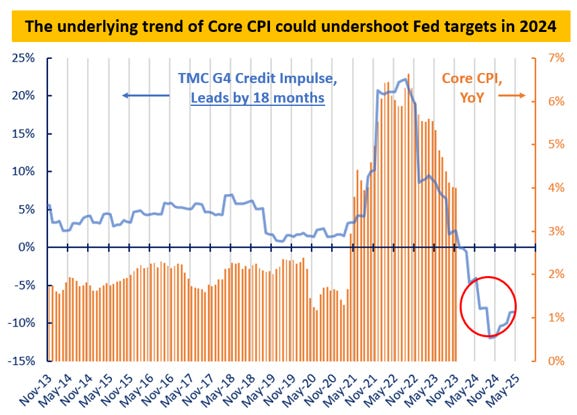

Let me get straight to the point: our models show inflation is on its way to undershoot (!) Central Banks targets in 2024.

Inflation is often a monetary phenomenon: print real-economy money too quickly for the supply side of the economy to adjust, give it enough time and the only release valve will be higher prices (inflation).

Abruptly stop or reverse this process, and inflation will moderate rapidly.

In plain words: the speed of real economy money creation leads inflation trends by roughly 18 months.

The money creation boom of 2020-2021 led to the strong inflationary pressures we saw in 2022.

Since then though mortgage applications and corporate borrowing collapsed as a result of higher rates.

Our Credit Impulse series captured that, hence it has well anticipated the disinflationary trend in 2023.

But there is more to come: the model now predicts these disinflationary lags to kick in further in 2024.

US Core Inflation could annualize at or below 1.5% (!) by early summer.

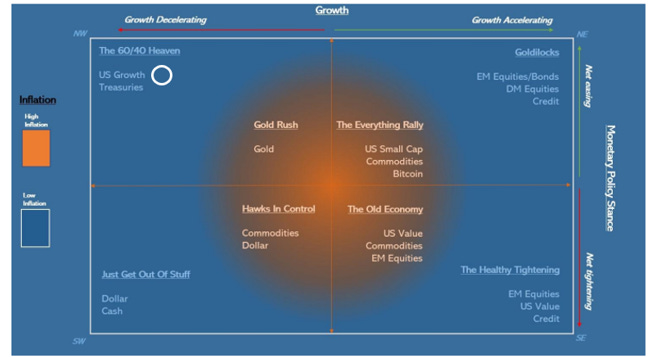

Inflation undershooting Central Bank targets is a big deal for macro investing in 2024.

This brings me to our improved Quadrant Asset Allocation Model (QAAM).

The TMC asset allocation starting point is the Forever Portfolio which distributes a similar amount of risk budget to internationally diversified equities, bonds, commodities, and the US Dollar.

In other words: a portfolio prepared for different macro outcomes.

The next step is to look at our TMC macro models: they dictate the direction ahead for growth, inflation, and the monetary policy stance so that we end up in one of the Quadrants represented above.

Based on the quadrant we land in, Macro Tilts are applied to the portfolio (e.g. more stocks, less bonds etc).

Judging from the above snapshot, one should strongly overweight TLT + QQQ and go to sleep.

Well: not so fast.

One must dig deep into the full TMC macro investment process to construct a perfect portfolio for 2024.

***

This article was originally published on The Macro Compass. Come join this vibrant community of macro investors, asset allocators and hedge funds - check out which subscription tier suits you the most using this link.