Inventories collapse giving a tailwind to crude oil whilst a weaker dollar lifts gold.

OIL

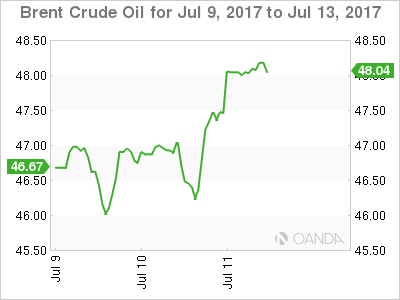

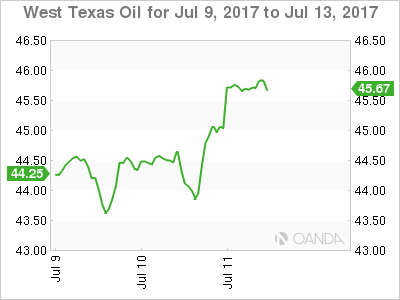

Both Brent and WTI spot staged an impressive two dollar rally in the New York session as the American Petroleum Institute reported a massive 8.1 million barrel drawdown in inventories overnight. All eyes will now turn to the official U.S. Crude Inventories number this evening where the Street is forecasting a 3.2 million barrel drawdown.

A larger than expected drawdown will add fuel to the fire and could see both contracts trading towards the top of their recent ranges of 49.50 and 47.00 respectively. With the Energy Information Administration downgrading 2018 U.S. crude production overnight, one suspects that even an undershoot will see both contracts running into buyers on dips in the short term.

Brent spot trades at 48.00 this morning with resistance at 49.00 initially and supports at 47.25.

WTI spot opened at 45.70 today with resistance at 47.00 and support at 44.80.

GOLD

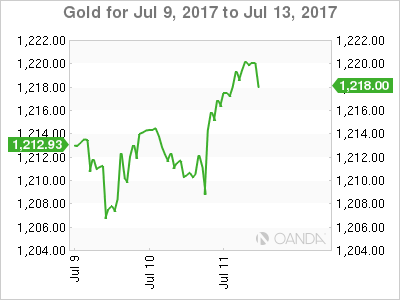

Gold has climbed overnight to open just below 1220 in Asia today. Although the rally was only some 0.20%, this marks the third consecutive higher open in Asia for gold, as it picks itself up off the floor following last Friday’s sell-off to 1205.

The rally overnight has been driven by a lower U.S. dollar in general. Investors are likely taking advantage of more attractive levels to go long ahead of Fed Governor Yellen’s two-day testimony to Congress which starts today.

Reaction to the latest developments in the Trump/Russia campaign saga has been strangely muted. Whether the Street does not think this is a “smoking gun,” apathy, Trump-fatigue or a combination of all of the above remains to be seen.

Although the rally from 1205.00 will be pleasing to gold bulls and now becomes technical support ahead of 1200 and 1195, gold faces stern technical resistance in the 1230.00/1231.00 region. This level capped gold multiple times last week and is now also home to the 200-day moving average.

Gold’s near-term direction will now be at the mercy of whether we get a hawkish Yellen on the Hill today, and potential further developments on Russia’s generous offer to assist President Trump’s campaign last year.