On Thursday, Intel (NASDAQ:INTC) delivered its Q3 2024 earnings report ending September. Following the dip in mid-October after announced layoffs for November, INTC stock remained relatively flat, slightly climbing from $22.16 to present $22.79 per share in those two weeks.

The Q3 filing has been received positively, as Intel managed to beat the revenue estimate of $13 billion at $13.28 billion. More importantly, Intel has an optimistic outlook for Q4, expecting to land between $13.3 billion and $14.3 billion revenue range, which is above the Wall Street consensus of $13.6 billion.

Although still considerably lagging behind Nvidia (NASDAQ:NVDA) and AMD (NASDAQ:AMD) on a year-to-date timeframe, with negative 52% returns, it appears that INTC stock found its bottom at the $21 per share range since mid-September. Based on Q3 earnings and strategic positioning, is there a meaningful headway for INTC stock into 2025?

Recap of Intel’s Q3 Earnings

Compared to the year-ago quarter at $14.16 billion, the $13.28 billion revenue this quarter fell short by $874 million. Following the launch of standalone Altera company for the field-programmable gate arrays (FPGAs) market in February, Altera’s revenue dropped by 44% YoY.

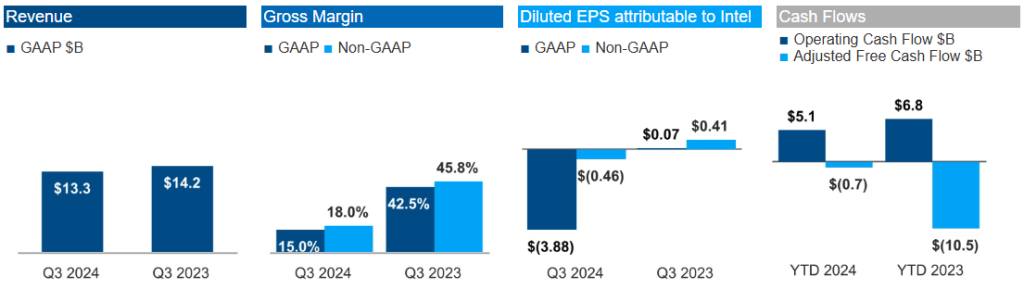

Expectedly, Intel Foundry’s revenue was the biggest loser, having its revenue decreased by 79% in the same period. This was offset by Intel’s data center and AI division (DCAI), which tracked 9% YoY growth. Due to the shift to lower-margin products catering to data centers and mobile, Intel’s gross margin dropped from 42.5% in Q3 2023 to $15%.

Yet, despite the heavy investments in long-term R&D, production and labor costs, Intel’s operating cash flow remained strong at $5.1 billion vs $6.8 billion in 2023 (YTD). Excluding capital expenditures, one-time expenses and restructuring costs, Intel’s adjusted free cash flow improved by 93%.

As mentioned previously, Intel is going ahead with its plan to cut its workforce by 16,500 employees, as a part of the $10 billion cost-cutting plan. One of the main reasons INTC stock had such poor performance was the investment in the exceedingly costly Intel Foundry. The long-term goal by 2030 is to position Intel as the world’s global chipmaker, behind TSMC and ahead of Samsung (KS:005930).

To that end, Intel plans to make Intel Foundry as an independent subsidiary, separating it from the core Intel Products division. Such a move is likely to be welcomed by INTC shareholders, as Intel can allocate resources more effectively and potentially attract more external funding.

This will be much needed, given the fact that Intel reported its biggest income loss on record this quarter. Accounting for nine months ending September, Intel’s net loss amounted to $18.6 billion compared to a net loss of $1.28 billion in 2023 for the same period.

Intel’s Problematic CHIPS Act Injection

In a geopolitical move to curb China’s chip-making capability, the US government enacted multiple chip export controls alongside its partners. On the domestic side of that move, the U.S. Department of Commerce granted Intel $8.5 billion in direct funding, out of total $52 billion, under the CHIPS and Science Act umbrella.

On top of that, Intel gained eligibility for U.S. Treasury’s Investment Tax Credit (ITC), up to 25%, across its $100 billion capital investments. Lastly, USG secured favorable low-interest loans to Intel for up to $11 billion.

Although that sounds good on paper for INTC shareholders, it appears that none of that CHIPS money landed into Intel’s hands. Most recently on Wednesday, Ohio Governor Mike DeWine told reporters that he communicated with the White House to speed up the process.

In January 2022, Intel announced plans to invest over $20 billion for semiconductor manufacturing facilities in Licking County, Ohio, as a part of its IDM 2.0 (Integrated Device Manufacturing) strategy.

However, bureaucratic delays are not surprising. Notably, when the Biden admin announced the Broadband Equity Access and Deployment (BEAD) program worth $42.45 billion in June 2023, it has yet to connect a single person.

The Impact of US Presidential Elections on Intel

During his appearance at The Joe Rogan Experience show, former President Donald Trump addressed the CHIPS Act rollout. He proposed a different approach entirely, one that relies on a “series of tariffs” instead to disincentivize domestic semiconductor companies from outsourcing.

Trump noted that giving money to rich semiconductor companies is not a good idea because “they’re not going to give us the good companies anyway,”.

Considering DeWine’s recent comms with the White House, it appears that Intel would benefit from some expediency before the US elections. However, Intel CEO Patrick Gelsinger is now committed to Intel’s investment, whether the funds go through or not.

“It’s well over two years since the CHIPS Act passed. And over that period, I’ve invested $30 billion in US manufacturing and we’ve seen $0 from the CHIPS Act. This has taken too long. We need to get it finished.”

Patrick Gelsinger to Yahoo Finance

However, Intel is likely to benefit long-term from Trump winning his 2nd term, owing to his favoring of minimal regulation and expanding US manufacturing capabilities across the board.

***

Neither the author, Tim Fries, nor this website, The Tokenist, provide financial advice. Please consult our website policy prior to making financial decisions.