Cryptocurrency exchange Coinbase Global (NASDAQ:COIN) on Apr. 14 via a direct listing. Unlike a standard initial public offering, a company that completes a direct listing doesn't issue any new shares or raise additional capital. Instead, it opens up the sale of its shares directly to the public.

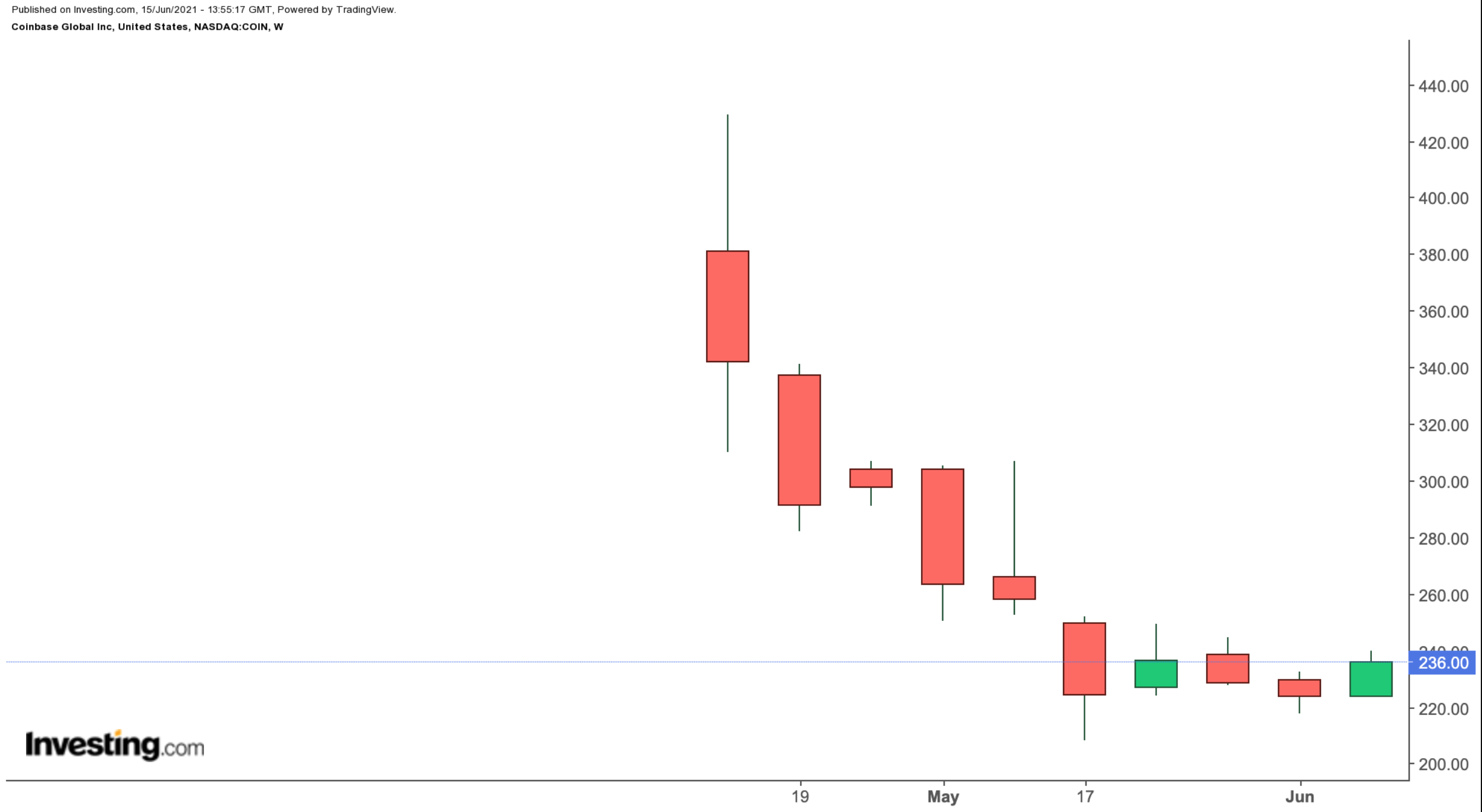

COIN started trading at $381 and hit a record high of $429.54 on the first day it went public. Since then, however, the trend has been down. On May 19, COIN stock hit an all-time low of $208. Now, as we write on Tuesday afternoon, the shares are hovering at $236.

Despite the decline in the share price over the past two months, the Street concurs that the digital platform has significant potential. In fact, given the interest and volatility in the price of cryptos, Coinbase has become one of the most widely followed stocks on Wall Street. Some investors might also regard COIN as a proxy to holding digital currencies like Bitcoin or Ethereum, as well as other altcoins.

Therefore, potential investors might consider buying the stock for their growth portfolio. However, investing in 100 shares of COIN stock would cost around $23,600, a considerable investment for many people.

