- Investors are gearing up for what is expected to be an eventful week ahead.

- CPI inflation and retail sales data will be in focus.

- In addition, Home Depot and Walmart report quarterly earnings.

- Looking for actionable trade ideas to navigate the current market volatility? Unlock access to InvestingPro’s AI-selected stock winners for just 60 cents a day!

Next week is expected to be an eventful one as investors await fresh clues on inflation and the strength of the U.S. consumer while continuing to ponder when the Federal Reserve will start lowering interest rates.

With the inflation report looming and the markets trying to anticipate the Fed's next move, you can prepare your portfolio for potential volatility. In that respect, our predictive AI stock-picking tool can prove a game-changer.

For less than $9 a month, it will update you every month with a timely selection of AI-picked buys and sells, giving you a significant edge over the market.

Subscribe now and position your portfolio one step ahead of everyone else!

Readers of this article enjoy an extra 10% discount on the yearly and bi-yearly plans with the coupon codes PROTIPS2024 (yearly) and PROTIPS20242 (bi-yearly).

Home Depot Reports on Tuesday: What to Expect

The last group of companies scheduled to report first-quarter earnings this season are major U.S. retailers.

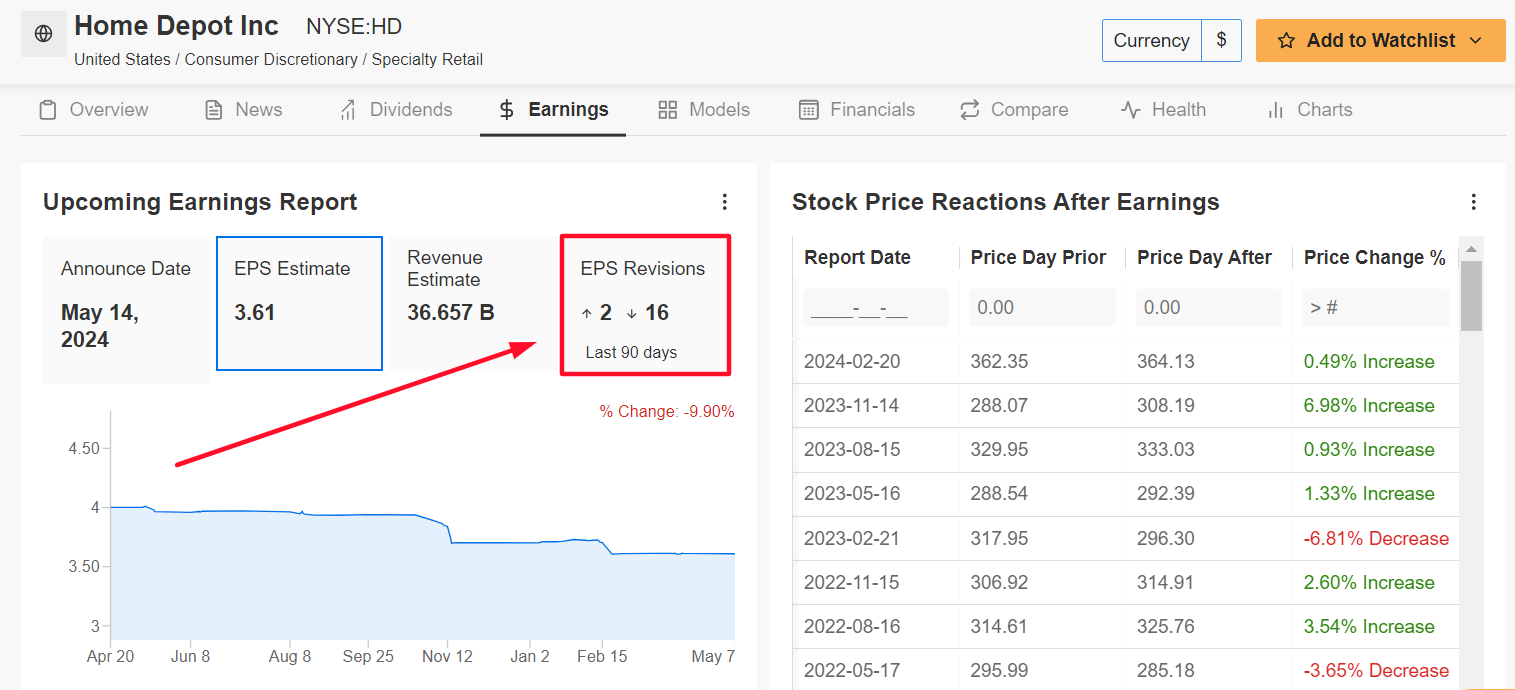

Home Depot's (NYSE:HD) first-quarter update is due ahead of the opening bell on Tuesday at 6:00 AM EST and results are likely to be negatively impacted by slowing demand for its assortment of building materials and construction products from both professional and do-it-yourself customers.

Source: InvestingPro

