- G20's FSB acknowledges cryptocurrencies pose no danger to the global economy

- IMF Managing Director Christine Lagarde posts “Addressing the Dark Side of the Crypto World”

- ECB believes Bitcoin is not the answer to a cashless society

- BoE warned that cryptocurrencies could be a risk to financial stability

There's been further progress this month as global regulatory bodies attempt to come to terms with the value—and potential dangers—cryptocurrencies bring to the marketplace. Central banks and governments are now openly discussing and sharing their positions on the burgeoning asset class.

Yesterday, as the first G20 summit of 2018 opened in Buenos Aires, the organization's Financial Stability Board (FSB), which coordinates financial regulation for the international forum for central banks, released a statement that, among other things, noted that cryptocurrencies pose no danger to the global economy. Crypto-assets form a small part of the financial system (at their peak late last year, they were worth less than 1% of global GDP):

“Their small size, and the fact that they are not substitutes for currency and with very limited use for real economy and financial transactions, has meant the linkages to the rest of the financial system are limited.”

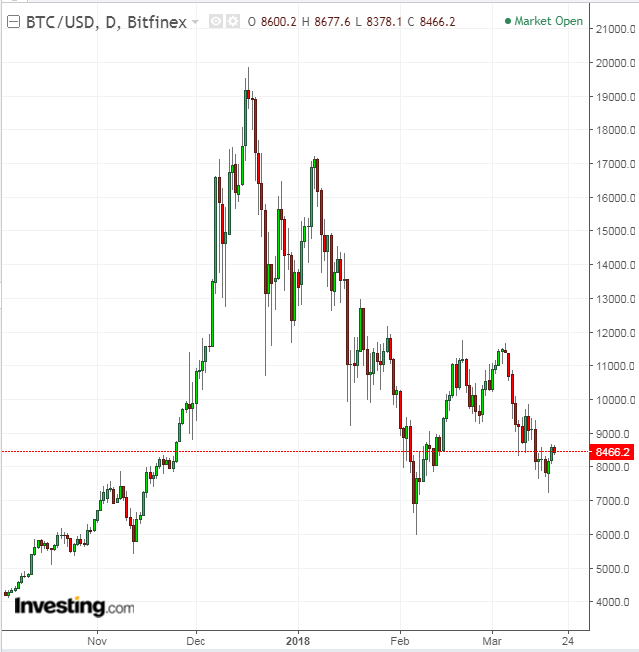

Digital currencies, including Bitcoin, Ethereum and Ripple, rallied on the news, though at time of writing each has shifted lower.

Last week, Christine Lagarde, Managing Director of International Monetary Fund (IMF) shared her position on cryptocurrencies in a blog post titled, “Addressing the Dark Side of the Crypto World." According to the post, her biggest concern with digital assets is that they have the potential to be a major new vehicle for money laundering and the financing of terrorism. She acknowledged that the IMF is working to reconcile policy on these issues.

On March 2nd, Bank of England (BoE) Governor Mark Carney warned that cryptocurrencies could be a risk to financial stability and noted that he believes the time has come to hold the crypto-asset ecosystem to the same standards as the financial system.

