Qantas Airways Ltd (ASX:QAN), Australia's leading airline, is on track to surpass its previous record profit of A$1.5 billion by a staggering $1 billion this year. The company anticipates an underlying pre-tax profit ranging from $2.425 billion to $2.475 billion – setting a new historical high for the renowned carrier.

Let's dig into the company’s fundamental data using InvestingPro tools.

What Does the Company Do?

The Qantas Group is an Australia-based company primarily involved in the transportation of customers through two airline brands: Qantas and Jetstar. These brands operate regional, domestic, and international services. In addition to the airline business, the company has a diverse range of subsidiary businesses, including Qantas Freight Enterprises and Qantas Frequent Flyer.

The company focuses on operating international and domestic air transportation services, providing freight services, and managing a frequent flyer loyalty program. The company operates in multiple segments, including Qantas Domestic, Qantas International, Jetstar Group, and Qantas Loyalty, each engaged in passenger flying, air cargo, and express freight operations.

With a presence in Australia, New Zealand, South Pacific, Asia, and the Middle East, Qantas Group is a key player in the airline industry.

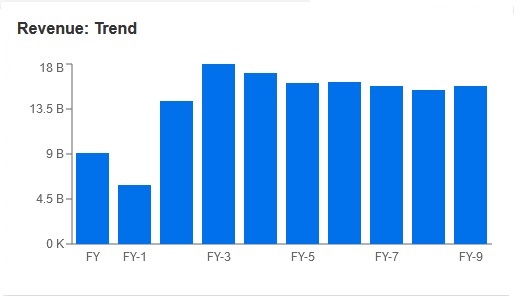

Let's start by going through the financial statement history using the InvestingPro tools. This gives us several useful insights.

Source: InvestingPro

In their recent quarterly update, Qantas forecasted a remarkable pre-tax profit of up to $2.48 billion for the 2023 financial year. The company also flagged five widebody jets scheduled to become operational as capacity was predicted to increase to 104% of pre-COVID levels by the end of 2H23.

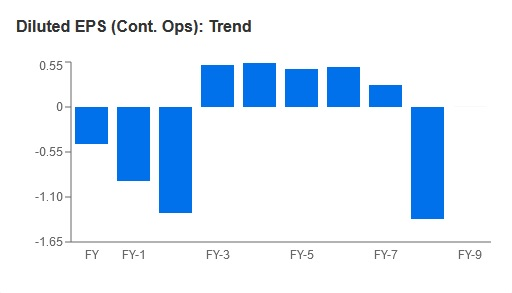

Source: InvestingPro

To further bolster investor confidence, Qantas announced an additional share buyback worth another A$100 million ($73 million). Group CEO Alan Joyce attributed these optimistic projections to improvements within aviation supply chains and more affordable fuel prices which have contributed positively towards profits. Accordingly, he stated that "more parts of aviation supply chain are returning to normal," allowing them "to put some spare aircraft and crew back in schedule." This also enables lower fares benefiting customers while pushing demand upwards.

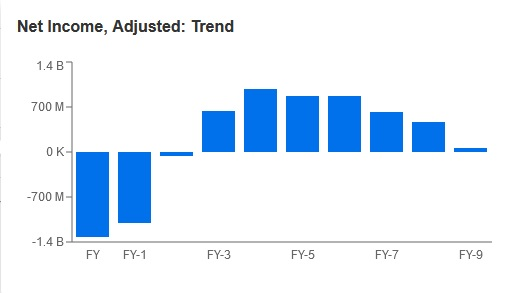

Source: InvestingPro

In addition to their impressive profit projections, Qantas recently announced plans for more international flights and routes which will help reduce the current high prices. They have also signed a deal with Finnish airline Finnair to lease two Airbus A330s operated by Qantas' own pilots.

Lastly, the company revealed that long-serving director Michael L'Estrange will retire later this year, with former American Airlines (NASDAQ:AAL) CEO Doug Parker set to take his place on the board.

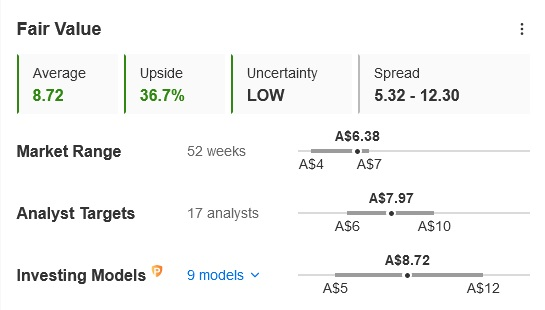

Fair Value Estimate

Currently, the stock is trading at A$6.37, indicating a 36.7% upside when compared to the fair value of A$8.72. The fair value estimate is based on 9 different mathematical models, available on InvestingPro.

Source: InvestingPro

The analysis was done using InvestingPro, access the tool by clicking on the image.

Find All the Info you Need on InvestingPro!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counseling or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky, and therefore, any investment decision and the associated risk remains with the investor.