Current brent oil prices are trading near yearly support levels of $75.5 as the continuing war in Ukraine and slowing economic data forced a surprise cut in oil output from OPEC+ at its recent meetings.

As the macroeconomic outlook darkens, a recession appears unavoidable. If central banks like the US Federal Reserve continue with planned interest rate hikes, markets – including oil – will likely factor in a much harsher recession.

However, while Goldman Sachs Group Inc (NYSE:GS) recently withdrew its $100-a-barrel prediction due to increasing uncertainty in both banking systems and economic outlooks, their revised forecasts still project Brent trading at an average of $94 per barrel over the next year and reaching $97 by H2 2024.

Meanwhile, Billionaire investor Warren Buffett purchased 4.66 million Occidental Petroleum Corporation (NYSE:OXY) shares for approximately $275 million between the period May 25th to 30th, taking his total stake to 24.9% of the company. The world-renowned investor began substantially increasing its stake in the international oil company over the past year following the invasion of Ukraine.

With this macroeconomic backdrop in mind, here are 2 local energy companies that hold the potential to outperform current market conditions according to InvestingPro.

Woodside Energy Ltd (ASX:WDS)

What Does the Company Do?

Woodside Energy Group Ltd (Woodside) is an independent global energy company based in Australia. It explores, develops, produces, and supplies oil and gas resources. With a portfolio of facilities, Woodside collaborates with major oil and gas companies worldwide. The company operates through three segments: Australia, International, and Marketing. The Australia segment focuses on the exploration, evaluation, development, production, and sale of liquefied natural gas (LNG), pipeline gas, crude oil, condensate, and natural gas liquids within Australia. The International segment engages in similar activities outside of Australia. The Marketing segment trades LNG and optimizes value through scheduling, shipping, and contract management. Woodside's projects include Pluto LNG, Northwest Shelf, Wheatstone, Julimar-Brunello, Macedon, Bass Strait, Calypso, Browse, Wildling, Atlantis, Woodside Solar, Scarborough, and Pluto Train 2.

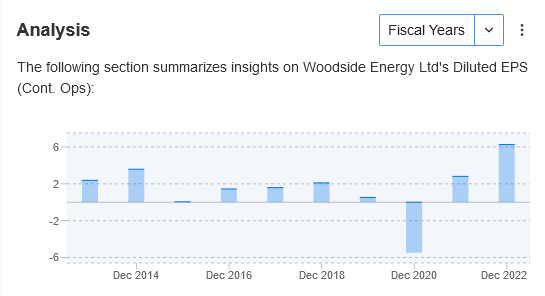

Woodside Energy Ltd (ASX:WDS) has fallen only 1.4% year to date, providing investors with a low price volatility, strong dividend yields and an increasing earnings per share:

Source: InvestingPro

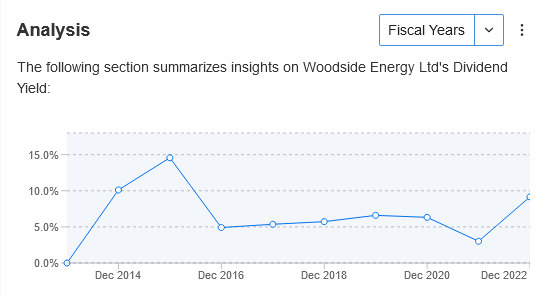

The company also maintains an average annual dividend yield of 10.9%:

Source: InvestingPro

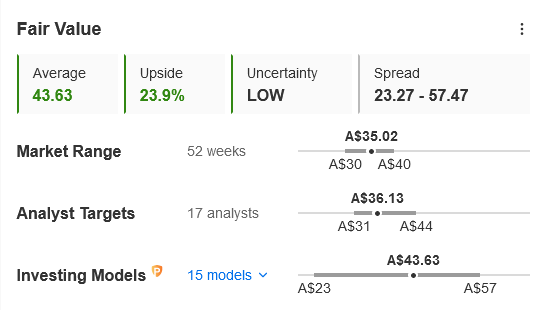

Fair Value Estimate

Currently, the stock is trading at A$35.28, while the average of 15 Fair Value Investing Models revealed a price target of $43.63, indicating an upside of 23.9%.

Source: InvestingPro

Beach Energy Ltd (ASX:BPT)

What Does the Company Do?

Beach Energy Limited is an Australian oil and gas exploration and production company with a diverse portfolio of assets across Australia and New Zealand. The company operates onshore and offshore in five producing basins. It owns strategic oil and gas infrastructure and assets, including interests in the Cooper Basin, Perth Basin, Otway Basin, Bass Basin, and Taranaki Basin. Beach Energy engages in the exploration, development, production, and transportation of hydrocarbons, as well as the sale of gas and liquid hydrocarbons. With headquarters in Adelaide, the company has a long history since its incorporation in 1961, operating under the name Beach Energy Limited in 2009.

Weekly price action for Beach Energy (ASX:BPT) shows that the company is holding just above 2-year lows and is vulnerable to further breakdown:

Source: Investing.com

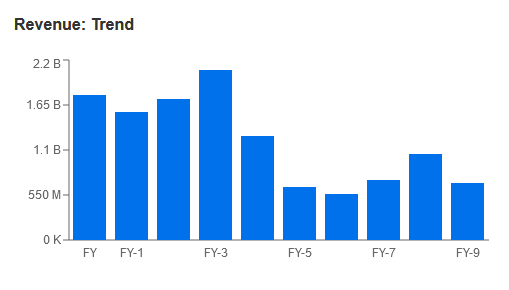

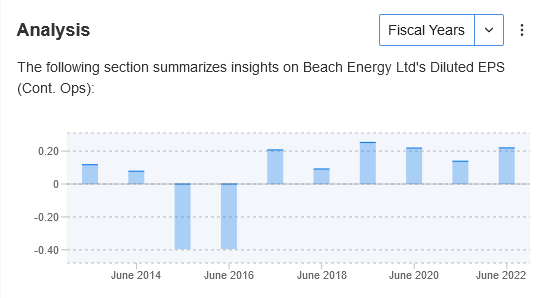

However, the company maintained strong revenues and positive earnings per share since 2017 and is well positioned to benefit from a lift in global oil prices:

Source: InvestingPro

Source: InvestingPro

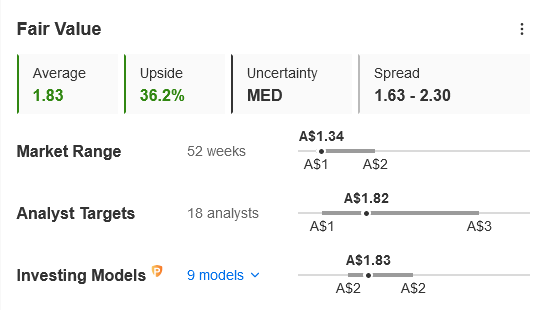

Fair Value Estimate

Currently, the stock is trading at A$1.35, while the average of 9 Fair Value Investing Models revealed a price target of $1.83, indicating an upside of 36.2%.

Source: InvestingPro

This analysis was done using InvestingPro, access the tool by clicking on the image.

Find All the Info you Need on InvestingPro!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counseling or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky, and therefore, any investment decision and the associated risk remains with the investor.