Analysts have cut their EPS estimates 16 times in the past 90 days, according to data found on InvestingPro, compared to only two upward revisions.

CPI, Cisco Earnings on Wednesday

The main event of the week will happen on Wednesday.

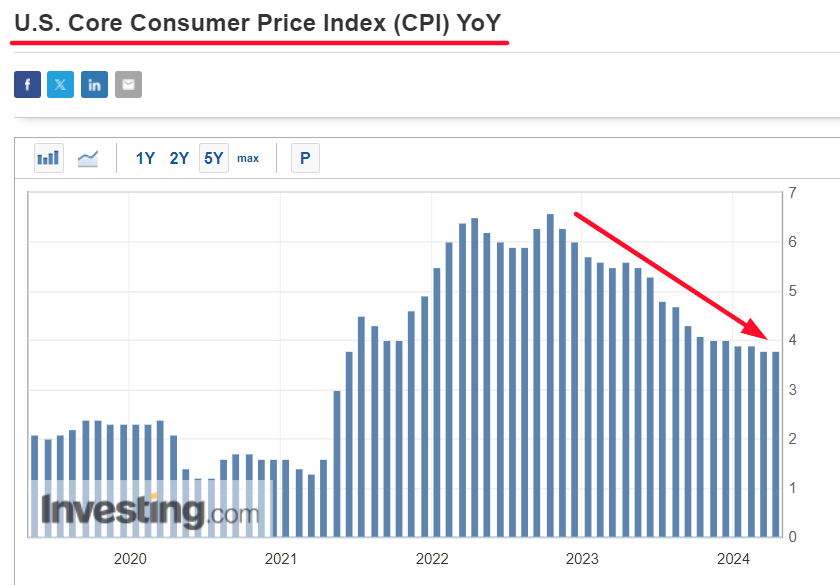

With investors now firmly expecting the Fed to start cutting rates after the summer, the latest CPI inflation report will likely be key in determining the U.S. central bank’s policy moves in the second half of 2024.

Financial markets see about a 68% chance of the first rate cut hitting in September, according to Investing.com's Fed Monitor Tool.

A cooler-than-expected print would likely add to the rate-cut buzz, while a surprisingly strong reading could keep pressure on the Fed to maintain its fight against inflation.

As per Investing.com, the monthly consumer price index is forecast to rise 0.3% in April, after inching up 0.4% in March. Meanwhile, the headline annual inflation rate is seen rising 3.5%, matching the same increase in the previous month.

The April core CPI index - which does not include food and energy prices - is expected to rise 0.3% on the month, after increasing 0.4% in March. Estimates for the year-on-year figure call for a 3.7% gain, slowing from the previous month’s 3.8% reading.

Source: Investing.com

If that is confirmed, it would mark the lowest annual core CPI reading since April 2021.

Besides CPI, the U.S. government will also release the retail sales report for April, with economists estimating a headline increase of 0.4% after sales rose 0.7% during the prior month.

After stripping out the volatile auto and gas categories, core retail sales are expected to show a 0.2% gain, slowing sharply from the 1.1% increase seen in March.

