DXY eased last night EUR popped. A little lift in CNY aided the latter:

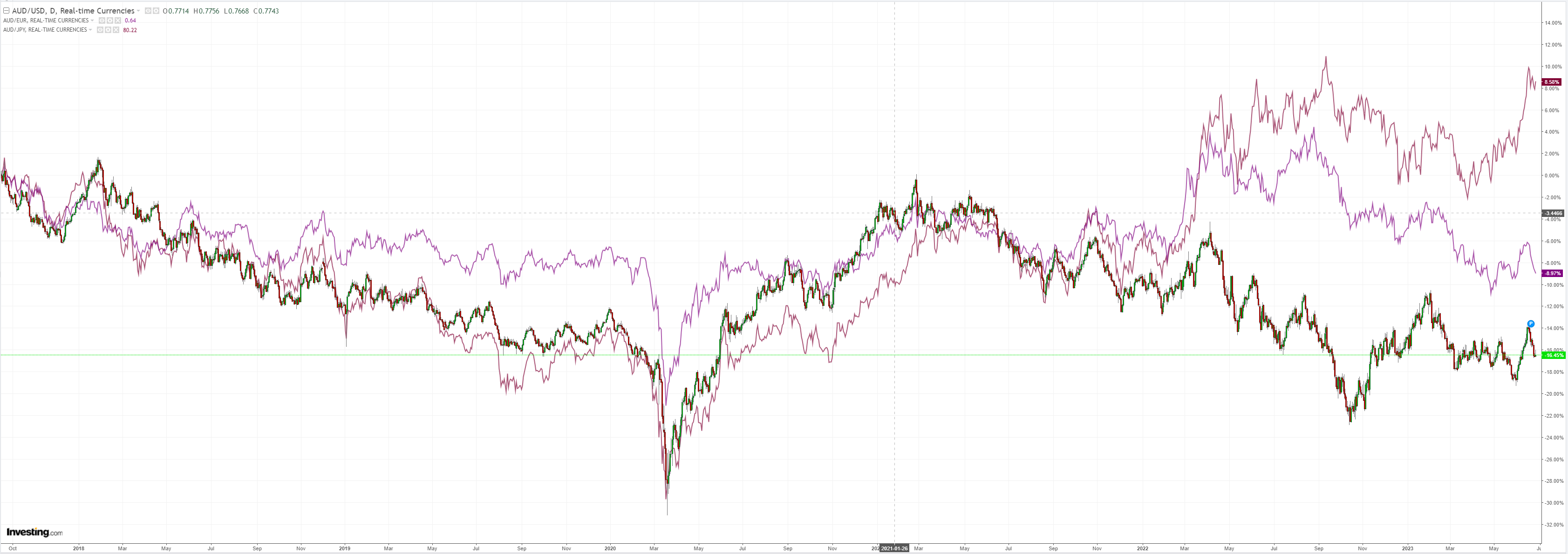

AUD trod water:

