- Q3 S&P 500 EPS growth is expected to come in at 3.4%, the fifth consecutive quarter of growth, yet the weakest quarter in over a year.

- Industrials in focus: Boeing, Honeywell, Southwest, UPS.

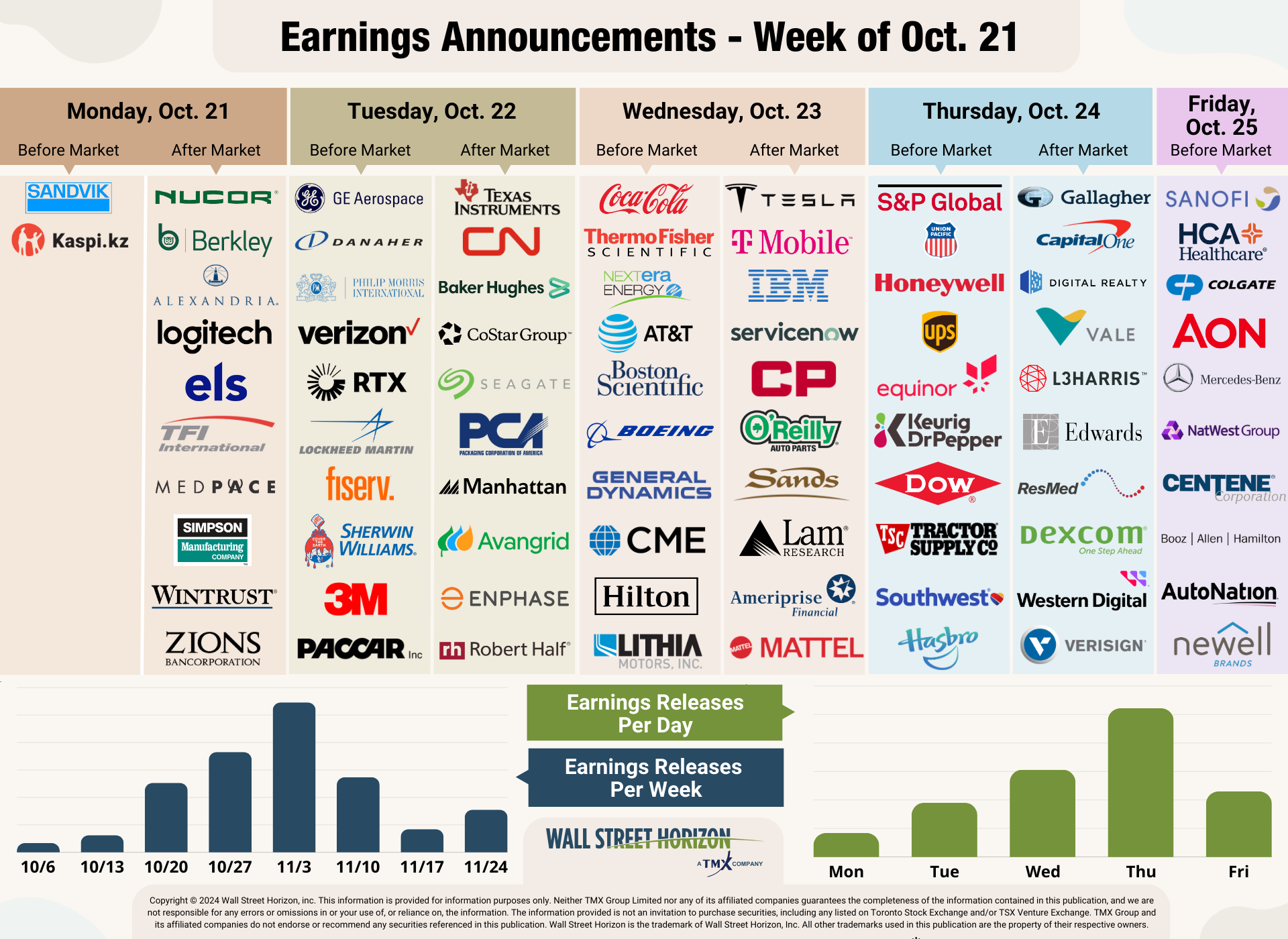

- Peak weeks for Q3 season run from October 28 - November 15

After reaching all-time highs on Friday, the S&P 500 and DJIA took a bit of a breather to start the week as investors waited for the next round of corporate earnings results to come in.

Before the bell on Tuesday, General Motors (NYSE:GM) surpassed Wall Street expectations and raised full-year guidance, causing investors to take the stock about 10% higher after the report. More good news came in from Philip Morris (NYSE:PM) which also saw a nearly 9% uptick in their stock after they beat Q3 expectations and raised EPS guidance.

On the flipside, Verizon (NYSE:VZ) and Lockheed Martin (NYSE:LMT) released what could be seen as disappointing results, which led to a downturn in both of those stocks.

Yesterday, markets continued to retreat in the face of rising yields. The 10-year Treasury yield climbed to 4.2%, its highest level since July, and the Dow dropped 400 points, to its lowest level since early September. Earnings results from Tesla (NASDAQ:TSLA) and IBM (NYSE:IBM) took center stage after the bell, and results were mixed.