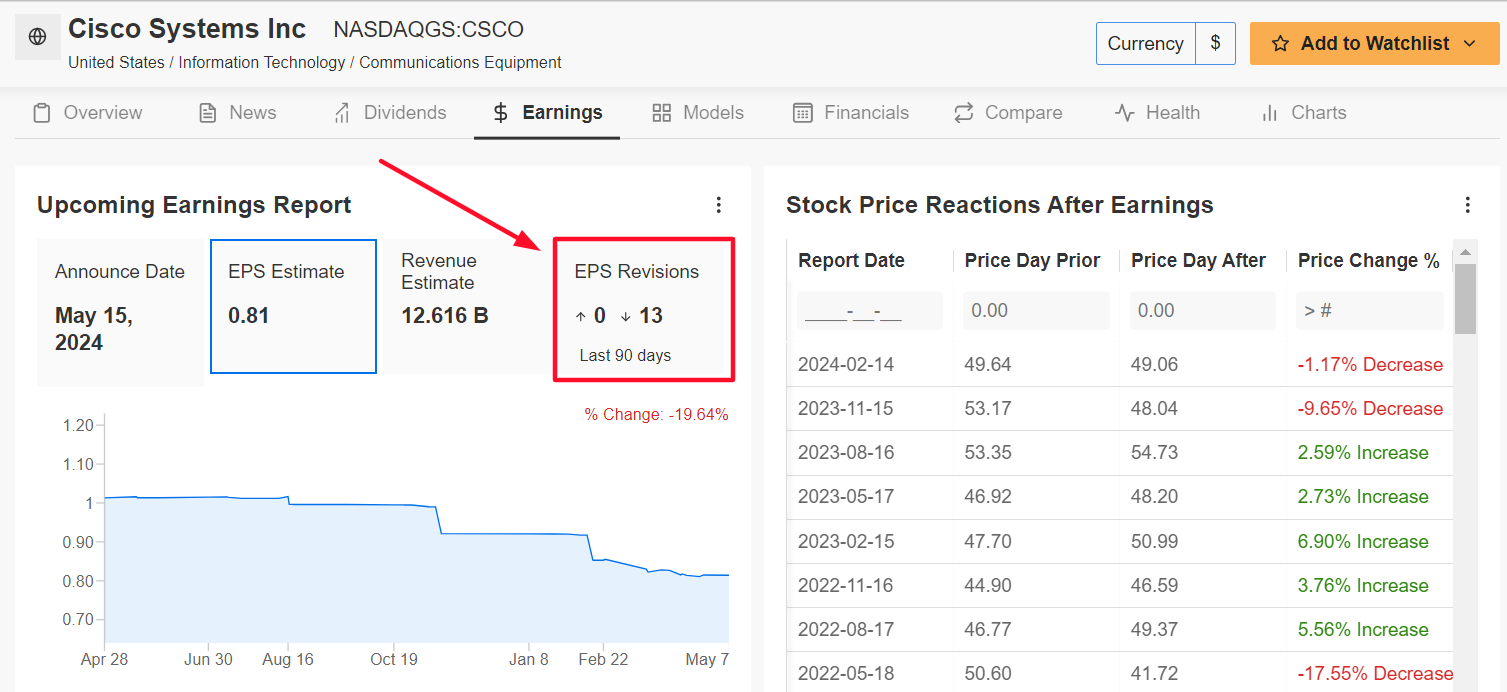

In addition, Wednesday brings an earnings report from networking-infrastructure company Cisco Systems (NASDAQ:CSCO). CSCO shares are down 5.4% year-to-date.

Source: InvestingPro

Underscoring several near-term challenges, all 13 analysts surveyed by InvestingPro slashed their profit estimates ahead of the print to reflect a drop of approximately 20% from their initial expectations.

