- US 10-year bonds have reached the highest levels since 2007

- PMIs for the US economy continue to show a negative trend

- Meanwhile, a bearish session for the Nasdaq 100 indicates a high risk of further declines

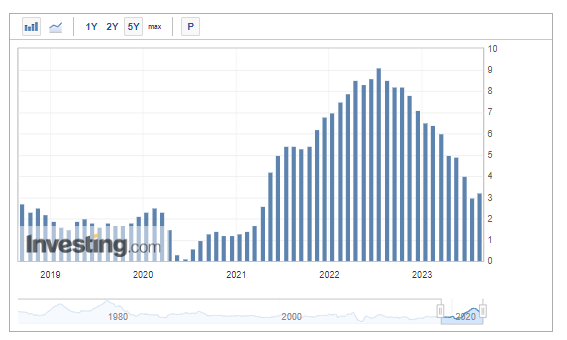

Earlier this week, US 10-year yields reached 4.36%, the highest point in over a decade. This comes as part of a medium-term upward trend that began in April of this year, fueled by both fundamental and technical factors.

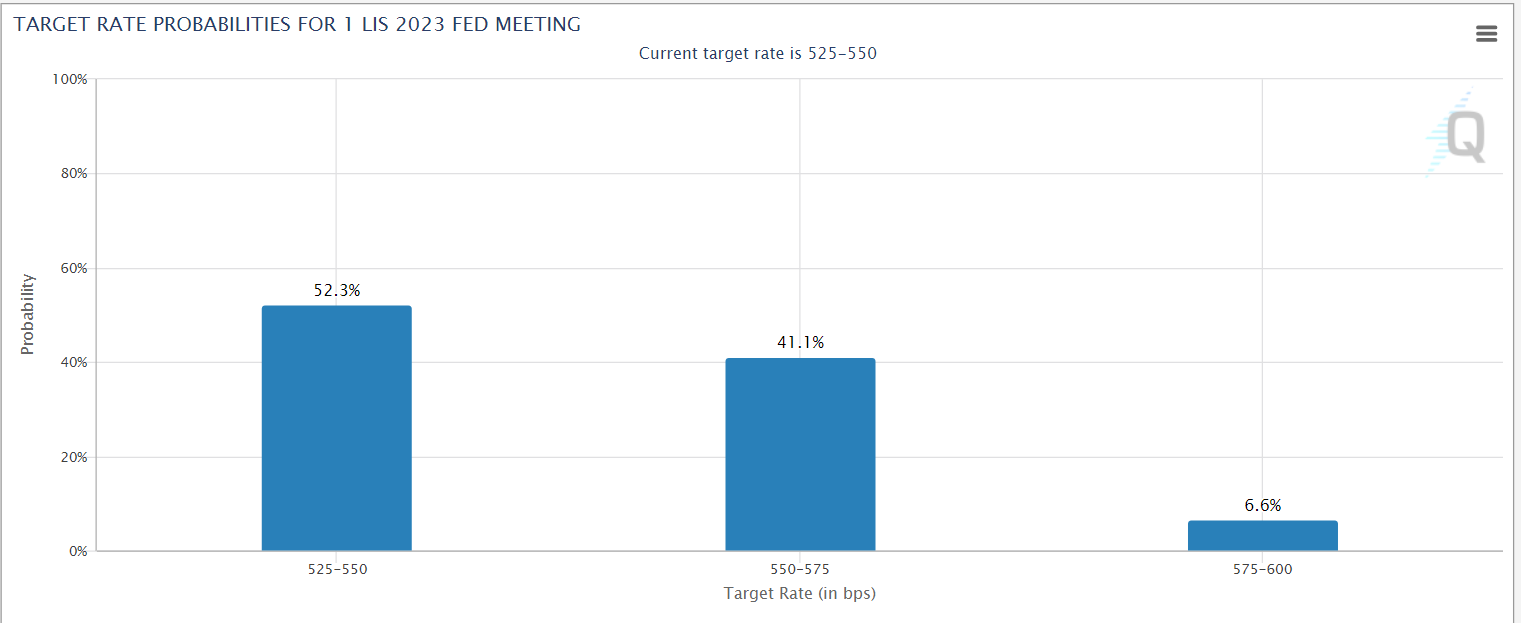

The market's concern about rising inflationary pressures and their impact on monetary policy is the primary driver behind the bonds' rally. Currently, the probability of another hike is increasing and is already above 40% for the Fed's November meeting. Source: www.cmegroup.com

Source: www.cmegroup.com

As a result, US stock indexes are having a challenging week, and yesterday's weak trading session could potentially further reinforce the downward trend — despite the highly positive surprise in Nvidia's (NASDAQ:NVDA) earnings.

However, the final verdict for the weeks ahead remains uncertain until the culmination of the Jackson Hole symposium later today and Federal Reserve Chair Jerome Powell's speech.

Where Will US 10-Year Bonds Stop?

The U.S. bond market is sending a clear signal that the fight against inflation may be much more challenging than previously expected. Although the 10-year has rebounded lower in recent sessions, the upward trend is still in effect.

The latest CPI readings were slightly better than forecast but showed the first monthly y/y increase since last July.

This indicates that even though there was solid advancement in the first half of the year, achieving the 2% target will be akin to climbing an 8,000-meter peak. As you ascend, gaining additional meters—here, percentage points—becomes progressively harder. If upcoming readings confirm the trend reversal, it might lean towards another interest rate hike.

US Services PMIs Approach 50-Point Mark

Apart from GDP, the main factors that indicate the well-being of an economy, namely the services and manufacturing PMIs, are still giving us no reason to feel upbeat. The figures released this week for July were notably lower than predicted, especially concerning services. This aspect could play a pivotal role in maintaining inflation dynamics above the target.

The services sector is showing more resilience compared to the manufacturing sector and remains above the critical 50-point threshold that distinguishes growth from slowdown. When it comes to tackling inflation, it would be beneficial to see a string of negative readings persist, as this would indicate slowing economic activity and abating inflationary pressures.

Nasdaq 100: Bears Remain in Control

Earlier in the week, there seemed to be an opportunity to wrap up the correction as the pace of declines eased and the Nasdaq 100 had a rebound. However, yesterday's trading session, where more than half of the upward recovery was wiped out, indicated that the bears still hold sway.

This suggests the possibility of further declines from this point. The bears have a fairly wide margin for downward movement, given that the closest support level lies just below 14,000 points within a significant support zone.

If the bearish situation unfolds, paying close attention to the supply-side dynamics would be prudent. In case of a correction to the upside, a move toward previous support areas would be good signal to consider long positions.

***

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counseling or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of assets, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.