The first of the Magnificent 7 names to report, Tesla, came in better than expected on the bottom line but slightly missed top-line estimates. Those numbers were good enough for investors who took the stock 10% higher after the report. Similarly, IBM reported results that surpassed Wall Street estimates on EPS, but not on revenues, investors were not so forgiving of the tech giant. Shares of IBM were down 5% after the report.

With nearly 20% of the S&P 500 reported thus far, the YoY growth rate stands at 3.4%, the fifth consecutive quarter of growth, yet the lowest growth rate in over a year. Despite better-than-expected reports from banks, the blended growth rate fell as a result of analysts lowering EPS estimates significantly for companies that have yet to report. Three sectors in particular have seen the most drastic cuts, Industrials, Energy, and Health Care.

On Deck for the Remainder of the Week

While we haven’t yet hit peak earnings season yet, 1,536 global companies are scheduled to have reported Q3 results by the end of the week. The biggest focus of the week has been on the Industrials names coming out as they are one of only two sectors (Energy) expected to report negative growth on both the top and bottom lines. One of the biggest drags on the blended growth rate has been Boeing (NYSE:BA), which preannounced weak expectations on October 11. When Boeing reported earlier today, results showed they lost more than $6B in Q3, the biggest decline since the COVID-19 pandemic hit in 2020 and halted most aircraft travel.

This morning a batch of Industrials reports hit the tape when Honeywell (NASDAQ:HON), Southwest Airlines (NYSE:LUV), and UPS (NYSE:UPS) all released results for Q3. Results were mixed with UPS and LUV beating on both the top and bottom lines, but HON slightly missing on revenues. Only UPS saw a boost in shares after their report.

Source: Wall Street Horizon

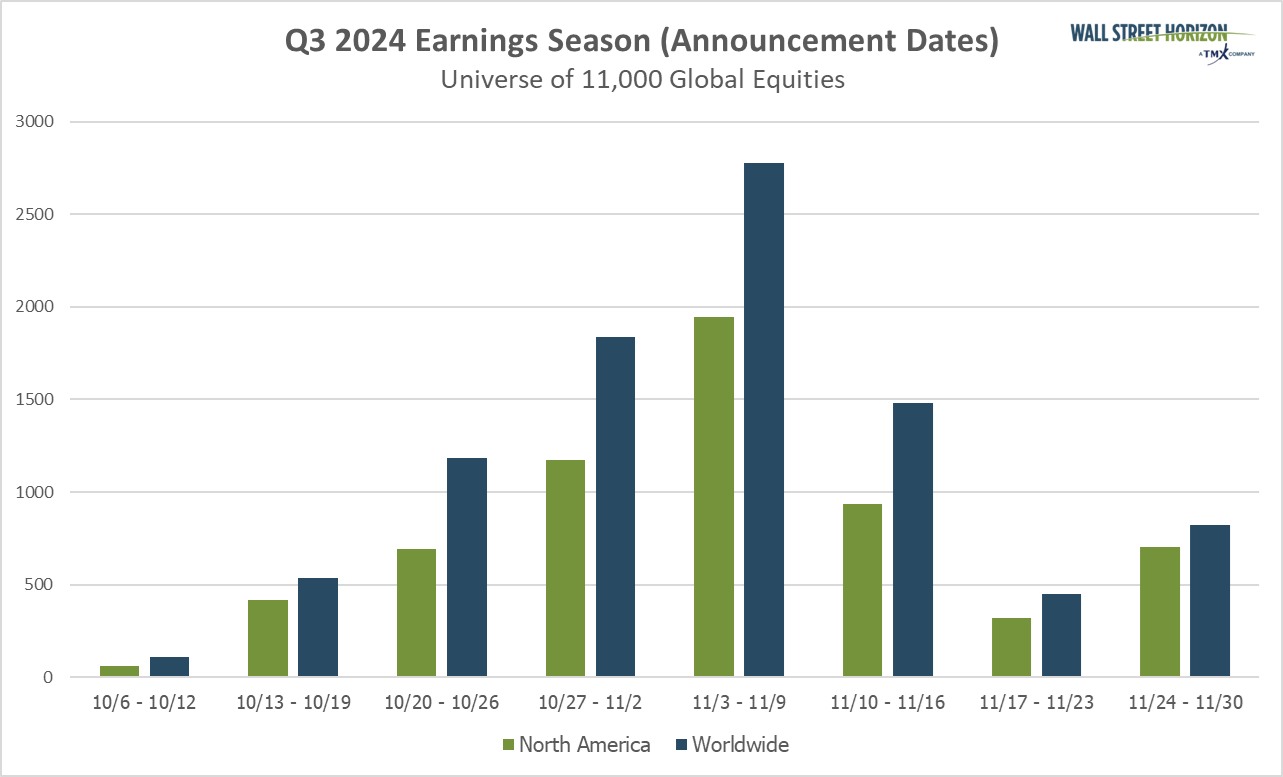

Q3 Earnings Wave

This earnings season, the peak weeks will fall between October 28 - November 15, with each week expected to see over 2,000 reports. Currently, November 7 is predicted to be the most active day with 1,422 companies anticipated to report. Thus far, 69% of companies have confirmed their earnings date (out of our universe of 11,000+ global names), so this is subject to change. The remaining dates are estimated based on historical reporting data.

Source: Wall Street Horizon