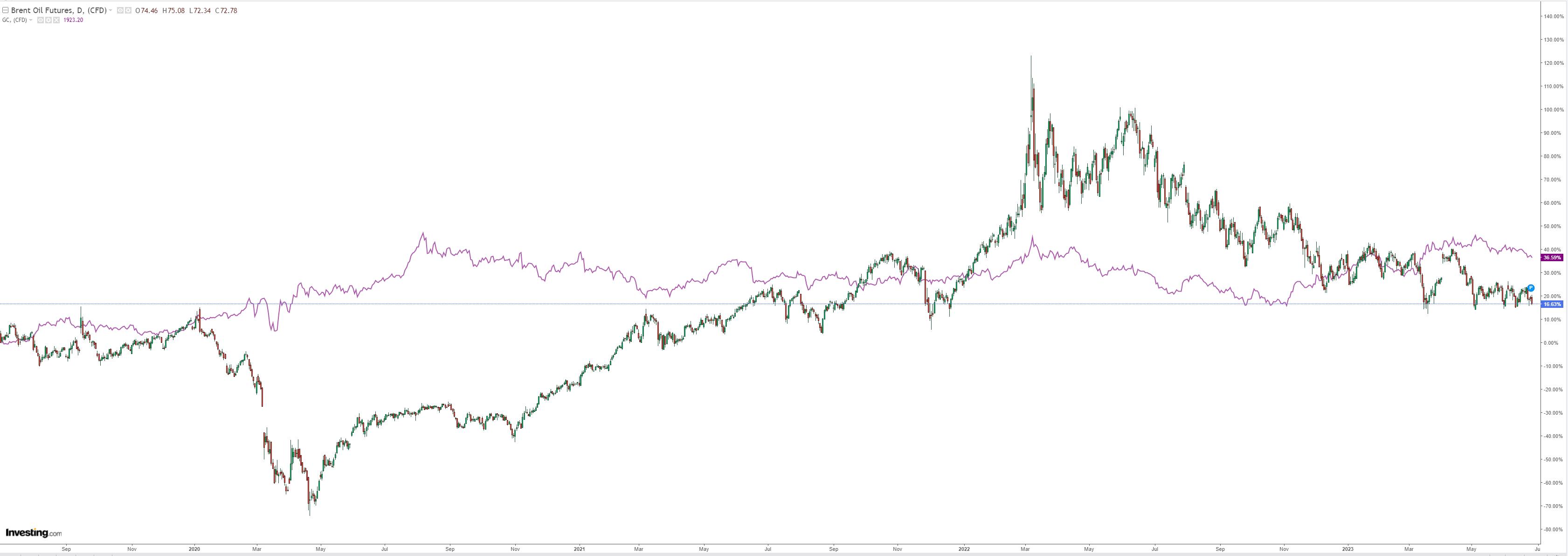

Oil needs another output cut:

