DXY rebounded strongly last night:

CNY managed a tiny bounce yesterday:

So AUD held on:

Oil surged:

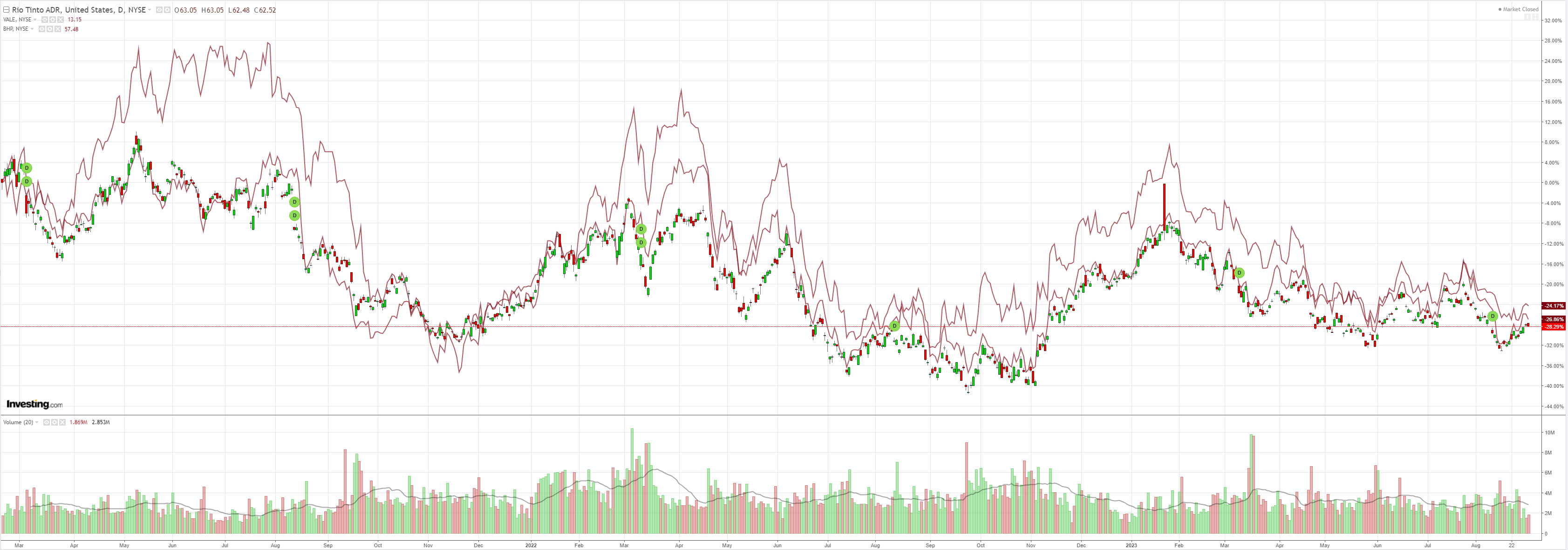

Dirt fell:

Miners rolled:

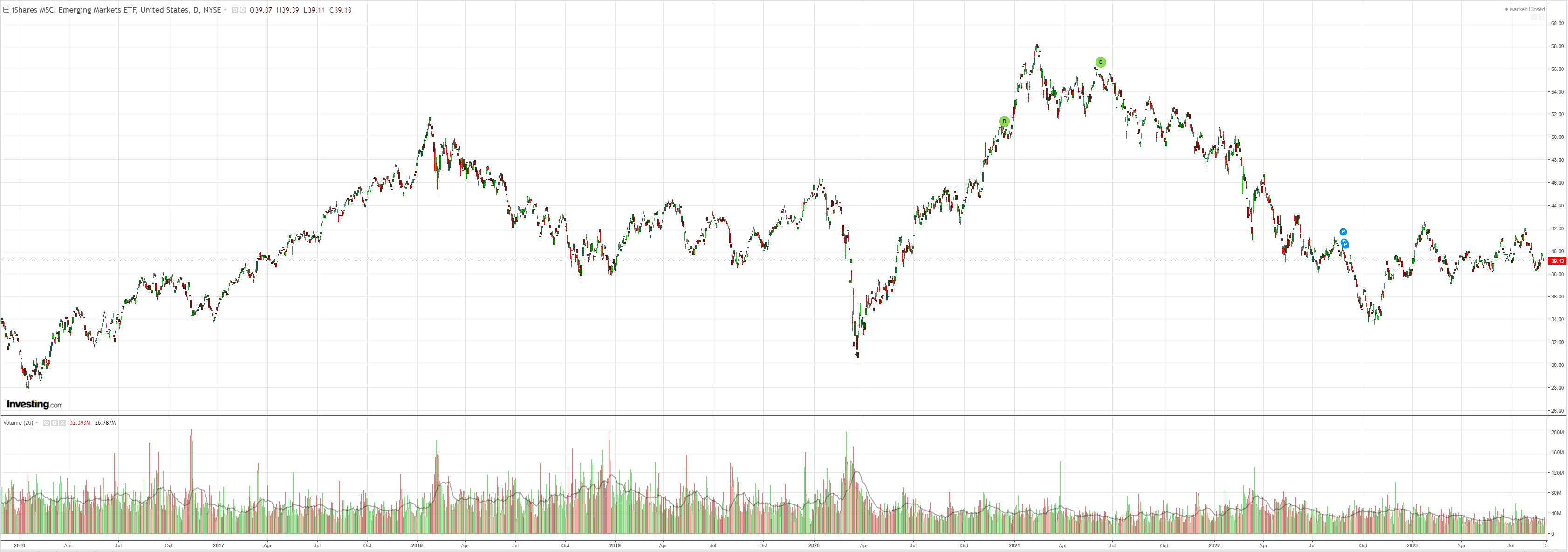

EM doomed:

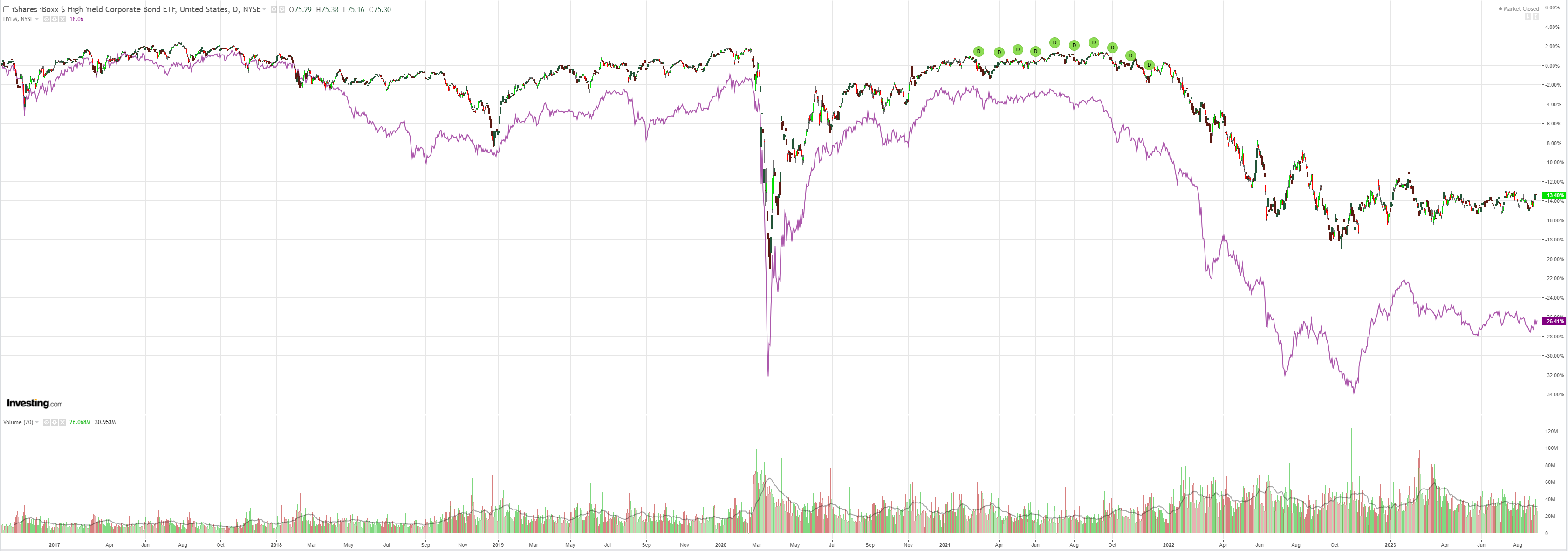

Junk blah:

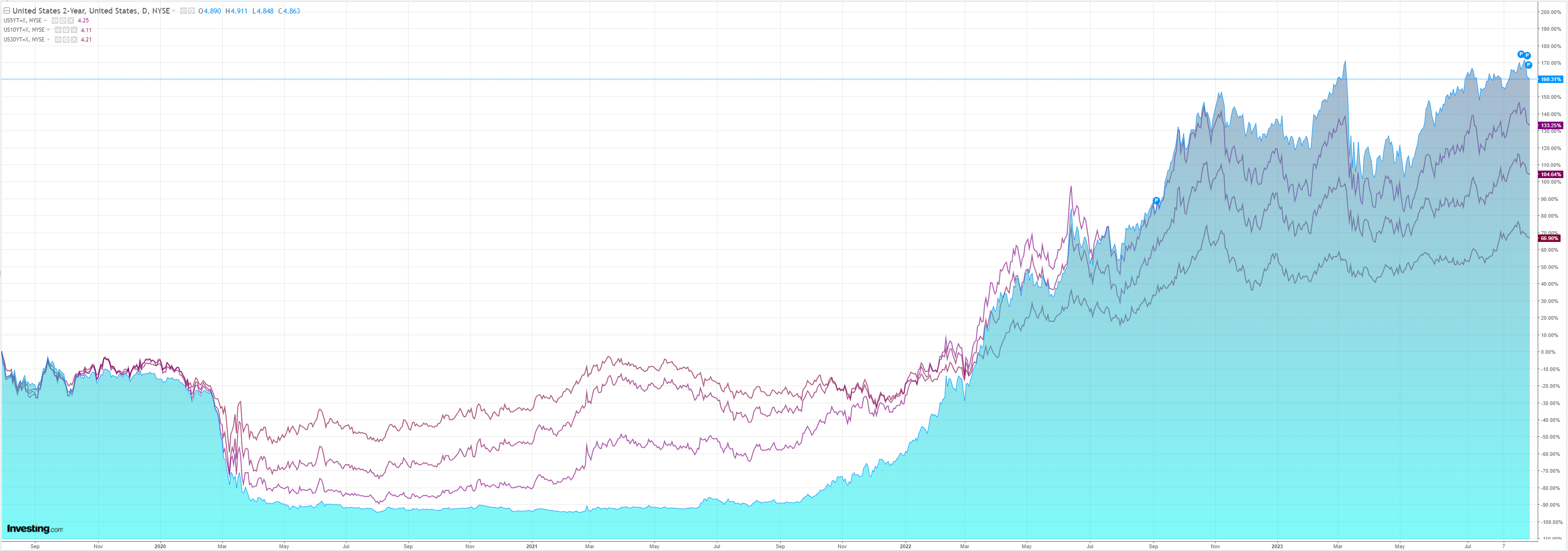

Yields fell:

Stocks stalled:

As we await NFP, Credit Suisse (SIX:CSGN) has a note worth considering:

