When considering the chart for crude oil, there is really only one question to answer and it is simply this – how low can it go?

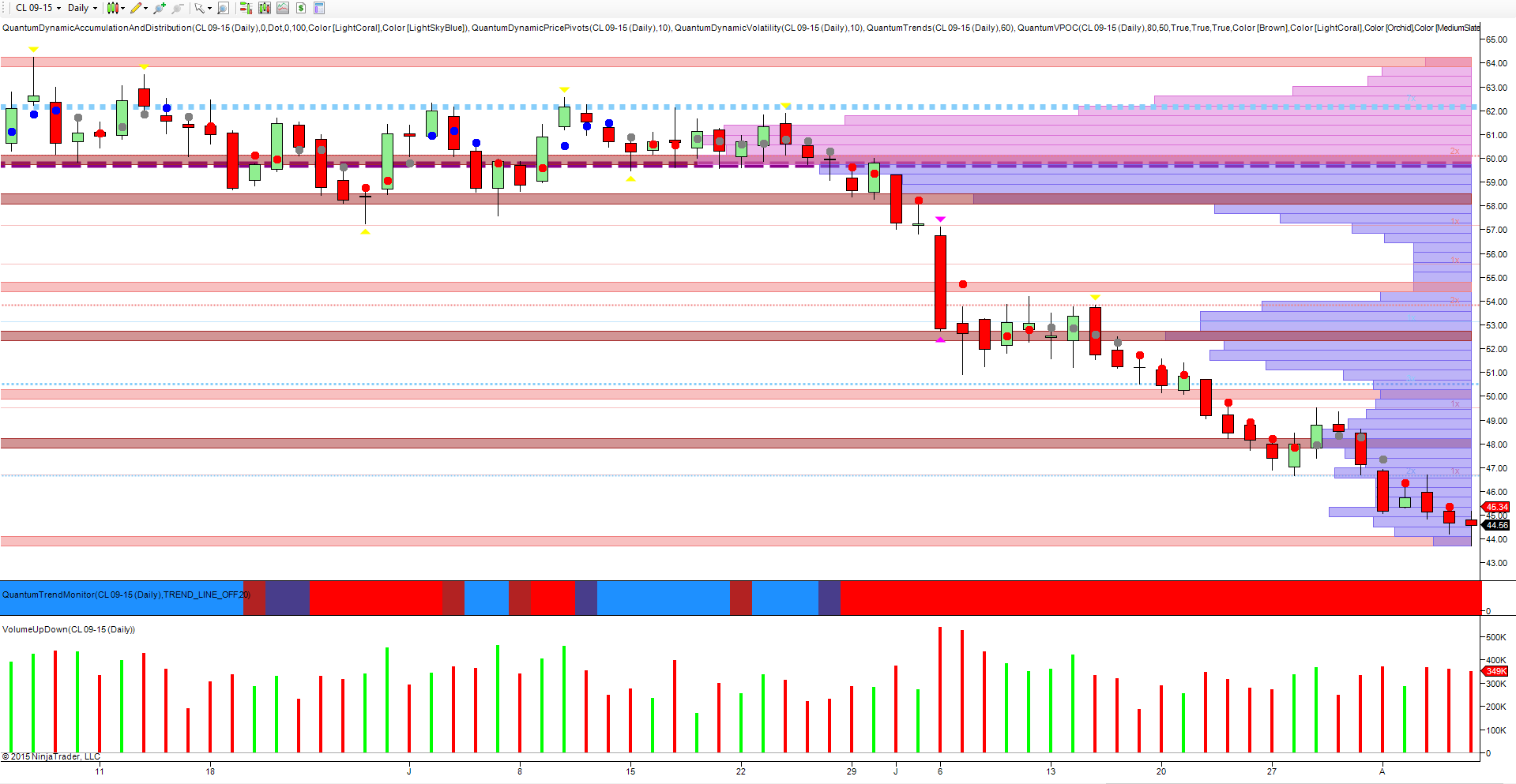

To answer that particular question, we need to consider the charts across a variety of time-frames. If we start with the daily chart, the self evidence of the bearish picture speaks for itself, with the VPOC (volume point of control) remaining firmly in the $59.80 per barrel region, with the transacted volumes at this level confirming the sustained pressure that has been driving oil prices ever lower.

Since early June we have seen oil's price find some support on the high volume node at $52.50 per barrel, before continuing to move lower once again, through the low volume node at $50 and down to the next high volume node at $48 per barrel, where prices paused once again. Finally, towards the end of July, the price of oil broke below this node to approach the low volume node now waiting in the $44.00 per barrel region, with the market closing just below at $43.70 per barrel.

Given this is a low volume node, we can expect to see this breached easily, with little transacted volume to provide a platform of potential support. Moving to consider the volume price relationship, volumes throughout July and August have been average, and certainly do not suggest any degree of buying at this level on the daily chart.

