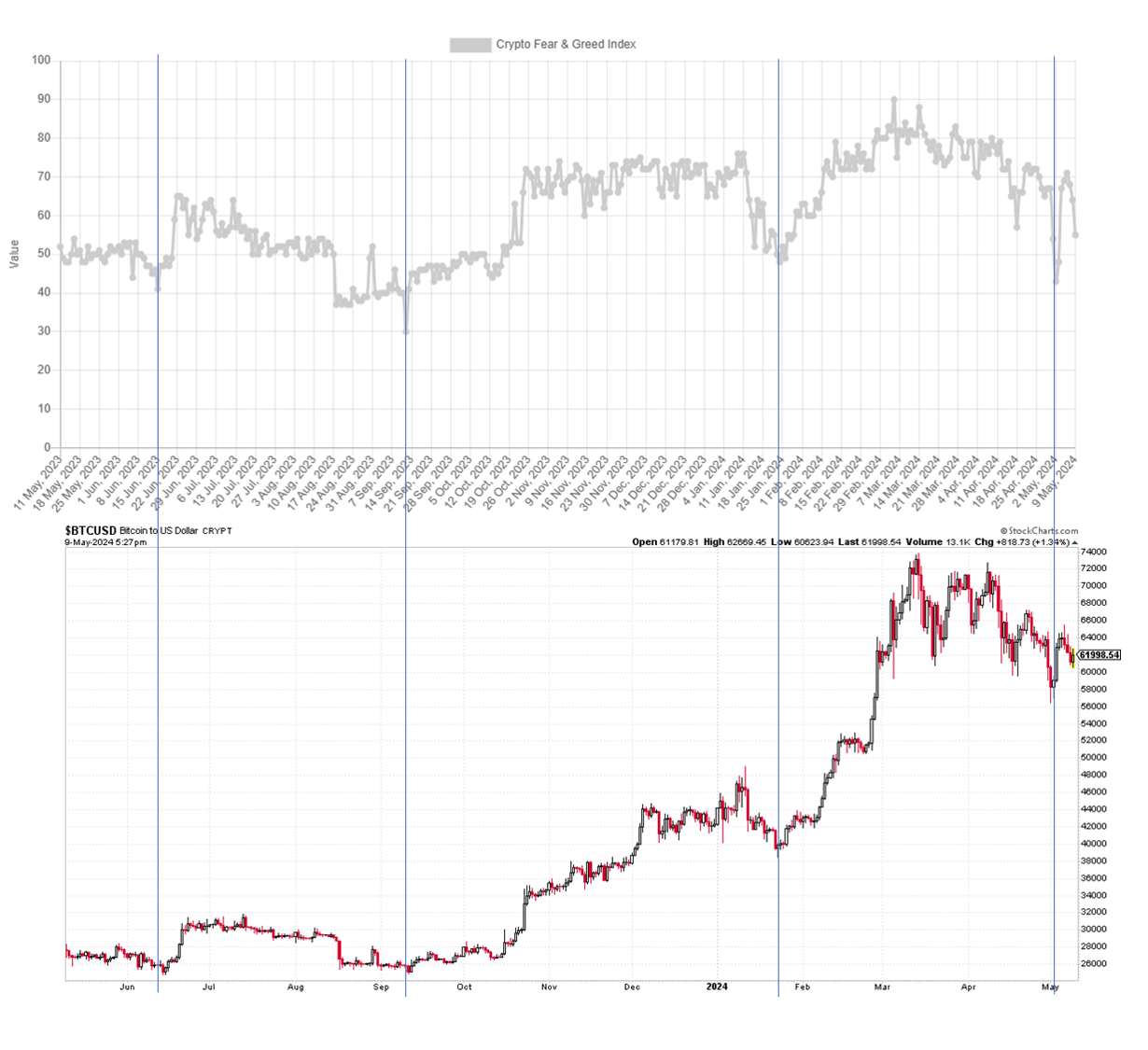

Another piece of evidence that an important low was struck in early May can be found when we overlay the Crypto Fear & Greed Index with Bitcoin’s price chart for the last year. See Figure 2 below.

Figure 2 shows that the June and September lows in 2023 coincided with below-average readings. In addition, the January low also saw below-average sentiment. The May 2 Fear & Greed reading of 42 matches prior Bearish sentiment at important recent price lows.

Thus, although we remain bullish over the long term for BTCUSD and expect it to reach $105-140K, the Bulls have their work cut out for them. They must show they mean business by at least providing a rally back above the 50d SMA. Because in the end, the Bull flag pattern is still only potential, albeit highly likely, and sentiment, albeit relatively Bearish on May 2, can always become more Bearish.