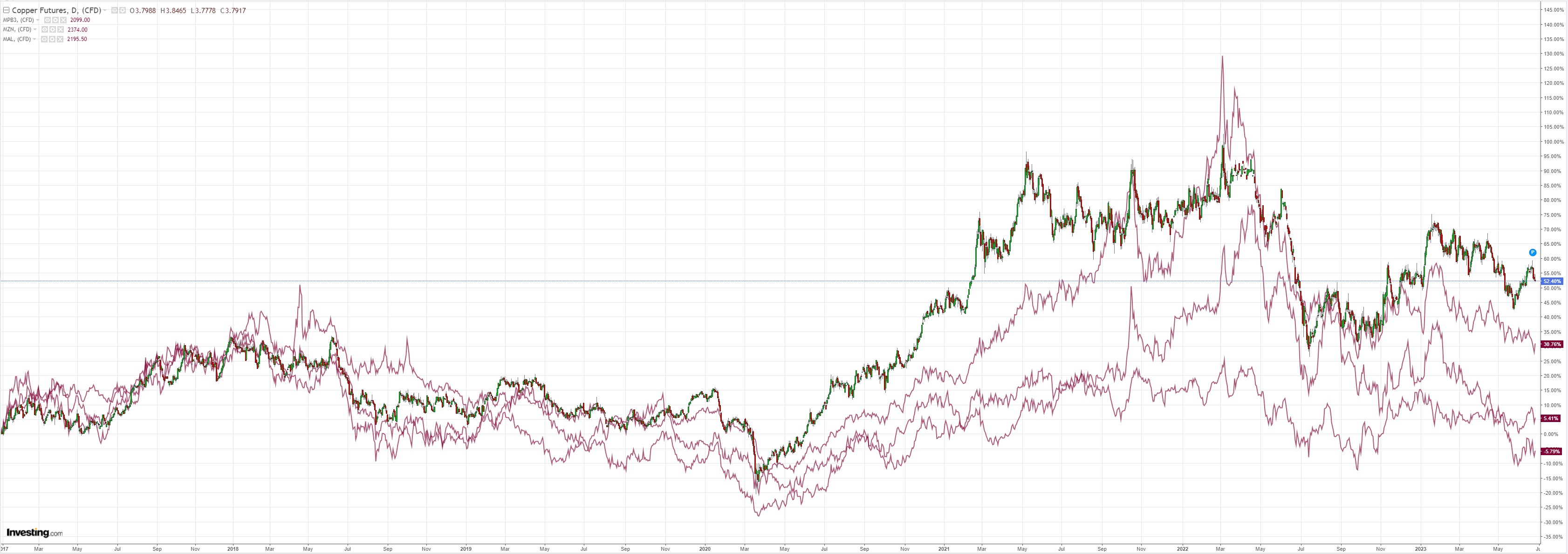

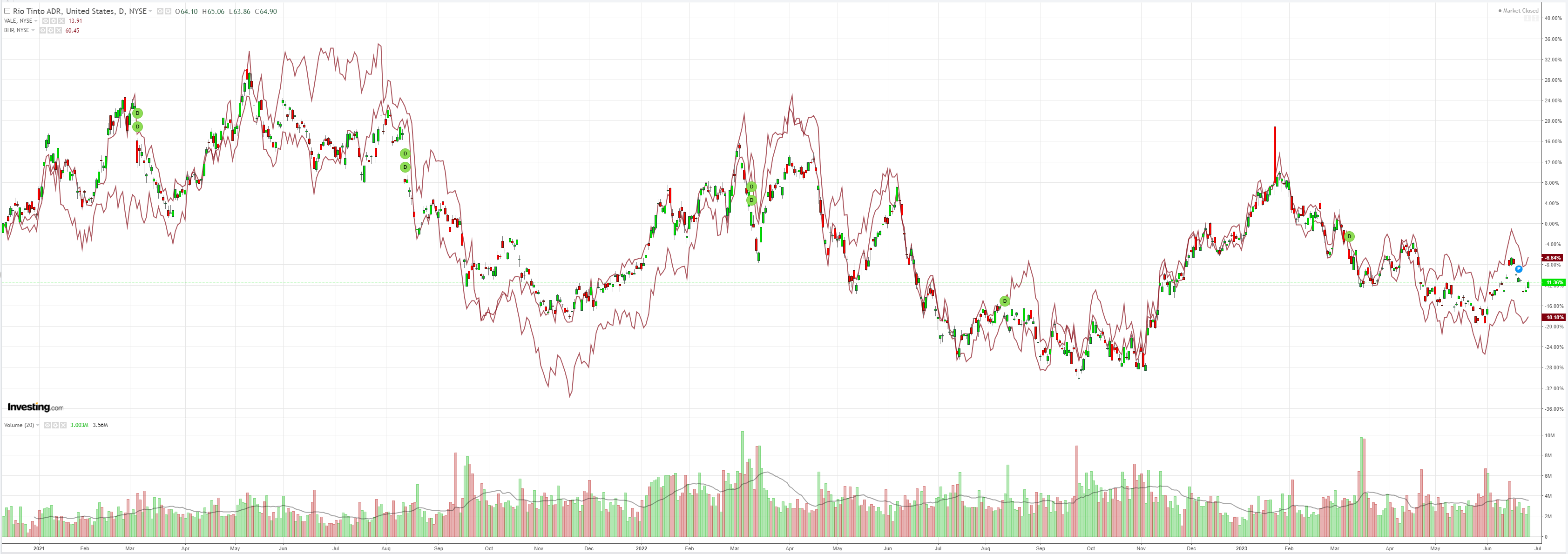

Dirt was mixed:

Miners (NYSE:RIO) lifted with iron ore:

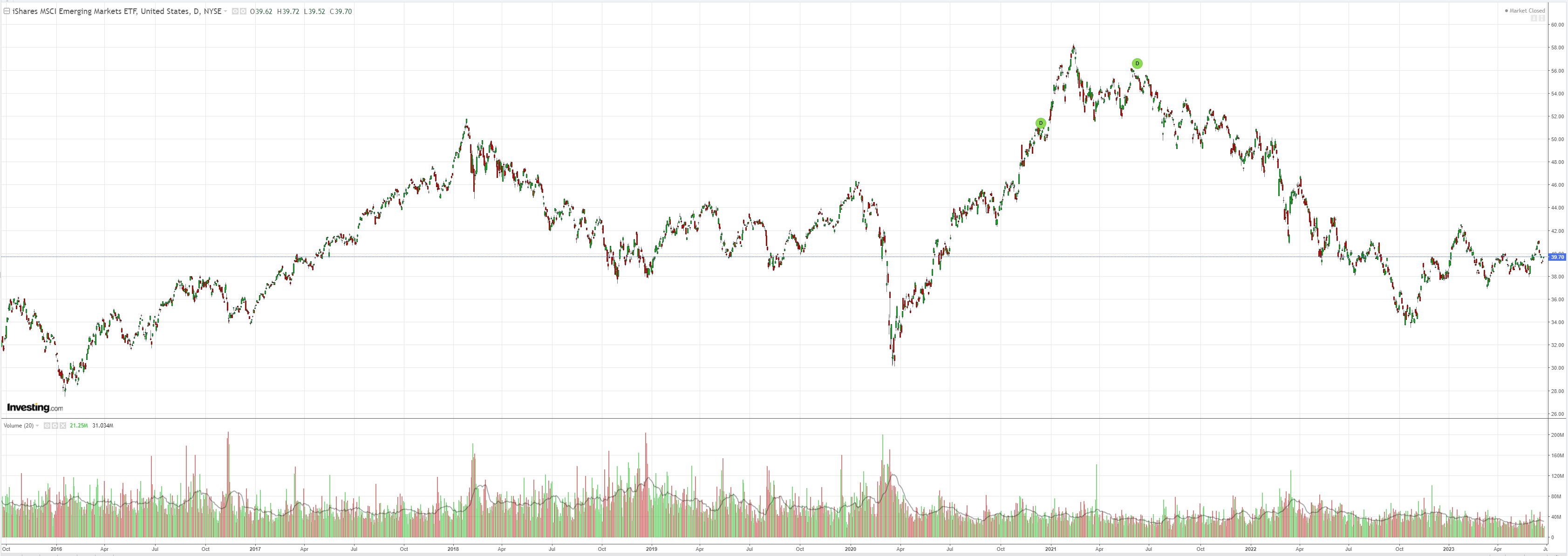

EM stocks (NYSE:EEM) yawn:

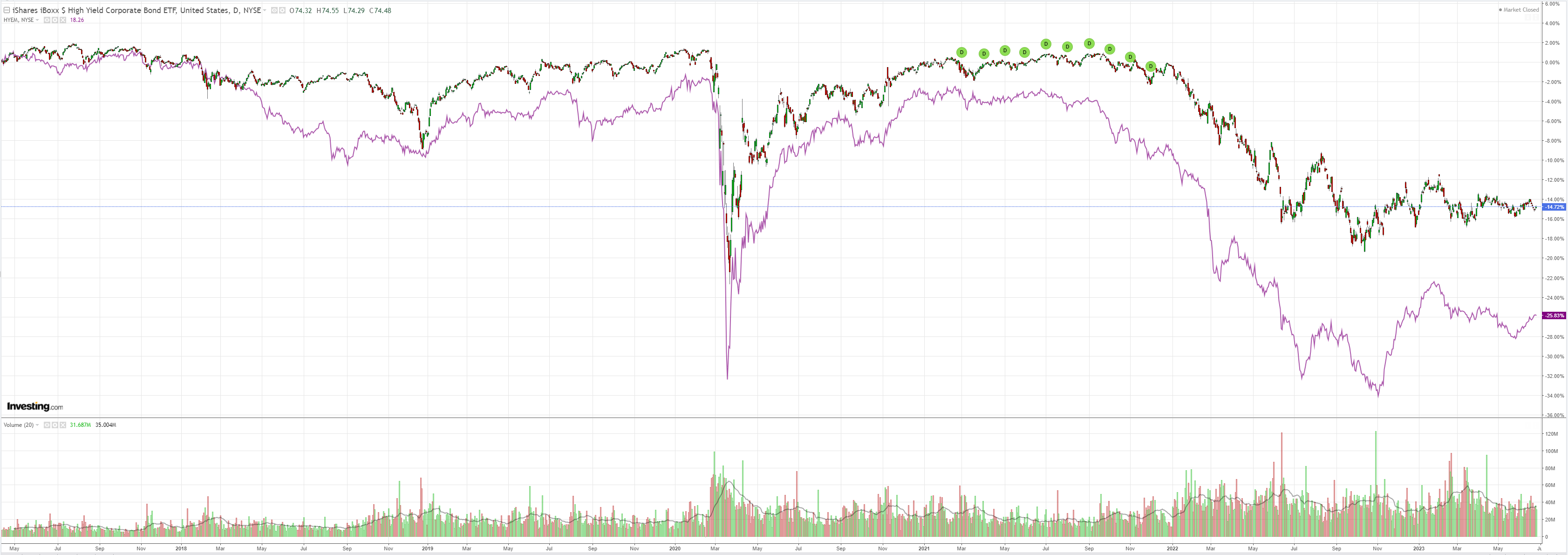

Junk (NYSE:HYG) is doing OK:

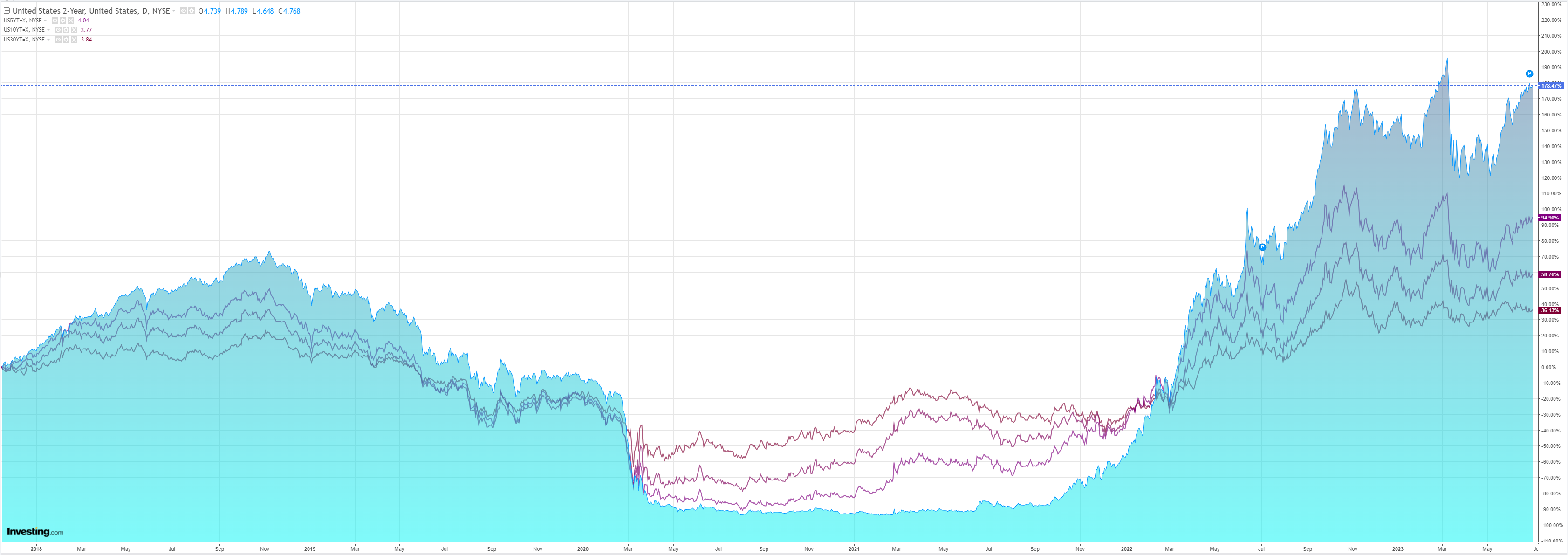

Yields firmed:

Stocks partied:

US data thumped along. Goldman:

- The Conference Board index of consumer confidence increased by 7.2pt to 109.7in June — 5.7pt above consensus expectations — from a slightly upwardly revised May level (+0.2pt to 102.5). Both the present situation (+6.4pt to 155.3) and expectations (+7.8pt to 79.3) components increased. The labor differential — the difference between the percent of respondents saying jobs are plentiful (+3.5pp to46.8%) and those saying jobs are hard to get (-0.2pp to 12.4%) — rebounded(+3.7pt to 34.4) after falling 5.9pt in May. The cutoff date for the preliminary results was June 20.2.