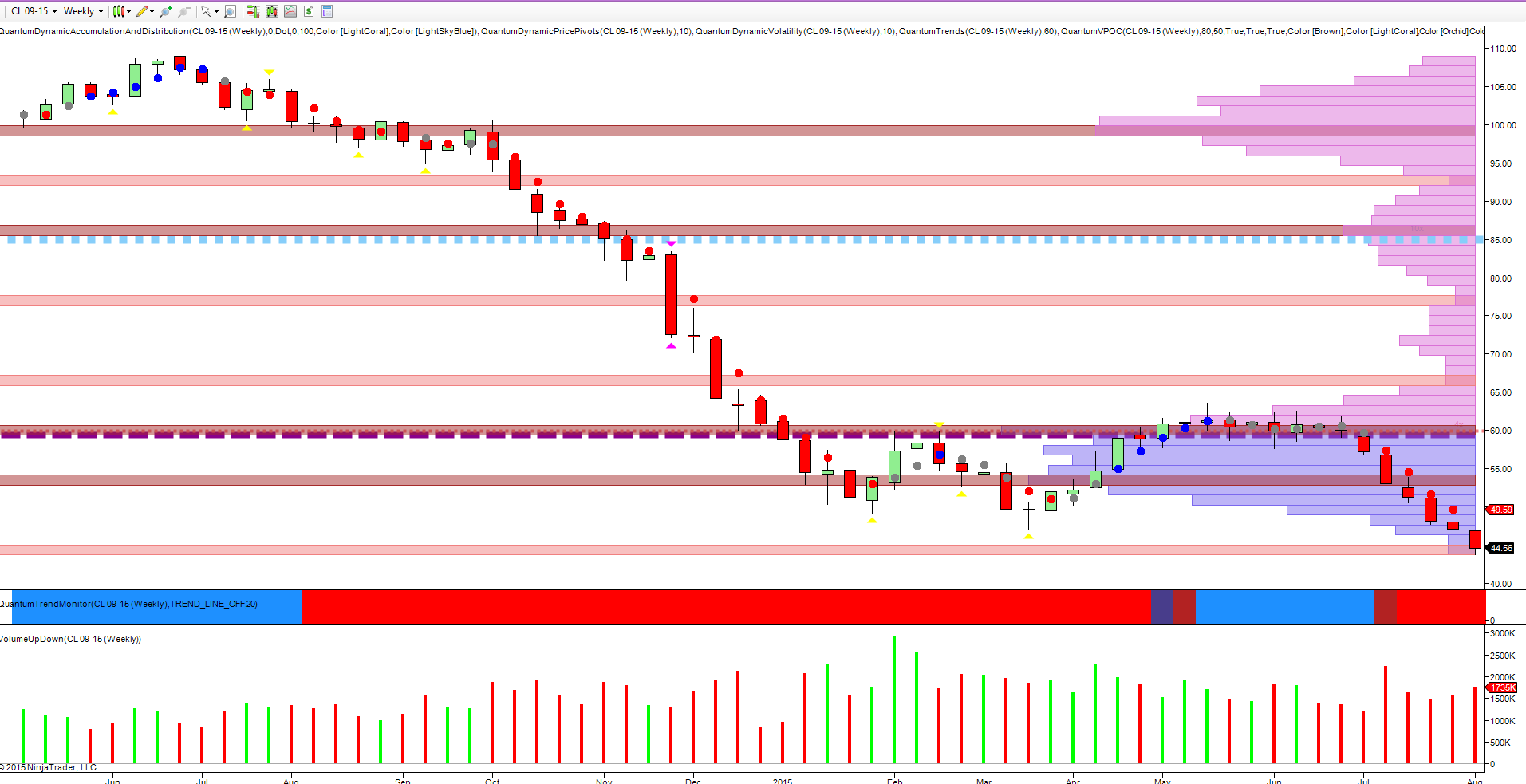

The weekly chart tells a similar story, with the fulcrum of the VPOC now sitting well above the current price action, just below the $60 per barrel area. With last week’s price action having taken out the low of March at $47.09, this has added yet further bearish sentiment to an already waterlogged commodity.

Here too on the VPOC we are approaching a low volume node and can therefore expect this to be taken out with little effort. In addition, the volume/price relationship is confirming the bearish picture of the last three weeks, with rising volumes and a falling market, again signalling the lack of any significant buying at present.

