This article was written exclusively for Investing.com.

The FOMC meeting came and went on Sept. 22 with a strong message that the course of monetary policy was shifting from very dovish to something that really seemed almost entirely unexpected, hawkish. It seems clear from the press conference that unless there is a significant disappointment in jobs data for September, the Fed would likely begin to taper in November.

There was more than that in the Fed’s underlying message, and perhaps the equity market didn’t quite grasp that point. The idea is buried deep in their projections for the Federal Funds Rate, which indicates more rate hikes and sooner than previously noted. All of this as the Fed also downgraded GDP growth for the balance of 2021.

The Fed’s message is unmistakable. Economic growth will be slower than previously thought, and monetary policy will be tightening sooner than expected.

More Rate Hikes and Sooner

It seems clear that tapering is coming at the next meeting and that the Fed would like to have tapering completed by sometime around June or July of next year. What was a surprise was that the Fed is now projecting the potential for one rate hike in 2022, with the Federal Funds rate moving to 0.3%. That was a notable change from the June FOMC meeting, where no rate hikes were seen.

More surprising is that the projects now note between three to four rate hikes by the end of 2023 in total, with the Federal Funds rate at 1%. That is up dramatically from the forecasts in June for the rate to be at 0.6%. It may seem minor, but two more rate hikes than previously anticipated isn’t.

Slower Growth

Additionally, the Fed downgraded GDP growth in 2021 to 5.9% from 7%, a massive drop since the June meeting. They did increase the growth forecast for 2022 to 3.8% from 3.3%, which doesn’t seem to make up for the lost growth of 2021.

The Markets Response

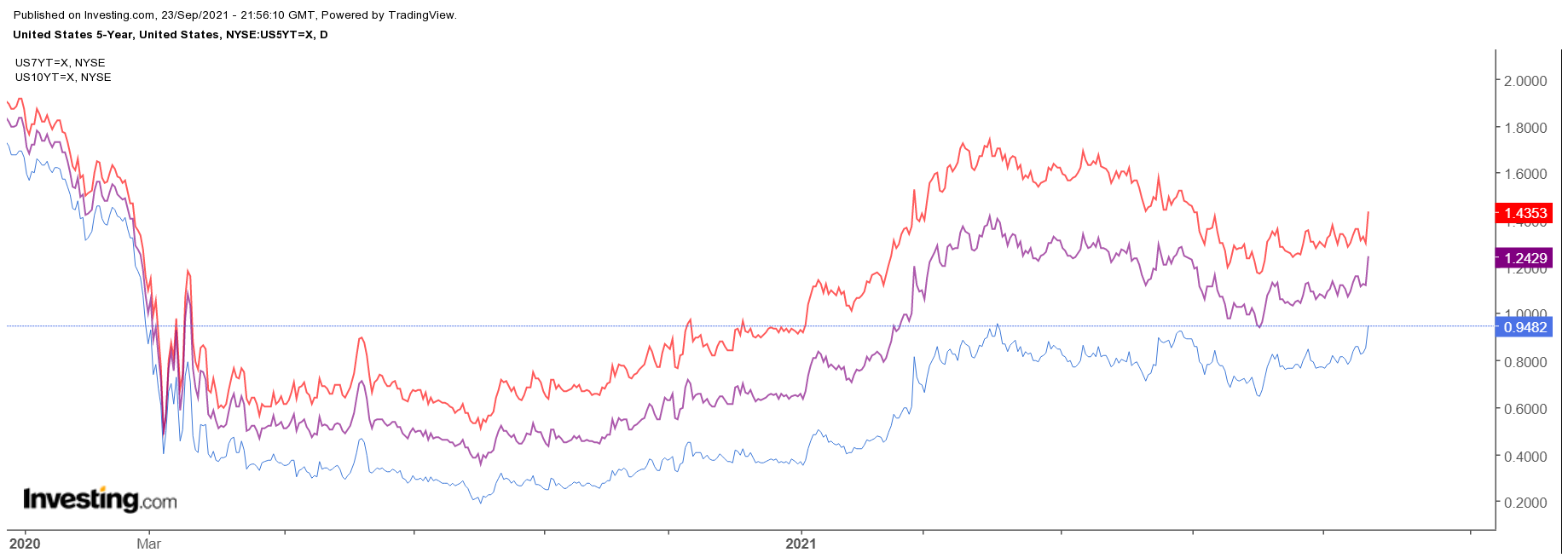

The bond market appears to have responded appropriately to this shift in the Fed’s stance, with rates rising on the shorter end of the yield curve. The longer end of the curve has seen rates rise as the market adjusts to the prospects of the Fed pushing rates higher over the longer term. However, with QE essentially coming to an end by the middle of next year, rates on the shorter end of the curve should rise faster than those on the longer end resulting in the yield curve flattening.

The most interesting response to all of this was from equity markets, which rallied rather dramatically since the news first broke. It seems that the equity market didn’t notice or didn’t care about the potential for higher rates coming sooner than previously expected. Knowing how sensitive the market has been to the prospects of higher rates in the past, it seemed rather strange that equity prices responded positively.

Of course, the market could simply have missed the entire concept here. When it eventually figures out the Fed’s attitude change, the market may choose to shift its stance. Of course, only time will tell, but a sleepy equity market unaware of the changes taking place could have significant and profound effects when it finally wakes up and returns to reality.