- Sales of new single-family homes increased by 12.2% in May to a seasonally-adjusted annualized rate of 763k units. The level of sales in April was revised down slightly (-3k to 680k). May sales increased month-over-month in the South (+48k), West (+26k), Northeast (+6k), and Midwest (+3k).3.

- This morning’s data indicated a firmer pace of residential, inventory, and equipment investment in the second quarter. We boosted our Q2 GDP tracking estimate by 0.4pp to +2.2% (qoq ar).

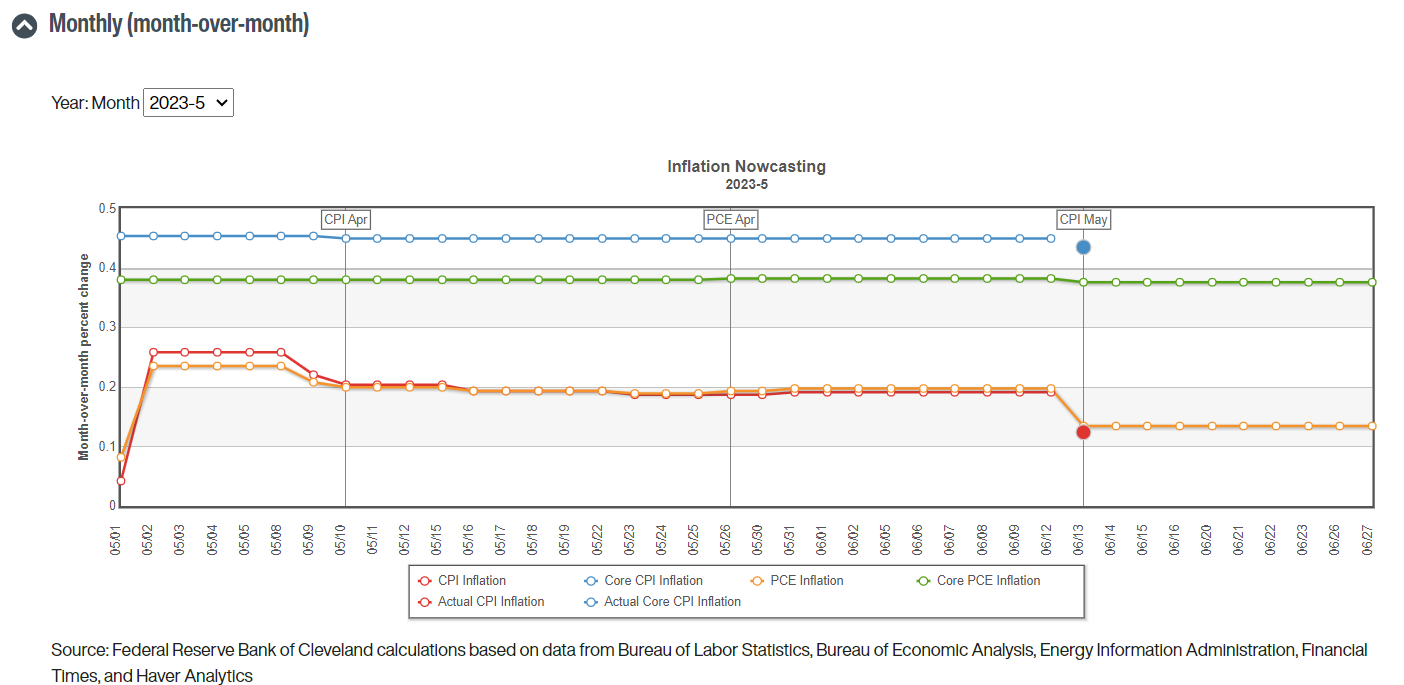

Always remember that the stock market does not discount recoveries, it creates them. The issue is not that the US economy can’t generate growth, it is that the inflation task is incomplete. Core PCE is still far too high:

And another rate hike in July is all but priced in:

The stock market is gambling that CorePCE will fall far enough to placate the Fed, but by doing so, it is dramatically decreasing the chances of it happening.

AUD is as flies to wanton boys in this environment.