- Fed may pause interest rate hike cycle at Wednesday meeting

- Meanwhile, ECB could hike with 2008 peak in question

- EUR/USD could move up following expected decisions by both banks

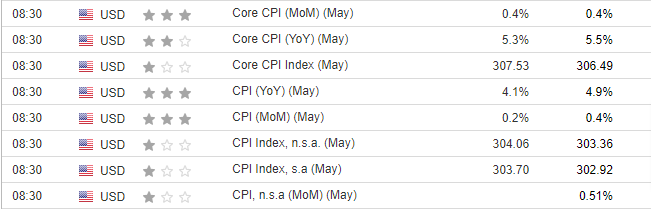

The releases of US and euro zone inflation data this week are set to intensify volatility in the Forex market in the coming days.

In the US, forecasts suggest the downtrend could continue, with CPI reaching 4.1% on a YoY basis. There is also optimism regarding a decrease in core inflation. These figures will set the tone for the markets ahead of the Fed's decision.

Source: Investing.com

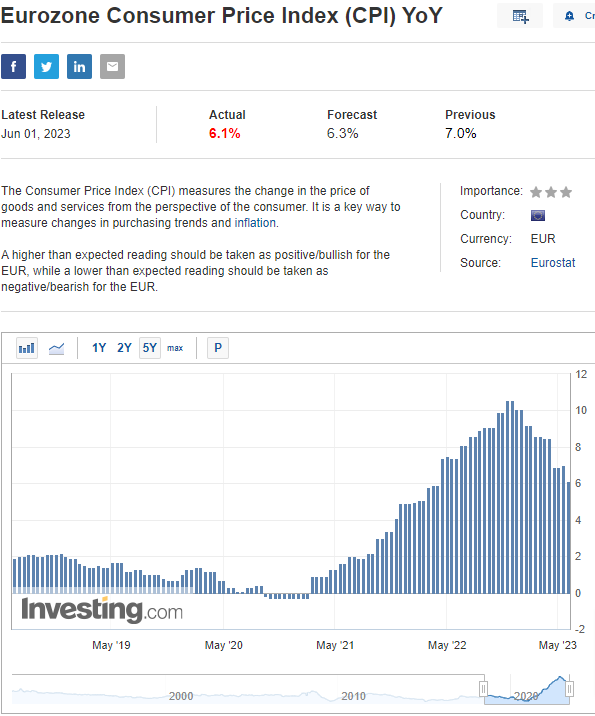

Similarly, in the euro zone, headline CPI is expected to slow down to 6.1% on a yearly basis, while core CPI could drop to 5.3%.

And if that wasn't enough, the Federal Reserve (Fed) and the European Central Bank (ECB) will likely close out their rate hike cycles. Like inflation data, these decisions will play a crucial role in shaping the market sentiment for the next few weeks.

The general expectation in the market is that the Fed will likely pause its cycle tomorrow. On the other hand, the ECB is expected to raise interest rates again, nearing the gap between the two rates.

Will the Fed Surprise Markets With a Hike?

In recent months, market expectations for the level of interest rates in the U.S. from month to month have fluctuated. However, as we approach the decision day, it is widely anticipated that the Fed will pause further interest rate hikes.

This aligns with Chairman Powell's remarks regarding the need to assess the impact of previous rate hikes on the economy. Nevertheless, the market continues to view this pause as temporary, with a probability of nearly 60% that the Fed will resume raising rates from July onward.

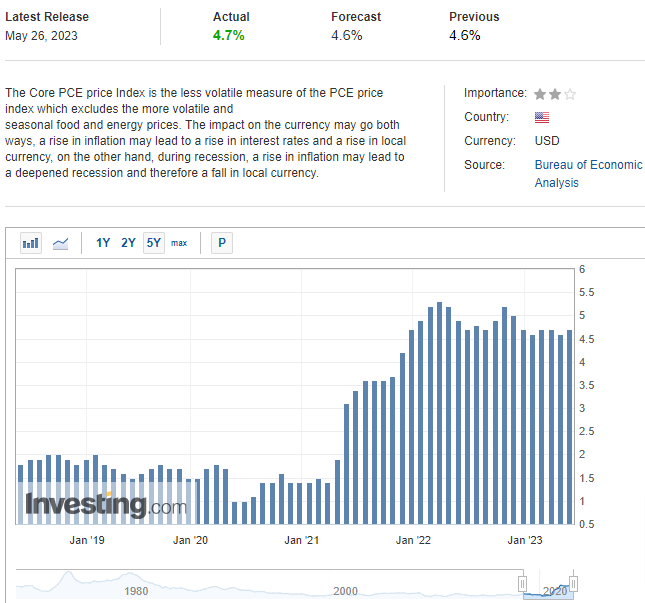

Why does the market assume further increases despite the decline in inflation?

It appears that the continued strong labor market, combined with the negative surprise of the core PCE index, which rose to 4.7% y/y in April, may force Federal Reserve officials to maintain a hawkish stance.

But this seems to have already been discounted by investors.

Consequently, the lack of a surprise hike as early as tomorrow's meeting could be the starting point for a weakening of the US dollar.

ECB to Continue Hiking

Given that the European Central Bank started its hike cycle after the Fed, the next two meetings should be marked by 25bp hikes. This means that we should witness a leveling off of the 4.25% level that was reached in 2008.

Whether the ECB stops there above all depends on the dynamics of inflation, which despite strong declines (caused mainly by energy prices), remains significantly above target.

The next readings will not be published until after Thursday's meeting, but they will remain crucial in the context of the monetary policy decisions in the coming months.

It is critical for the core inflation to consistently head lower, as this is one of the basic conditions for the ECB to pause hikes or consider cutting rates.

While the debt crisis in euro zone countries, particularly Italy and Greece, has subsided in recent years, the recent rise in interest rates within the euro zone poses a risk of bringing this issue back into focus.

It is important for the ECB to be mindful of this potential resurgence going ahead.

EUR/USD - Technical View

If the basic scenarios come true: a deceleration of hikes in the US and further increases in the euro zone, then depending on the statements, EUR/USD could surge.

The confluence of the demand zone and the equality of corrections located in the price area of 1.06 are key.

Currently, buyers have halted their momentum just before reaching the indicated area. However, it would be prudent to monitor the price reaction if a retest of that level occurs.

If sellers are unable to test the mentioned confluence and there's another surge, the target for bulls would be $1.12.

The InvestingPro tools assist savvy investors in analyzing stocks. By combining Wall Street analyst insights with comprehensive valuation models, investors can make informed decisions while maximizing their returns.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counseling, or investment recommendation. As such, it is not intended to incentivize the purchase of assets in any way. As a reminder, any type of asset is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remain with the investor.