- The inflation data forecasts are pointing toward two contrasting scenarios

- The Core CPI could decline, while the CPI could inch up

- But the question still remains: How will the actual data affect the Fed's decision?

- A +0.4% increase in the Consumer Price Index (CPI) is being forecast.

- On the flip side, the Core CPI, which excludes volatile food and energy prices, is expected to drop by -0.4%.

Today's inflation data release presents an intriguing situation with two contrasting scenarios:

This divergence in forecasts adds an interesting dimension to the situation, particularly considering that the Fed's decision looms on Sept. 20.

Source: Investing.com

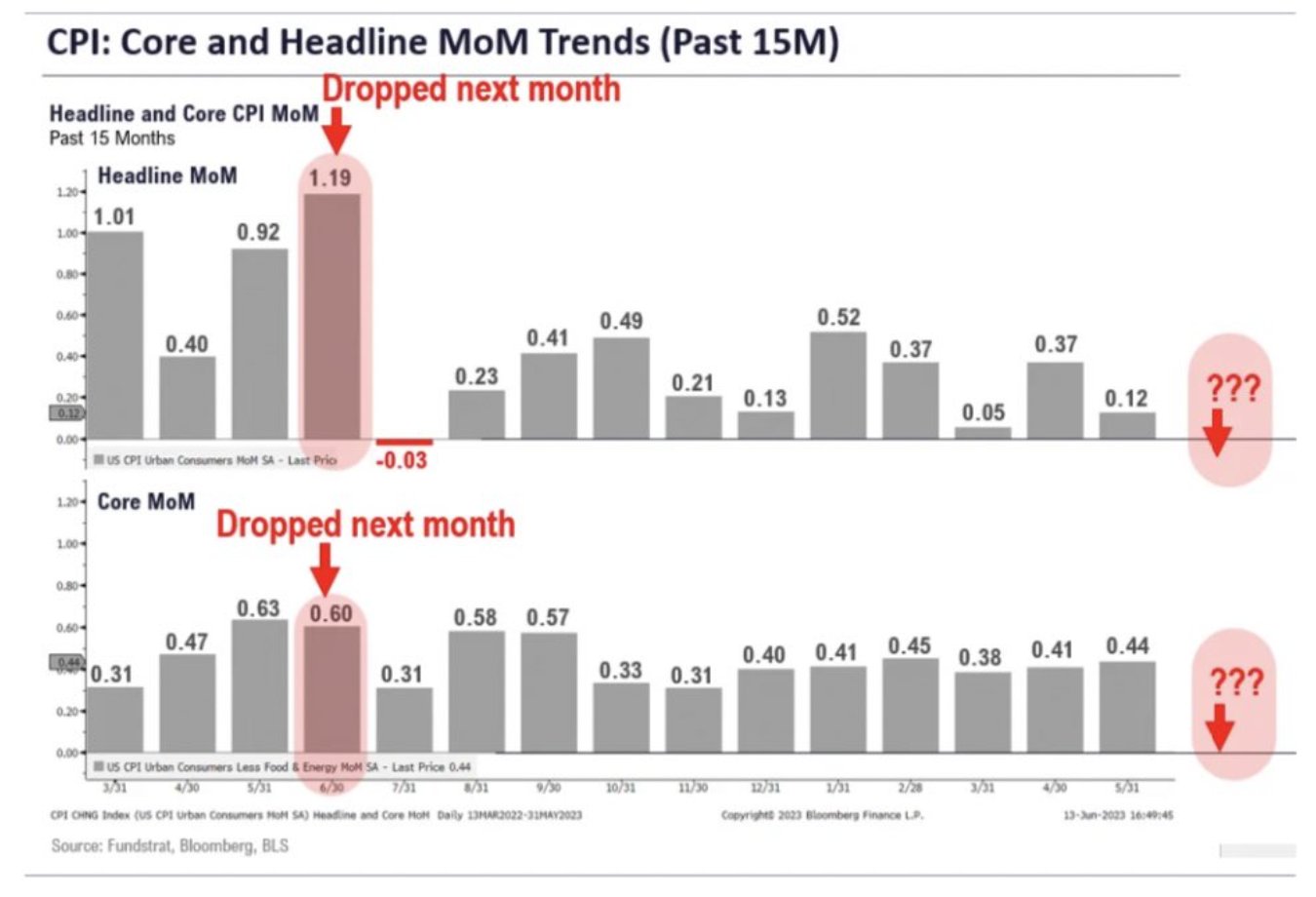

This is primarily because of a significant base effect. The calculation for the reading can be broken down like this:

CPI (t) = CPI (t-1) + CPI Change (t) - base effect

So, for the CPI, it's 3.2% + 0.6% - 0.2%, which equals precisely 3.6%, matching the expected figure.

The same principle applies to Core CPI: 4.7% + 0.2% - 0.6%. Source: Bloomberg Finance

Source: Bloomberg Finance

Here's something noteworthy: for CPI, we need to consider removing this month's reading (which is 0.23) from the equation, resulting in an increased figure this time.

Conversely, for Core CPI, we should expect a smaller change this month (around 0.2%, as per monthly expectations), but we need to subtract a larger base effect (0.58) from it.

In this context, it will be fascinating to observe not only the market's reaction but also how the Core figure's significance compares to the overall CPI figure.

The same curiosity extends to the Fed: Will it hit the brakes on rate hikes because Core inflation is declining, or will it stay the course?

As of now, the odds of the Fed hitting the brakes at the upcoming meeting on September 20 are at a substantial 92%.

Source: Investing.com

Meanwhile, the markets have kicked off the week on a positive note and are gearing up for the data release today with a certain degree of confidence that we'll witness declining readings, particularly in Core CPI.

***

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counseling or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. As a reminder, any type of assets, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor. The author does not own the stocks mentioned in the analysis.