As the Fed started lifting interest rates aggressively in early 2022, pundits almost universally declared the end of the housing market. Taking the rather lazy approach of projecting what happened in 2008-2010 and just changing the year, utter disaster was forecast for home construction, home sales, and home prices.

The more clever analyses mused about how the higher interest cost of a mortgage lowered the amount of home that can be bought by a given payment, and suggested that home buyers would naturally back up their bids by that much and sellers would be obliged to hit those bids.

The Case-Shiller Home Price futures, which are (thinly) traded on the CME, went from pricing in additional upward movement in home prices to pricing in a collapse worse than the post-financial-crisis debacle. For example, the February 2024 futures dropped 22% between May and November 2022. Keep in mind that these futures track nominal prices, so at the worst levels the futures market was pricing in something like a 25% drop in real prices.

That was never going to happen, especially in a housing market that was much, much tighter than in 2007. In the summer of 2007 there were approximately 3.4 million existing homes on the market; in the summer of 2022 the figure was about 1.2 million. And, as it turns out, homeowners did not hit any bid that was shown, which would have been irrational in an inflationary environment.

Nominal home prices are sticky on the downside anyway, because buyers don’t like to sell below other recent prices which serve as an ‘anchor’ for their expectations. All of which is to say that 2007 really was an amazing outlier in a lot of ways: price, activity, builder activity, financial buyer activity, mortgage structuring, and home inventory. The current situation is much different.

Naturally, we all know that now as we have noticed that home prices have not in fact collapsed. But they have declined in real terms, because the overall price level has advanced while home prices have been flat. Given the level of inflation, this has actually changed the level of home valuation fairly substantially in a short period of time and I thought it worth pointing out.

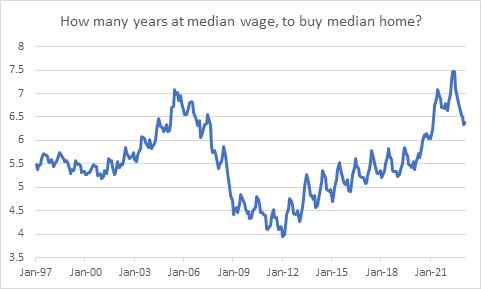

Consider the following chart (Source: BLS, ADP (NASDAQ:ADP), National Association of Realtors, author’s calculations). It plots the Existing Home Sales Median Price divided by the Median Annual Wage. I’ve used the Atlanta Fed’s Median Wage figures and converted them to annual wages so that the series matches, for the most recent point, the median annual wage reported by ADP.)

By doing this, we can see roughly how many years’ wages it would take to purchase the median home outright. Note that one of the series is seasonally-adjusted and one is not, which causes the scalloping effect you see. I could correct for this, but figure this is close enough to make the main point.

And the main point is that as home prices have stagnated and wages have been rising rapidly to keep pace with inflation, the cost of a home relative to the wages people are receiving has dropped pretty sharply.

Although this measure doesn’t tell the whole story, you can see how there was a reasonable concern that home prices may have been getting ahead of themselves somewhat (although with extremely low inventory, that’s not necessarily unsustainable in the medium-term). However, since last summer homes have gotten much cheaper, by just staying in one place.

Don’t get locked in on the nominal price. That’s called money illusion, and in an inflationary environment it leads to mistakes.