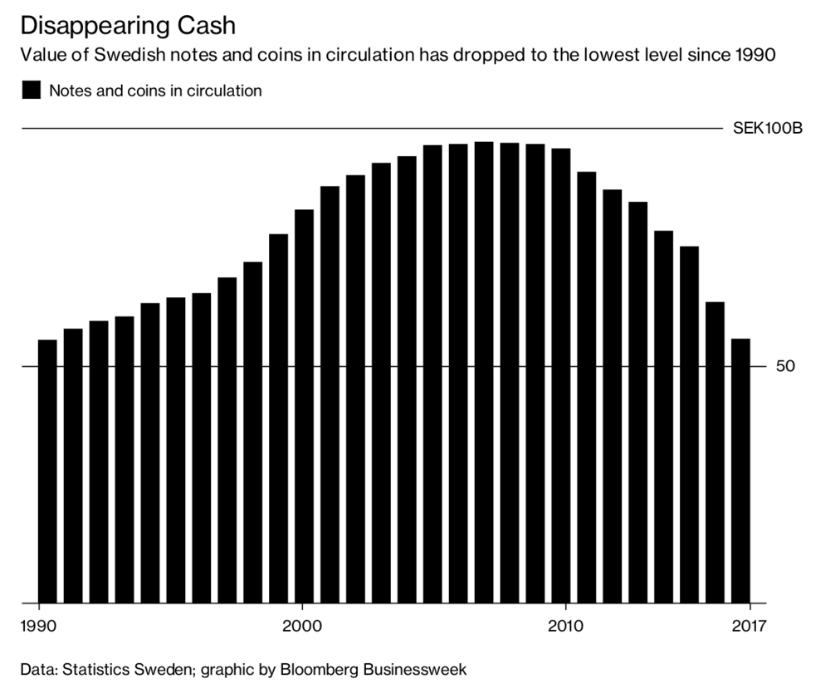

The European Central Bank (ECB), also last week, in a joint research report with the Bank of International Settlements (BIS), released a statement explaining why Bitcoin is not the answer to a cashless society. But the ECB statement went on to highlight that some Nordic countries are already cutting back on cash, irrespective of Bitcoin. And the iGeneration is more likely to reach for a payment app than a purse. To their children, banknotes and coins may look like museum exhibits.

Sweden is a good example. The Scandinavian country's central bank is looking into the possibility of introducing a digital version of Sweden's currency, the krona.

Dr. Jeppe Stokholm, partner and general counsel at Black Swan, a VC firm based in Zurich, Switzerland, sees this development as a plus. In his view, the digital economy provides a practical tool for authorities to eradicate money laundering and other shady business. That's the elephant in the room when the Nordic governments speak so warmly about the cashless society.

According to Stokholm, Brian Mikkelsen, the Minister of Business and Financial Affairs in Denmark is also looking to create a cashless society. He strongly supports the use of electronic payments. Says Stokholm:

“His argument is, that electronic payments benefit both consumers, stores and banks. According to the Minister, electronic payments are easier to handle and cheaper in administration.”

But, Stokholm adds:

“It is not only Nordic governments that see electronic payments as benefits. In 2015, the US Federal Bureau of Investigation (FBI) issued a report titled “Virtual Currency: Investigative Challenges and Opportunities”. The report provides a framework for law enforcement to investigate the illegal use of virtual currencies and to prosecute criminals and their e-commerce activities”.

Understand the Underlying Technology

Many note that before any governing body can decide how to institute and enforce regulation, it's important they understand the underlying technology. John Wantz, a retail technology entrepreneur as well as the CEO of SHOP, explains that governments need to develop insightful regulations based on a real understanding of cryptocurrency's underlying technology and recent advances in that realm:

“Heavy-handed policies that are based on a lack of technical knowledge will only serve to stifle innovation and curb economic growth. The industry is well-founded and will provide invaluable solutions to the current issues plaguing global financial systems, such as hyper-inflation. The first step is to take action against the ‘bad players’, which will move the industry closer to mainstream adoption and the recognized legitimacy cryptocurrency needs.”

Hope Liu, co-founder and CEO of Eximchain stresses how important it is for policymakers to understand the difference between central bank digital currencies (CBDC) and cryptocurrencies:

“Cryptocurrencies like bitcoin were created to avoid centralized banking and government money via a peer-to-peer network. Although the technology itself could be used as a centrally banked currency. Given the key features of anonymity and un-traceability of cryptocurrency, the "cashless society" in many policymakers’ minds could be a CBDC that doesn't operate through a peer-to-peer mechanism in order to prevent money laundering and illegal financing activities, but helps to strengthen the role of sovereign currency by curbing the public’s demand for alternative currencies.”

Will real, hard cash eventually be phased out as digital assets become mainstream?

Marcin Rudolf, CTO and co-founder of Neufund believes so. He explains that cutting back on cash, for example, is a sign of a global trend to control and centralize the flow of money by financial institutions such as banks and regulatory agencies.

Following up on the ECB's acknowledgement of the shift away from hard cash among the Nordics, Rudolf adds:

“It's in Nordic countries' culture to trust institutions and other members of society; so, undoubtedly they are leading the trend. Cryptocurrencies and cash have a lot in common. With cryptocurrencies, you actually own your own wallet, you can transact peer-to-peer with anyone, and you can be anonymous in your transactions. Cryptocurrencies are going against the trend to control.”

As more and more policymakers question and discuss crypto usage and its role in society and the global economy, many believe the conversation is finally heading in the right direction. Open, productive dialogue on digital currency's place in society means appropriate regulation as well as broader uptake of the technology is bound to follow.