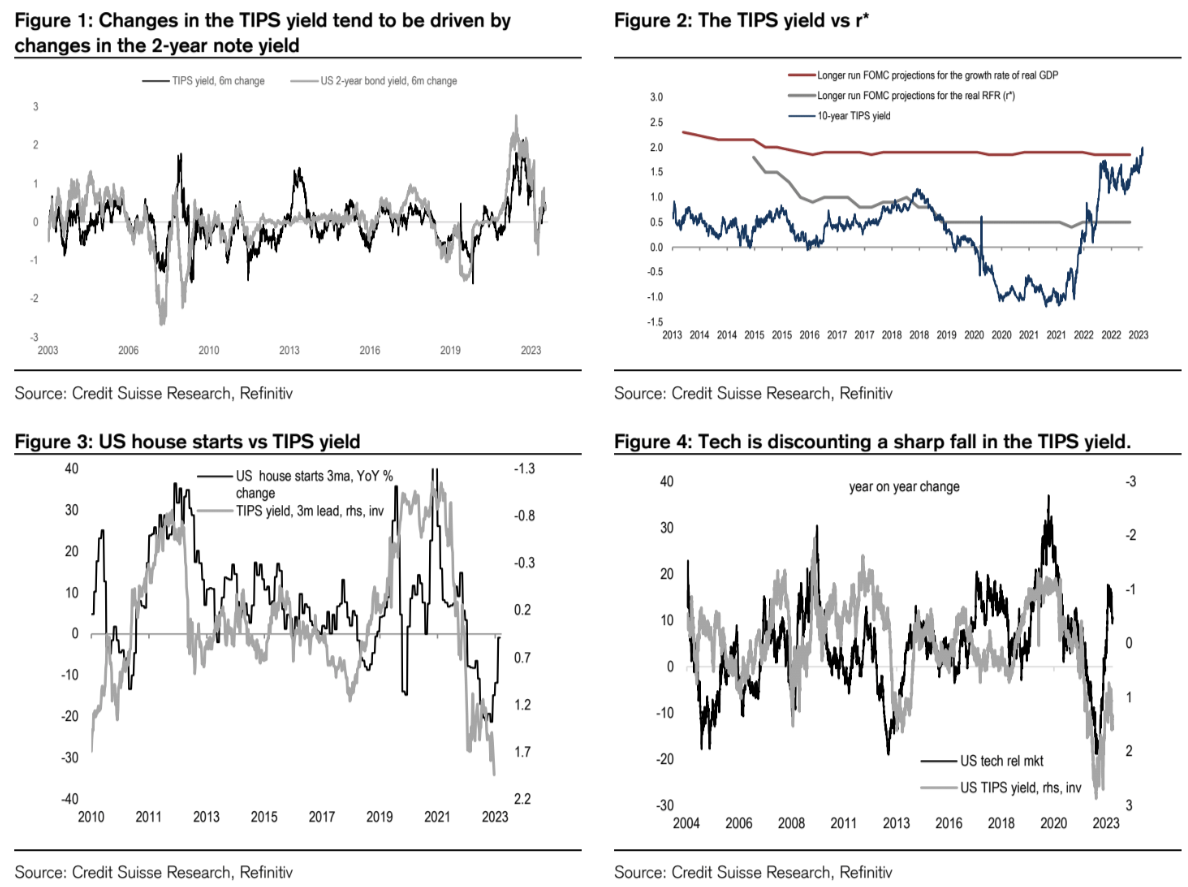

We think 10-year US real bond yields are close to a peak and can fall to c1% (from 1.9%) because: i) Changes in real bond yields tend to be driven by changes in the 2-year note yield. Our model shows that the 2-year note yield is now appropriately tight. ii) Economic momentum has peaked. Composite PMI new orders (which we think are the appropriate PMI measure) imply c0% GDP growth in Europe and c0.5% GDP growth in the US over the next one to two quarters.iii) Inflation uncertainty remains high, and that is ordinarily associated with lower real yields. iv) The current 10-year TIPS is nearly 1.3% above the Fed’s estimate of neutral real short rates (which is 50bp). If the term structure in the TIPS market is the same as the conventional bond market, then TIPS should fall by c1%. v)The bottom-up pull: Japan continues to buy cY1.3trn JGB a week and the weakness in European data has pushed 2-year Bund yields to their lowest levels since early June (3%). vi)Fiscal fundamentals: Government debt arithmetic will not allow real yields to get too far above trend real GDP growth. Otherwise, we get a government debt crisis requiring coordinated central bank intervention to push real yields lower.

Implications: Normally a fall in the TIPS yield is good for economic growth, growth stocks and equities, but this time around this appears to be more than discounted.

o GDP growth: Normally1% off the TIPS yield adds c20% to housing starts,but housing starts are at a level that seems to be discounting nearly a 1% fall in the TIPS yield.

o Equities:In the past decade, a fall in TIPS has been good for equities but even with a fall in TIPS to c1%, the fair value P/E would be 17x. Moreover, our ERP model continues to show that real yields need to fall by c1% to return equities to fair value.

o Growth stocks are discounting at least a 1% fall in the TIPS yield (they outperformed as the TIPS yield rose). Normally the best performing sectors when TIPS fall are software and utilities, and the worst performing sector is banks (as is the case if inflation expectations fall). Utilities should be re-examined (we focus on the utilities related to transmission and distribution).

o The dollar tends to be sensitive to the TIPS yield. A fall in TIPS we think leads to a weaker dollar.

o Regionally, GEM has been the biggest beneficiary from a fall in the TIPS yield.

This is absolutely right for a typical cycle. The AUD would generally outperform as well. The question is, is this a normal cycle?

The problem is China. Traditionally, falling US yields would mobilise Chinese activity and commodities. But how can that happen when China is undergoing the greatest property construction collapse in global history? Even if US yields fall, the spread to China is likely to widen.

I am unconvinced and wonder if what are entering is something atypical as US yields fall but DXY remains strong as China and Europe deteriorate even more.

Both arguments have merit, so we may have to settle on a position in between as the war of macro data plays out: rising volatility!