Some investors might prefer to put together a "poor person's covered call" on the stock instead. So today we introduce a diagonal debit spread on Coinbase Global by using LEAPS options. Such a strategy is sometimes used to replicate a covered call position at a considerably lower cost.

Investors who are new to options might want to-revisit our previous articles on LEAPS options (for example, here and here) first, before reading further.

A Diagonal Debit Spread On COIN Stock

Current Price: $235.98

52-Week Range: $208.00 - $429.54

A trader first buys a “longer-term” call with a lower strike price. At the same time, the trader sells a “shorter-term” call with a higher strike price, creating a long diagonal spread.

Thus, the call options for the underlying stock have different strikes and different expiration dates. The trader goes long one option and shorts the other to make a diagonal spread.

In this strategy, both the profit potential and risk are limited. The trader establishes the position for a net debit (or cost). The net debit represents the maximum loss.

Most traders entering such a strategy would be mildly bullish on the underlying security—here, Coinbase Global. Instead of buying 100 shares of COIN, the trader would buy a deep-in-the-money LEAPS call option, where that LEAPS call acts as a “surrogate” for owning the COIN stock.

As we write on Tuesday afternoon, COIN stock is $235.98. Therefore, for this post, we'll use this price.

For the first leg of this strategy, the trader might buy a deep in-the-money (ITM) LEAPS call, like the COIN Jan. 20, 2023, 170-strike call option. This option is currently offered at $100.85. It would cost the trader $10,085 to own this call option that expires in about one and a half years instead of $23,598 to buy the 100 shares outright.

The delta of this option is almost 80. Delta shows the amount an option’s price is expected to move based on a $1 change in the underlying security.

If Coinbase Global stock goes up $1, to $236.98, the current option price of $100.85 would be expected to increase by approximately 80 cents, based on a delta of 80. However, the actual change might be slightly more or less depending on several other factors that are beyond the scope of this article.

So an option’s delta increases as one goes deeper into the money. Traders would use deep ITM LEAPS strikes because as delta approaches 1, a LEAPS option's price moves begin to mirror that of the underlying stock. In simple terms, a delta of 80 would be like owning 80 shares of COIN in this example (as opposed to 100 in a regular covered call).

For the second leg of this strategy, the trader sells an out-of-the-money (OTM) short-term call, like the COIN Aug. 20, 2021, 250-strike call option. This option’s current premium is $15.95. The option seller would receive $1,595, excluding trading commissions.

There are two expiration dates in the strategy, making it quite difficult to give an exact formula for a break-even point in this trade. Different brokers might offer “profit-and-loss calculators” for such a trade setup. Calculating the value of back-month (i.e., LEAPS call) when the front-month (i.e., the shorter-dated) call option expires requires a pricing model to get a “guesstimate” for a break-even point.

Maximum Profit Potential

The maximum potential is realized if the stock price is equal to the strike price of the short call on its expiration date. So the trader wants the COIN stock price to remain as close to the strike price of the short option (i.e., $250 here) as possible at expiration (on Aug. 20, 2021), without going above it.

Here, the maximum return, in theory, would be about $2,641 at a price of $250.0 at expiry, excluding trading commissions and costs. (We arrived at this value using an options profit-and-loss calculator). Without the use of such a calculator, we could also arrive at an approximate dollar value. Let’s take a look:

The option seller (i.e., the trader) received $1,595 for the sold option. Meanwhile, the underlying COIN stock increased from $235.98 to $250. This is a difference of $14.02 per share of COIN, or $1,402 for 100 shares.

Because the delta of the long LEAPS option is taken as 80, the value of the long option will, in theory, increase by $1,402 X 0.8 = $1,121.60 (However, in practice, it might be more or less than this value.)

The total of $1,595 and $1,121.60 comes to $2,716.60. Although it is not the same as $2,641, we can regard it as a good approximate value.

Understandably, if the strike price of our long option had been different (i.e., not $170.00), its delta would have been different, too. Then we need to use that delta value to arrive at the approximate final profit or loss value.

Here, by not investing $23,598 initially in 100 shares of COIN, the trader’s potential return is leveraged.

Ideally, the trader hopes the short call will expire out-of-the money (worthless). Then, the trader can sell one call after the other, until the long LEAPS call expires in about a year and half.

Position Management

Active position management in a diagonal debit spread is typically more difficult for novice traders.

If COIN is above $250 on Aug. 20, the position will make less than the potential maximum return as the short-dated option will start losing money.

Then, the trader might feel the need to close the trade early if the price shoots up and the short call gets caught deep ITM.

In a regular covered call, the trader might not necessarily mind being assigned the short option as s/he owns 100 shares of COIN as well.

However, in a poor person’s covered call, the trader would not necessarily want to be assigned the short call as s/he does not actually own those COIN shares yet.

On Aug. 20, this LEAPS covered call trade would, in theory, also start losing money if the COIN stock price falls to about $219 or below. Understandably, a stock's price could drop to $0, decreasing the value of the long call with it.

In future weeks, we will continue our discussion with different examples of options strategies.