Thursday: Walmart Reports

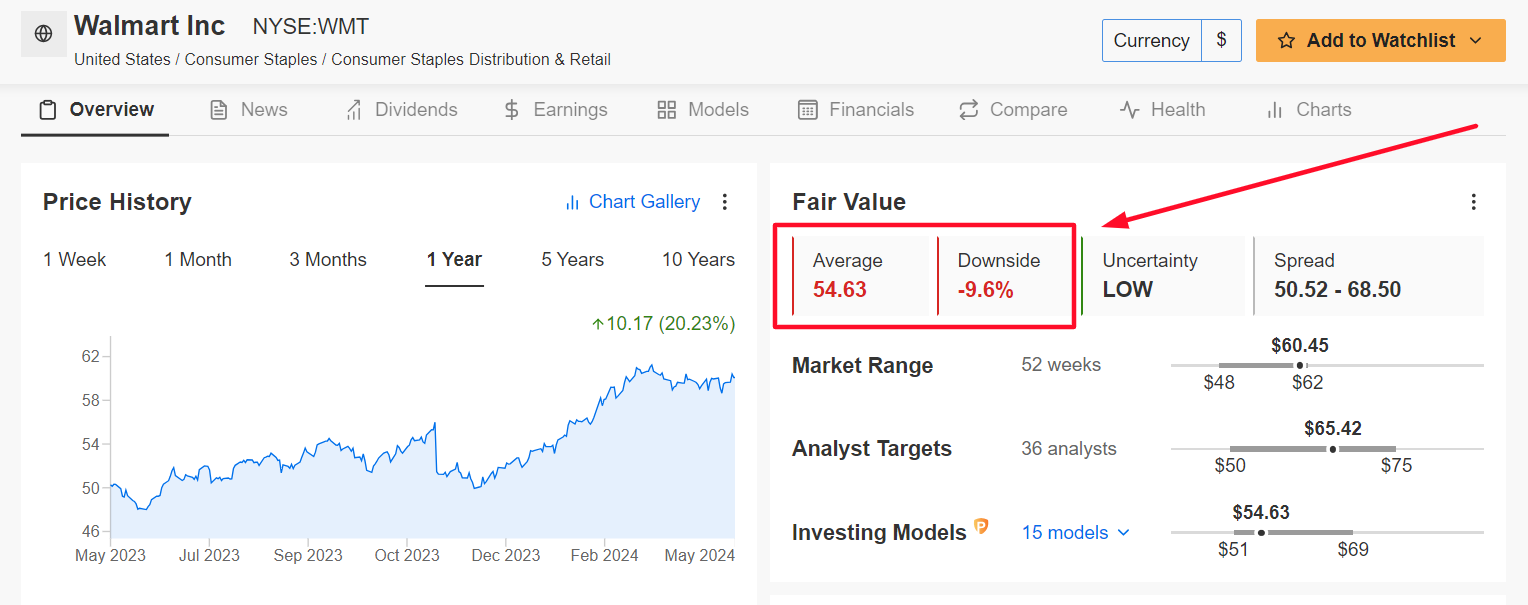

Staying in the retail sector, Walmart (NYSE:WMT) is scheduled to report its Q1 results before the U.S. market opens on Thursday in what will arguably be the biggest earnings report of the week.

The big-box retailer is vulnerable to numerous challenges, including growing concerns over potential food deflation and fluctuating demand for general merchandise.

It should be noted that WMT stock appears to be a tad overvalued, according to InvestingPro’s AI-powered quantitative models.

Source: InvestingPro

Its ‘Fair Value’ price estimate stands at $54.63, which points to a potential downside of nearly 10% from the current market value.

What To Do Now

As investors navigate through the week, the interplay between economic data, Fed policy, corporate earnings, and market sentiment will shape trading dynamics.

With inflation concerns and interest rate expectations on the radar, market participants are advised to remain vigilant for any signals that could influence investment decisions in the days ahead.

Whether you're a novice investor or a seasoned trader, leveraging InvestingPro can unlock a world of investment opportunities while minimizing risks amid the challenging backdrop of elevated inflation, high interest rates, and mounting geopolitical turmoil.

Subscribe here and unlock access to:

- ProPicks: AI-selected stock winners with proven track record.

- Fair Value: Instantly find out if a stock is underpriced or overvalued.

- ProTips: Digestible, bite-sized insight to simplify complex financial data.

- Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters, and criteria.

- Top Ideas: See what stocks billionaire investors such as Warren Buffett, Ray Dalio, Michael Burry, and George Soros are buying.

Disclosure: At the time of writing, I am long on the S&P 500, and the Nasdaq 100 via the SPDR S&P 500 ETF (SPY (NYSE:SPY)), and the Invesco QQQ Trust ETF (NASDAQ:QQQ).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies' financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

Follow Jesse Cohen on X/Twitter @JesseCohenInv for more stock market analysis and insight.