Investing.com - The global economy continues to struggle with persistently high inflation pressures and expectations of further hikes from central bank policymakers. Despite an AI-fueled tech stock melt-up and resilient labor markets, there are growing predictions for a recession in H2 2023 as tightening financial conditions drive slowing growth.

Meanwhile, the ongoing conflict in Ukraine continues to significantly impact global macroeconomic and geopolitical environments, including increased volatility in capital and commodity markets, rapid changes to regulatory conditions around the globe including the use of sanctions, operational challenges for multinational corporations, inflationary pressures, and an increased risk of cybersecurity incidents.

With this macroeconomic backdrop in mind, here are 2 companies with the potential to outperform current market conditions according to InvestingPro.

Harvey Norman Holdings Ltd (ASX:HVN)

What Does the Company Do?

Harvey Norman is a prominent Australian-based multinational retailer specializing in furniture, bedding, computers, communications, and consumer electrical products. Operating primarily as a franchise, it is owned by Harvey Norman Holdings Limited, an ASX-listed company. The company functions as a franchisor, offering a wide range of products, investing in property, leasing premises, managing media placement, providing consumer finance, and offering commercial loans and advances.

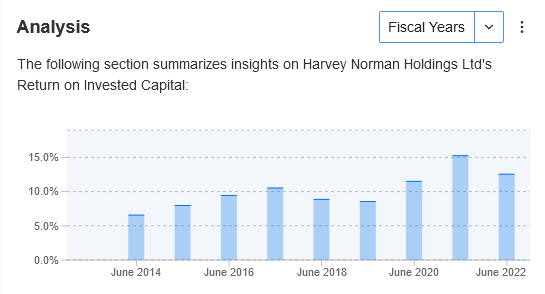

With Harvey Norman Holdings Ltd (ASX:HVN) down 14.5% over the past year, its discounted price provides investors with a strong upside potential considering its strong dividend yield of 9.1%, as well as growing return on invested capital:

Source: InvestingPro

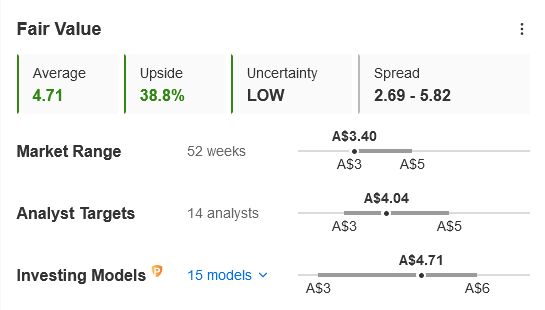

Fair Value Estimate

Currently, the stock is trading at A$3.39, while the average of 15 Fair Value Investing Models revealed a price target of $4.71, indicating an upside of 38.8%.

Source: InvestingPro

JB Hi-Fi Ltd (ASX:JBH)

What Does the Company Do?

JB Hi-Fi Limited is a specialty retailer of home consumer products, focusing on consumer electronics, software, whitegoods, and appliances. With over 300 stores across Australia and New Zealand, the company offers a wide range of products at competitive prices, supported by knowledgeable staff. They operate various store types, including an online presence, and also provide informational technology and consulting services.

Weekly price action for JB Hi-Fi Ltd (ASX:JBH) shows that the company is trading just above yearly support levels and is vulnerable to further breakdown in the event of a global downturn:

Source: Investing.com

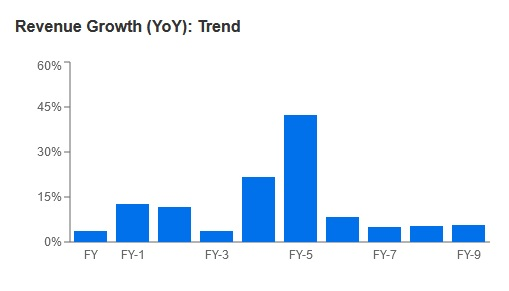

Despite these risks, the company has maintained an average revenue growth of 10.6% since 2018, posting record earnings for Q2 2023 as post-covid normalization boosted sales in the face of slowing consumer spending and rising inflation.

Source: InvestingPro

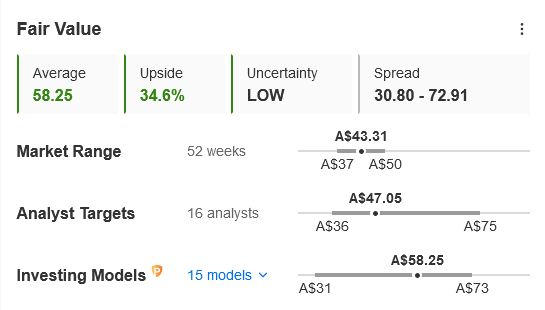

Fair Value Estimate

Currently, the stock is trading at A$43.22, while the average of 15 Fair Value Investing Models revealed a price target of $58.25, indicating an upside of 34.6%.

This analysis was done using InvestingPro, access the tool by clicking on the image.

Find All the Info you Need on InvestingPro!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counseling or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky, and therefore, any investment decision and the associated risk remains with the investor.