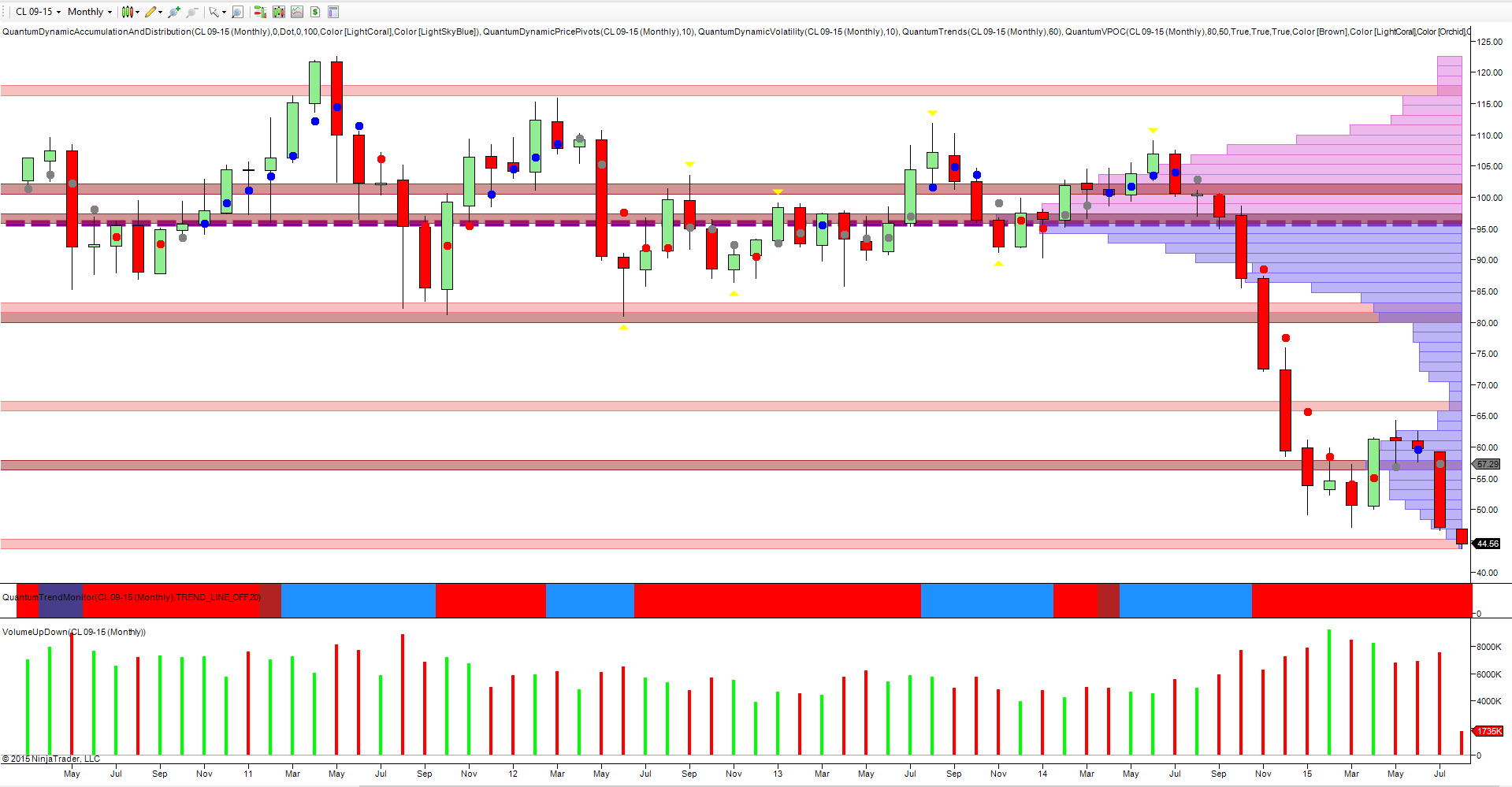

Finally, to the monthly chart. Once again we have breached the high volume node on the VPOC indicator in the $57.29 per barrel region and are now testing the low volume node at $44.50 in this timescale. Last month’s increase in volume confirmed the wide spread down candle, which saw oil prices fall over $10 per barrel in the month.

For the time being, the price war continues unabated, with the battle lines drawn: OPEC on one side and the alternative suppliers on the other. Only time will tell who will blink first, and even the weekly oil inventories seem to have been relegated to the ‘also rans’ of the news, with last week’s big draw in inventories failing to spark any kind of meaningful rally.

The gyrations of the US dollar also seem to be passing largely unnoticed, with the longer term price war now dominating oil prices. In the short term, we are likely to see oil continue lower and down to test the $40.85 per barrel level in due course, with any move through this area then opening the prospect of a move towards the $36.47 per barrel level last seen in 2003.

From a fundamental perspective what is interesting to note is that of all the oil producers only Norway is equipped to withstand oil prices at $40 per barrel and balance its 2015 budget. By comparison, Venezuela needs oil to be at least $160 per barrel, but with the December 2020 contract currently priced at $62.05 OPEC’s gamble is looking increasingly misguided.

Finally, what I find perplexing whenever these current trends develop and prices fall so dramatically—nobody thanks the speculators, but when prices rise we are everybody’s whipping horse!